Realty Income Corporation (NYSE:O) just announced that it would invest in two data centers that are currently under construction, and I have seen many investors celebrate this latest news.

Here are just a few examples of comments that I have read:

“Seems like a very attractive deal for O”

“Let’s go, O!”

“How can anyone be upset when O is making smart business decisions?”

“$O firing on all cylinders. Getting into the data center sector is exactly what I was looking for. An aggressive buyer at these levels.”

“Love it. $O makes another smart move. [This comment got 15 likes!]”

Digital Realty Trust

But I actually don’t like this deal, and it has caused me to reduce my Price Target for Realty Income stock.

There are three reasons for this:

Reason #1: No Spread

The first reason is that there is essentially no spread in this deal for Realty Income.

The going-in cap rate is 6.9%, but Realty Income is today priced at an ~8% the funds from operations (“FFO”) yield. With some debt, its average cost of capital comes down a bit, but it doesn’t help much in today’s higher interest rate world.

In any case, the margin for Realty Income is very small at best, and nonexistent at worst, and it is concerning me that they would make such a deal, knowing that the expected return does not cover their cost of equity.

If this wasn’t Realty Income, I would say that this seems like a classic case of growth-at-all-cost. Given how discounted their stock has become, I would rather see them buy back some stock if they have some cash left over. It would send a strong bullish signal to the market and perhaps help its future cost of capital. I fear that this transaction will have the opposite effect.

Reason #2: Higher Risk Deal

Realty Income has traditionally been a net lease REIT that would focus on lower-risk service-oriented retail properties such as Dollar General (DG) and Walmart (WMT) grocery stores.

Those are relatively safe investments.

But now this triple net lease landlord is investing in a data center development project. Clearly, this is a higher-risk investment. Realty Income is going up the risk spectrum, and it is still not able to earn a spread over its cost of capital.

I dislike data centers because I fear that depreciation is a real risk for these properties. They can earn strong initial yields, and this is why the likes of Digital Realty (DLR) and Equinix (EQIX) have done so well as they built large portfolios of data centers and earned large spreads over their cost of capital.

But what if in 20 years this technology has aged and today’s properties aren’t as valuable anymore? I am not saying that this will be the case, but it is a risk. I am much more confident that a well-located net lease property that’s occupied by Walmart and has performed well for 10 years will still be valuable a few decades from now.

Reason #3: “Diworsification”

Historically, the market has rewarded REITs that would specialize in a specific property sector with a premium valuation, and on the flip side, it would punish REITs that lacked focus with a discounted valuation.

The rationale here is that a specialist deserves a higher valuation because it is likelier to develop competitive advantages that would result in greater shareholder value creation.

On the other hand, you cannot be a “jack of all trades,” and so if you get too spread out, your focus will be diluted, and that warrants a lower valuation.

This is the reason why diversified REITs like Armada Hoffler Properties, Inc. (AHH) have long traded at discounts relative to REIT sector averages.

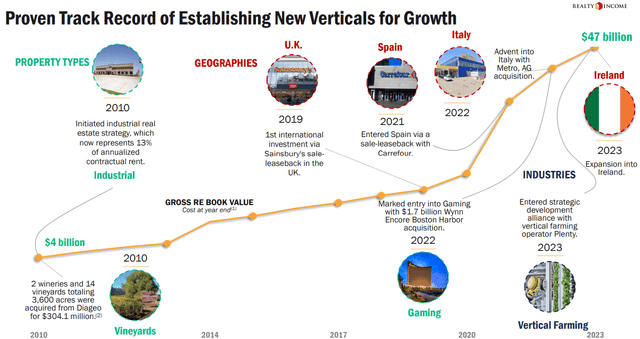

I am telling you this because it appears that Realty Income is losing its focus.

One of the reasons why Realty Income used to trade at a premium valuation is because it was highly specialized and it had achieved a great track record in its niche.

But now it is stepping out of it.

Last year, it started investing in casinos

Then, it invested in vertical farming.

After that, it acquired Spirit Realty Capital (SRC), which significantly expanded its industrial property portfolio.

Now, it is investing in data centers…

What’s next? Is there anything Realty Income wouldn’t go into?

Realty Income

I think that their management is very competent and they know that stepping out of their circle of competence has significant risks. It could hurt their market sentiment and also lead to future losses.

But they are still doing it anyway because they have no other choice.

They have gotten so big that there simply aren’t enough investment opportunities in service-oriented net lease properties.

They need to acquire billions of dollars’ worth of assets each year, and to keep the ball rolling, they just have to step into new property sectors, and this data center deal is further proof of that.

It is concerning because it tells you loud and clear that it is getting harder for them to grow, and it also increases the risk that their market sentiment will take a permanent hit, preventing them from ever recovering to their previous highs.

Takeaway: Buy, Hold, or Sell Realty Income?

Even despite all of this, I am still bullish on Realty Income and I give it a Buy rating. It is so heavily discounted today that it does not need to achieve much growth to achieve high single-digit or low double-digit annual total returns.

It is priced at just 12.5x FFO and it offers a safe and growing 5.8% dividend yield right now. If your goal is to maximize safe income, then Realty Income is a great choice, and if and when interest rates go lower, it will likely also enjoy some upside.

But I am reducing my price target. This recent deal reaffirms my belief that there are better options in the REIT sector for those investors who are seeking to maximize total returns.

Read the full article here