On a personal level, I have always liked the recreational vehicle market. Given that it is the type of product that is really only purchased by those who are upper middle class and above, it is a barometer of how a very important segment of the economy is doing. Unfortunately, 2023 has not been particularly pleasant for shareholders in this space. A surge in demand during the COVID-19 pandemic, combined with supply chain issues, ultimately resulted in a surplus of vehicles in this space. That surplus persists to the present day and it is unlikely that the trend will be corrected until sometime next year. For the companies in this market like Lazydays Holdings (NASDAQ:LAZY), this does not bode particularly well. But for those who don’t mind accepting some risk and dealing with a great deal of volatility for the next six to nine months, this kind of holding might make sense to buy into.

A tough ride

Given the worsening conditions in the recreational vehicle industry, I ended up, in an article published in February of this year, downgrading Lazydays Holdings from a ‘buy’ to a ‘hold’. The company had seen its share price drop rather significantly leading up to that market because of a major reduction in demand. The aforementioned issues, combined with a surge in interest rates that made these vehicles more expensive in the long run, caused demand to fall and inventory levels at dealerships like Lazydays Holdings to jump. Had shares of the business been more expensive, I would have downgraded it further to a ‘sell’. However, the stock was already trading at incredibly low levels relative to financial performance in both 2021 and 2022.

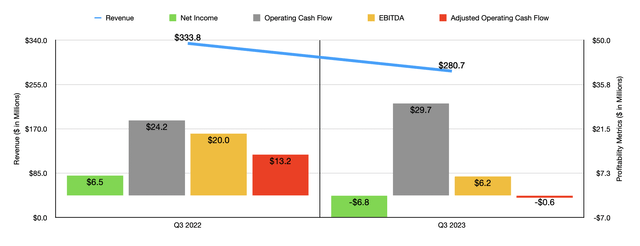

Author – SEC EDGAR Data

In retrospect, I wish I would have downgraded the company further. That’s because, since the publication of that article, shares have returned a loss of 36.6% compared to the 14% increase seen by the S&P 500. Simply put, even I underestimated just how bad market conditions would get. To see what I mean, we need to only look at the most recent data provided by management, data that covers the third quarter of the 2023 fiscal year. Revenue for that time came in at $280.7 million. That’s 15.9% lower than the $333.8 million the company reported one year earlier.

Author – Lazydays Holdings

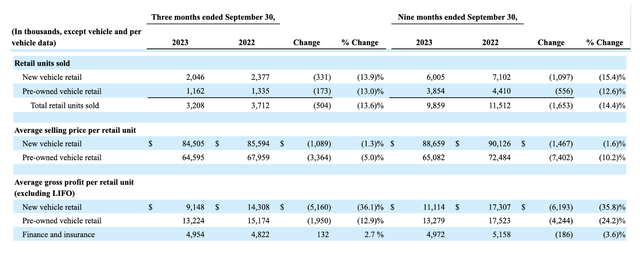

This drop in sales was driven by weakness when it came to both new vehicle retail units and pre-owned vehicle retail units. New vehicle retail units sold dropped by 13.9% from 2,377 to 2,046. And pre-owned vehicle retail units fell by 13% from 1,335 units to 1,162 units. Selling prices also declined, though not by much. For new vehicle retail units, prices dropped about 1.3% from $85,594 to $84,505. And for pre-owned vehicle retail sales, price per unit dropped 5% from $67,959 to $64,595.

The bad thing about even a modest decline in revenue in an industry in which margins tend to be tight is that margin contraction can be painful. Even though the average selling price per unit fell modestly for new vehicle retail units, the gross profit per new vehicle retail unit plunged 36.1% from $14,308 to $9,148. So even though the company continued to suffer from a reduction in demand, it was also unable to pass on inflationary pressures to its customers. Pre-owned vehicle retail sales, meanwhile, fell a more modest but still significant 12.9% from $15,174 to $13,224.

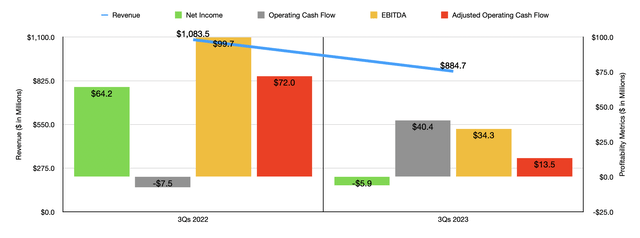

Author – SEC EDGAR Data

As a result of these changes, profitability for the company suffered significantly. Net income went from $6.5 million in the third quarter of 2022 to negative $6.8 million at the same time this year. Operating cash flow did manage to rise from $24.2 million to $29.7 million. But if we adjust for changes in working capital, we would see a drop from $13.2 million to negative $0.6 million. Meanwhile, EBITDA for the firm fell from $20 million to only $6.2 million. It’s important to note that the third quarter was not the only time in which the company has seen weakness. As you can see in the chart above, financial performance for the first nine months of this year as a whole was quite a bit worse than it was in the first nine months of 2022.

