Not since October of 2020 have I written an article dedicated to Devon Energy (NYSE:DVN). Back then, I rated the company a ‘buy’ after news broke that management struck a deal to absorb WPX Energy in a massive transaction valued at $2.84 billion. At the time, I acknowledged that the transaction created a major power player in the Delaware Basin, and I recognized just how much of a boon to shareholders synergies would be if ultimately realized. Clearly, something has gone right. I say this because, since the publication of that article, Devon Energy has generated a return for investors of 499.3%. That dwarfs the 34.2% increase seen by the S&P 500 over the same window of time.

Given the amount of time that has passed, we now have some idea as to how that purchase played out. The fact of the matter is that management has done a fantastic job of growing the company. The firm has also benefited tremendously from higher oil prices and other strategic moves made over the years. And even though the stock has risen materially, if current projections are correct, additional upside very likely exists for shareholders from this point on. So, because of that, I have decided to keep the business rated a ‘buy’ for now.

The picture looks as good as ever

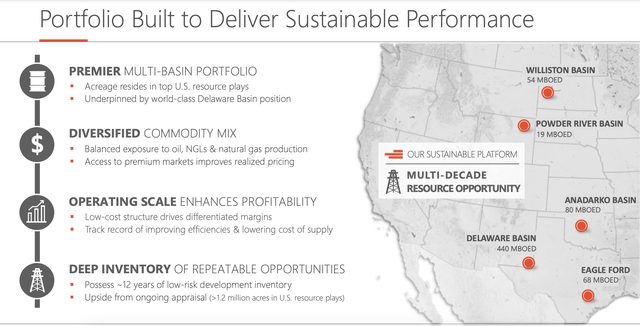

For those not terribly familiar with Devon Energy, the company operates as an oil and gas exploration and production firm that is focused on onshore production in the U.S. market. These days, the behemoth has operations spread across various parts of the nation. Using current data, the company gets about 12% of its production from the Anadarko Basin. Another 8% comes from the Williston Basin, while 10% is attributable to the rather prolific Eagle Ford Basin. Its smallest production region is in the Powder River Basin, which accounts for only about 3% of output.

Devon Energy

While all of these areas are important for the company, there is no denying that its true focus is on the Delaware Basin that straddles Texas and New Mexico. In 2022, the Delaware Basin was responsible for 414,000 BOE (barrels of oil equivalent) worth of output per day, accounting for 68% of the company’s output for the year. Throughout this year, investments in that region have created tremendous upside for the business.

Devon Energy

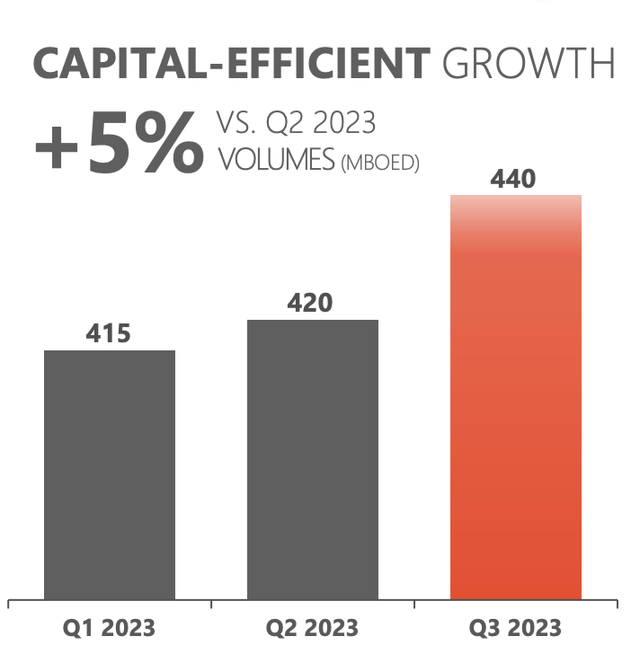

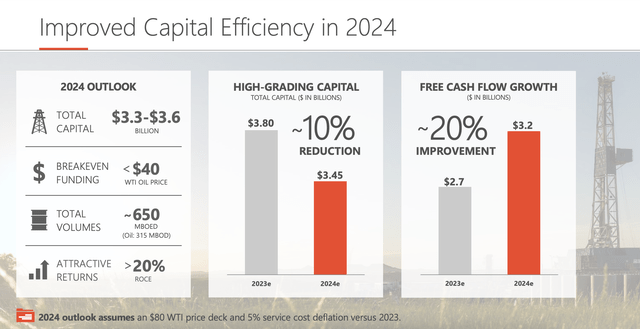

By the third quarter, output had grown to 440,000 BOE per day, and management expects this growth to continue. What’s really great is that the company has a lot of space to work with. It controls about 400,000 net acres of land between New Mexico and Texas. So, by allocating significant amounts of capital expenditures, management hopes to use this region as fuel for shareholder value creation. To answer the question of how much spending, consider that the company is going to be allocating between $3.3 billion and $3.6 billion toward capital projects in 2024. And about 60% of that is going to be dedicated to the Delaware Basin.

