Investment Thesis

The Hartford Financial Services Group, Inc. (NYSE:HIG) is a financial services company with a history dating back to 1810. The company provides property & casualty insurance, group benefits insurance and services, and mutual funds and ETFs to individual and business customers globally.

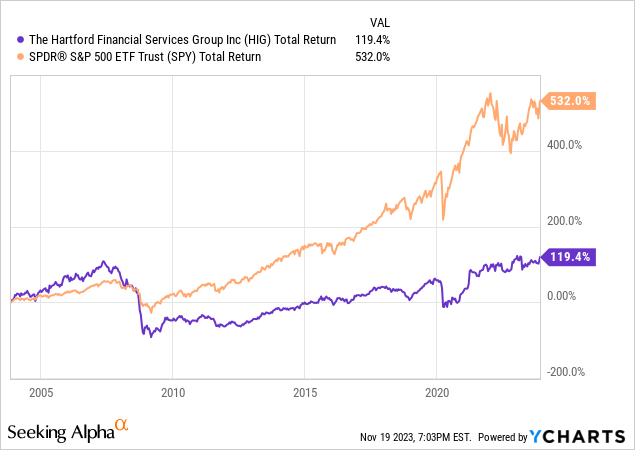

HIG has significantly underperformed the S&P 500 over the past 20 years. A significant driver of underperformance was the company’s struggles during the 2008 financial crisis when it was weighed down by problems in its life insurance and annuities business. However, HIG today is a much different company following a number of key divestitures including the 2013 sale of its individual life insurance business to Prudential and the 2018 divestiture of its annuity business to Talcott Resolution.

I believe HIG represents an attractive investment at current levels for four reasons:

1. HIG is poised to benefit from higher interest rates

2. HIG has a very aggressive buyback program in place along with an attractive dividend

3. HIG is trading at an attractive valuation relative to the S&P 500, its own history, and peers

4. HIG remains a highly attractive takeover target for a number of key players

Company Overview

HIG is a provider of property & casualty insurance, group benefits insurance and services, and mutual funds and ETFs to individual and business customers globally.

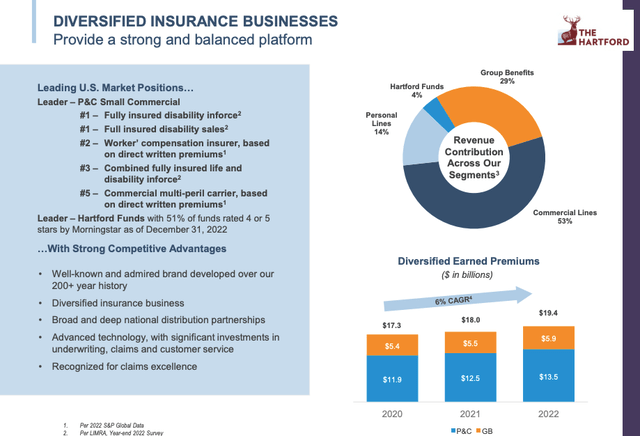

HIG’s largest business is its property and casualty business which encompasses two separate reporting segments: commercial lines and personal lines.

The commercial lines business accounts for ~53% of total revenue while personal lines account for ~14% of total revenue. In total, HIG is the 13th largest property & casualty insurance company in the U.S.

The group benefits business, which primarily offers group disability and group term life insurance, accounts for ~29% of revenue.

Hartford Funds is HIG’s asset management business and accounts for ~4% of revenue. In total, the Hartford Funds has ~$123 billion in assets across asset classes.

HIG Investor Presentation

1. Beneficiary of Higher Interest Rates

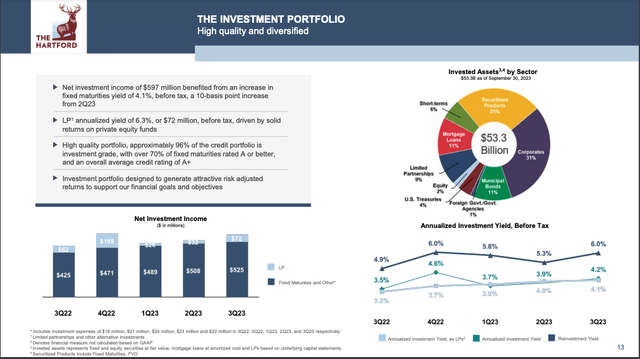

HIG is poised to benefit from higher interest rates as the company’s investment portfolio is primarily invested in high-quality fixed income assets. HIG’s portfolio is focused on relatively short maturity securities as the portfolio’s duration was 4.1 years as of Q3 2023.

