2023 has been a really nasty year for shareholders of Walgreens Boots Alliance (NASDAQ:WBA). The company, which is most famously known for its drugstore chain, has seen its share price drop 42.9% year to date. This comes at a time when overall financial performance is mixed, with revenue climbing but profits and cash flows having declined. When you dig into the firm’s numbers, you find a lot of working parts, with some portions of the company performing exceptionally well and others experiencing hiccups or long-term declines. Relative to rival CVS Health (CVS), shares are pricey. But when you look at the positive sides of the company and how cheap the stock is on an absolute basis, it does seem to warrant some upside from here.

A jumble of things

To really understand Walgreens Boots Alliance, it’s important to have a comprehensive view of the company. But you can’t do that without digging into the weeds to some extent. The fact of the matter is that, just like any large company with many different operating entities, Walgreens Boots Alliance has many working parts that make it difficult to understand. To start with, we should touch on each of its operating segments and how they are individually performing. In truth, anyone of these segments could warrant a standalone article on their own. But a high-level view will help us understand where the business as a whole is and whether the problems it’s facing are temporary or permanent.

U.S. Retail Pharmacy

The first and largest of the segments that Walgreens Boots Alliance has is called the U.S. Retail Pharmacy segment. Using data from the recently completed 2023 fiscal year, this portion of the company accounted for 79.3% of the firm’s overall revenue. As its name implies, it is a unit that is dedicated to the retail side of the conglomerate here in the US. And it involves the physical retail drug stores, health and wellness services activities, and specialty and home delivery pharmacy services that the business offers. It also includes its equity method investment in Cencora (COR), which was previously known as AmerisourceBergen Corporation.

While some might disagree with me, this is the part of the company that I think is the most complicated to dissect and to diagnose with problems. This is largely because the picture has become clouded over the past few years by the COVID-19 pandemic. The administration of vaccines and COVID-19 test kits created something of a boon for the enterprise. And now that the COVID-19 pandemic is essentially over, having devolved into something more like a seasonal flu in terms of magnitude, that wave is now over for the business.

Walgreens Boots Alliance

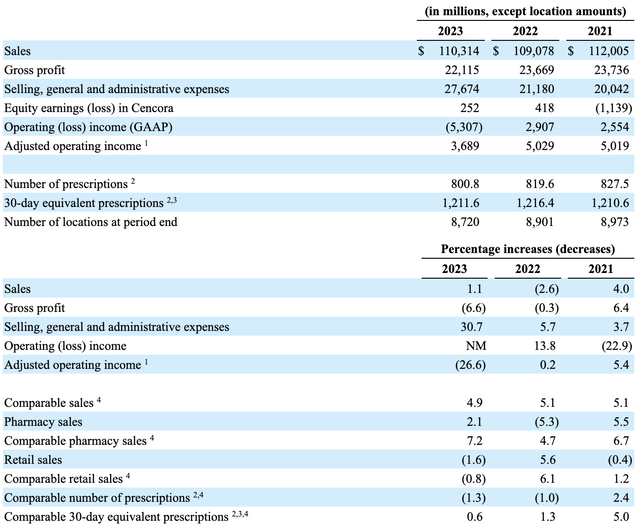

Keeping the COVID-19 pandemic in mind, it’s important to note that revenue for the past three fiscal years has remained in a fairly narrow range of between $109.08 billion and $112.01 billion. In 2023, it totaled $110.31 billion. Even though revenue remained range bound, there are some indicators that indicate issues with the firm. For starters, the number of prescriptions that this unit doled out showed a clear downtrend from 827.5 million in 2021 to 800.8 million in 2023. Management made clear that included in these counts are the COVID-19 vaccines. But there is also a structural component to this decline. The fact of the matter is that the company has been slowly decreasing the number of locations that it has in operation. Back in 2021, it ended its fiscal year with 8,973 stores. By the end of the 2023 fiscal year, this number had dropped by 2.8% to 8,720.