Author – SEC EDGAR Data

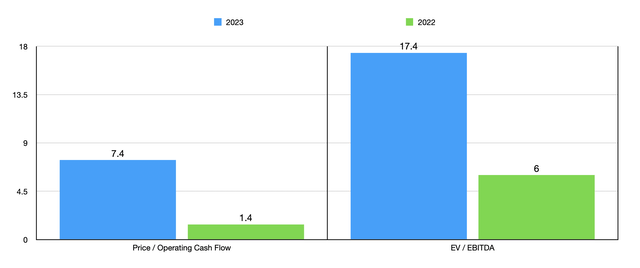

When fundamentals change so rapidly, any sort of valuation of a company becomes difficult to rely on. The best we can do is assume that this year is the worst and see what kind of price we are looking at. If we annualize the results experienced so far for 2023, we would expect adjusted operating cash flow this year of $14.1 million. Meanwhile, EBITDA for the company would be around $36.5 million. Using these figures, I valued the company as shown in the chart above. I also compared to that the valuation of the company using data from 2022.

The reason why the EV to EBITDA multiple of the firm is so much higher is because net debt as of this writing stands at $471.3 million. That dwarfs the $104.1 million market capitalization of the company. One thing that investors likely saw as a negative was the rights offering that the company announced in September of this year. The objective was to raise up to $100 million by giving shareholders the ability to buy stock at a good price. This would have been significantly dilutive for anybody who did not participate in the transaction. But it would have also given the company additional cash to use for growth or debt reduction. I would go so far as to say that this was the primary driver behind the plunge in pricing for the business. Shares are actually down 30.8% compared to the day prior to the rights announcement being made public.

Likely in response to this reaction by shareholders, management, on November 13th, announced the decision to cancel the previously announced rights offering. The company made clear, however, that it would be looking at additional sources of funding such as mortgage financing on owned real estate, and other potential avenues. In all likelihood, management knew well in advance of the November 13th date that the rights offering would likely be canceled. That does make me wonder if it was wise for the firm to announce, on November 6th, that it was acquiring yet another dealership for an undisclosed sum that is anticipated to bring in $35 million of additional revenue to the enterprise. Management did say in the press release regarding the rights offering cancellation that they would be slowing down asset purchases. That is a positive when you consider all that is going on in the space.

To be perfectly clear, Lazydays Holdings is not a riskless or low-risk prospect at this point. The high amount of debt and uncertain industry conditions make it a worrisome opportunity. The good news, however, is that we might not need to wait much longer for the tide to turn. According to current forecasts, we should see between 287,000 and 307,000, for a midpoint of 297,000, RV Sales at the wholesale level this year. But we are expected to see a nice rebound next year, with between 363,700 and 375,700 units sold. This could ultimately work well in the company’s favor because, in addition to there being a 48% drop in the number of RVs produced this year, the company has excess inventories on its books that are proving to be an issue.

| Type of Vehicle Sold | Q3 2023 | Q3 2022 |

| New Vehicle Retail Unit | 171 | 136 |

| Pre-Owned Vehicle Retail Unit | 133 | 109 |

As of the end of the most recent quarter, the business had 171 days of new vehicle retail unit inventory on its books and 133 days of pre-owned retail unit inventory on its books. These numbers compare to the 250 and 78, respectively, that management reported for the final quarter of last year. But in the third quarter of 2022, these numbers came in at 136 and 109, respectively. What this shows is that inventory levels might be coming down compared to the last few quarters when it comes to new retail units. But they are still quite a bit higher year over year. If the plunge in the number of RVs produced is not offset by a surge in production and assuming that we do experience much higher sales levels next year, that could give the company’s fantastic supplier power over its consumers come next year.

Takeaway

At this time, Lazydays Holdings remains a very interesting prospect. The company is far from being a riskless or low-risk opportunity. The high amount of debt is certainly a problem and industry conditions are weak. Inventory levels are still far too high as well. However, if the market does recover as quickly as sources suggest it will, that could ultimately work to the firm’s advantage. At the same time, failure to recover in a timely manner could prove destructive when it comes to shareholder worth. So it’s because of how volatile this situation is and how much uncertainty exists in it that, even though the stock is still quite cheap, even on a forward basis, I have decided to keep the firm rated a ‘hold’ for now.

Read the full article here