Antero Midstream (NYSE:AM) delivered its fifth consecutive quarter of free cash flow after dividends in Q3 2023 and looks set to continue delivering positive free cash flow after dividends in the future. I currently project that Antero Midstream can deliver $225 million to $245 million in 2024 free cash flow after its approximately $430 million per year in dividends.

There is some risk that Antero Resources (AR) looks to slightly reduce production in 2024 compared to 2H 2023 levels given that the current natural gas strip is down to around $3.10 now. However, even if Antero Resources slightly reduces production, Antero Midstream should still be able to hit around $225 million in free cash flow after dividends in 2024.

Antero Midstream is tracking slightly better than I had modeled before, so I now estimate its value at $13.75 per share, not including potential proceeds from its lawsuit with Veolia. If that judgment remains in Antero’s favor after the appeals are exhausted, I’d estimate its value at $14.35 to $14.40 per share.

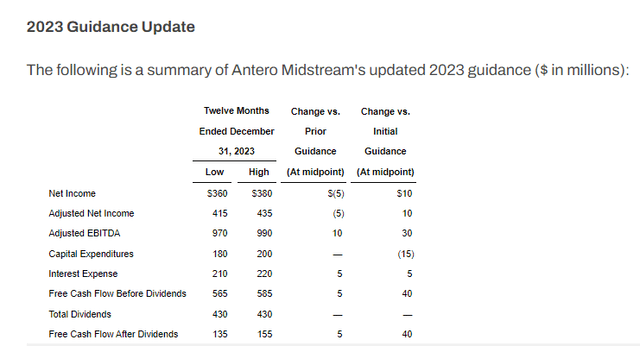

Updated 2023 Guidance

Antero Midstream made another positive revision to its guidance for 2023. It increased the midpoint of its adjusted EBITDA guidance to $980 million, which is a $10 million increase compared to its prior guidance update and a $30 million improvement from its original 2023 guidance.

Antero Midstream did also increase its 2023 interest expense expectations by $5 million, reflecting the impact of rising interest rates during the year. Antero Midstream had $676 million in variable rate credit facility debt at the end of Q3 2023, accounting for 21% of its total debt. Antero Midstream’s credit facility had a weighted average interest rate of 6.17% at the end of 2022, but this increased to 7.04% at the end of Q3 2023.

Antero’s Guidance (anteromidstream.com)

Antero currently expects to generate $145 million in free cash flow after dividends in 2023, a $5 million increase over its prior guidance and a $40 million improvement from its original guidance.

Initial 2024 Outlook

Antero Midstream expects to benefit from a couple items during 2024. It mentioned that its growth incentive fee program (from its 2019 agreement with Antero Resources) ends at the end of 2023. Thus, Antero Midstream expects to save $48 million on fee rebates next year.

As well, Antero Midstream’s fees are subject to annual Consumer Price Index based adjustments. It indicates that it expects these adjustments to add approximately 1.5% to its 2024 adjusted EBITDA.

Antero Resources’ development plans for 2024 are currently uncertain, although it talked about keeping 2024 production at close to 3.45 Bcfe per day for 10% lower capex than 2023, or having 2024 production around 3.375 Bcfe per day with even less capex.

The latter scenario would involve a slight (0% to 1%) production decline from 2023 levels, while the former scenario would involve 1% to 2% production growth.

Thus, Antero Midstream is probably looking at around $1.06 billion in adjusted EBITDA in 2024 if Antero Resources keeps production at 2H 2023 levels of around 3.45 Bcfe per day in 2024. If Antero Resources has 2024 production of around 3.375 Bcfe per day instead, its 2024 adjusted EBITDA may end closer to $1.035 billion.

While the 2025 NYMEX gas strip is still pretty decent at near $4, the 2024 strip is currently around $3.10. That is a level where Antero Resources will seriously consider going with a lower capex budget and production level for 2024.

| In $ Millions (Except for Daily Production) | ||

| AR’s 2024 Daily Production | 3.375 Bcfe | 3.450 Bcfe |

| Adjusted EBITDA | $1,035 | $1,060 |

| Capital Expenditures | $175 | $180 |

| Interest Expense | $205 | $205 |

| FCF Before Dividends | $655 | $675 |

| Dividends | $430 | $430 |

| FCF After Dividends | $225 | $245 |

If Antero Resources aims for 3.375 Bcfe per day in production during 2024, I project Antero Midstream to end up with around $225 million in free cash flow after dividends for the year. At 3.45 Bcfe per day in 2024 production from Antero Resources, that would lead Antero Midstream to end up with around $245 million in free cash flow after dividends for the year. This also assumes that interest rates remain flat, resulting in slightly lower interest costs for Antero Midstream due to a lower average credit facility balance in 2024 compared to 2023.

Debt And Valuation

Antero Midstream had $3.276 billion in net debt at the end of Q3 2023. Based on its 2023 guidance, it can reduce this to $3.237 billion by the end of 2023. My projections show that it can get its net debt down to around $3 billion by the end of 2024, which would give it leverage of approximately 2.9x.

This does not include potential funds from its lawsuit with Veolia. At the last report, Antero had a judgment in its favor for $280 million (including pre-judgment interest), while it was also awarded costs and attorneys’ fees, which will be determined separately. All of this is still in the appeals process though.

I now estimate Antero Midstream’s value at around $13.75 per share, not including the potential funds from its lawsuit. If the lawsuit appeals are exhausted and the current judgment stands, Antero Midstream’s estimated value would increase to around $14.35 to $14.40 per share.

Conclusion

Antero Midstream is steadily generating free cash flow after dividends now and is currently projecting around $145 million in free cash flow after dividends in 2023. I expect Antero Midstream to be able to generate $225 million to $245 million in free cash flow after dividends in 2024 now, with the lower end of the range, reflecting the potential for Antero Resources to aim for slightly lower production in 2024 (compared to 2H 2023) amidst relatively weak natural gas prices.

This free cash flow would allow Antero Midstream to get its leverage to around 2.9x by the end of 2023, with the potential Veolia lawsuit proceeds bringing its leverage to around 2.6x if that is finally resolved in Antero’s favor.

Read the full article here