Adyen N.V. (OTCPK:ADYEY) had its 2023 investor day and Q3 2023 business update earlier in November.

If you have not watched the close to three-hour-long event, I have done so for you and summarized the key points from the presentation below.

If you are still interested in watching the investor day presentation, I will leave a link here for you to check it out.

One of the most positive nuances of the investor day is that there were several senior staff at Adyen talking about the teams that they are heading. In the U.S., where it is hiring aggressively, it is hiring from big tech companies like Microsoft (MSFT) and Alphabet (GOOGL).

I don’t think this has been mentioned by many analyst reports, but this clearly shows the talent that Adyen has been hiring over the past 18 months, and it has been hiring aggressively.

Overall, I come out of the investor day event even more positive about the direction in which Adyen is taking, the strategy and efforts to get there, and the people that are driving that to success.

To start, we first have to go through the industry trends underpinning the Adyen opportunity set.

Industry trends

Adyen reiterated the industry trends that are driving its long-term opportunity.

Firstly, digital transformation is a key trend that has been driving the growth for Adyen as merchants are increasingly looking to collect data about their customers, and payments data is increasingly key for that.

Secondly, with commerce becoming more global and each market having its own unique payment solutions, Adyen is able to leverage this opportunity to grow and provide a simple payment solution for merchants looking to go global.

Thirdly, the trend of moving to a cashless society continues and it leads to new ways to pay and more digital payments. With that new technology is needed to help merchants tap that.

Regulation is getting more complex for merchants and on top of that, it changes very rapidly. This involves protecting data and protecting payment security. With many methods of authentication, having a solution that helps to manage that brings more opportunities for Adyen. This trend continues to grow as regulation continues to pick up in many markets.

In addition, the trend of platforms is taking over for smaller and medium businesses, and this brings an opportunity for Adyen to embed payments as part of the holistic offering of these platforms.

Last but not least, as merchants look to become more cost-efficient amidst the current uncertain macro backdrop, this brings opportunities for a player like Adyen. It is able to lower payment costs for merchants through a variety of ways, including optimizing the routing of transactions, using and embedding technology in the process, and many more ways that can help to lower costs.

Commercial strategy

Adyen has always been focused on the enterprise type of customers and meeting their needs. Through the Platforms segment, Adyen then targets the smaller types of merchants.

The focus on enterprises here is key for Adyen because, by focusing on these huge companies, Adyen can invest in the business to help them succeed and support them along the entire value chain.

There are three main pillars that Adyen looks at, and these are Digital, Unified Commerce, and Platforms.

Digital merchants are those that only sell online. Unified commerce merchants are those that sell both online and in stores. Platforms are where Adyen targets smaller and medium businesses.

With the payments space becoming increasingly complex, Adyen is trying to make it simple for these enterprises. It does so by providing all its payments solutions through a single platform. On top of that, it provides an end-to-end solution that is all built in-house with no third-party dependency. This means that Adyen can have full control over all of its solutions and, in turn, provide merchants with the simplicity and consistency they need for all the markets in which they operate.

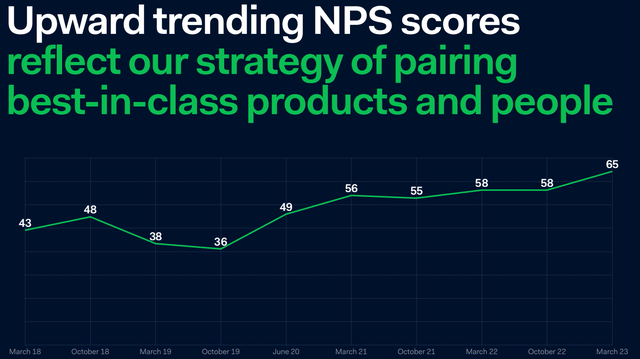

With that focus on the customer, Adyen tracks its net promoter score to see how customers are perceiving its solutions. As we can see below, Adyen’s net promoter score has been tracking upwards and continues to improve.

