Symbotic Inc. (NASDAQ:SYM) shares popped 40% yesterday as the company reported blockbuster financial results for the fiscal fourth quarter. Initiating coverage on Symbotic last September, I claimed SYM stock was well-positioned to register more gains before a valuation reality check. The company reported revenue of $392 million for the fourth quarter, a YoY increase of 60%. Symbotic, boosting the market sentiment toward the company, reported an adjusted EBITDA of $13 million for the quarter, marking the first positive adjusted EBITDA since going public. On a GAAP basis, the operating loss narrowed by 1%, and the net loss narrowed by 15% compared to the corresponding quarter last year, highlighting the company’s potential to turn profitable with sufficient scale. Symbotic is proving to be a very interesting business but I am not ready to invest yet because of two main reasons.

The Numbers Are Improving

In my previous article on Symbotic, I praised the company’s focus on improving gross profit margins and wrote:

A crucial aspect of this growth strategy is the company’s focus on expanding its gross margin. To achieve this, Symbotic is diligently addressing redundant costs associated with rapid growth. As the business continues to expand and shifts toward outsourcing partners, these redundant costs are expected to diminish gradually. This reduction in costs will free up resources that can be reinvested in new growth initiatives.

Building on the recent growth momentum, Symbotic’s adjusted gross margin improved by 80 basis points compared to Q3 to 19.1% in the fourth quarter. This margin expansion was driven by recurring revenue streams turning profitable. According to the management, system segment gross margins improved slightly while the bulk of the margin improvement was driven by recurring revenue streams. On the back of a 98% YoY revenue growth in Fiscal 2023 and an improvement in margins, the gross profit for 2023 almost doubled to $190 million.

This improvement in gross margin on higher revenue is an early sign that Symbotic is on the right track to turning GAAP profitable in the long run if it continues to grow at a stellar pace.

Symbotic, at the end of fiscal 2023, served over 3,000 customer stores. The company has already deployed 12 fully operational systems and is in the process of deploying another 35 systems. These deployments in progress are with six different customers, which is a good sign as customer diversification will be key to sustainable long-term growth. In my previous article, I highlighted customer concentration as one of the main risks for Symbotic’s business, which is something the company is proactively addressing. The company recently lured Southern Glazer’s Wine and Spirits, the world’s largest distributor of beverage alcohol, showcasing its ability to not only attract large-scale customers but also serve a diverse set of businesses.

To cater to the growing demand for warehouse automation, Symbotic is investing aggressively to expand its capacity. Today, Symbotic can move 400 million cases per year, but the company is in the process of increasing its capacity to move 1.6 billion cases annually.

Symbotic is performing well today – better than my initial expectations for the short term. Improving margins, efforts to diversify the customer base, and the company’s investments to expand capacity are impressive.

Symbotic’s Growth Is Far From Over

Fiscal 2023 proved to be a transformational year for Symbotic, with the company benefiting from the rising popularity of everything AI. A quick look at the company’s vision statement is enough to understand how Symbotic is planning to leverage its robotics platform to capture a meaningful share of the growing supply-chain automation market.

Symbotic’s vision is to “reimagine the supply chain with artificial intelligence and robotics and transform the distribution network into a strategic asset”.

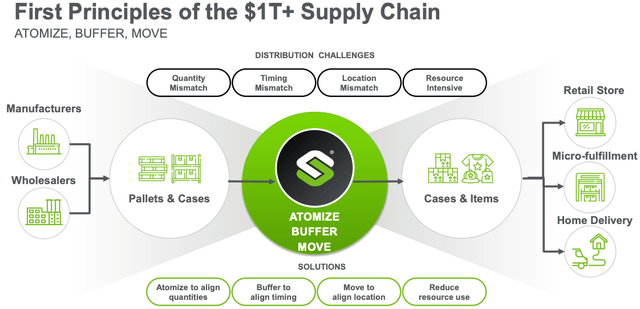

Symbotic is trying to solve a real problem, which is one of the reasons why I was attracted to the company in the first place. At an age where every other company wants to use AI as a catchphrase to win new business and investors, Symbotic is trying to provide tangible, quantifiable benefits to its customers. In the long run, companies that succeed in doing so will often enjoy competitive advantages. Symbotic is trying to address several distribution challenges faced by businesses today, including quantity, timing, and location mismatches. These are real-world problems that cost businesses millions of dollars, so a robust solution that could address these problems is likely to gain traction.

