Dear readers/followers,

the amount of table-pounding I’ve done for KION (OTCPK:KIGRY) is fairly staggering over the past year or so – but there’s a reason for me doing so. KION’s stock has seen a significant increase, making it no longer a bottom-fishing opportunity. The company has experienced a reversal in earnings and improved financial metrics, after a significant downturn following COVID-19 and what some characterized as a complete collapse of the company’s earnings potential – at least for the short term.

While this is of course a significant negative for anyone having previously invested in the company for the long-term, investors such as us that weren’t in the company until it was significantly cheaper, can enjoy the upside from the valuation reversal here.

KION has not yet reached anywhere close to its potential. In my last article I showcased RoR of around 50% – that’s now around 42%, and I expect we’ll be volatile for some time to come.

But the time of this being a cigar-butt, that time is over.

This article is an update on KION, and you can find my last article here.

Let’s revisit and see how things look after 3Q because since my last article, we’ve actually seen the company, for some time, declining in valuation prior to this earnings report.

KION – After 3Q23, the upside is clearer than before

Investors in KION want to see very clear reversals in the company’s fortunes year-over-year and a sequential increase in results. To some degree, that’s exactly what we have in this quarter.

Why?

Because the company managed a better-than-expected Q3 performance.

This was based on improvements in the KPIs for order intake, for revenues, for EBIT, for Free cash flow, and for EPS. Many of these improvements were entirely expected. We’re going to see a 100%+ improvement in both FCF and EBIT/EPS, for instance, that was clear based on the yearly results from a YoY perspective.

Some leadership changes as well. The company appointed a new President of Supply Chains Michael Larsson, and a CTO, Ching Pong Quek, leaving KION in a strong position following the retirements of the others here.

So what are the things that are causing not only the company to improve its guidance here but also causing the stock to move back up in valuation?

Obviously, a big part of it here is the fact that we can confirm the company moving back up in profitability in a very big way. The ITS segment is as of this quarter, back to double-digit EBIT margins on an adjusted basis. Order intake is good, and the margin is now at 11.6%, which is a recovery of 600 bps YoY, and over 200 bps QoQ. This was caused by improvements in volumes, pricing, and benefits from the company’s structural improvements across the board here.

Even in the SCS segment, which was actually expected to decline somewhat from the previous quarter, the company saw a weighing up in the results here, thanks to a large order in the segment. The expectations here are for a relatively lumpy order cadence, still characterized by an overall hesitation to sign larger contracts due to continued macro uncertainty and higher financing costs. The company’s order book is showing increased duration due to several, longer-term projects in the pipeline.

However, the sheer speed at which the company has shifted around its strategy has been impressive. Over 80% of the current SCS order book has price adjustment clauses. And despite everything, including the somewhat lumpy order intake, the company is showing excellent trends in EBIT and margins for this segment as well.

These are the company’s two segments. In short, KION is showing improvements across both of the business segments here.

What this means is that the company is improving its KPIs for the fourth consecutive quarter since we saw an absolute trough in the company’s valuation. This represents normalization and stabilization, which is exactly what we expected this company to manage. There are some effects from higher financing costs – KION certainly isn’t immune to these trends here.

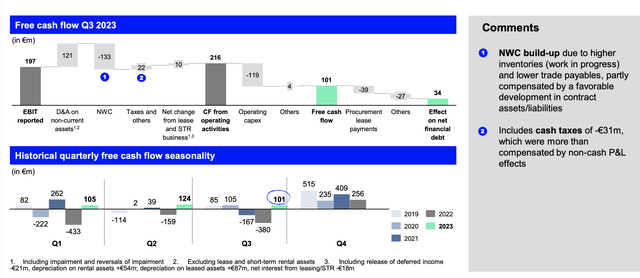

However, if you want further positives, you need to look no further than the company’s cash flow statement for the quarter, which shows the third consecutive triple-digit positive FCF on a quarterly basis. , and this is outside of the typical seasonality that KION is typically under.

