AT&T Shareholders Celebrating Selling At $13.43

On our last update on AT&T (NYSE:T), we remained bullish on the prospects of the company. Balancing the debt load with the undervaluation got us to a $20 price target, even in this high interest rate environment.

As for the A&T stock, the company is slightly on the cheap side relative to our fair value and extremely cheap relative to its three neighbors to the north. It also offers the second highest dividend yield after Verizon Inc. (VZ). So if you had to get some communications sector exposure, we think you could do far worse than AT&T. We currently own AT&T (and VZ for that matter), and have sold the $20 covered calls for January 2024 against that position. We don’t think you are going to get a runaway move here, but the option premiums plus the dividends should provide a solid income.

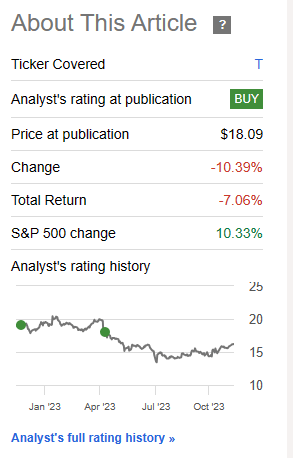

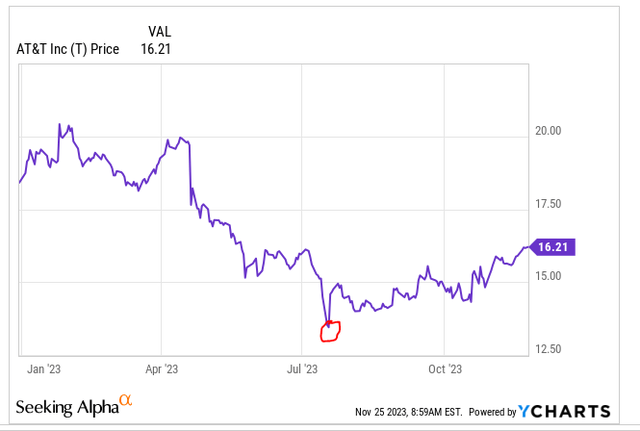

The stock basically ignored that and went lower, underperforming the S&P 500 (SPY) by over 17%.

Seeking Alpha

While that give us an opportunity to do another trade, we will focus on the Q3-2023 results and how they have led to a slightly higher valuation for us.

