Forestar Group (NYSE:FOR) has seen solid price movement over the past year even with strong macro headwinds beating down on the housing sector. I believe that Forestar is currently a buy due to being undervalued, hedging against headwinds, and having a fair balance sheet positioned for the long term

Business Overview

Forestar Group Inc. is a well-known residential lot developer with a significant market share in the US. The company’s principal objective is to facilitate the establishment of prosperous, long-term single-family residential communities through the judicious acquisition of real estate and the deliberate construction of infrastructure. The core of Forestar’s business plan, which emphasizes the company’s commitment to excellence, is the sale of completed residential single-family lots. These developed lots are available to a broad spectrum of home builders, including regional, national, and even local building enterprises. Not only does Forestar ensure that its residential lots will be widely available, but its large range of customers across different geographies also significantly influences the constantly shifting American real estate market. Forestar Group Inc. is a major contributor to the creation and upkeep of the nation’s residential infrastructure because of its meticulous approach to lot development and its versatility in working with builders of all sizes.

Forestar

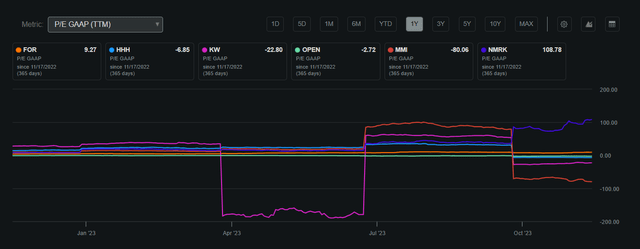

Forestar has a market capitalization of $1.54 billion and has delivered an 8% Return on Invested Capital which is solid in the current high-rate environment. The stock’s 52-week trading range has seen highs at $31.95 and lows at $13.72. Presently valued at $30.88 and a P/E GAAP ratio of 3.57, Forestar is near its highs. Furthermore, the company’s P/E GAAP ratio is superior to its industry counterparts, suggesting a possible attractive value proposition.

Forestar P/E GAAP Compared to Peers (Seeking Alpha)

Although Forestar does not pay a dividend, the firm has demonstrated that it can still grow demonstrated by its 8% ROIC and earnings outperformance. I believe that as the firm continues to scale, repurchasing shares and distributing a dividend would be prudent to create additional shareholder value once FCF is less effective. But, until we see slowing growth, I believe that Forestar’s ability to protect and scale its core business model has given it a competitive advantage in the areas in which it operates.

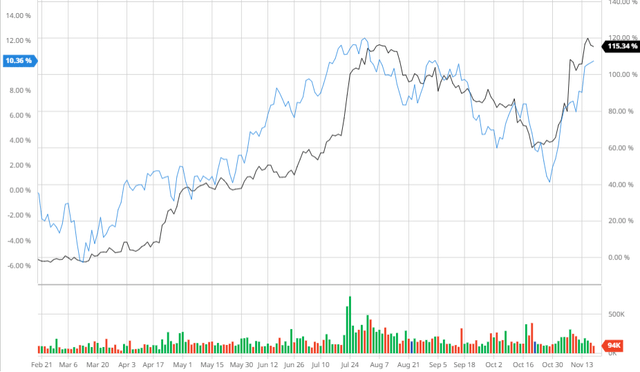

Share Performance (Seeking Alpha)

Performance Compared to the Broader Market

Forestar has significantly outperformed the broader market with 118% returns in the last 6 months compared to 10.36% from the S&P 500. I believe that this outperformance demonstrates the firm’s ability to hedge against macro headwinds even though they are in the homebuilder sector. This also underscores the firm’s effective use of FCF to build such as resilient core business model and is an excellent sign for more expansion in the upcoming future.

Forestar Performance Compared to the Broader Market (Created by author using Bar Charts)

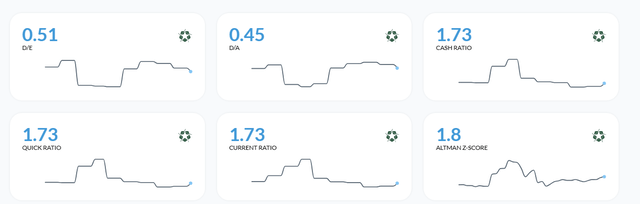

Balance Sheet

Forestar’s balance sheet also looks fairly stable with debt remaining relatively unchanged over the last 3 years. With Forestar’s stock price at an all-time high and room to leverage with a 1.73 Current Ratio and 1.8 Altman-Z-Score, the firm is able to capitalize on lower costs of equity through share issuance or due to their safe financials as of now. This will allow the firm to hedge against headwinds if interest rates reduce Forestar’s growth and profitability.

Financial Position (Alpha Spread) Solvency Ratios (Alpha Spread)

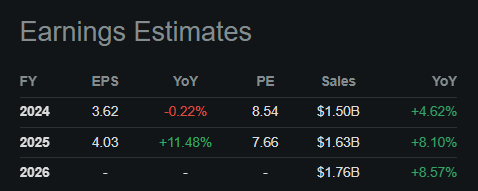

Earnings

Forestar’s Q4 2023 earnings came in excellent with EPS surpassing expectations by $0.50 at $1.44 and revenues beating estimates by $160 million at $549.7 million showing a 44.1% YoY growth. This stemmed from Forestar’s 27% increase in lots sold compared to the prior year. In macro headwinds where spending strains are evident, Forestar’s excellent performance shows the firm’s ability to convert projects from low-rate environments and cater them toward the now high-rate, inflationary environment. I also agree with EPS and revenue estimates in the upcoming years due to inflation beginning to cool down and rates remaining or decreasing in the next year which will make the firm’s performance even better.