HIG benefits from rising rates as it is able to reinvest maturing securities into higher-yielding securities of the same credit quality. On the Q3 2023 conference call the company provided additional color:

Our diversified investment portfolio produced strong results. For the quarter, net investment income was $597 million. Our fixed income portfolio is continuing to benefit from higher interest rates, and we continue to be pleased with the positive 150 basis point differential between our reinvestment rate and the yield on sales and maturities. The total annualized portfolio yield, excluding limited partnerships, was 4.1% before tax, slightly higher than the second quarter. We expect the full yield excluding LPs will be about 80 basis points higher than the prior year.

Looking forward to 2024, we anticipate another 25 basis points of improvement based on the current yield curve, which will contribute to about a $200 million before tax increase in investment income excluding LPs.

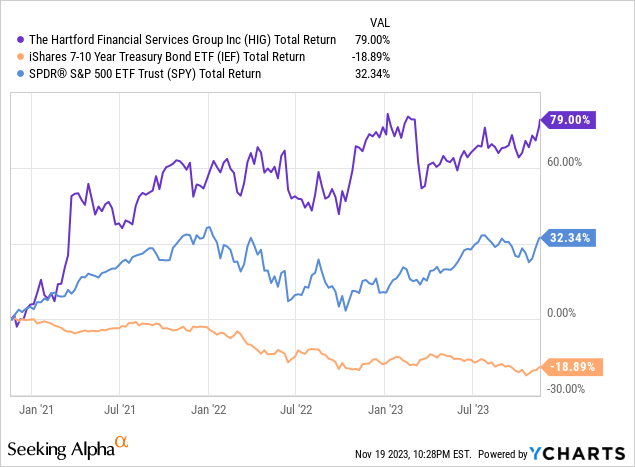

While interest rates have come down from their recent peaks, the fact remains that interest rates remain generally elevated vs levels of the past few years and HIG is poised to benefit. Further evidence of the fact that HIG benefits from rising rates can be seen in the chart below. Over the past 3 years, HIG has substantially outperformed the S&P 500 while interest rates have increased substantially.

HIG Investor Relations

2. Aggressive Share Repurchase Program & Attractive Dividend

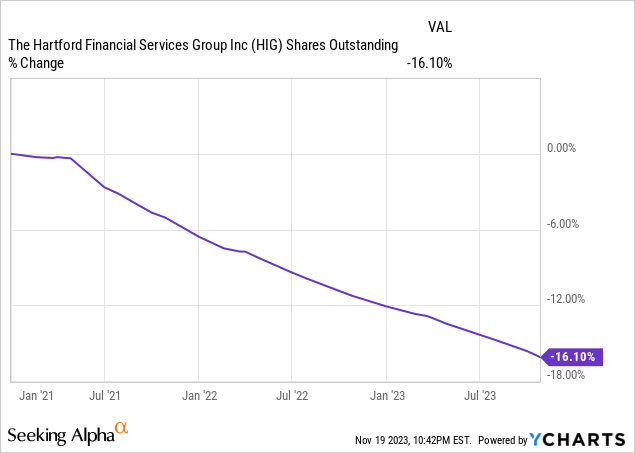

In mid-2022, HIG’s board authorized a $3 billion share repurchase program which is effective from Aug 1. 2022 through the end of 2024. During Q2 2023, the company has repurchased $350 million worth of shares and has repurchased $1.05 billion worth of shares so far in 2023. HIG has $1.7 billion remaining on its authorization program and has said it expects to repurchase ~$350 million worth of stock during Q4 2023.

The remaining $1.7 billion worth of share repurchases represent ~7.3% of shares outstanding based on a current market cap of $23 billion. This potential further reduction in shares is in addition to the ~16% of stock the company has repurchased over the past 3 years.

