Martin Wolf, writer for the Financial Times, has warned us: “Painful fiscal choices seem to lie ahead.”

Public debt has reached high levels when compared with the past. Mr. Wolf reports that the IMF has shown that in 2023 the ratio of public debt in high-income countries reached 112 percent. This is down from the recent peak of 124 percent hit in 2020. Wolf notes that this latter peak hit the level of the previous peak in 1946, a period still connected with the Second World War. Whether or not these ratios stay stable or decline depends upon the fiscal affairs of the future and the economic growth rates of these economies involved.

But, let’s look at the prospects for economic growth over the next five years for these higher-income countries. Mr. Wolf cites figures put out by the International Monetary Fund. The forecasts are for the period 2024-2028. Real growth in the United States is forecast to come in at 1.9 percent, Canada is to hit 1.8 percent, the U.K. is to come in at 1.6 percent, and for Germany, 1.4 percent. The world is not going to be a very active place in the near term.

I have been arguing that the problem of slower economic growth is coming from the supply side of the economy and not from the demand side. Lots and lots of good things are going on in these economies, but, they are resulting in a slower performance in labor productivity growth not due to demand deficiencies. A major part of the reason for this result is that the economy is changing and changing very rapidly to reduce the importance of hard-core manufacturing output into a world that is more dependent upon networks and connections.

In a real sense, the data need to be looked out and brought up-to-date with the “new” world. This is one reason why things have been staying as good as they have and not tumbled into a “classic” recession, a movement in the business cycle.

So, for the next five years, the IMF is projecting the real growth rate of the United States to be 1.9 percent. This expectation is not too far below the record for the 2010s and up until the Covid-19 recession. The compound annual rate of real growth during this time period was 2.2 percent.

The decade was a pretty good one, but not one that produced annual growth statistics similar to those that the U.S. achieved in the past. The supply-side effects of the slower growth in labor productivity played a major role in how the economy performed in this decade.

So, I would argue that the forecast for the next five years is very consistent with the performance of the U.S. economy in the earlier decade.

What About Fiscal Policy?

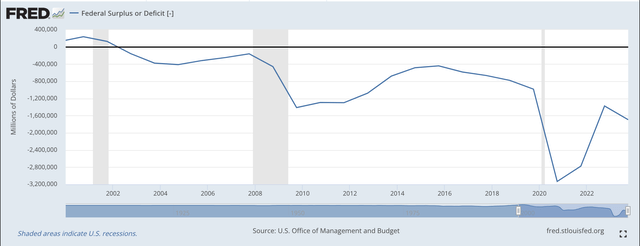

Well, the story about fiscal policy is somewhat different. In fact, one of the charts Mr. Wolf uses has the title “Government Indebtedness Has Mostly Soared In The Past Two Decades.”

In the case of the United States, this tells us a lot about governmental policymaking since 2001. Note, in the fiscal year 2001, the United States government produced a SURPLUS. Yes, believe it or not, the United States government produced a SURPLUS in fiscal year 2001.

Here, let’s take a look back.

Federal Deficit or Surplus (Federal Reserve)

The budget surplus was thanks to the economic policy decisions of the Clinton administration. Note, that after the end of the Clinton administration, the budget deficits pile up and it is very difficult to discern any real continuity to the outcome. The Covid-19 pandemic hit in the 2020-2021 period. However, budget deficits became large and stayed large. The future shows that the deficits continue to remain quite large and they extend out through the end of this decade.

To me, it looks as if there was very little control of the federal deficit during this time period. The federal budget deficit just turned out to be what it turned out to be. One further note to go with these statistics… the rate of interest in the United States was low for a long period of time and interest rates did not really start to rise again until 2022. Interest charges were not driving up the deficit during these years. One could argue that during this particular period of time, presidential administrations gave very little attention to keeping their budget deficits down.

And, so here we are. As Mr. Wolf SHOUTS OUT, “Painful fiscal choices seem to lie ahead!”

The Future

Very few people are now crying for the government to do something about the government’s fiscal state of affairs.

What happened after the Clinton administration? President Clinton was a Democrat, one with pretty liberal credentials. But, Mr. Clinton and his administration fought hard to generate and then sustain a budget surplus. Mr. George W. Bush, supposedly a fiscal conservative, got the government back into the steady, deficit spending habits. The administration of President Obama got the government further into the debt buildup. And, this has just continued through the presidencies of Trump and Biden.

Of course, the latter two presidents were helped to generate deficits by the pandemic and subsequent recession that hit the economy. But there seems to be no one really talking about how badly the government is out of balance and what really is necessary to correct all of the current shortfalls that exist.

In effect, I would say that the government budget and its production of deficits are “off-limits” for serious discussions. So, we are left with discussions about how the debt has built up in the United States, and also all over the world. Mr. Wolf is trying to say… this can’t go on! Let the politicians “kick the can” down the road again… and again… and again. But, this can’t continue.

Investors need to be very, very aware of this market situation. The world is currently full of irrational uncertainty. Fiscal irresponsibility just adds to the irrationality of the situation.

Read the full article here