Q3-2023

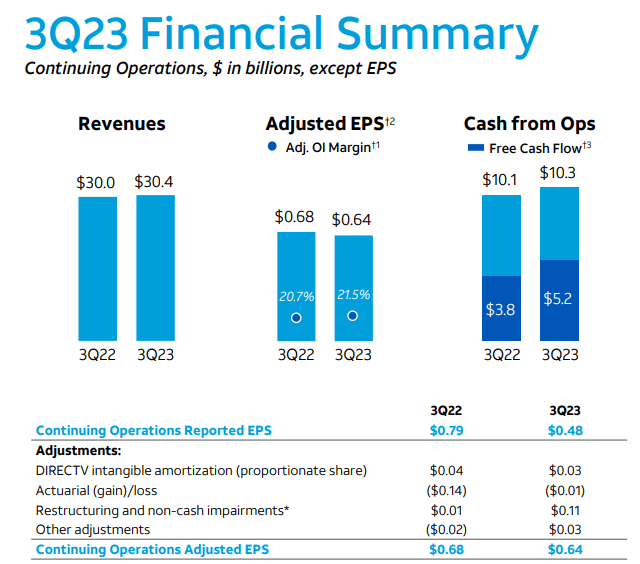

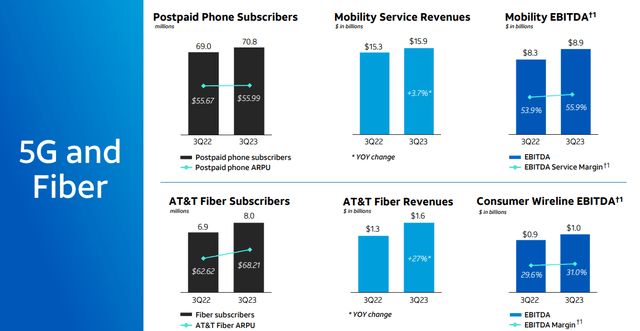

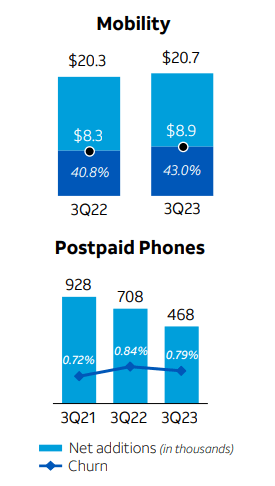

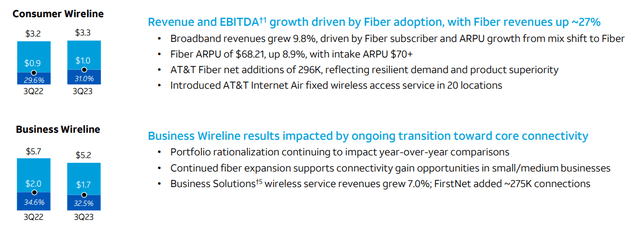

Solid was the best way to describe the Q3-2023 numbers. Revenues were up just a smidge and cash from operations followed that trend. Revenue per customer moved slightly higher and cost cutting lifted the critical wireless EBITDA margin by more than 2% to 43% in Q3-2023.

AT&T Q3-2023 Presentation

Adjusted earnings per share were down slightly, but both revenues and adjusted earnings came ahead of expectations. Looking at the segmental performance for mobility and fiber, we saw a clear trend higher this quarter.

AT&T Q3-2023 Presentation

One thing that might bug the bulls was the net postpaid phone customers total. That was an addition of 468,000 versus 708,000 seen a year ago. IT was improvement though over Q2-2023 (326,000) where the market hyperventilated over cash flow worries.

AT&T Q3-2023 Presentation

Business wireline remains the Achilles heel of those ultra bullish on the prospects of the company. AT&T calls this portfolio rationalization but it remains a detractor from the overall numbers.

AT&T Q3-2023 Presentation

This is also one reason that we are seeing such weak revenue growth when the trailing 12 month CPI inflation number is far higher.

What Really Matters

As we had pointed out in our last piece, the worries over free cash flow were completely unfounded.

They are likely to deliver on their free cash flow outlook, even if it means cutting back on their capex. The most likely impact of this is going to be felt in the tower REITs like Crown Castle Inc. (CCI) and American Tower Corporation (AMT) as we likely head into a recession later this year.

Source: These Are Not The Red Flags You Are Looking For

AT&T gave a nod to our outlook and delivered strong free cash flow during the third quarter. They upgraded their expectations as well putting some seasoning on the bear wounds.

Capital investment was $5.6 billion in the quarter and this reflects continued historically high levels of investments in 5G and fiber. We expect to move past elevated capital investment levels as we exit the year. We feel really good about free cash flow of $5.2 billion in the quarter. Through the first three quarters, our free cash flow was $10.4 billion, up $2.4 billion versus the same period a year ago. We’re also now tracking to about $16.5 billion free cash flow for the full year.

Source: AT&T Q3-2023 Conference Call Transcript

As you can see above, they also are planning on investment cutbacks though the timeline on this is next year.

Outlook

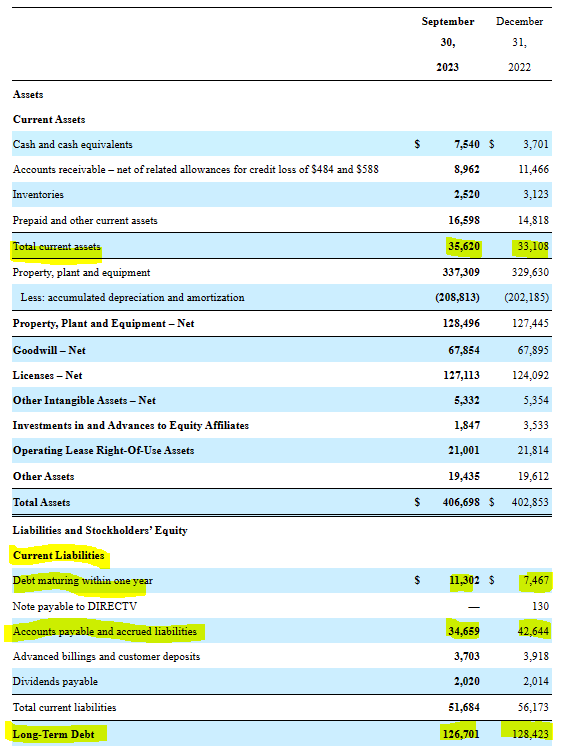

AT&T is not going to give any surprises during Q4-2023, considering how little time was left in the year post the conference call. With a solid year of free cash flow in the bag, it should surpass its $128 billion net debt target during the year. That net target has moved a bit slower than what bulls have expected, but it is important to note that the company’s free cash flow has gone towards reducing its current liabilities markedly. You will note the drop from $42.64 billion to $34.66 billion below.