I believe HIG’s large share repurchases are a significant positive signal as it suggests that management views the stock as significantly undervalued.

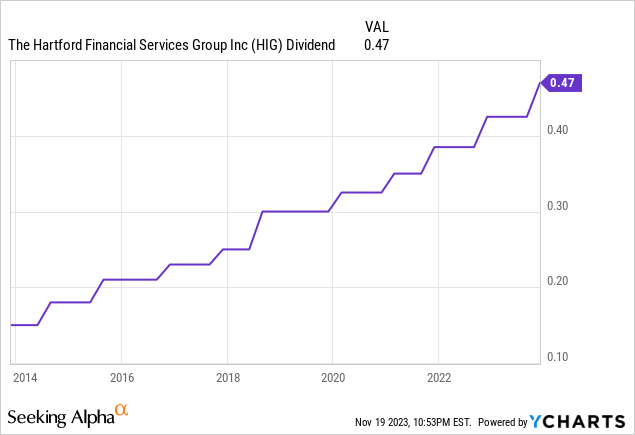

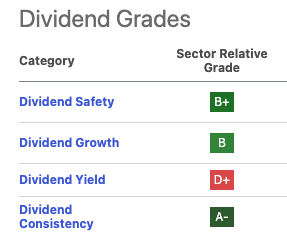

In addition to a significant share repurchase program, HIG also carries a relatively attractive dividend yield of ~2.5%. The company has been growing the dividend over the past few years and announced an 11% increase in Q3 2023.

Seeking Alpha

3. Attractive Valuation

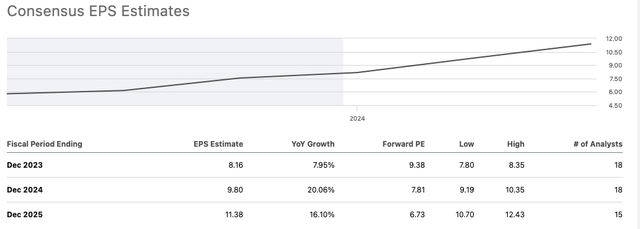

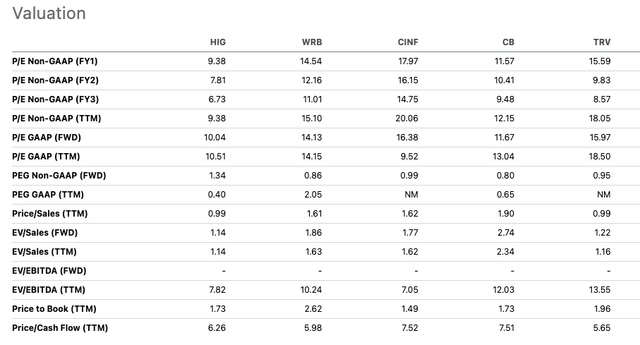

HIG trades at just 9.3x consensus FY 2023 earnings, 7.8x consensus 2024 earnings, and 6.7x consensus 2025 earnings. Comparably, the S&P 500 trades at ~18.4x consensus 2024 earnings.

While HIG’s short-term EPS growth rate is driven in part by aggressive buybacks, cost cuts, and rising interest rates, I do believe the company also has solid long-term growth potential.

Over the past 3 years, earned premiums have increased at a ~6% CAGR while book value per share (excluding accumulated other comprehensive income) has increased at a ~7% CAGR. Thus, over the long term, I believe HIG can grow by mid-single digits. However, there will be a significant amount of volatility along the way as HIG’s earnings have the potential to be impacted by fixed income market volatility.

I view HIG as highly attractive vs the S&P 500 due to the company’s above-average near-term growth prospects and solid long-term growth prospects.

HIG is currently trading at a significant discount to peers based on key metrics such as forward P/E ratio, EV/ revenue, EV / EBITDA, and price to book. Thus, based on relative valuation I view HIG as attractive.

