Investment Overview

Arvinas (NASDAQ:ARVN), ahead of Kymera Therapeutics (KYMR) is the largest (by market cap), most advanced (by study phase), richest (in terms of cash available), and best performing (by share price) company currently developing a class of drug known as a protein degrader. According to Arvinas 2022 annual report / 10K submission:

We use our PROTAC Discovery Engine, our proprietary technology platform to engineer proteolysis targeting chimeras, or PROTAC targeted protein degraders, that are designed to harness the body’s own natural protein disposal system to selectively and efficiently degrade and remove disease-causing proteins.

We have three investigational clinical stage programs: ARV-471, a novel PROTAC estrogen receptor (“ER”) protein degrader for the treatment of patients with locally advanced or metastatic ER positive / human epidermal growth factor receptor 2 (“HER2”) negative, or ER+/HER2-, breast cancer and bavdegalutamide (ARV-110) and ARV-766, each an oral PROTAC protein degrader that targets the androgen receptor protein (“AR”), for the treatment of men with metastatic castration-resistant prostate cancer (“mCRPC”).

This differentiates Arvinas further from Kymera, whose primary focus is on autoimmune conditions as opposed to oncology. ARV-471 is now known as Vepdegestrant, and it is being co-developed alongside the Pharma giant Pfizer (PFE), who paid $650m up-front, and pledged up to $1.4bn in future milestone payments, as well as taking a $350m equity stake in Arvinas, for a 50% share of all future profits from the drug, if commercialised.

Arvinas is a cash rich company, reporting current assets of >$1bn when announcing its Q3 earnings on November 7th. The company’s cash burn is considerable however, with a net loss of $(64m) reported in Q3, and $(236m) year-to-date. Immediately after the earnings announcement, Arvinas filed an automatic mixed securities shelf which will allow the company to raise another ~$260m.

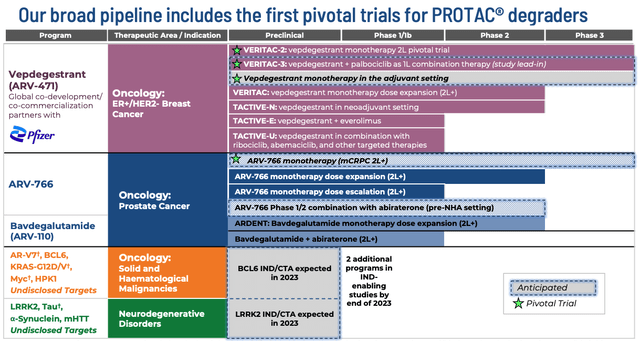

Future raises will dilute investors holdings, but will also likely give Arvinas the funding runway it needs to complete its Phase 3 studies of vepdegestrant and ARV-766, push for commercial approval, complete its other studies, and bring new candidates into the clinic – the company’s pipeline is illustrated as below in a recent corporate presentation.

Arvinas pipeline (Arvinas presentation)

Exploring Arvinas’ Pipeline – Vepdegestrant Has Blockbuster Potential In Breast Cancer, But Weak Data Implies A Struggle For Approval

Arvinas IPO’d in 2016, raising ~$120m via the issuance of ~7.5m shares priced at $16 per share. At the end of 2020 the company released some promising Phase 1 study stage data in relation to ARV-471 / Vepdegestrant, showing one confirmed partial response (PR), two additional patients with unconfirmed PRs, and a clinical benefit rate (CBR) of 42%, in 12 evaluable patients. Arvinas’ Chief Medical Officer stated that:

Based on data to date, we believe ARV-471 is the most promising ER-targeting therapy in the clinic, showing early signs of efficacy, a favorable tolerability profile, and better ER degradation than that previously reported for fulvestrant.

Fulvestrant is marketed and sold by AstraZeneca (AZN), under the brand name Faslodex. The drug earned blockbuster (>$1bn per annum) revenues in 2018, but only $335m in 2022 due to its patent having expired. The Phase 1 data sent Arvinas’ share price soaring to >$80 per share, and in July 2021, when the Pfizer deal was first announced, shares reached their peak value of >$100 per share.

This was arguably a high water mark for the protein degradation thesis – after the failure of 2 other breast cancer candidates with a similar mechanism of action (“MoA”) to vepdegestrant – French Pharma giant Sanofi’s (SNY) selective estrogen receptor degrader and Swiss based Roche’s (OTCQX:RHHBY) giredestrant – to meet key endpoints of progression free survival (“PFS”), there was widespread scepticism around the protein degradation thesis, and the market began to dump Arvinas stock, which sank to ~$38 per share by mid-2022.

In November 2022, Arvinas and Pfizer shared their own Phase 2 study data for vepdegestrant, and it was arguably no better than the data shared by Sanofi and Roche, with a single partial response observed in a patient population of 35. The market sold Arvinas stock on the news, and the bear run continued until last month, when the stock price reached a 4-year low of ~$14 per share.