KION IR (KION IR)

Leverage is up a bit – that much is true. The company’s liabilities from procurement leases and financing costs, as well as some pension liabilities, increase the industrial net debt to around €3.3B here – which represents a 2.1x industrial net debt/EBITDA. Is this worrying?

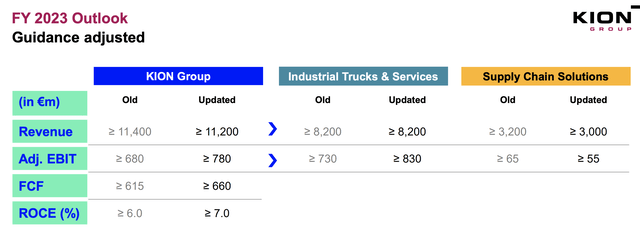

I would say no – the company has ample room to handle these, and overall these leverages have actually significantly improved over time. The outlook is now significantly improved for the 2023E period. While revenue is actually expected to be slightly lower, the quality of that revenue is now expected to be significantly higher.

In layman’s terms, the company is expected to reverse quicker than initially expected even by me.

KION IR (KION IR)

With the combination of ITS advantages of favorable input material availability, and effects from improvement programs as well as the stability in SCS, I now believe the company to revert in 2024 or early 2025E if nothing materially negative occurs. The company has managed to secure a good position for future profitability and continues to prove to the market that it’s able to continually improve the trends here. The benefits from the implemented operational measures are likely to continue to drive significant and improved metrics, that will result in double-digit adjusted EBIT margins for both segments here.

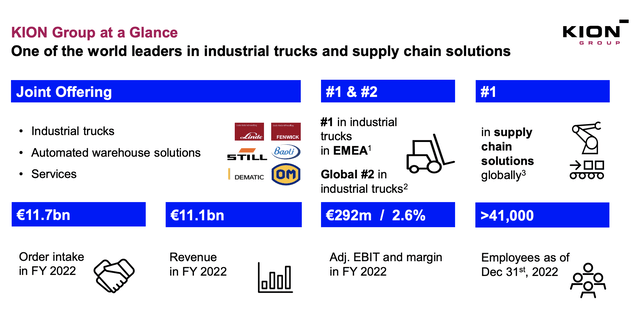

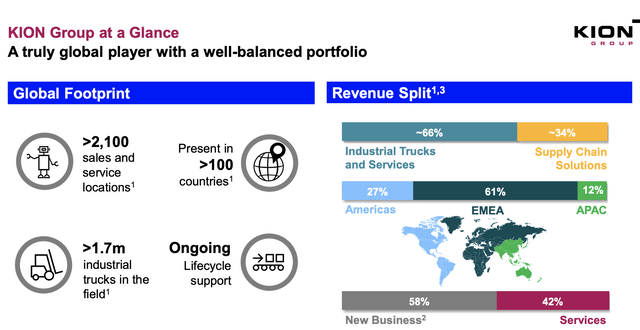

At this juncture, I really want to remind you that KION is a world-leading business in one of the more crucial segments in supply chain management. It’s 40k+ employees that keep the world moving, and if you like me managed to secure shares at a very low level, I believe you’re in for a several hundred percent RoR eventually.

KION IR (KION IR)

Will this continue to take time? Of course, it will. Nothing worth doing is “easy” or quick – that’s something I very firmly believe. And no safe recovery is going to be “fast” in nature, at least very few that I have seen.

What’s important to me is that the fundamentals are sound and things are moving in the right direction. And no matter how you choose to slice things here, this is certainly true at this particular time.

The acceleration for the company is broad-based. It reflects a fundamental restoration of demand levels in both of the company’s key sales segments, following a few quarters of struggle. Despite lower intake, the company’s current order book is well-filled. The split between ITS and SCS is still somewhat unfavorable, in that one segment is somewhat worse than the former – but cash flow trends have reversed, and the company’s working capital on a net basis is almost completely stable. And once things fully recover here, I do not think it unlikely that we’ll see the same sort of earnings or trends we saw only a few years ago.

