Japan’s private sector growth ground to a halt in November according to the latest flash PMI data, which is based on about 85%-90% of total PMI survey responses each month.

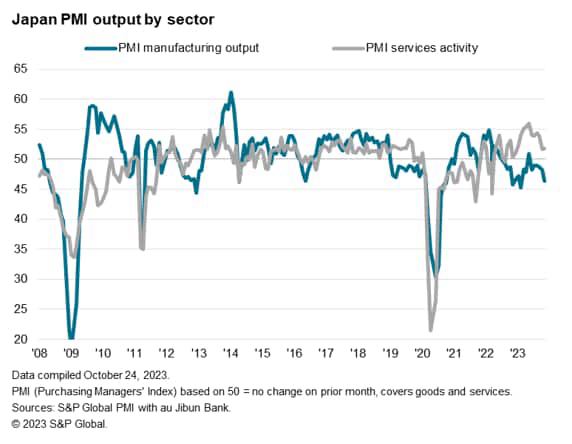

This was mainly attributed to a sharper fall in manufacturing output as service activity expanded at a slightly faster pace in the penultimate month of the year.

Amidst the softening of economic conditions, price pressures declined, signalling further moderation of CPI in the months ahead.

At the same time, business sentiment slightly improved among private sector firms, hinting at better performance in the 12 months ahead despite the latest stalling of private sector economic growth.

Japan’s flash PMI signal softening growth conditions

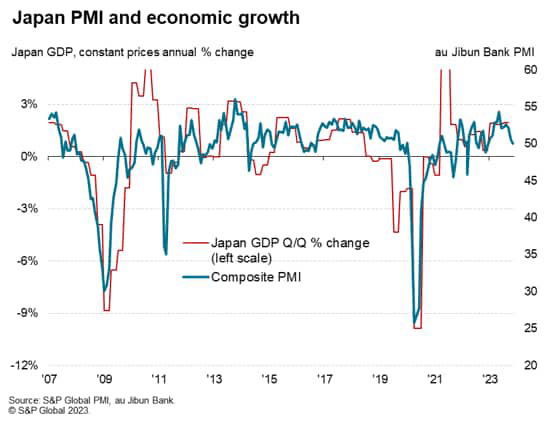

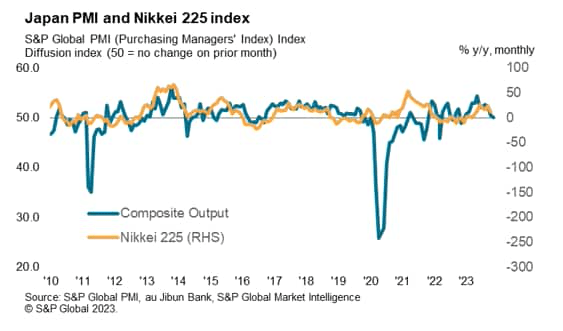

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, fell to the neutral 50.0 mark in November, down from a final reading of 50.5 in October.

The flash reading, based on approximately 85%-90% of total PMI survey responses each month, therefore suggested that Japan’s private sector conditions stalled in November after ten straight months of growth.

The latest composite output reading – covering both manufacturing and services – therefore points to GDP growing at an annual rate just below 1.0% midway into the fourth quarter, which is slightly lower than the pre-pandemic 10-year average.

Manufacturing and services conditions diverge in November

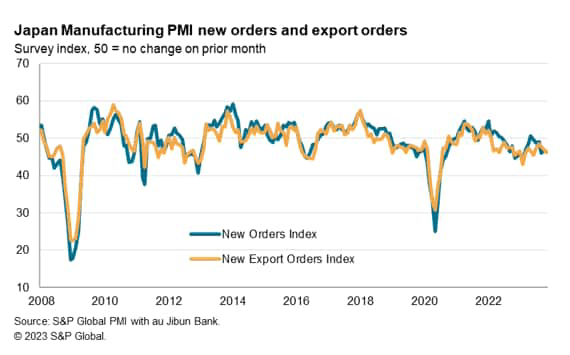

The latest downturn in private sector conditions was driven entirely by manufacturing sector weakness. Goods production contracted at the quickest rate in nine months, with new orders further drying up into the end of year.