Arvinas management interpreted the results differently to the market, however, noting the clinical benefit rate – defined as the “total number (or percentage) of patients who achieved a complete response, partial response, or had stable disease for 6 months or more” – of 38%, which rose to 51% in patients with ESR1 mutant tumors, and progression free survival of 3.7 months in all patients, and 5.7 months in ESR1+ patients. The safety profile was another positive, with no dose reductions, and only 1 study discontinuation due to a treatment related adverse effect (“TRAE”).

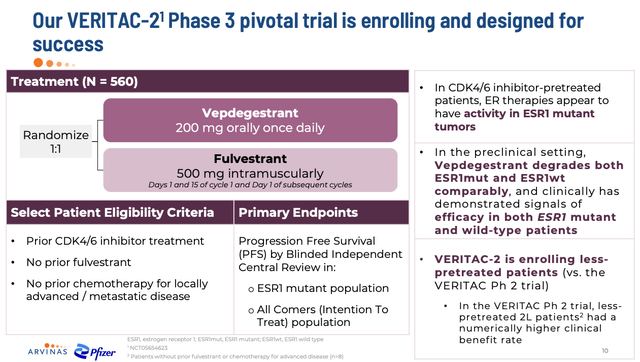

Phase 3 vepdegestrant study (investor presentation)

The VERITAC-2 Phase 3 study is expected to read out top line data in the second half of next year, and as shown above it has been designed to include less heavily pre-treated patients, with no patients included who have received fulvestrant, although all patients will have received one prior line of a CDK4/6 inhibitor, such as Pfizer’s Ibrance – $5.4bn of revenues in 2022. The primary endpoint will be PFS in all-comers, and in the ESR1 mutant population specifically.

While VERITAC-2 evaluates vepdegestrant as a monotherapy, VERITAC-3 will evaluate a combo of 200mg of the protein degrader plus 100mg or 75mg of Ibrance, again with a PFS endpoint. While these may be the key studies to keep track of, Arvinas believes it is “building a robust vepdegestrant development program across multiple setting of breast cancer”, including as third, second, and first line therapy, and as an adjuvant, and in combo with several different drugs, including, for example, Swiss Pharma Novartis’ (NVS) Afinitor, an m-TOR inhibitor.

Pfizer itself has referred to vepdegestrant as a “potential next-generation backbone therapy”, although based on data collected to date it would be tough to make the case that the drug is a “slam dunk” for approval, given the failure of other drugs with the same MoA, and the lukewarm results from the VERITAC Phase 2 study. One positive is that vepdegestrant can be administered orally, whilst fulvestrant is an injectable therapy. Fulvestrant has been approved since 2002, but a more recent approval came in 2017, in combo with Eli Lilly’s (LLY) Verzenio – according to a press release:

The FDA approval is based on data from the Phase III MONARCH 2 trial, which met the study’s primary endpoint of PFS.

The trial included 669 women with HR+, HER2- advanced breast cancer. The results showed a statistically significant increase in investigator-assessed median PFS of 7.1 months (16.4 months vs 9.3 months) in patients who received Faslodex 500 mg and abemaciclib 150 mg over Faslodex and placebo (HR: 0.553; 95% CI: 0.449-0.681; p<0.0001).

By comparison, the PFS generated by vepdegestrant of 5.7 months in ESR1 mutated patients looks unimpressive – although it is rarely a good idea to compare study results. Based on the available data, one conclusion could be that the VERITAC Phase 2 studies are proceeding more in hope, than expectation. Nevertheless, the changes to the trial design may change matters considerably, and the potential market opportunity excites – if approved as a best-in-class therapy, vepdegestrant would surely be a guaranteed blockbuster, and in that scenario, Arvinas’ valuation ought to increase by 2/3 times at least. A buyout by partner Pfizer would be another scenario in which Arvinas shareholders would likely make a triple-digit return on their investment, if buying at today’s prices.

ARV-766 & Bavdegalutamide & Remaining Clinical Pipeline

Another asset of Arvinas’ – this time wholly owned by the company – slated for a Phase 3 clinical study is ARV-766. This candidate has apparently been preferred to bavdegalutamide, given:

New interim data from Phase 1/2 trial with ARV-766 showed a broader efficacy profile and superior tolerability versus bavdegalutamide in the clinical setting, with a potentially differentiated profile against other AR directed therapies.

The indications are metastatic castrate resistant prostate cancer (“mCRPC”), which represents a 35k patient market, and metastatic castrate sensitive prostate cancer (“mSCPC”), which is an 87k patient market. A Phase 3 study in post-novel hormonal agent (“NHA”) mCRPC patients, most likely later line, could begin as early as 2Q 2024.

