Investment Thesis

In times of high market uncertainty, the strategic incorporation of high dividend yield companies into your investment portfolio can be an adequate and necessary step towards the construction of a better balanced and more diversified investment portfolio.

In this article, I will introduce you to two high dividend paying companies that blend dividend income with dividend growth, can help you to increase the extra income your portfolio generates via dividend payments, and can augment the probability of your dividend portfolio producing positive results when investing over the long term.

Before I dive deeper into the characteristics of these two dividend companies, I would like to highlight some general benefits that high dividend yield companies can provide for your investment portfolio:

- The Generation of Income: Dividend paying companies bring you the enormous benefit of helping you to produce income. This provides you with much higher financial flexibility and offers the enormous benefit of not having to sell some of your stocks when you might need some extra money at a time when the market is not in your favor.

- Significant Reduction of the Volatility and Risk Level of Your Overall Investment Portfolio: Companies that pay a relatively high and particularly sustainable dividend, tend to come attached to a lower risk level, particularly when compared to growth companies, thus contributing to reducing the volatility and overall risk level of your investment portfolio (their lower risk level can be reflected in their lower Beta Factor).

- Psychological Investor Benefits in Times of a Stock Market Decline: In times of high volatility and declining stock markets, receiving dividend payments can bring you a psychological effect that can lead you to keep the positions in your portfolio to continue benefiting from dividend payments, acting like a business owner, instead of a stock market trader. This behavior can help you to significantly increase your wealth over the long term.

I have selected the following companies for November 2023:

- Morgan Stanley (NYSE:MS)

- Ares Capital (NASDAQ:ARCC)

Morgan Stanley

Morgan Stanley is a globally operating financial services company founded in 1981. It operates in the following business segments:

- Institutional Securities

- Wealth Management

- Investment Management

Presently, Morgan Stanley has a Market Capitalization of $131.76B.

Morgan Stanley’s Latest Quarter Results

In 3Q23, Morgan Stanley reported Net Revenues of $13,273M when compared to the $12,986M that were presented for the same period a year ago. It is further worth noting that the bank delivered a Return on Tangible Common Equity of 13.5%, underscoring its financial health and efficiency.

Morgan Stanley’s Current Valuation

Different metrics underline that Morgan Stanley is currently fairly valued: the bank’s current Price/Book [FWD] Ratio of 1.45 only stands slightly above its average from the past 5 years (which is 1.34), suggesting that the U.S. bank is fairly valued at this moment in time.

At the same time, it is worth mentioning that Morgan Stanley’s current Dividend Yield [TTM] of 4.05% stands 43.85% above its average from the past 5 years, further indicating that the bank is at least fairly valued at its current price levels.

Morgan Stanley’s Dividend and its Combination of Dividend Income and Dividend Growth

Morgan Stanley features a Dividend Yield [TTM] of 4.05% and a Dividend Yield [FWD] of 4.24%. Furthermore, the U.S. bank has shown notable dividend growth, with a 5 Year Dividend Growth Rate [CAGR] of 24.19%. Coupled with a Payout Ratio of 55.11%, this suggests potential for further dividend enhancements.

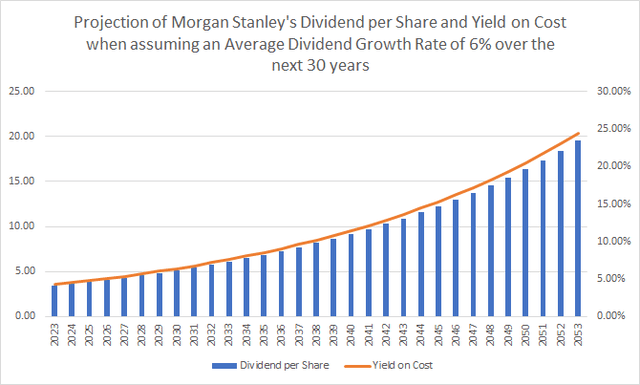

The Projection of Morgan Stanley’s Dividend and its Yield on Cost

Below you can find a graphic that illustrates Morgan Stanley’s Dividend and its Yield on Cost when assuming that the company would be able to raise its Dividend by 6% per year within the following 30 years.

Source: The Author, data from Seeking Alpha

I do not believe that Morgan Stanley will be able to maintain the impressive dividend growth rates it has shown in recent years (Dividend Growth Rate [CAGR] of 24.19% over the past 5 years). Therefore, I have made this significantly more conservative assumption (assuming a Dividend Growth Rate of 6% for the following 30 years).

