VICI Properties Inc. (NYSE:VICI) investors have suffered a torrid year since VICI topped out in August 2022. Notwithstanding its position as a market-leading experiential REIT, macroeconomic factors matter, suggesting investors must consider the broader view even when assessing individual REITs.

I last updated my thesis on VICI in mid-September 2023, urging investors to be wary about adding more exposure. I stressed that “a subsequent re-test of the $30 level cannot be ruled out, with momentum increasingly favoring sellers.”

That thesis has panned out accordingly, with VICI falling toward the $26 level before bottoming out in early November 2023. Therefore, I believe it’s timely for me to reassess the current opportunity in VICI on whether dip buyers waiting patiently can finally pounce on it.

VICI has underperformed the S&P 500 (SPX) (SPY) over the past year, registering a 1Y total return of -9.5%. The downward volatility over the past two months hit VICI holders particularly hard, with the stock down 8% on a total return basis since my update, contributing significantly to its underperformance.

Vici delivered its third-quarter or FQ3 earnings release in late October 2023. It was a solid quarter, as management also upgraded its guidance for the year. Despite that, the downward volatility experienced since then demonstrated that market participants remain concerned over the overall health of REITs.

VICI bulls would likely point out the supposed non-cyclical and sticky experiential assets in Vici’s portfolio. The recent sale-and-leaseback transaction with Bowlero Corp. (BOWL) expanded Vici’s exposure to leading non-gaming assets that are expected to be AFFO-accretive.

However, the acquisition cap rate of 7.3% was well below the 9% to 10% rates that would have lifted investors’ confidence further. Accordingly, management accentuated that such opportunities are unlikely in the current market environment. CEO Ed Pitoniak indicated that “there are few opportunities to acquire high-quality real estate occupied by strong operators at 9 and 10 cap rates.”

Pitoniak also cautioned that the volatility in funding costs could implicate transactions “with longer gestation periods.” As a result, investors must remain patient as the company assesses the opportunities in its pipeline that meet its requirements.

I commend management for arranging a substantial forward sale agreement in January 2023, when its shares traded much higher. The company has “completed the physical settlement of all the remaining 17,702,500 shares of common stock under the January 2023 forward sale agreements.” After completion, it delivered net proceeds of about $560.3M, equivalent to about $31.7 per share.

It has provided the company with significant financial flexibility as it deals with a high adjusted EBITDA leverage ratio of 5.7x, well above its long-term target. Coupled with a debt maturity profile comprising more than 18% of its total debt base through 2025, it could hamper Vici’s ability to continue driving acquisitive growth. Furthermore, the lowered cap rates on its most recent transaction could also impact the growth rates on its AFFO per share, justifying the downward de-rating on its valuation over the past year.

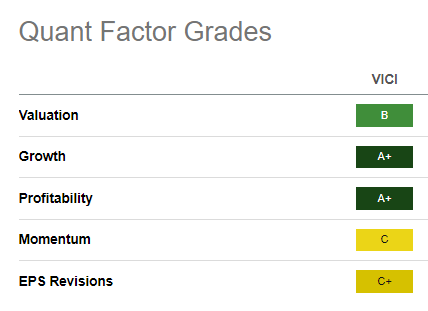

VICI Quant Grades (Seeking Alpha)

VICI’s valuation has improved, assigned a “B” valuation grade by Seeking Alpha Quant. I assessed that the market has likely priced in the headwinds highlighted earlier, suggesting its growth could slow.

Despite that, VICI has dropped to a zone that I believe should proffer robust support for long-term buyers. VICI’s $26 support level has been defended since early 2022 and underpinned by dip buyers in early November 2023.

Also, its forward dividend yield of 5.9% seems reasonable, considering the spread against the United States 10-Year Bond Yield (US10Y), which last printed at 4.46%. I believe the market has likely priced in a resurgent 10Y, which could affect Vici’s cost of capital for its pipeline opportunities.

Investors must remain cautious, using the $26 support zone as a benchmark to assess robust buying sentiments. For now, I believe an upgrade to my thesis is appropriate, considering the recent developments markedly improving the risk/reward in VICI.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here