Devon Energy

Surprisingly, this amount of spending is actually a reduction from the $3.8 billion management has forecasted for capital projects for this year. But even so, it’s expected that overall production across the enterprise will be around 650,000 BOE per day. 48% of this should be in the form of oil, with 25% in the form of NGLs and the remaining 27% in the form of natural gas. When combined with the expectation that costs should decline by around 5% year over year, the company is forecasting a surge in free cash flow from $2.7 billion this year to $3.2 billion next year. It is worth noting that this assumes that oil prices average $80 per barrel. We aren’t too far off that right now at $77.76 per barrel. Even in the event that energy prices plunge, management assures investors that the breakeven point for crude is around $40 per barrel. It is certainly possible that prices could fall at some point below that. With a net leverage ratio for this year of about 0.7, the company should be fine.

Devon Energy

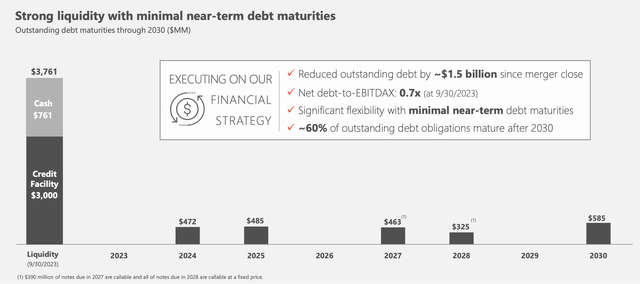

Speaking of debt, net debt as of this writing is $5.40 billion. Even though the net leverage ratio for the enterprise is comfortably below the 2 handle that many investors in this space see as the upper acceptable range, the company intends to drive leverage even lower. Using the free cash flow the company is expected to generate this year and next, as well as through 2025, it is targeting the retirement of $957 million worth of debt that comes due between next year and the year after. If management ends up paying down that debt, the next debt due is not until $463 million that the company has to pay in 2027.

Devon Energy

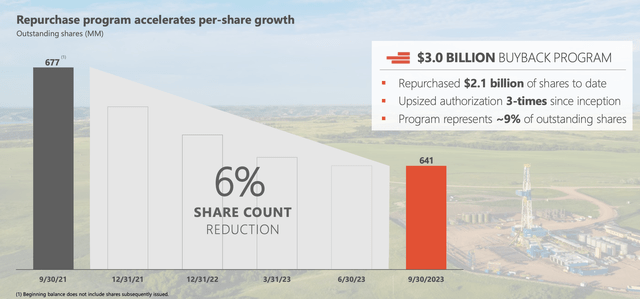

With the extra cash flows that the business is generating, it also plans to return capital to shareholders. In fact, moving forward, the company intends to allocate around 70% of its free cash flow to dividends and share repurchases. Since launching a share buyback program (that was eventually grown to $3 billion) back in September 2021, management has repurchased $2.1 billion worth of stock. They have also made sure to pay out a distribution, with the current goal of growing that distribution by 5% next year.

Author – SEC EDGAR Data

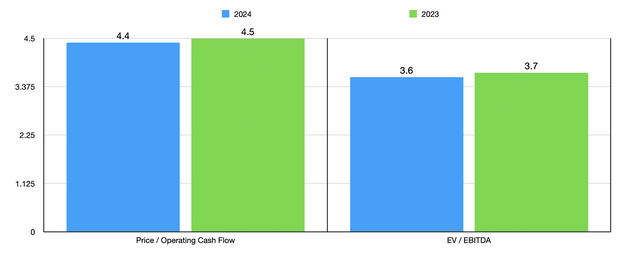

You would think that such a high-quality operator would be an expensive company to buy into, but it’s not. Based on my own estimates, if management’s forecasts for 2023 and 2024 are accurate, then EBITDA should be around $9.39 billion this year and $9.61 billion next year. Based on these figures, I was able to value the company as shown in the chart above. These multiples are quite low on an absolute basis. But they also look low compared to some other major firms I have seen recently. Earlier this year, for instance, Exxon Mobil (XOM) struck a deal to purchase Pioneer Natural Resources (PXD) valued at $59.5 billion. That translated to a price to operating cash flow multiple of 4.9 and an EV to EBITDA multiple of 5.1.

Similarly, Chevron (CVX) decided to purchase Hess Corporation (HES) at a rather hefty multiple using data from this year. With production expected to surge next year, the EV to EBITDA multiple on a forward basis came in at 7.5. Another big player in the space, Occidental Petroleum (OXY), is trading out a price to operating cash flow multiple of 4.8 and an EV to EBITDA multiple of 5.6. Now, none of these are perfect comparables by any means. For instance, the big appeal behind Chevron acquiring Hess involves its big offshore opportunity in Guyana while Devon Energy is a big onshore player, but they do go to demonstrate just how cheap Devon Energy happens to be compared to other large oil and gas companies.

Takeaway

Based on all the data provided, I would argue that Devon Energy is doing quite well for itself. Future growth looks appealing, and the stock is trading at low levels. Debt is under control and it should be falling even further from here. The breakeven point for oil is lower than what we realistically will see for the foreseeable future. Management has a good track record of returning capital to shareholders while simultaneously growing output. Add all of these factors together, and I believe that the ‘buy’ rating I assigned the stock previously still makes sense.

Read the full article here