We maintain a neutral sentiment on Zoom Video Communications, Inc. (NASDAQ:ZM). Investors got excited last quarter when Zoom beat expectations and guided higher for FY on enterprise business strength, but October quarterly results and management’s guidance for its January quarter confirm our negative thesis that weak enterprise spending will likely continue into 2024. Zoom derives roughly 58% of total sales from its enterprise revenue; hence, our concern for the company’s financial performance through the next quarter is due to its higher exposure to enterprise spending behavior. We think the enterprise optimization cycle is wrapping up, but we don’t see a near-term catalyst boosting enterprise revenue in the near term. We believe investors are better positioned on the sidelines for the near term.

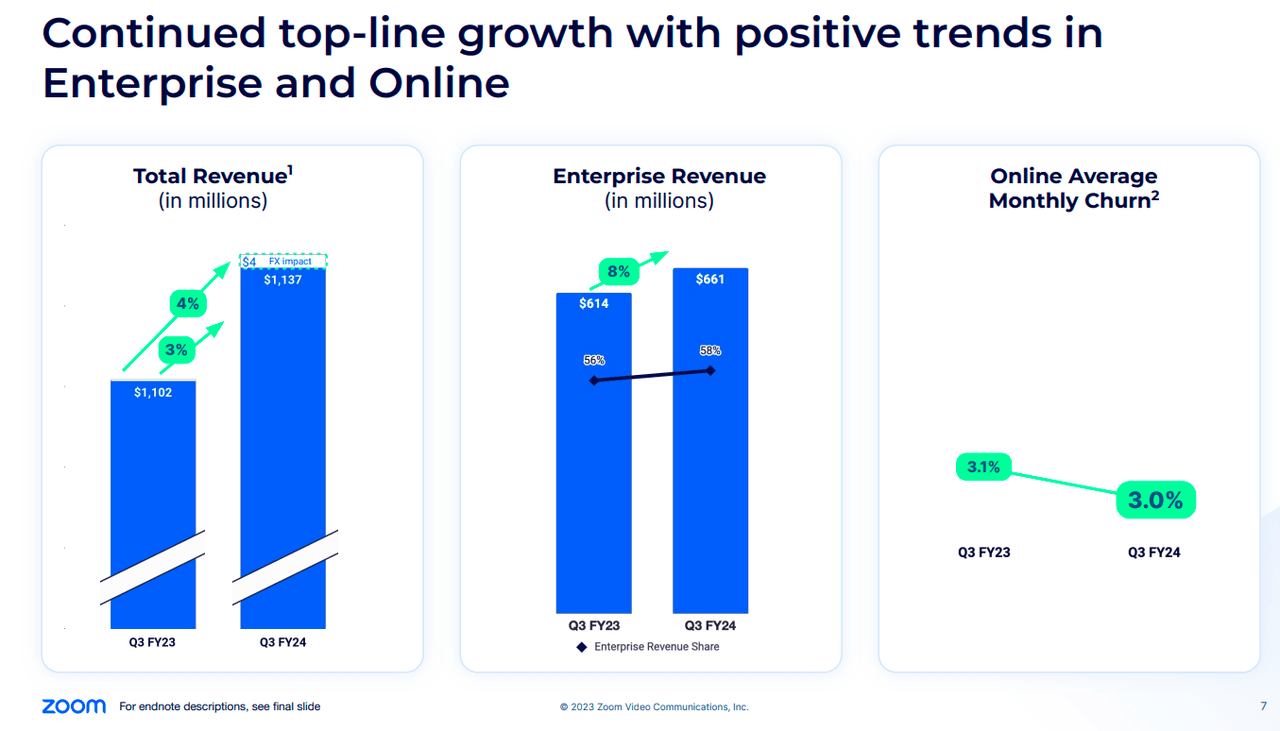

The company reported revenue of $1,136.7M, up 3.2% Y/Y and flat to slightly down sequentially, with 2Q24 revenue at $1,138.7M. Enterprise revenue was up 7.5% in the higher single-digit range to $660.6M, while Online revenue declined 2.4% Y/Y to $476.1M. Zoom’s Y/Y revenue growth has stabilized; the company’s revenue growth has been stuck in the 3-5% Y/Y range in FY24; current consensus estimates call for a mid-single-digit percentage Y/Y growth. While we think this is achievable, we believe there is a risk that headwinds experienced in APAC and EMEA could spill over into North America. This quarter, Zoom APAC and EMEA revenues declined 2% Y/Y each, after a decline of 3% and 1%, respectively, a quarter ago. We’re concerned that headwinds may spill into the company’s main revenue-driving region, the Americas, which grew 5% Y/Y this quarter versus 6% last quarter.

The following outlines Zoom’s metrics this quarter.