Anecdotal evidence again pointed to destocking efforts at clients, which alongside reduced budgets on the back of deteriorating global economic conditions, negatively affected demand.

The pace of export order contraction notably picked up to match that of overall goods new order decline, with both being historically marked.

Survey panellists mentioned deteriorating foreign demand at key export destinations including mainland China, the US and Europe.

Furthermore, falling interests in electronics were also flagged by respondents. As a result, the level of backlogged work in the goods-producing sector further depleted into November, signalling the paring of production momentum in the near term.

In contrast, services activity extended the sequence of expansion that commenced September 2022 with the rate of growth accelerating for the first time in three months, albeit only slightly.

This was driven by faster new business inflows amid reports of increased tourism activity into the year-end.

Additionally, forward-looking indications including the backlogs of work index also showed renewed growth, which are supportive of continued business expansions in the months ahead.

Further cooling of price pressures

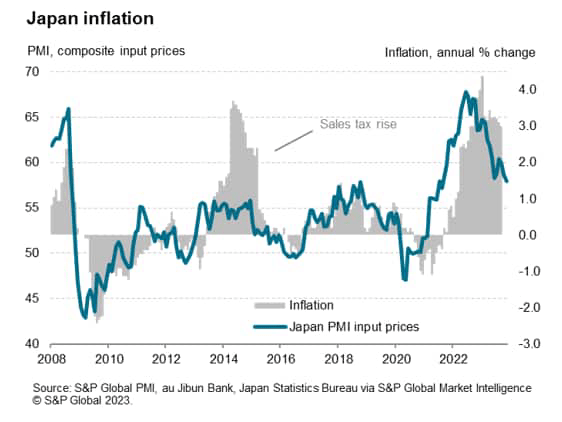

Amid the manufacturing-driven stalling of private sector activity in November, price pressures eased again.

Overall selling price inflation, measured across both manufacturing and service sectors, fell for a fourth month in a row to the lowest since February 2022.

This is consistent with headline CPI sliding to around the 2.0% mark in the months to come.

Supporting the paring of overall inflationary pressures had been softer selling price increases in both the manufacturing and services sectors, aided also by slower cost inflation among service providers and little changed goods input inflation in November.

While the overall selling price inflation remains well elevated above the long-run series average in November, it will be worth watching the trajectory from here, especially with demand conditions remaining subdued in the latest survey.

Any further easing of price pressures may pose challenges to existing expectations of the Bank of Japan (BoJ) departing from the ultra-accommodative monetary policy settings.

Optimism improves

Examining the correlation of the PMI and the Japanese equity market, we are seeing the latest figures pointing to subdued price action in the near term.

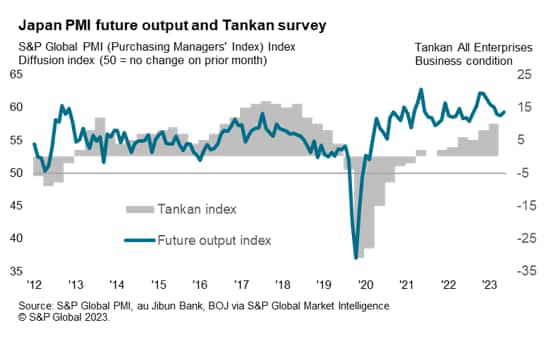

That said, the Future Output Index, the only sentiment-based PMI sub-index, offers some hope for better performance in the coming months. Optimism among Japanese private sector firms improved to the highest since August, with better confidence spread across both manufacturing and service sectors.

It will, however, be important to see the key manufacturing sector performance catch up to their service sector counterpart to drive better output performance.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here