Meanwhile, a Phase 2 dose expansion study in the same indication is ongoing, and a pre-NHA study of ARV-766 in combo with abiraterone – Johnson & Johnson’s (JNJ) $1.8bn (in 2022) selling prostate drug, is expected to begin before the end of the year.

As with vepdegestrant, the market opportunity is large, and the efficacy bars to hit are not high – when Zytiga was approved in December 2012 for late-stage prostate, it was based on a median overall survival of 35.3 months compared with 30.1 months for those receiving the placebo.

My suspicion is that Arvinas will likely discontinue studies of bavdegalutamide in order to save costs, with ARV-766 emerging as the superior candidate, but Arvinas has promised to initiate 4 in-human studies of new PROTAC programs in the next 2 years, and says it has 20+ preclinical programs in development, so there is no shortage of diversification in the pipeline. In its Q3 earnings release the company makes the following pledges:

- Submit two investigational new drug (IND)/clinical trial authorization (“CTA”) applications for the Company’s BCL6 (oncology) and LRRK2 (neuroscience) PROTAC protein degraders by year-end 2023.

- Progress at least two additional PROTAC protein degrader programs into IND- or CTA-enabling studies by year-end 2023.

The BCL6 candidate will address diffuse large B-cell lymphoma (“DLBCL”), a first foray into hematological cancer treatment, a field where orally available drug options are limited, and apparently, the candidate has shown near-100% tumor reduction in preclinical models. The LRRK2 candidate will look at Parkinson’s Disease, expanding the breadth of addressable diseases into the central nervous system (“CNS”).

Concluding Thoughts – Why I Make Arvinas A Speculative Buy

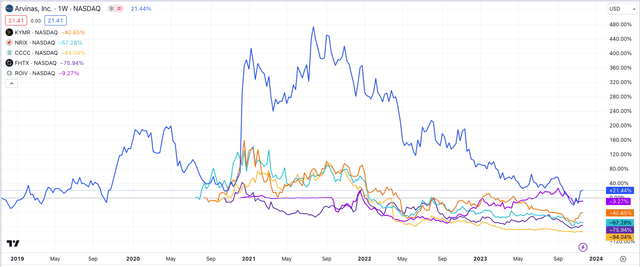

Of all the biotechs launched specifically to develop protein degrading drugs, Arvinas is the only one to be trading above its IPO price today.

Arvinas SP performance vs peers (TradingView)

As we can see above, companies such as C4 Therapeutics (CCCC), Nurix Therapeutics (NRIX), and Foghorn Therapeutics (FHTX) have become almost uninvestable, while Kymera’s market cap of $1.1bn has now slipped below Arvinas’, which is currently $1.2bn.

The reality is that we can identify plenty of red flags in relation to Arvinas, also. The underwhelming study results, the cash burn, market sentiment, slow pace of progress, and the undermining of the protein degradation thesis due to the failures of other drugs.

There are several reasons why I believe investors may wish to keep the faith with Arvinas, however. First of all, the company has a lengthy funding runway, meaning there are few brakes on the R&D spend. With Pfizer sharing the costs of vepdegestrant pivotal studies, Arvinas can keep bringing new candidates into the clinic, and it has plenty of such candidates, targeting a diverse range of diseases.

Secondly, although an eventual approval looks a challenging target, vepdegrestrant has at least outlasted rival candidates developed by Sanofi and Roche, and with the changes to the Phase 3 trial design, perhaps Pfizer and Arvinas can find the efficacy edge required to secure a crucial approval in breast cancer, and open the door to label expansion opportunities at the same time. It should be remembered that this is a new class of drug that has not been widely tested, therefore it may take time to discover where and how it may be most effective.

Even if vepdegestrant fails to make it to market, Arvinas will have learned a great deal from the process, and may be able to tweak future candidates based on data gained from trialling vepdegestrant. That seems to be what happened in prostate cancer with ARV-766 and bavdegalutamide. Protein degradation may be out of favour with the market, but it remains a potentially compelling MoA that can only improve as testing continues.

If vepdegestrant is approved, it will undoubtedly be a major upside catalyst for Arvinas, and with top line data arriving next year, it’s possible we won’t see shares trade this low again, at least until that data arrives, as the market begins to anticipate such a crucial catalyst.

Indeed, if that data readout is positive, gains ought to be spectacular. There is additionally data arriving in December from the combo study with ibrance, and other studies with other CDK4 inhibitors ongoing. There is a potential Phase 3 study of ARV-766 arriving next year, and more, potentially better, candidates for which the company has submitted investigation new drug (“IND”) applications.

In summary, while protein degradation may currently out of favour with Mr. Market, Arvinas at least has multiple reasons to be optimistic it can push the envelope in this space, and whilst acknowledging the risk of share price losses should vepdegestrant fail, if it succeeds, the near-term upside catalysts are tantalising, and even if it fails, while the short term losses will be damaging, I don’t think it will spell the end of the road for Arvinas, or its PROTAC drug development technology.

Read the full article here