Earnings Estimates (Seeking Alpha)

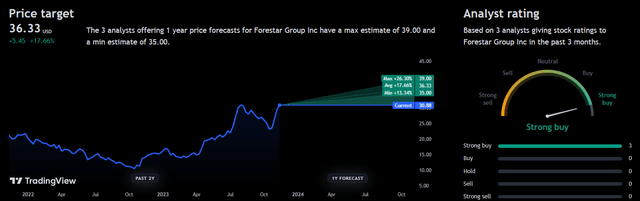

Analyst Consensus

Analysts currently rate Forestar as a “strong buy” indicating confidence in the firm’s ability to weather headwinds and foster growth. With a 1Y average price target of $36.33, Forestar presents a potential 17.66% upside.

Analyst Consensus (Trading View)

Valuation

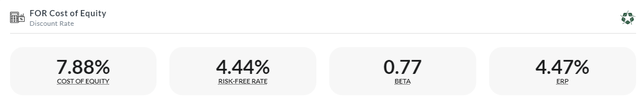

Before creating my DCF, I decided to calculate Forestar’s Cost of Equity using the Capital Asset Pricing Model. Assuming a risk-free rate of 4.44% based on the 10-year treasury yield, the firm’s Cost of Equity is 7.88%.

Cost of Equity (Created by author using Alpha Spread)

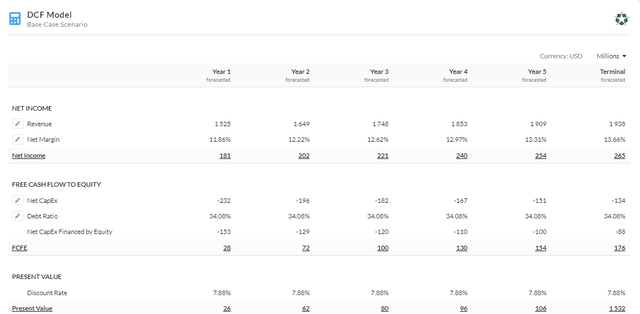

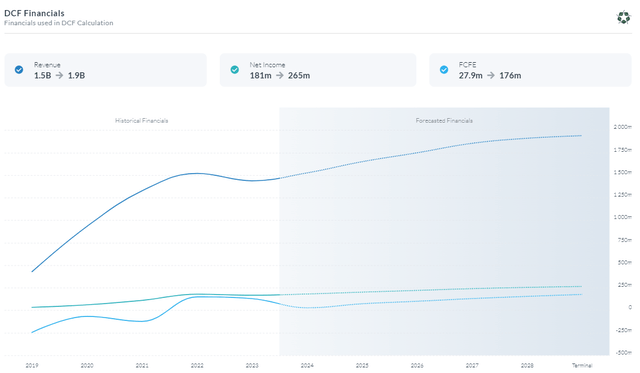

After finding an appropriate discount rate, I used a 5-year Equity Model DCF based on FCFE. In regard to my revenue and margin estimates, I assumed that the firm would continue to expand in line with expectations due to its outperformance in tough times making these assumptions fair. I also added a discount rate of 7.88% based on the Cost of Equity calculation. I decided to not add a risk premium because although Forestar’s industry is negatively impacted by interest rates, I have not seen any signal of pullback even at the peak of rates demonstrating the business’s resiliency operationally. Forestar also holds a solid balance sheet which also inclines me to maintain my discount rate as pullbacks would not create financial strain on upcoming projects. This resulted in an undervaluation of 19% with a fair value of $38.12.

5Y Equity Model DCF Using FCFE (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Strategic Land Positioning Fostering Margin Expansion

In addition to focusing on areas with significant development potential, Forestar Group’s strategic land positioning plan takes financial factors into account that help make all of its real estate endeavors successful. To increase the financial feasibility of its initiatives, the corporation chooses locations with advantageous economic circumstances. For instance, Forestar deliberately purchases land in areas that are just outside of densely populated areas, enabling the business to profit from market growth after the project is finished. Furthermore, by maximizing the selling values of residential properties inside these well-located communities, this strategy can have a good effect on return on investment.

Furthermore, Forestar’s emphasis on financial discipline guarantees effective cost control and capital allocation, which boosts the projects’ profitability even further. The overall objectives of Forestar, which include building vibrant and sustainable communities as well as providing strong financial returns to its shareholders, are in line with this mix of prudent financial management and smart land placement. In the ever-changing real estate market, Forestar Group strives to position itself for long-term success by carefully balancing financial acumen with strategic insight.

This, in my opinion, enables the company to surpass rivals in terms of pricing as well as increase profits. The community’s growth has increased the value of the properties during the course of development, allowing the business to establish competitive pricing and increase profits. This is one of the reasons the company may perform better in the face of macroeconomic challenges and will set up Forestar for compound growth through higher cash flows.

Risks

Real Estate Market Risks: Because of the cyclical nature of the real estate industry, Forestar is subject to market risks including fluctuations in property values, mismatches in supply and demand, and differences in local markets. The capacity of the business to sell developed lots may be impacted by a downturn in the real estate sector.

Regulatory and Entitlement Risks: Political and regulatory concerns are present during the land development project approval and entitlement procedure. Inadequate or delayed acquisition of required permissions might impede project schedules and escalate expenses.

Conclusion

To summarize, I believe that Forestar is currently a buy even after the solid price movement due to being undervalued, hedging against headwinds, and having a fair balance sheet positioned for the long term. I believe that revisiting this stock if inflation remains persistent and rates increase would be prudent as my short-term thesis on the company would change due to demand risk.

Read the full article here