The graphic emphasizes the substantial long-term benefits of investing in Morgan Stanley, especially given its combination of dividend income and dividend growth.

Morgan Stanley compared to its competitors

I consider the risk level for Morgan Stanley investors to be marginally higher compared to traditional banks like Bank of America or JPMorgan. This theory is not only based on Morgan Stanley’s higher Payout Ratio of 55.11%, in contrast to Bank of America’s (NYSE:BAC) (Payout Ratio of 25.21%), or JPMorgan’s (NYSE:JPM) (24.18%).

Additionally, the lower Valuations of Bank of America (P/E [FWD] Ratio of 8.87) and JPMorgan (9.22) compared to Morgan Stanley’s (14.17), and their superior Profitability (Bank of America has a Net Income Margin [TTM] of 31.52%, JPMorgan’s is at 35.98%, versus Morgan Stanley’s 18.37%), support my view.

However, it is worth mentioning that Morgan Stanley’s Payout Ratio and Valuation are similar to the ones of competitor Goldman Sachs (NYSE:GS) (Payout Ratio of 49.61% and P/E [FWD] Ratio of 14.53).

Given their lower Payout Ratio, I consider Bank of America and JPMorgan’s Dividend to be slightly safer compared to Morgan Stanley’s, especially considering the higher growth rates of JPMorgan and Bank of America (EPS Diluted 3 Year [CAGR] of 20.73% and 29.77% respectively, versus Morgan Stanley’s -1.87%).

The more secure Dividends of Bank of America and JPMorgan reduce the likelihood of dividend cuts, thus decreasing the probability of their stock prices dropping due to a dividend cut. Therefore, I suggest allocating a slightly higher proportion to Bank of America and JPMorgan compared to Morgan Stanley.

Incorporating Morgan Stanley into Your Portfolio: The Case for a 3% Allocation Limit

In case you decide to add Morgan Stanley to your investment portfolio, I suggest allocating a maximum of 3% of your overall investment portfolio to the company.

Moderating the size of a single company relative to the entire portfolio mitigates the portfolio’s downside risk. This is because a reduced stock price (for example, due to a dividend cut) would have a less significant adverse effect on your portfolio’s overall performance.

Restricting Morgan Stanley to a maximum of 3% effectively reduces your portfolio’s company-specific concentration risk, enhancing your portfolio’s potential for positive investment results.

Ares Capital

Ares Capital is a business development company founded in 2004 with the objective of generating income and capital appreciation through investments in equity and debt. Ares Capital invests primarily in “middle market” companies (which include companies with an EBITDA between $10M and $250M).

Ares Capital’s Current Dividend

Today, Ares Capital pays a Dividend Yield [FWD] of 9.77%, suggesting that the company is particularly attractive for dividend income investors and for those looking for options to increase the Weighted Average Dividend Yield of their investment portfolio.

Ares Capital’s Current Valuation

Ares Capital presently has a Market Price of $19.65, which is only slightly above its NAV of $18.99, suggesting that the company is fairly valued at its current price level.

Comparing Ares Capital’s current Dividend Yield [FWD] of 9.77% with its average over the past 5 years (which is 9.41%), also suggests that it is currently fairly valued, thus reinforcing my buy rating for the company.

Ares Capital’s Profitability and Growth Perspective

I consider Ares Capital to be an attractive pick in terms of Profitability, which is underscored by the company’s Return on Common Equity of 12.67%, which is above the Sector Median of 11.66%.

I further believe that its growth outlook is appealing, which is underlined by the company’s Revenue Growth Rate [FWD] of 14.81% and its ROE Growth Rate [FWD] of 9.15%, which are both significantly above the Sector Median (5.36% and -3.83% respectively).

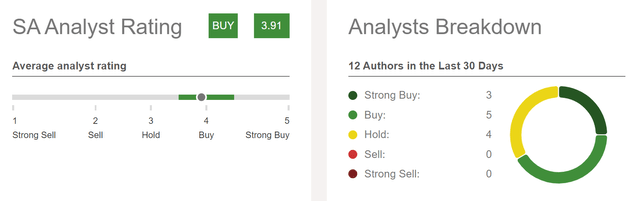

Ares Capital According to the Seeking Alpha Analysts and According to the Wall Street

According to the Seeking Alpha Analyst Rating, Ares Capital is currently a buy. The company is presently rated with a strong buy from 3 analysts, with a buy from 5 analysts, and it receives a hold rating from 4 analysts. These ratings, once again, reinforce my buy rating for the company.