Despite this decline, there has been some positive news for investors. And this is that comparable sales are actually doing quite well. Even though retail sales for the company dropped 1.6% in 2023 compared to 2022, comparable retail sales fell a more modest 0.8%. On the pharmacy side, the picture was much better. Overall sales for the company’s pharmacy operations grew by 2.1%. But on a comparable basis, they grew an impressive 7.2%. That was actually the highest comparable sales increase that the pharmacy portion of this segment experienced in at least three years.

Irrespective of what the prescription picture looks like, what we have clearly here is a segment that continues to grow on a comparable basis but that is contending with what could become a long-term decline in store count. That’s an awful thing to see for a business that generates most of its revenue from retail activities. Further complicating this are concerns about increased competition. The competition I speak of does not involve other retail companies necessarily. Rather, it includes newer entrants into the medical space like Amazon (AMZN) with its Amazon Pharmacy business.

As with any time in which technology disrupts an old industry, nobody knows what the end picture will look like for existing players. But as an example of the kinds of threats that Walgreens Boots Alliance must contend with, consider that, in October of this year, Amazon said that it will begin testing prescription drug delivery using drones, with the goal of offering up over 500 different medications for common conditions, but not including controlled substances at this time.

International

The second largest segment that Walgreens Boots Alliance has is its International segment. This particular unit accounted for 16% of the company’s revenue in 2023. And according to management, this part of the company really involves the pharmacy LED health and beauty retail businesses that the company has overseas, as well as its pharmaceutical wholesaling and distribution operations in Germany. This is where the Boots part of its name comes into play, with that business largely focused on the UK and a few other countries.

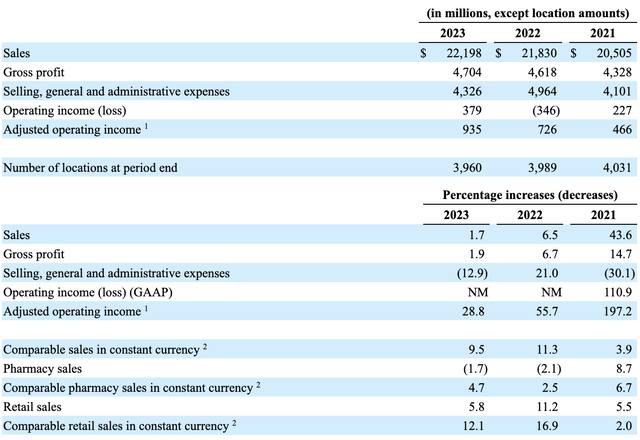

Walgreens Boots Alliance

Like the U.S. Retail Pharmacy business, International is facing some of the same long term structural concerns. Namely, the number of locations continues to decline, dropping from 4,031 in 2021 to 3,960 this year. Long term, this is something that needs to be corrected. At a minimum, investors should hope that the store count remains flat. But an ideal scenario would be to see some growth. Regardless of these concerns, however, the company has seen some positive developments. Revenue has actually grown consistently under this segment, climbing from $20.51 billion to $22.18 billion over the past three years.

The revenue picture would be even more appealing if it weren’t for the impact associated with foreign currency fluctuations. Consider the 2022 to 2023 window. Total pharmacy sales for the segment actually dropped by 1.7%. But comparable pharmacy sales utilizing constant currency popped up by 4.7%. Retail sales increased by 5.8%. But on a constant currency basis, comparable retail sales skyrocketed 12.1%. According to management, Prescription drug inflation in certain markets like Mexico and Chile, as well as improved funding for the NHS (National Health Services) in the UK, we’re responsible for the pharmacy side of things. And on the retail side of things, the company benefited from market share growth in the UK and increased store traffic following the COVID-19 pandemic. Robust demand for pharmaceutical wholesale services in Germany also were responsible for a good portion of this expansion.

U.S. Healthcare

Lastly, we end up with the most exciting segment. And that is the U.S. Healthcare segment. While this may sound like it has significant overlap with the U.S. Retail Pharmacy business, the fact of the matter is that this is a different animal altogether. And it might be a long-term answer to the company’s problems. When dealing with segments that are showing signs of permanent declines caused by structural issues, one good solution can be to invest in other growth avenues with the hope of replacing the outdated revenue sources. This is a costly process that is fraught with risk and that can take many years in order to achieve. But sometimes, it’s the best answer. In fact, this is a very popular strategy that is employed in the telecommunications industry. But I digress.