Adyen NPS (Adyen investor day)

The company also shared more about its commercial strategy and how it is scaling up globally.

Given that Adyen focuses on enterprise customers, it requires two different teams in its commercial teams to ensure success.

There is the Sales team, which is focused on getting new customers into Adyen. and also there is the Account Management team, which is focused on managing these existing enterprise customers’ needs.

In addition, Adyen organizes its commercial teams based on its three pillars (Digital, Unified Commerce and Platforms) so that they have a better focus on specific customers.

It also has a Commercial Academy to teach the commercial team the “Adyen Way of Selling” by understanding the customers and what their needs are.

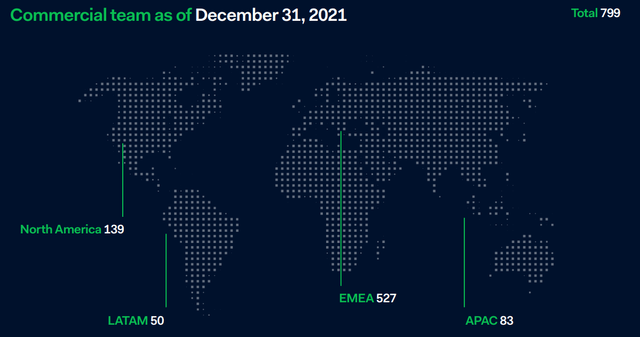

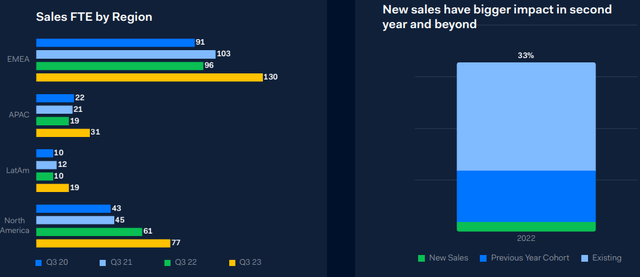

Adyen has grown the commercial team significantly over the past 18 months.

As can be seen below, the commercial team had 799 people as of the end of 2021.

Commercial team as of end of 2021 (Adyen Investor Day)

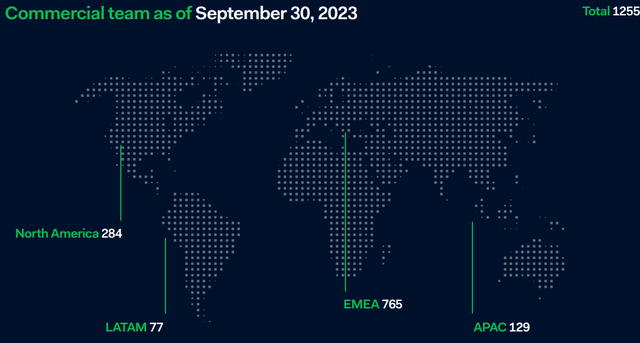

However, in just 18 months, the commercial team grew by 57% or 456 people.

In particular, the growth was strong in North America where the commercial team more than doubled, and also in Europe where the company continued to add 238 staff to the commercial team.

In particular, Adyen mentioned that the Accounts Management team has grown rather linearly over the past 18 months, but the Sales team has really accelerated and grown significantly over the period.

That said, Chief Commercial Officer Roelant Prins emphasized that the impact of the acceleration of growth in the Commercial team will take time to materialize given that the sales cycle is long and even after acquiring a new customer, there is also a ramping cycle that the customer needs to go through in order to become a more meaningful revenue contributor.

Commercial team as of end September 2023 (Adyen Investor Day)

Digital

The opportunity for Adyen in its Digital pillar remains strong given that 15% of online transactions still fail, regulation and technology surrounding payments methods are constantly evolving, and customer priorities also continue to evolve.

With these opportunity sets in mind, Adyen’s key selling points in its Digital segment continue to be that it provides performance and cost savings at scale, it helps to simplify these complexities, and lastly, brings an end-to-end solution that brings a strong value proposition outside of just processing.

