Unity (NYSE:U) will be going through some drastic changes throughout the next quarter as James Whitehurst seeks to turn around the firm. As Unity has faced several challenges throughout the last few years between client revenue reporting errors and shareholder litigation resulting from the merger with ironSource, and now a significant corporate restructuring, there are many avenues Unity can go down over the course of the next few years. With Whitehurst taking the helm, Unity may very well be setting itself up for either a major turnaround or to be acquired. Again, given his history with RedHat, the latter may very well be a viable option. Given the near-term challenges Unity faces I provide U a SELL recommendation with a price target of $23.24/share based on the expectations of a -10% revenue decline in FY24.

Corporate Reports

We are currently doing too much, we are not achieving the synergies that exist across our portfolio, and we are not executing to our full potential. We aim to address these opportunities to emerge as a leaner, more agile, and faster growing company.

– James Whitehurst, CEO

Corporate Operations

The first order of business since taking the CEO helm has been a total evaluation of Unity’s products and services and assessing their value to the firm. Mr. Whitehurst outlined in his q3’23 letter that it will be likely Unity will discontinue certain product offerings, reduce headcount, and reduce their office footprint. In reviewing their 10-Q, there are certain items that pertain to specific clients that may be adding unnecessary costs, including Multiplay and Vivox.

I do want to highlight that Unity Software may be set up as an acquisition target much like what happened to RedHat. James Whitehurst has two varying experiences. The first is with Delta Airlines where he fended the firm from a takeover bid. The second is with RedHat where he was involved in setting up the firm to be acquired by IBM. Though this is purely my speculation, his title as “interim CEO” may either result in a new CEO, the continuation of Mr. Whitehurst as a fulltime CEO, or a set up for an acquisition. Two recent acquisitions that come to mind with a similar set up are VMware (VMW) and Coherent (COHR) in which the sitting CEO resigned, an interim took over, and the acquisition bid was executed. Cutting out the excess operations and reducing headcount are absolutely a step towards becoming an acquisition target. Again, this is purely my speculation and aside from correlating previous deals, holds little merit.

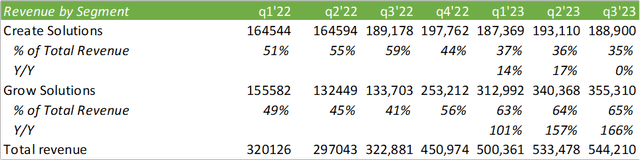

Management outlined three challenges faced that impacted growth in q3’23: Unity Game Services, China, and Professional Services. The verbiage suggests that the firm is rolling off of their professional services offering as part of their restructuring. This can be beneficial as headcount is their largest operating cost and professional services in its nature is a people-based product. As for China, the CCP mandated a 3-hour per week limit on gaming for citizens under 18 years of age. Though this isn’t a new challenge faced by Unity, as Reuters reported the restrictions over two years ago, its impacts continue to ripple through the market as hours spent gaming become more scarcely competitive.

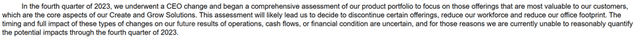

Corporate Reports

Unity’s Grow Solutions segment grew revenue by 166% y/y, or 12% y/y on a pro forma basis for q3’23 to $355mm. For those less familiar with the segments, Create Solutions is their developer platform and Grow Solutions is their monetization platform. Similar to Roku (ROKU), Unity acts as an advertisement broker/platform in which advertisers can pay for ad placement within games. Though the overall advertisement arena is well-saturated, Unity has the opportunity to take market share and continue building up their advertising platform. I do want to note that during times of economic slumps, marketing budgets are oftentimes the first to be reduced. Given Unity’s global presence, risk factors are not limited to the US.

Corporate Reports

Create Solutions experienced flat growth due to a decline in the consumption of hosting services by customers which was partially offset by an increase in revenue from subscription offerings. Management did disclose very few details on their updated model for runtime fees. As disclosed on their 10-Q, Unity is changing their pricing model beginning in 2024 and has received a considerable amount of backlash from customers. Management did discern in their q3’23 earnings call that a lot of this tension has been alleviated once disclosing additional benefits and features to be added to their Create Solutions. From the outside perspective, this can be a huge positive or it can be a bridge to buy the firm more time as many of these features are yet to be available and value add hasn’t yet been proven.

Corporate Reports

My biggest concern with the new fee structure is that if we are going into a global slump/recession, Unity may not be the only firm in this network cutting down on costs. Given the potentially higher fees directed towards game developers, firms may more heavily weigh the value add for additional costs and become more selective relating to services offered by Unity or using Unity’s platform for future developments all together.

One detail that is appealing is Unity’s partnership with Apple in developing a creative platform for their AR/VR headsets. Though this market is slow to develop, landing in the space early on can offer significant strengths as the AR/VR space becomes more relevant. The firm is also actively expanding their AI/ML features for creators to enhance gameplay and other functionality. It’s not disclosed how much value these features bring to their customers; however, it may be one of the value drivers when evaluating their new fee structure.

Unity has done well at improving their adjusted EBITDA over the last year, achieving a 16% margin at $329mm on a TTM basis.