AT&T 10-Q

These things move around quarter to quarter and take a random path. But all that cash AT&T is generating after capex and after dividends continues to be put to work.

This takes us to the final priority, and that’s how we’re putting our improving operating leverage to work. In the third quarter, we reduced our net debt by more than $3 billion and are on track to achieve our 2.5 times net debt to adjusted EBITDA target by the first half of 2025. Less net debt allows us to continue investing in AT&T’s durable connectivity businesses and enhance our ability to deliver additional shareholder returns once we reach our long-term target.

Source: AT&T Q3-2023 Conference Call Transcript

The funny aspect here is that the crowd which kept insisting the high interest rates would end the bull case, were in for another rude data point.

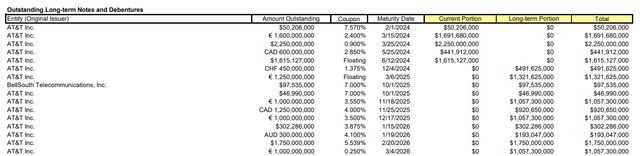

We had more than $9 billion of cash equivalents and interest-bearing deposits on hand at the end of the quarter. In this high-rate environment, we find ourselves in the enviable position of being able to earn more on this cash than the cost of our long-term debt. It is also important to remember that more than 95% of our long-term debt is fixed at an average rate of 4.2% and a weighted average maturity of 16 years.

Source: AT&T Q3-2023 Conference Call Transcript

The company is actually making more on its cash parking than what it is paying on most of its upcoming maturities.

AT&T Debt Maturity Profile As Of Sep 30, 2023

The company does not need to even enter the capital markets over the next 2 years. Its cash on the balance sheet plus expected free cash flow should pay all of it.

Verdict

It is tough to maintain a bullish perspective when every piece of news sends the stock down. That has been the case with AT&T over the past couple of years. We think this pessimism cycle climaxed with the story about lead sheathing.

CNBC

Guess where that was?

Y-Charts

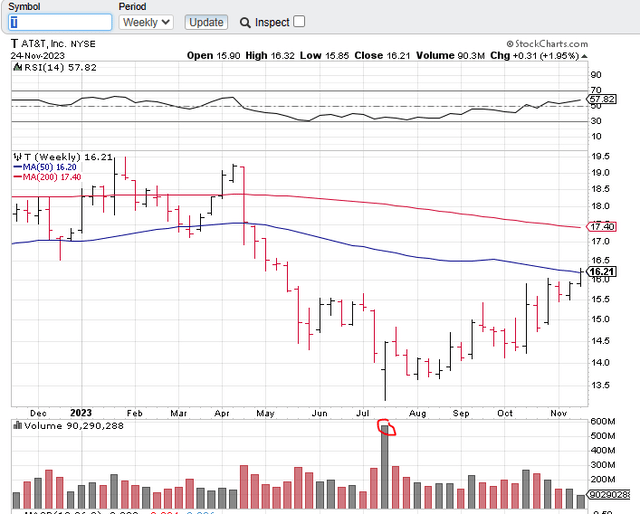

Look at the level of panic in the crowd that abandoned their favorite investment right at the bottom.