Adyen has been focused on both lifting performance and cost efficiencies at the same time, and it is not a matter of either. To optimize for performance, Adyen has been focused on providing customers with the payment methods that consumers want, improving issuer approval rates, minimizing frauds, reducing authentication friction, and eliminating technical errors.

Unified Commerce

The unified commerce business helps customers enable unified payments solutions to customers.

Adyen is the only global financial technology provider that runs on all channels (online, in-store, mobile and in-app) on a single end-to-end technology platform that is fully built in-house and spans across multiple geographies.

The key unique selling point of unified commerce business is that Adyen can help merchants make it simpler to sell online and in-store at scale, helping them grow to new markets and lower costs, and at the same time bring constant innovation to the table.

Alexa von Bismarck, President of EMEA, gave a brilliant concrete example of how it has reduced complexity for Burberry. It reduced the number of Payment Service Providers from more than 20 to just 1, it reduced the number of terminals, fleet management, and processing contracts from 94 to just 12, and it reduced the need for 30 minutes of cash reconciliation per cash register per store each day to a fully automated reconciliation process.

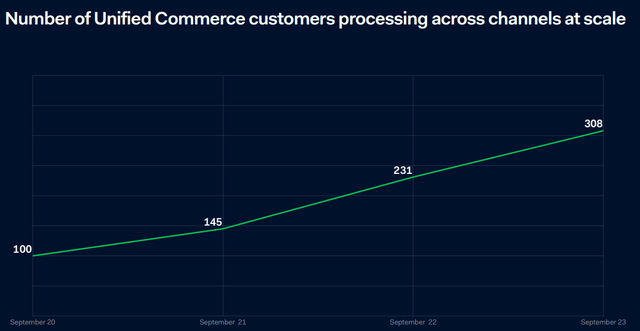

With a strong value proposition, the unified commerce team has seen strong traction in scaling up the number of customers in the business, growing from just 100 unified commerce customers at scale in September 2020 to more than 300 in September 2023.

Unified Commerce customers at scale across channels (Adyen Investor Day)

Adyen has been investing in its unified commerce business in two key areas.

Firstly, it is leveraging the data across the Adyen network to invest in machine learning that can optimize not just for performance, but also for cost.

As a result of these investments, merchants can have a more optimized checkout funnel and convert interested buyers to paying customers. At the same time, this machine learning model is also integrating the risk engine with the payments process. What this does is that it helps to reduce fraud for its merchants.

Secondly, the team is also investing in the in-store experience and bringing Adyen’s own terminal to merchants. By improving the in-store experience, Adyen is completing and creating a unified commerce offering that is end-to-end, and unlike any other.

Platforms

Platforms are Adyen’s solution to addressing the long tail of the market in a scalable manner.

Today, Adyen has onboarded about 7 million active users through these platforms and marketplaces, and of those, 70,000 are active business customers who are highly likely to adopt an embedded financial product in the future.

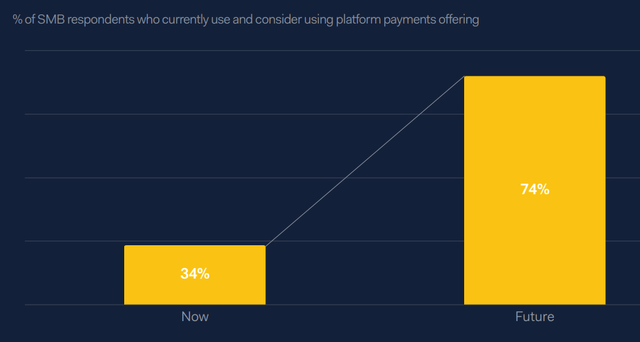

Today, only 34% of small and medium businesses use platform payments offerings

Platform opportunity (Adyen Investor Day)

