Overview

My recommendation for Howmet Aerospace (NYSE:HWM) is a buy rating. The 3Q23 results were perfect, and I have become more positive about HWM’s ability to further expand margins. Note that I previously rated a buy rating for HWM as momentum remained strong and the end market growth remained robust. While there were hiccups previously, I saw the share price decline as a buying opportunity.

Recent results & updates

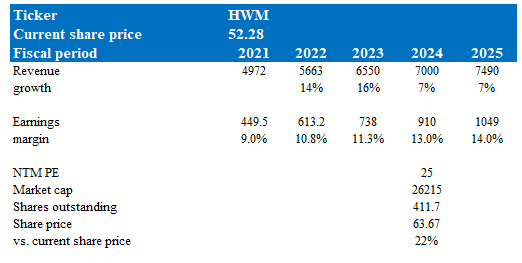

HWM reported 3Q23 adjusted EPS of $0.46 a few weeks ago, which was $0.30 higher than the consensus estimate. Adjusted EBITDA of $382 million, or 23% margin, and revenue growth of 18% to $1.66 billion were the primary drivers of the beat. The updated FY23 guidance from management includes the following: revenue between $6.53 and $6.56 billion, adjusted EBITDA between $1.48 and $1.49 billion, adjusted EPS between $1.76 and $1.78 billion, and free cash flow between $600 and $670 million. Management has also given a preliminary revenue growth target of around 7% for 2024.

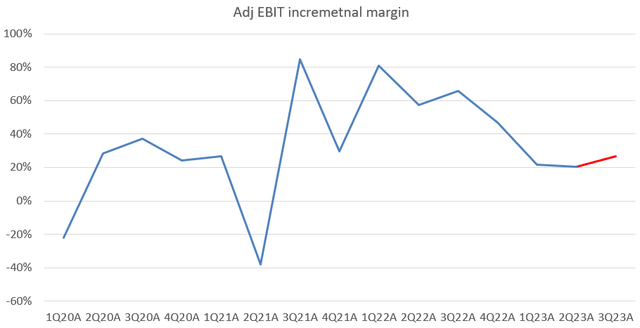

A perfect set of results with an expected stock price reaction would summarise my entire view of the results. HWM results are even better when viewed from an end-market perspective. With each end market up double digits and very strong year-to-date growth, the top line has been stellar, and 4Q23 is shaping up to be just as strong. As of 3Q23, on a year-to-date basis, Aero is up 25%, Industrial is up 15%, Defence is up 14%, and Commercial Transport is up 11%. The sheer strength and momentum of these end markets pushed the adj. EBIT margin to 18.5%, an increase of 50 basis points vs. last year and 120 basis points sequentially. The improvement in adj EBIT margin is an important one as, in my view, it sends a very positive signal to the market and investing community that the margin explanation is now back on track. If we look at the incremental margin (calculated by taking the annual difference in adj EBIT and dividing it by the annual difference in revenue) over the past 4 quarters, it has decelerated every quarter but has finally picked up in 3Q23. What’s more, my calculated incremental margin in 3Q23 points to 27% (~850 bps above the current EBIT margin), clearly indicating more room for margin to expand.

Author’s valuation model

Looking into FY24 and beyond, I believe margins will further improve as the past headwinds are no longer present in FY24. For example, previously, HWM was on a hiring spree, which led to several batches of new employees. Given the complexity of HWM work, it takes time for new employees to ramp up the learning curve and be effective alone. Existing employees’ efficiency was also dragged down as they needed to teach and supervise. The one-off issue (the titanium plant) that I discussed previously is not going to impact FY24 as well. Hence, from an overall perspective, I had expected margins to improve as employees are now much more efficient, and FY23 is going to be an easy year given all the headwinds.

And so I’ll say general improvement in conditions for the business, but still with a big thrust on improving its productivity and throughput efficiency, which needs to occur.” From: 3Q2023 earnings call

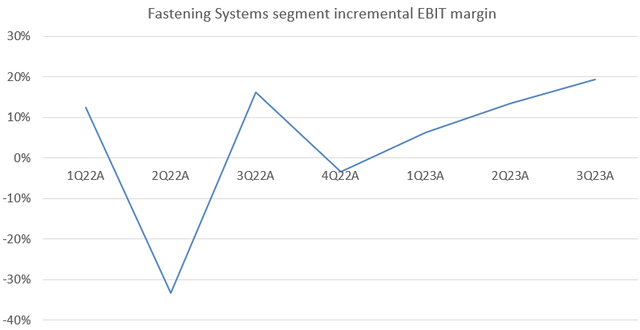

Furthermore, there are structural margin drivers within each segment that I am positive about as well. For instance, Fastening Systems saw a big sequential step up in margin (from 14.8% to 18.4%), and incremental margins are pointing to 20% as of 3Q23. Pre-covid, the segment had an incremental margin of mid-20%; as such, I believe profitability can further improve from here. I attribute this to the rising widebody build rates as widebodies take more high-margin titanium fasteners (3Q23 earnings call).

Author’s valuation model

HWM’s capital allocation continues to be shareholder-friendly as they balance out allocation of cash to capex, debt paydown, and cash. I note that the HWM net debt to EBITDA ratio has declined to near its all-time low of 2.5x (the last time it was lower than this was in FY18). On average, net debt to EBITDA has largely been in the 3-3.5x range. With growing EBITDA, this ratio is going to go down further, which makes me believe that management is likely to allocate more capital back to shareholders if there are no major projects that require huge CAPEX investments. HWM is expected to generate around $1.6 billion of EBITDA and $831 million in cash in FY24. This makes the net debt to EBITDA ratio drop to less than 2x, at which point I would expect management to raise its dividend and pace of share buybacks.

Valuation and risk

Author’s valuation model

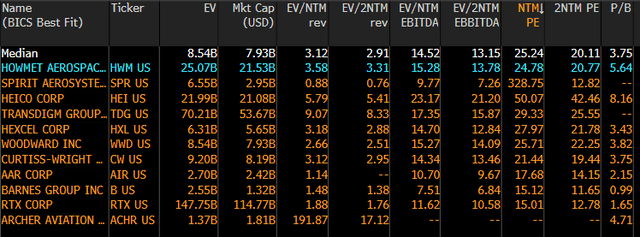

According to my model, HWM is valued at $63.67 in FY24, representing a 22% increase. This target price is based on my revised growth outlook of 7% for FY24 and FY25, which is a 200 cut from my 9% growth expectations previously as management has explicitly guided for 7%. On the contrary, I increased my margin expectations as the incremental margin performance was very positive, leading me to believe that margins can expand faster than expected. As I mentioned previously, I value HWM by comparing it to its peers. Over the past few months, peer valuation has improved, and so has HWM. Given the optimistic earnings growth outlook for HWM, the current valuation (25x forward PE) should be sustainable.

Bloomberg

HWM’s financial performance will be significantly impacted if the new COVID variant leads to another round of major pandemics. This would impact the demand for planes as OEMs reduce their demand outlook, thereby reducing their need for additional capacity.

Summary

HWM showcased a perfect 3Q23 performance. Notably, Aero, Industrial, Defence, and Commercial Transport segment grew impressively, drive adj EBIT margin to 18.5%. Looking ahead, I anticipate continued margin improvement in FY24, supported by enhanced employee efficiency and the absence of previous headwinds. Structural margin drivers within segments, like Fastening Systems, also indicate room for profitability enhancement.

Read the full article here