KION IR (KION IR)

Let’s look at what this means for the company’s valuation trends.

KION – Plenty to like, even at a lower upside

Last time I wrote about KION, I made it clear to you that the longer you wait to invest here when the company is cheap, the worse it will be in the long term for your returns. That’s why I have added to my position as we’ve seen a drawdown.

KION trades at the native ticker KGX. That’s how I “BUY” the company. I believe this might be one of the last chances you have to get in on the ground floor of this company, even if the yield is likely to continue to be abysmal for this company. Reversal, however, is expected to be superb.

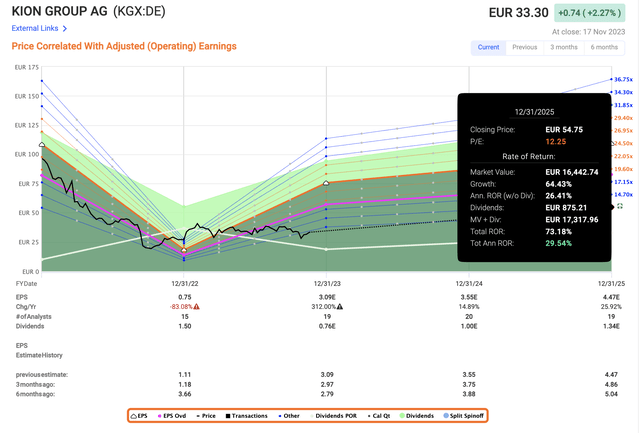

Including 2023-2025E, we’re expected to see a reversal of an average of 25%+ per year, which even if you forecast the company at only 12.25x P/E makes for 30% per year (almost) per year until 2025E.

KION IR (KION IR)

And let me clarify once again, that’s the lowest possible RoR I expect here.

More realistically, I now expect the company to be able to manage at least 19-20x P/E in this upward trend. Remember that KION typically manages an average of 24x P/E during better times, so such expectations are in no way outlandish. The result if the company manages to do this is an annualized RoR of 60%, with an implied share price of around €80/share, coming to over 170% in total RoR from today. Then you add the fact that I am already up more than 40% on my initial investment, and you can see why I consider this company such a great overall potential.

The thesis hasn’t changed. The company continues to prove its ability to restore its earnings and margins, and this also translates to increased analyst targets. The current averages from analysts are significantly higher than during the trough when the low realistic PT went down to €17/share (I’d still want to see that calculation, given my SOTP even at that time). We’re now at a range from €23 to €64/share, with an average of €44. This is obviously a target I consider to be far too low – but I believe the fact that 15 out of 21 analysts are now at “BUY” or equivalent ratings showcases the positive potential for the company at this particular time. If we just use median PS values for peers, or if we do a simple FCF projection based on the most recent results, we get valuations that easily come up to €70/share. Every single negative for the company, including asset growth rates, gross margin, and operating margin declines, is explainable by the recent things the company has been through, while the company seems fully able to improve all of these going forward.

For that reason, the following positive thesis for KION remains.

Thesis

My thesis on KION is as follows:

- KION Group is an attractive capital goods play with an emphasis on intralogistics solutions, automation, and warehouse technologies – things like forklifts, to put it simply.

- The company is undervalued and forecasts imply a significant upside over the coming 5 years, with an upside of over 100%. Even though this upside is now significantly lower than it once was, I still consider this company a massive buy. I haven’t shifted my PT for a very long time, and I won’t shift my PT here, over 1 year later.

- KION is a “BUY” with a price target of €78/share, and I have a high conviction and exposure to this company. I am not changing my PT as of this time, and remain at a high conviction.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (Italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansions/reversions.

That means that the company currently fulfills all of my criteria for attractive valuation-oriented investing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here