ZM earning results

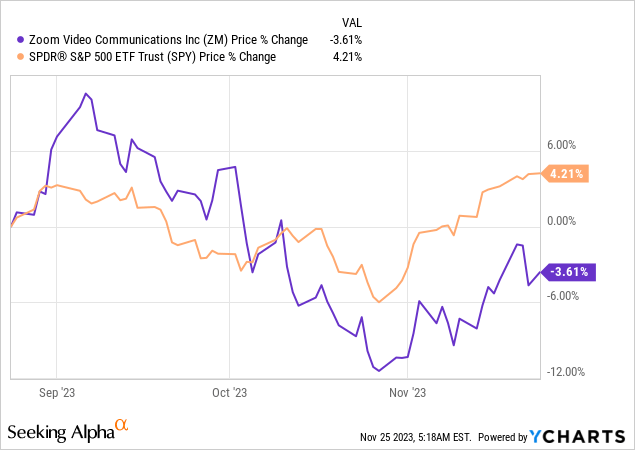

Management is now guiding for revenue of $1.125-1.130B, versus consensus of $1.13B and Non-GAAP diluted EPS of $1.13 and $1.15 compared to consensus expectation at $1.08. We think the uncertain macro environment will make it difficult for Zoom to show a material upside surprise in the near term. The stock’s underperformance of the S&P 500 over the past quarter confirms our hold-rating from October in our view; now, we expect the stock to be an in-line performance. We recommend investors stay on the sidelines in spite of Zoom’s tempting valuation, as we don’t see the stock working in the near term. The following graph outlines Zoom’s stock performance against the S&P 500.

TSP

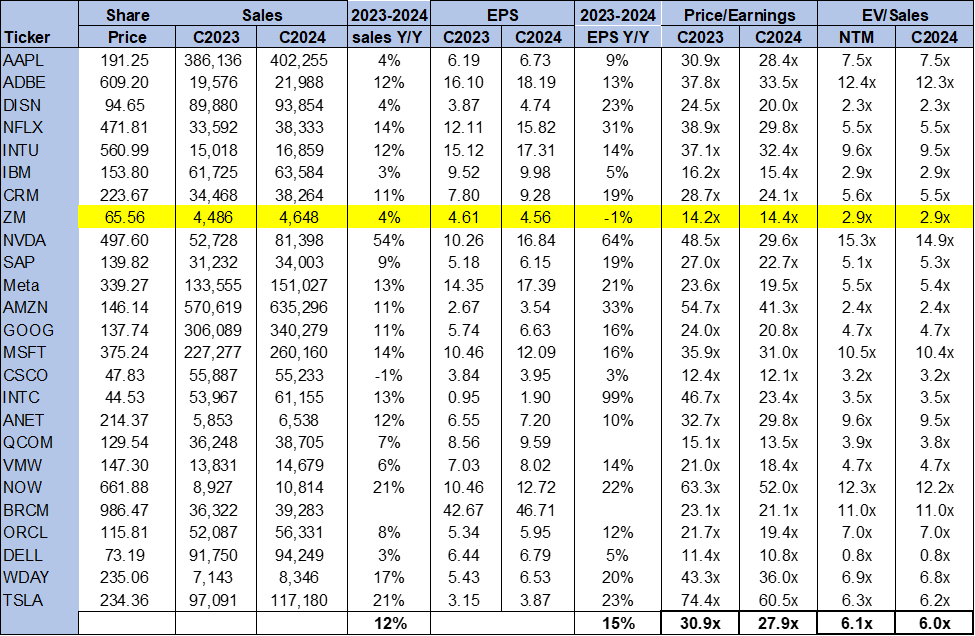

Valuation

The stock is trading well below the peer group average; we think Zoom is a value stock. On a P/E basis, the stock is trading 14.4x C2024 EPS $4.56 compared to the peer group average of 27.9x. The stock is trading at 2.9x EV/C2024 Sales versus the peer group average of 6.0x. We still expect the stock will be an in-line performer in the near-to-mid term, so we recommend investors remain on the sidelines.

The following chart outlines Zoom’s valuation against the peer group average.

TSP

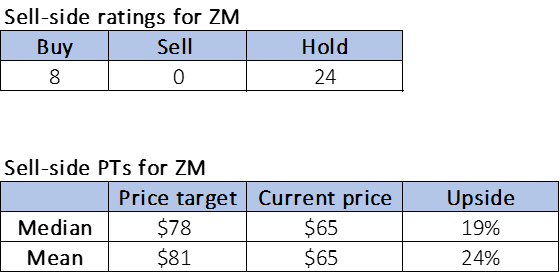

Word on Wall Street

Wall Street maintains a more neutral sentiment on the stock, similar to ours. Of the 32 analysts covering the stock, eight are buy-rated, and the remaining are hold-rated. The stock is currently priced at $65 per share. The median sell-side price target is $78, while the mean is $81, with a potential 19-24% upside. We think Wall Street shares our caution on the enterprise video communication space in early 2024.

The following outlines sell-side ratings and price targets for Zoom.

TSP

What to do with the stock

We maintain our hold rating on Zoom. We think the stock will be an in-line performer in the near term due to softer enterprise spending, and headwinds experienced in APR and EMEA may spill over into North America. Additionally, we continue to think Zoom faces heightened competition in the CCaaS market, especially from Microsoft Teams (MSFT), which is strongly embedded in Microsoft’s ecosystem and has an economic moat. We like Zoom in the mid-to-long run but don’t see the stock outperforming in the near term. We recommend investors stay on the sidelines into 2024.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.

Read the full article here