This particular unit is really a collection of businesses that Walgreens Boots Alliance has invested in in recent years. The bulk of the segment includes the company’s majority ownership position in VillageMD, a national provider of value-based care that provides primary, multi-specialty, and urgent care providers that serve patients not only in traditional clinic settings, but also in their homes or online. To be clear, this particular line of business is not immune to the innovations occurring in the medical space. Going back to Amazon for a moment, that company previously acquired One Medical for almost $4 billion. And in August of this year, it began offering video telemedicine services across all 50 states.

Walgreens Boots Alliance

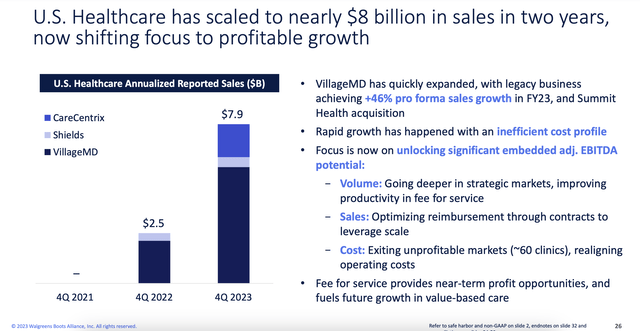

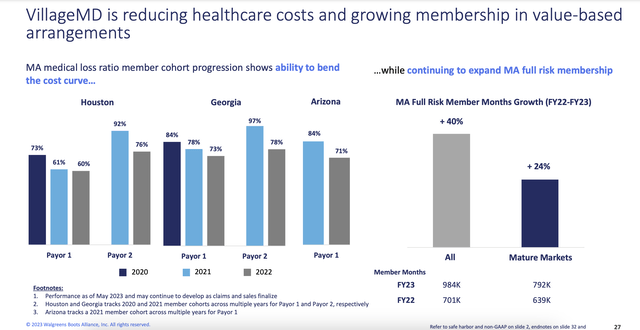

VillageMD, it’s worth mentioning, is doing very well on its own. According to management, the enterprise has proven successful in decreasing costs for its customers. And in the 2023 fiscal year alone, its legacy business experienced a 46% pro forma sales growth relative to 2022. There are other investments that the company has made in recent years for this segment as well. For instance, this includes its ownership of Shields, which is a specialty pharmacy integrator and accelerator for hospitals. And lastly, in March of this year, management completed the acquisition of the 45% of stock that it did not previously own of CareCentrix, which is a player in the post-acute and home care management sectors. That particular purchase cost the company $378 million.

Walgreens Boots Alliance

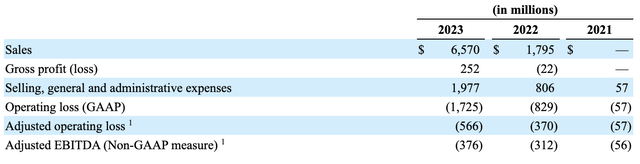

Thanks to these acquisitions, the U.S. Healthcare segment has been the most rapidly growing for the company. Revenue went from nothing in 2021 to $6.57 billion in 2023. Even ignoring the prospect of other acquisitions that may or may not come across, management is forecasting growth in this segment to take revenue up to between $8.3 billion and $8.8 billion this year. That would imply a pro forma growth rate year over year of between 10% and 17%.

Walgreens Boots Alliance

But there are other issues as well

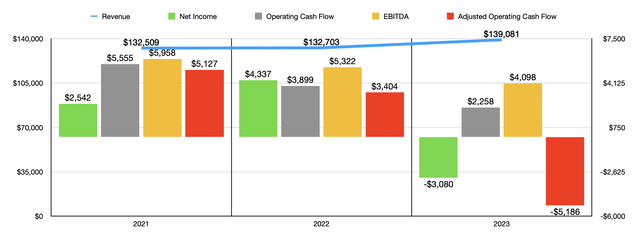

For all the different working parts and all of the strengths and weaknesses under the Walgreens Boots Alliance umbrella, the revenue picture for the company in recent years has been quite promising. Revenue has grown from $132.51 billion in 2021 to $139.08 billion in 2023. Yes, most of this is because of acquisitions. But revenue growth is still revenue growth. Where the picture becomes more complex is on the bottom line. In the chart below, you can see what I mean. Even as revenue has grown, profits and cash flows have shown weakness. These weaknesses are most evident when you look at the 2023 fiscal year compared to 2022. The company generated a net loss of $3.08 billion. And while operating cash flow came in at $2.26 billion, the number actually is negative to the tune of $5.19 billion if we adjust for changes in working capital.

