Markets continued to rally for most of last week, before taking a breather on Thursday and Friday. The major indices are now up over 6% for November after a rough patch from August-October.1

Leading stocks higher during the first half of last week was encouraging data on inflation. Both the Consumer Price Index (CPI) and Producer Price Index (PPI) showed a continued cooling of inflation in October.

CPI came in flat on a month-over-month (MoM) basis, while PPI fell 0.5% for the month, the lowest reading since April 2020.2 As a result, expectations for Fed rate cuts in 2024 have risen, with the CME Group’s FedWatch tool now baking in a 1% rate cut in 2024.3

Less of a bright spot last week was Retail Sales for October which fell 0.1%, the first monthly decline in 7 months.4 However, this was a smaller drop than economists were expecting at -0.3%5, and excluding gas and autos that number actually turned positive at 0.1%.

Still, it serves as a sign that consumers are inflation fatigued and are feeling squeezed by interest rates that remain at a 22-year-high, forcing them to rack up credit card debt and deplete savings.6

Another read on the US consumer came from Q3 retail earnings reports. While Q3 numbers mostly came in strong, there was some cautionary commentary regarding Q4 and the holiday shopping season.

Such comments from Walmart (WMT) seemed to spook investors the most, when full year guidance for EPS was given in the range of $6.40-6.48, lower than analysts expected.7

Walmart has been a favorite in this high inflation environment due to the size of its grocery business which was bolstered as consumers focused on purchasing necessities.

Both Walmart and TJX Companies (TJX) said in remarks last week that the US consumer is in search of a bargain this holiday shopping season and will hold out for deals.8

As a result of better-than-expected retail results, the blended EPS growth rate for Q3 has grown to 4.3% vs. last week’s 4.1%.9

Corporate Uncertainty Closes Out the Q3 Season Relatively Unchanged

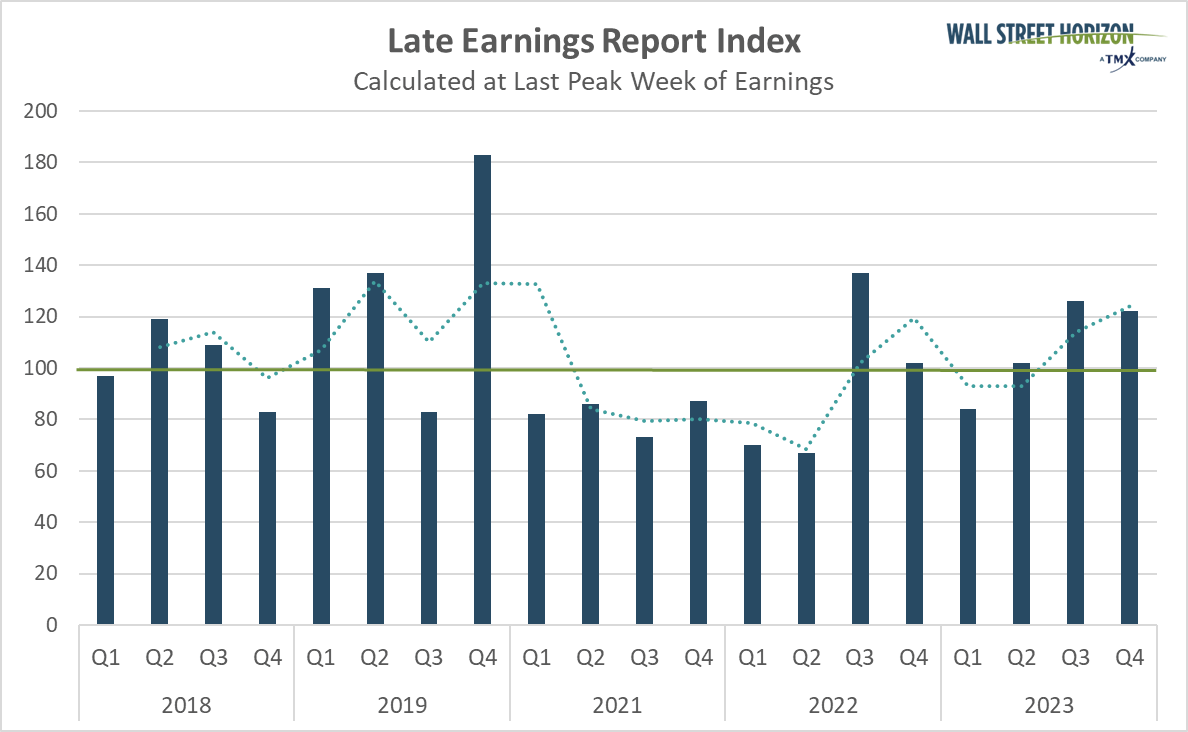

The official post-peak reading of the Late Earnings Report Index (LERI) released on November 10 showed that CEOs remained hesitant throughout the third quarter earnings season.