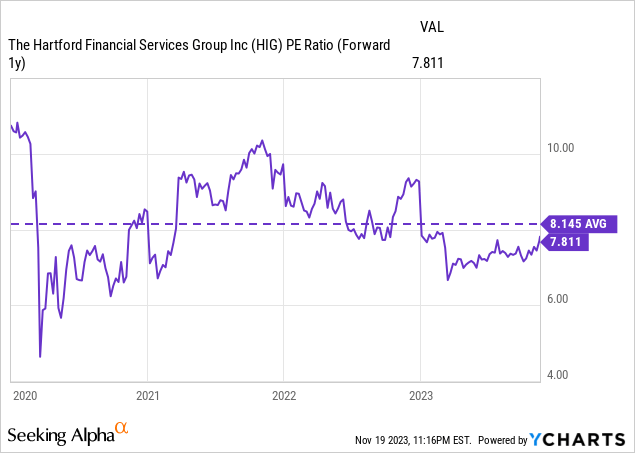

HIG is also trading at a modest discount to its own recent historical valuation range. I believe the stock deserves to be trading closer to the upper part of its historical valuation range given the potential benefit due to operating in a higher interest rate environment than has been the case historically.

Seeking Alpha

Seeking Alpha

4. Attractive Takeover Target

As the 13th largest P&C insurer in the U.S., HIG remains a potential takeover target for larger players. Scale is becoming increasingly important in the insurance market due to large investments in technology.

In 2021, HIG rejected three takeover offers from Chubb (CB) ranging from $65 to $70 per share. While Chubb has not come back to the table since then, I believe they could come back with a higher offer for HIG. One reason for this is that the P&C insurance business has generally improved since 2021 due to a higher interest rate environment. Additionally, since Chubb’s cash and stock $70 offer for HIG was made in April 2021 shares of Chubb have risen by ~41.5%. Thus, the stock component of any potential deal could be worth significantly more than was previously the case.

In addition to Chubb, there are a number of other insurance companies which might be interested in HIG. Travelers Companies (TRV) would be one natural buyer. Another insurer previously rumored to be interested in HIG is Allianz. Warren Buffett is another potential interested party as Berkshire Hathaway (BRK.B) is the second largest P&C insurance company in the U.S. and has been active in the space. In 2022, Berkshire completed $11.6 billion acquisition of Alleghany Corp which is a large P&C player.

Potential Risks To Consider

The biggest near-term risk to a bullish view on HIG is the potential for interest rates to fall significantly. If rates fall sharply from here then HIG may soon be in a position in which the reinvestment rate drops below the current portfolio investment yield. I do not view this as highly likely in the near term as the economy continues to be relatively strong and inflation is still running well above 2%. Additionally, I believe HIG’s attractive valuation and significant share repurchase program may limit the downside in the event of declining interest rates.

Another potential risk to consider is related to a potential economic slowdown. While HIG has a very high-quality investment portfolio, it remains 31% exposed to corporate issuers. In a significant economic stress event, even high-rated corporate issuers may run into trouble which could result in losses for HIG. Moreover, the company is highly dependent on the commercial lines and group benefits parts of the business. An economic slowdown could result in the shutdown of a significant number of companies or a reduction in demand from existing clients for new policies.

Conclusion

HIG is a leading insurance company with a long history of operations. The company has gone through a transformation and is now primarily focused on the P&C business and group benefits business.

The company has been a beneficiary of rising interest rates as its investment portfolio is primarily short-duration fixed income securities. As securities mature, HIG has been able to invest the proceeds at higher interest rates which has led to rising earnings. The company expects this trend to continue going forward even if rates remain where they currently are.

HIG has been engaged in a large share repurchase program and has a considerable amount remaining under its current authorization. The relatively aggressive nature of the buyback suggests that management views the stocks as undervalued. In addition to a strong buyback, HIG also has a dividend yield of ~2.5%, which is fairly attractive.

I view HIG’s valuation as fairly attractive given the significant discount to the S&P 500 and relatively strong short-term EPS growth prospects. I also view HIG’s current valuation as attractive relative to peers and HIG’s own valuation history.

HIG received a number of takeover bids from its larger rival Chubb in 2021. While HIG rejected these bids, I believe the company remains a highly attractive acquisition target for a number of players.

For these reasons, I am initiating HIG with a buy rating. I would consider downgrading the company if the valuation became less attractive or a significant drop in interest rates becomes more likely.

Read the full article here