Source: Seeking Alpha

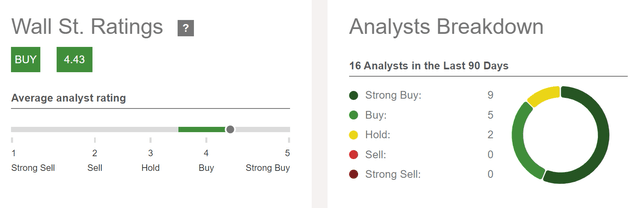

The Wall Street Ratings confirm the same theory: according to the Wall Street, Ares Capital receives a strong buy rating from 9 analysts, a buy rating from 5 analysts, and a hold rating from 2 analysts.

Source: Seeking Alpha

Incorporating Ares Capital into Your Portfolio: The Case for a 4% Allocation Limit

I consider Ares Capital to be an excellent choice for enhancing the generation of income. I suggest limiting its position to a maximum of 4% of your overall investment portfolio, reducing your portfolio’s company-specific concentration risk.

Risk Analysis

Conducting a thorough analysis of risk factors is vital for investors to mitigate the downside risk of their portfolio, increasing the likelihood of securing positive investment results.

An extensive risk analysis was also part of my latest portfolio allocation article, which I published on Thursday:

How To Build A Dividend Portfolio Allocating $100,000 among November’s Top 20 Dividend Companies

Both Morgan Stanley and Ares Capital are part of this dividend portfolio, accounting for 3% and 4% of the overall investment portfolio, following my own suggestion to limit their share in relation to the overall portfolio, aiming to reduce its risk level.

Risk Analysis – Morgan Stanley

Key Risk Factors for Morgan Stanley Investors to Consider

- Intense Competition within the Financial Services Industry: Operating globally, Morgan Stanley faces intense competition within its industry, competing with commercial banks, investment banking firms, brokerage firms, insurance companies, electronic trading and clearing platforms, etc.

- Market Risk: Morgan Stanley’s financial results are sensitive to global market and economic conditions, including the volatility of equity, or fixed income, interest rate fluctuations, inflation and currency changes.

- Credit Risk: Morgan Stanley’s Institutional Securities and Wealth Management business segment carries significant credit risk. The inability of a borrower to meet its financial obligations could notably impact the bank’s financial results.

Morgan Stanley’s A1 credit rating from Moody’s reflects a low credit risk. This aligns with my investment approach, which prioritizes capital preservation above all else.

Reducing Portfolio Risk When Investing in Morgan Stanley for Improved Investment Outcomes

In a long-term investment portfolio, I suggest allocating a higher proportion to Bank of America and JPMorgan compared to Morgan Stanley, due to their lower risk levels. This is evidenced by their significantly lower Payout Ratio, lower Valuations, and higher Profitability.

As mentioned, I suggest limiting the Morgan Stanley position to a maximum of 3% of your overall investment portfolio. This allocation strategy reduces company-specific concentration risk, thus increasing the probability of obtaining positive investment outcomes.

Additionally, I suggest a long-term investment approach, aiming for a minimum holding period of seven years to benefit from the company’s steadily increasing dividend payments. This strategy can help you to steadily increase your wealth.

Risk Analysis – Ares Capital

Key Risk Factors for Ares Capital Investors to Consider

- Volatile Markets: Market Volatility can hinder Ares Capital’s ability to raise equity capital or debt capital, and negatively affect the valuations of the company’s investments, thus impacting its financial results.

- Interest Rates Fluctuations: Changes in interest rates can have a significant negative impact on Ares Capital’s investment performance and the company’s financial results.

- Risks from Non-Public Companies: Ares Capital invests in private companies, whose fair value can be challenging to determine accurately. This presents an additional risk factor for investors.

Reducing Portfolio Risk When Investing in Ares Capital for Improved Investment Outcomes

Ares Capital is an attractive choice to boost the Weighted Average Dividend Yield of your investment portfolio. However, due to the risk factors previously discussed, I suggest limiting the proportion of Ares Capital to a maximum of 4% of your overall portfolio to reduce its company-specific concentration risk. This approach aims to increase the likelihood of realizing an attractive Total Return for your investment portfolio.