Author – SEC EDGAR Data

Even on the topic of cash flow, an entire article could be dedicated. But there are a couple of headline items that helps you explain most of the pain. For starters, the company has had to contend with significant litigation issues. Its bottom line for the year actually includes a $6.8 billion pre-tax charge for opioid related claims and litigation settlements. I wish I could say that this is all that the business will be on the hook for. But the fact of the matter is that they probably will face additional expenses at some point in time. This is because the company remains a defendant in multiple actions in federal courts that allege that it participated in the spread of opioid abuse and addiction. And the charge in 2023 specifically covers estimated liabilities involving a multi-state settlement agreement and other related claims that are outside of these unresolved ones.

Interestingly, if we exclude the charge the company saw related to opioid issues, its selling, general, and administrative costs actually improved relative to revenue in 2023 compared to 2022. But there were some other areas where costs worsened. The gross profit margin for the U.S. Retail Pharmacy segment, for instance, fell from 21.7% to 20.1%. While this might not seem like a big change, when applied to the revenue for the company for that particular segment, it translates to an extra $1.82 billion in annual pretax expenses. This is largely because of a decline in COVID-19 vaccines and tests that proved to be a cash cow for the enterprise. And it’s also due in part to a reduction in pharmacy reimbursables.

The last thing I would like to point to involves the U.S. Healthcare segment. Even though this is expected to be a continued source of growth for the company, it has not been particularly pleasant for the firm’s bottom line. It went from generating an operating loss of $57 million in 2021 to generating an operating loss of $566 million in 2023. We can see a similar trend when looking at EBITDA, with that metric turning from negative $56 million to negative $376 million over the same window of time. The fact of the matter is that growth costs money. And significant investments do not translate to attractive bottom lines in the near term. The good news is that management is forecasting break even for that segment on an EBITDA basis for this year, plus or minus $50 million.

Shares are quite cheap

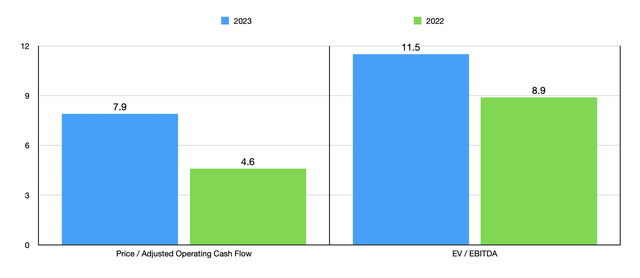

For all of the good and bad associated with Walgreens Boots Alliance at this time, it is undeniable that shares of the business are attractively priced. Even if we use the depressed results from the 2023 fiscal year, the firm is trading at a price to operating cash flow multiple of 7.9 and at an EV to EBITDA multiple of 11.5. This is up from the 4.6 and 8.9, respectively, that we get when using data from 2022. Although the stock does look attractively priced on an absolute basis, it is a bit pricey compared to rival CVS Health, which is trading at multiples of 6.2 and 7.3, respectively.

Author – SEC EDGAR Data

Takeaway

Based on my own review of Walgreens Boots Alliance, the company seems to have potential. But this is far from a riskless investment. Given all of the disruption occurring in this space and some of the weak points of the company, I would not feel comfortable having my money in the stock if I knew that I were to go into a five-year or ten-year coma tomorrow. But when you look at the growth initiatives that the company has and you consider that some of the pain recently has been one time in nature, shares do look cheap enough to warrant perhaps some upside for those who don’t mind having a speculative prospect in their portfolio. It is with this in mind that I have decided to rate the company a soft ‘buy’ at this time.

Read the full article here