Exhibit 1: Symbotic’s value proposition

Investor presentation

Management estimates based on data provided by Symbotic’s customers indicate Symbotic’s systems offer task accuracy of over 99.99% and increased pallet capacity, lower transportation costs, and lower operating costs compared to traditional warehouse systems.

In the long run, I believe the warehouse automation market will grow thick and fast because of a few reasons.

- The increasing penetration of e-commerce, which is boosting the demand for fast and efficient order fulfillment.

- The ongoing shortages of skilled labor.

- Significant cost savings associated with warehouse automation, as evident by the data published by some of Symbotic’s customers.

- The prospects for building competitive advantages by offering faster and more accurate order delivery through warehouse automation.

Symbotic’s system solutions are centered around deploying robotic systems that can increase efficiency while reducing operating costs. These solutions are highly flexible and scalable, which allows industries with different business characteristics to utilize Symbotic’s solutions to fulfill their automation needs. As a result, I believe Symbotic is well-positioned to capitalize on the growing demand for warehouse automation in the next few years.

The company’s long-term growth strategy consists of 5 pillars.

- Increasing the penetration among existing customers.

- Winning new customers in existing verticals.

- Expanding into new verticals such as apparel, home improvement, and auto parts.

- Expanding geographically.

- Expanding the product suite through concentrated R&D investments.

Today, Symbotic is focused on the first three pillars of its growth strategy. In the long run, I believe international markets will open new doors for the company to maintain double-digit revenue growth over an extensive period.

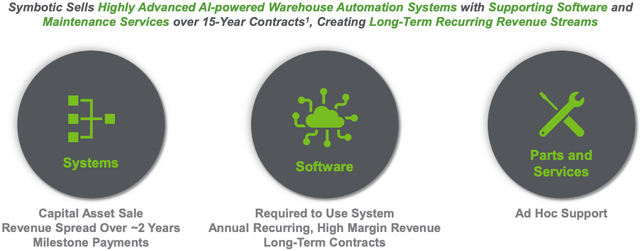

The growing recurring revenue base is another positive that cannot be ignored. In the fourth quarter of fiscal 2023, recurring revenue stream gross margins turned positive. During the fourth quarter earnings call, CEO Tom Ernst highlighted that recurring revenue gross margins can eclipse 60% in the long run as this business scales. The company now has 12 systems generating recurring revenue, which will only grow in the future with Symbotic already boasting 35 systems in deployment that are likely to bring recurring revenue in the future after their deployment. In addition, the $11 billion backlog from GreenBox is expected to bring over $500 million of recurring revenue annually in the long term.

Exhibit 2: Symbotic’s business model

Investor presentation

I believe companies with recurring revenue streams will trade at premium valuation multiples in the market, in the long run. Symbotic’s impressive prospects on this front, therefore, should support higher stock prices in the future.

Valuation Is Still Concerning

At a forward price-to-sales multiple of 1.8, Symbotic is not ridiculously valued. We are talking about a company that is growing in leaps and bounds (double or triple-digit revenue growth in every quarter since its market debut in 2022) so P/S multiples of less than two can be deemed outright attractive as well. I am, however, worried about the long-term sustainability of growth given that one-time system sales still account for the bulk of revenue. Growth may come to a standstill if Symbotic’s recurring revenue streams fail to grow as expected, which is a major risk that needs to be incorporated into the analysis of the company. I remain concerned about the lack of economic moat as well. There is room for disruption in the warehouse automation market, which needs to be discounted.

Takeaway

Symbotic is proving to be a growth machine, not surprisingly. There are a lot of positives to take away from its fiscal 2023 financial performance. However, based on the two major concerns highlighted above, I will remain on the sidelines for now but I will closely monitor Symbotic’s progress.

Read the full article here