Similar to investing in Morgan Stanley, I suggest a long-term investment strategy, with a minimum intended holding period of at least 7 years. This strategy allows you to benefit from the attractive and continuously raising dividend payments of the company.

Maximizing Investor Benefits from Investing in Morgan Stanley and Ares Capital

I am confident that investing in Morgan Stanley and Ares Capital will be most beneficial for investors when both are included in a well-balanced and broadly diversified investment portfolio with a reduced risk level (as suggested, allocations should not exceed 3% and 4% of your overall portfolio).

Such a portfolio should not only include high dividend yield companies (like Morgan Stanley and Ares Capital), but also companies with a focus on dividend growth (here you can find an article on the 10 dividend growth companies that I currently consider to be attractive).

On Seeking Alpha, I am constructing and detailing a well-balanced portfolio that includes both high dividend yield and dividend growth companies with a broad diversification:

The Construction Of The Dividend Income Accelerator Portfolio

The portfolio’s investment approach offers substantial benefits for investors, including the generation of extra income, and a high probability of attractive investment outcomes, to which its broad diversification and reduced risk level contribute significantly.

Such a mix of high dividend yield and dividend growth companies is further appealing for investors, since it not only offers immediate income, but also the potential for annual increases. Through its additional goal of obtaining an attractive Total Return, it contributes to maximizing investor benefits when investing over the long term.

Why Ares Capital Has Been Incorporated into The Dividend Income Accelerator Portfolio

I have recently added Ares Capital to The Dividend Income Accelerator Portfolio. I’ve done this as I’m convinced that the company aligns strongly with the portfolio’s investment approach of combining dividend income and dividend growth:

2 Stocks Yielding Up To 12%: The Latest Acquisitions For The Dividend Income Accelerator Portfolio

Why Morgan Stanley is a Strong Candidate for Inclusion into The Dividend Income Accelerator Portfolio

Morgan Stanley is on my watchlist for potential inclusion into The Dividend Income Accelerator Portfolio in the coming weeks. I believe that the company aligns with the portfolio’s investment approach.

Key factors that underscore this belief are its financial health (A1 credit rating from Moody’s), and competitive advantages, as well as its mix of dividend income (Dividend Yield [FWD] of 4.24%) with dividend growth (5 Year Dividend Growth Rate [CAGR] of 24.19%), in addition to having a relatively attractive Payout Ratio (55.11%).

Conclusion

Conducting a Risk Analysis: The Key to Lowering Portfolio Risk and Enhancing Investment Outcomes

Effectively combining high dividend yield and dividend growth companies is crucial when building a solid and robust dividend portfolio with a reduced risk level. Reducing the portfolio’s risk level is a key factor, since it augments the likelihood of successful investment results.

By using the following example, I would like to further illustrate the importance of reducing risks when investing: I would not classify acquiring a stock as an investment if it only offers a 1% chance of attractive investment outcomes (for example, due to the high amount of risk factors that comes attached to the investment), even with a possible (but due to the risk factors highly unlikely) annual return of 20%.

My investment approach (reflected though The Dividend Income Accelerator Portfolio) is characterized through the preservation of capital above all, while providing you with a high probability of attractive investment outcomes when investing over the long term.

Why Morgan Stanley and Ares Capital Are Currently Attractive Investment Choices

I consider both Morgan Stanley and Ares Capital to be attractive for investors, since both provide a high probability of achieving an attractive Total Return, in addition to blending dividend income and dividend growth.

I have already incorporated Ares Capital into The Dividend Income Accelerator Portfolio and am planning to add Morgan Stanley within the next weeks.

The Importance of Limiting Individual Investments Relative to Your Total Portfolio

I suggest incorporating Morgan Stanley and Ares Capital into a carefully diversified dividend portfolio with a reduced risk level, limiting their allocation to a maximum of 3% and 4% of the overall portfolio, respectively. This strategy allows you the generation of extra income while maintaining a high likelihood of achieving an attractive Total Return for your overall portfolio.

The Benefits of High Dividend Yield Companies for You as an Investor

High dividend yield companies provide investors with diverse advantages: they can contribute significantly to reducing portfolio volatility, highlighting the potential for investors to be rewarded even in times of a stock market decline. This can help you and your investment portfolio to keep on track in challenging times.

Through the generation of this supplementary income, you will have extra money available that you can use for leisure activities: visiting a sport event or a concert you have long envisioned, a weekend trip to a city you have always wished to visit, or any other activity you have in mind.

Read the full article here