There’s nothing not to like about Verizon (NYSE:VZ) right now. The company reported decent earnings results for Q3, its business appears to be recovering, and its stock is a decent dividend and value play with a modest upside. While Verizon’s business could be negatively affected by the worsening of the macroeconomic environment next year if we enter a recession, there are nevertheless reasons to believe that its shares remain an attractive investment at the current price.

Recovery Is On The Way

A few weeks ago, Verizon reported its Q3 earnings results which showed that it generated $33.33 billion in revenues, down 2.7% Y/Y but in line with the estimates, while its non-GAAP EPS was $1.22, above the expectations by $0.04. The decline in revenues is attributed mostly to the decline of postpaid upgrades which resulted in a 12% Y/Y revenue decline in the wireless equipment business. Despite this, Verizon managed to generate $14.6 billion in FCF YTD, which is already above its 2022 levels.

Going forward, there are reasons to believe that Verizon will be able to improve its overall business and grow its revenues in the foreseeable future. This is mostly due to the fact that the company has a decent momentum going for it. Its broadband business in Q3 had 434,000 net additions and recorded a fourth quarter of over 400,000 net adds in a row. At the same time, despite the $10 increase for new bundled customers, Verizon delivered 384,000 fixed wireless access net additions, while its bundled offering Fios managed to deliver 72,000 internet net adds, up 20% Y/Y. The company now has 10.3 million broadband subscribers, up 21% Y/Y, and it appears that it’s going to remain the case in the following quarters.

Let’s also not forget about the fact that with the rising inflation, wireless prices have been going up and increased by 5% over the last year, and yet it didn’t stop Verizon from improving its user metrics in recent months. After launching myPlan earlier this year and later the Ultimate Unlimited tier for it, the company was even able to increase its average revenue per account by 4.5% Y/Y in Q3 to $133.47, while its churn rate stood at only 0.85%. Considering that we’re likely seeing the bottom for prepaid volumes, it would be safe to say that Verizon will be able to retain its momentum in Q4 in part thanks to the offering of its flagship plans to the customers of the recently launched iPhone 15 that have already lifted the smartphone market.

What’s more is that as the macroeconomic environment improves, there’s a possibility that the company’s revenue growth will accelerate in the foreseeable future. Considering that the inflation stalled M/M in October after the two months of M/M increases, it’s safe to say that we’re in the disinflation mode which bodes well for companies like Verizon. The earlier rate-hiking cycle certainly negatively affected Verizon’s ability to exceed expectations, especially as it was in the middle of increasing its capital expenditures into 5G to remain competitive. As capital expenditures decrease, while the rates could be cut next year, Verizon has an opportunity to retain its momentum not only in Q4 but in 2024 as well.

The street already believes that that’s exactly going to be the case as it expects a return to the Y/Y revenue growth starting next year. Verizon’s management itself sounded optimistic at the latest conference call and increased its FCF guidance for FY23 to above $18 billion, up from the previous estimates of $17 billion.

Is The Stock A Buy?

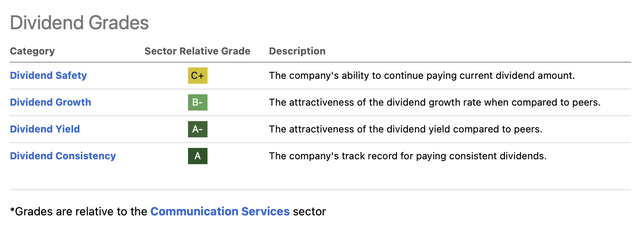

With such a positive outlook for the year, it’s safe to say that Verizon’s current debt situation is more than manageable while its dividends are relatively safe. Even though the company had only $4.3 billion in cash reserves and $137.2 billion in long-term debt at the end of Q3, it has an interest coverage ratio of over 5x, which makes it easy for it to continue to cover interest expenses and pay dividends at the same time. Considering the consistency at which Verizon has been rewarding its shareholders even during the troubled times, it makes sense to say that the company’s stock is a great dividend play at the moment, especially since it has a forward yield of ~7%.

Verizon’s Dividend Grades (Seeking Alpha)

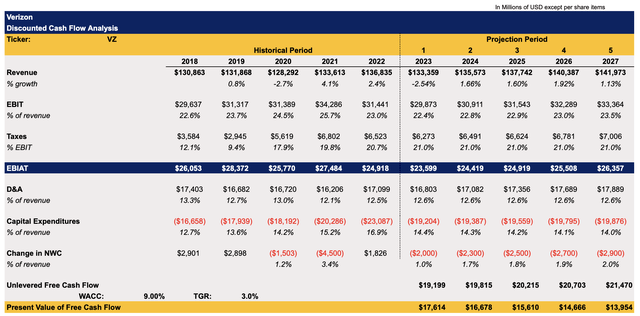

On top of that, there are also reasons to believe that Verizon’s stock is undervalued and offers a decent upside at the current levels. My DCF model below assumes that the top-line growth will return in FY24 and beyond, which aligns with the current sentiment on the street. The EBIT as a percentage of revenue is expected to be in the range of 22.4% to 23.5%, which closely mirrors rates from the previous years. The tax rate stands at 21%, which is currently the standard corporate tax rate in the United States. The capital expenditures assumptions for FY23 align with the management’s forecast for the year. At the same time, the model assumes a deceleration of capital expenditures as a percentage of revenue in FY24 and beyond since the initial heavy investment into the 5G infrastructure has already taken place in recent years. The WACC in the model stands at 9%, while the terminal growth rate is 3%.

Verizon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

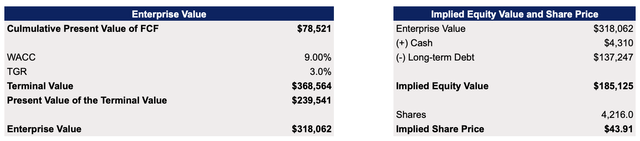

This model shows that Verizon’s enterprise value is $318 billion, while its fair value is $43.91 per share, which represents an upside of ~20% from the current market price. Considering this, it’s safe to say that Verizon is a decent dividend and value stock at the current price.

Verizon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The Only Risk That Truly Matters

It’s safe to assume that the only thing that could undermine Verizon’s recovery is the worsening of the macroeconomic environment. The company operates a predictable business that mostly grows during the good times and mostly declines in times of uncertainty.

That’s why there’s a risk that if the macro conditions deteriorate and impact consumers and businesses, Verizon’s recovery could be in jeopardy, and the company could start losing its broadband subscribers. Even though the inflation data for October surprised many, there’s a risk that the inflation itself won’t fall to the 2% level, which the Federal Reserve targets, anytime soon and could lead to the extension of the current hawkish monetary policy by the regulators for a longer period. There’s already an indication that consumer purchasing power might be declining due to inflation ahead of the holiday season.

Considering that a company like Verizon is expected to grow only at 1% to 2% a year, there’s always a risk that any small worsening of the macroeconomic conditions could easily undermine its growth story. That’s something that potential or current investors need to constantly keep in mind, as it’s the only major risk that truly matters at this stage.

Other than that, there’s nothing not to like about Verizon’s business and if the macro risks won’t fully materialize – then it’s unlikely that something would be able to undermine its recovery or the investment attractiveness of its shares.

Read the full article here