The Late Earnings Report Index tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near term.

The post-peak season LERI reading came in at 122, the third-highest reading since the COVID-19 pandemic. As of November 10, there were 114 late outliers and 84 early outliers.

Source: Wall Street Horizon

Earnings on Deck – Week of November 20, 2023

The last trickle of reports this week will come mostly from the retail sector. This week, we expect earnings releases from 395 publicly traded companies (out of our universe of 10,000), with 11 of those coming from S&P 500® companies.

Eyes will still be on the last of the retailers reporting on Tuesday: Lowe’s Companies (LOW), DICK’S Sporting Goods (DKS), Nordstrom Inc. (JWN), Kohl’s (KSS), Burlington Stores (BURL), Best Buy (BBY), Abercrombie & Fitch (ANF), Urban Outfitters (URBN), American Eagle (AEO), as well as the final constituent of the Magnificent 7, Nvidia (NVDA) out on the same day.

Potential Surprises This Week: Farfetch and Footlocker

In the next two weeks, we continue to get results from companies that have pushed their Q3 2023 earnings dates outside of their historical norms. Only two of those companies trade on a major index. Zscaler Inc. (ZS) reports November 27, nearly two weeks earlier than expected, and therefore has a positive DateBreaks Factor*.

The J.M. Smucker (SJM) reports on December 5, a week later than usual and therefore has a negative DateBreaks Factor. According to academic research10, a later than usual earnings date suggests a company will report “bad news” on their upcoming calls, while an earlier date suggests “good news” will be shared.

Farfetch Ltd. (FTCH)

Company Confirmed Report Date: Wednesday, November 29, BMO

Projected Report Date (based on historical data): Tuesday, November 28, BMO

DateBreaks Factor: -3*

Luxury fashion e-commerce site, Farfetch, is set to report Q3 2023 results on Wednesday, November 29. Since IPOing in 2018, the retailer has always released Q3 results on a Thursday during the 45-47th week of the year. This will be the first Wednesday report, and the first in the 48th week of the year.

The Farfetch story is not as much about the state of US retail at the moment, albeit the environment is softening, but more about company-specific issues. The company continues to be burdened with debt and a capital-heavy model that it has not been able to work out.

After initially benefiting from the popularity of online shopping following the COVID-19 pandemic, the retailer has been struggling to keep up, posting YoY declines in EPS growth for all of 2022 and badly missing revenue estimates last quarter.

Q2 2023 results also came with a drastically lowered forecast for the value of orders processed.11 It’s possible the later than usual report date, especially one that is right before a major US holiday, could be signaling more disappointing news to come for Farfetch.

Footlocker Inc. (FL)

Company Confirmed Report Date: Wednesday, November 29, BMO

Projected Report Date (based on historical data): Friday, November 17, BMO

DateBreaks Factor: -3*

Footlocker is set to report Q3 2023 results on Wednesday, November 29, twelve days later than expected. This would be the latest they’ve ever reported (since we began collecting data for this company in 2006) and the first time in four years that they aren’t reporting on a Friday.

This is predicted to be the seventh consecutive decline in YoY EPS growth for Footlocker. The footwear retailer blamed “consumer softness” for poor Q2 2023 results which included a miss on revenues, and also struggled with pressured profit margins due to markdowns and shrink. As such, they lowered their forecast for the second time this year.12

1 According to Google pricing data

2 According to the US Bureau of Labor Statistics

3 CME FedWatch Tool – CME Group, November 20, 2023

4 Advance Monthly Sales for Retail and Food Services, United States Census, November 15, 2023, Monthly Retail Trade – Sales Report

5 According to economists polled by Reuters

6 According to savings and credit card delinquency data from the US Federal Reserve

7 Walmart Reports Third Quarter Results, Q4, Walmart, November 16, 2023

8 The TJX Companies, Inc. Reports Above Plan, The TJX Companies, Inc., November 15, 2023

9 Earnings Insight, FactSet, John Butters, November 17, 2023

10 Journal of Financial and Quantitative Analysis, Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec. 2018

11 Farfetch Announces Second Quarter 2023 Results, Farfetch, August 17, 2023

12 FOOT LOCKER, INC. REPORTS 2023 SECOND QUARTER RESULTS | Foot Locker, Inc., August 23, 2023

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Original Post

Read the full article here