Corporate Reports

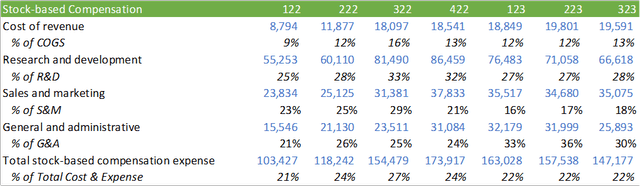

Though the firm continues to operate at a net loss on a GAAP basis, the firm has made significant improvements in narrowing their loss in the last year. Though the firm has a long way to go before achieving profitability, Whitehurst may be taking the firm in the right direction by focusing on its core offerings and narrowing the overhead costs. 22% of total costs are attributable to stock comp alone. Though reducing stock comp alone won’t lead the firm to profitability, it will alleviate a lot of the pressure on GAAP margins. Do note that stock comp is technically a non-cash expense; however, given the firm’s growth in shares outstanding, their buybacks, and the 1% excise tax on buybacks, it might be worth considering the effects on the bottom-line when evaluating the firm.

Corporate Reports

Unity currently holds $2.7b in debt on the balance sheet with $2,725mm as convertible issues. Though these two issues are due in 2026 and 2027, the conversion should be considered by those seeking to hold U shares longer term. The 2027 notes hold a conversion option at $48.89 and the 2026 notes have an option at $308.72/share and are considered busted. Near-term, these issues should be far in the back of an investor’s mind; however, come the due date, Unity may need to refinance or have the ability to pay off the $1,725mm in cash come 2026, assuming the share price remains far below the $48.89 strike. As of q3’23, Unity has $1,507mm in cash on the balance sheet. Between this and stronger operating performance, Unity shouldn’t have challenges come term.

Valuation

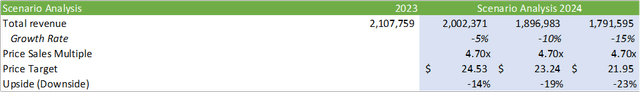

Valuing the firm on a fundamental basis will be challenging given Whitehurst’s cost-cutting initiatives. There’s no telling how many revenue streams he will be cutting from within the firm and their overall impact, whether it results in just a reduction of offerings or inclusive of a reduction of customers. Overall, consensus forecasts anticipate a significant slowdown in topline growth as forward estimates value the firm at 5.06x next year’s sales. I believe these estimates are coming in as conservative as cuts to product offerings may alienate customers all together and result in a loss of client base. With the presumption that next year’s revenue will decline as a result of the restructuring, we can run a sensitivity analysis on the effects of revenue and its reflective multiple. In this hypothetical scenario, let’s assume revenue for q4’23 grows at 4% on a TTM basis for $2.1b. Below is a list of three scenarios for downside risk relating to next year’s sales growth.

Corporate Reports

The price multiple is taken from the comps table below. Given the anticipated sales decline, U shares should be expected to decline in line. Given that U is a growth stock, further downside risk may be associated given the momentum factor.

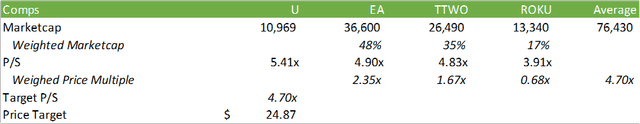

The table below is a comparison analysis between Unity’s peer group, Electronic Arts (EA), Take-Two (TTWO), and Roku (ROKU). Using market cap weights, I came up with an average multiple of 4.7x TTM sales.

Corporate Reports

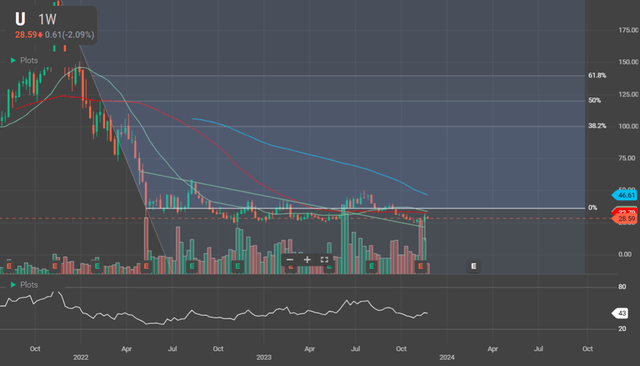

Technical analysis doesn’t provide much of a story on the market’s price perspective. Given the sideways trend since May 2022, I expect the market is in a wait and see mode and has put Unity into the “show me” category. Given that the 200-day moving average is trending down towards the 20- and the 50-day moving averages, it wouldn’t be too farfetched to expect further price declines before any reversal. Given these features, I provide U shares a SELL recommendation with a $23.24/share price target based on eFY24 revenue declines.

In the instance of Unity becoming an acquisition target as outlined above, I believe purchasing shares at a lower valuation may be prudent to take advantage of an appealing acquisition premium. Though I do believe the first half of 2024 will be a challenging period for Unity, leading to the downward price risk, buying shares at this low price target of $23.24/share can set an investor up for an upswing in the instance of an acquisition announcement. I will be updating my analysis as the restructuring progresses.

WallStreet.io

Read the full article here