Stock Charts

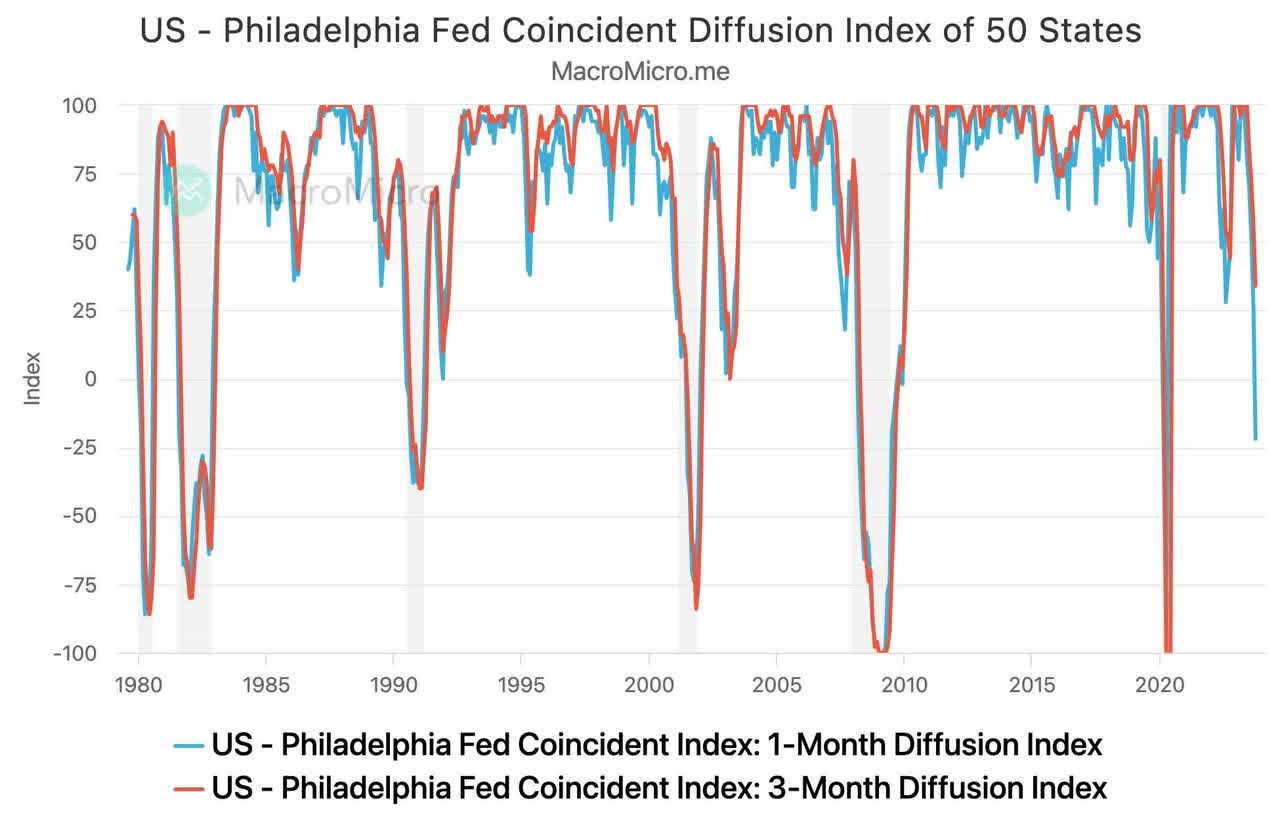

Of course, the company is likely to have challenges ahead. While 2023 saw two quarters of negative GDI, the actual, official, GDP measured, recession, lies ahead.

Macro Edge On X

The major carriers are unlikely to blow their pricing apart during the next recession, but there will likely be a soft period at the minimum. The good part is that AT&T’s valuation compression is already about as extreme as you can get. So we think it can deliver modestly positive total returns over the next 12 months (though a shorter term pullback looks very likely). We think the capex cuts in the pipeline and the ones yet to come during the recession, will make AT&T (6.7X earnings) a superior play over overhyped tower REITs like AMT (19.5X FFO). We remain long AT&T with a $21 price target. This is an increase over the $20 we had previously and reflects primarily the debt reduction flow to equity from debt. We recently initiated a short position in AMT via puts.

The Preferred Shares

AT&T has two preferred shares that trade on the exchanges.

1) AT&T Inc. 5% DEP RP PFD A (NYSE:T.PR.A)

2) AT&T Inc. 4.7% DEP SHS PFD C (NYSE:T.PR.C)

They both yield around 6.5% on a stripped basis. They are rated BBB- by Fitch. They offer a slightly lower yield than what we would like for their rating, and hence we are not particularly enchanted by them. Ideally we would look to pick these up in a market panic with a 7% or greater yield on current price. That would work to $17.86 for T.PR.A (52 week low $18.20) and $17.00 for T.PR.C (52 week low $17.30).

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here