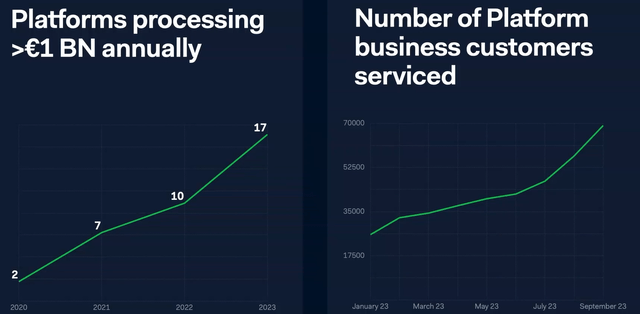

As can be seen below, the Platforms business has grown tremendously over the last four years, with the number of platforms processing more than $1 billion annually growing from 2 in 2020 to 17 in 2023.

Also, the number of Platform business customers serviced also grew tremendously as a result.

Platforms key metrics (Adyen Investor Day)

Commercial success in the U.S.

Adyen believes that it can be successful in the U.S. because not only does it have one of the widest range of local payment methods used by different markets and generations, but it also is able to help merchants tackle an environment that is becoming increasingly complex as the number of payment methods continues to grow.

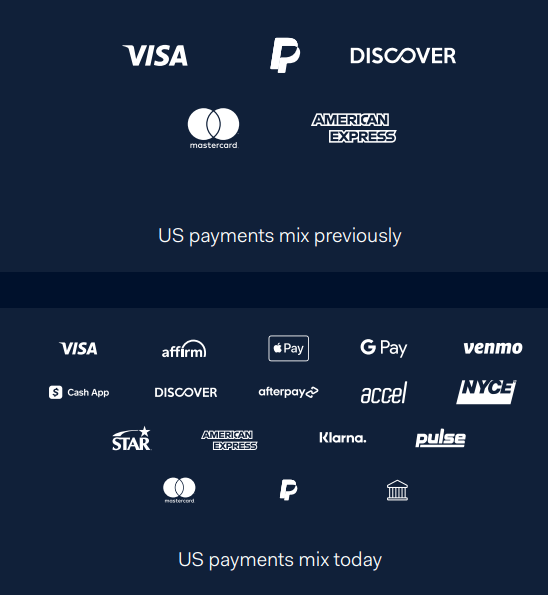

In the past, the U.S. payments mix was more concentrated on just cards, but the payments mix has evolved drastically in the recent few years as new generations come into the mix, bringing in new payment methods like Buy Now Pay Later (“BNPL”), digital wallets, and more recently, banks.

I think this was one of the most interesting points from Adyen’s angle because it demonstrates that the U.S. market is indeed increasingly complex and no longer just about pricing as it was just about the major card players a decade ago.

Increasingly complex payments mix in the US (Adyen Investor Day)

Also, Adyen is helping merchants solve technical challenges faced in the payments industry when authorization rates are only 85% when the cards are not present.

Adyen has grown tremendously in the U.S., and it went from just 10% of its net revenue 6 years ago to about 25% of its net revenues today.

However, the team is confident that there is a huge room for growth given its single-digit market share in the U.S. and that it remains in the early stages there.

Needless to say, it has been investing in the people, products, and technology behind its platform. In the U.S., the commercial, technology, and engineering teams have been growing rapidly, while it only just got its banking license two years ago.

Re-acceleration in Q3 2023

While Adyen only typically reports on a half-yearly basis, the company stated in October that it would be publishing a Q3 2023 business update during its November 8 Investor Day.

When a company that typically reports only on a half-yearly basis voluntarily publishes 3Q23 business updates when the stock itself has been hurt by poor sentiment, I think that Adyen was clearly confident about the business update that it was rolling out for 3Q23.

And of course, Adyen delivered once again.

For 3Q23, Adyen’s net revenue accelerated from 19% year-on-year growth in 1H23 to 26% growth in net revenues in 3Q23 on a constant currency basis, with revenues reaching €414 million.

While there is no 3Q23 consensus expectations, there is a consensus expectation of 18% net revenue growth in 2H23 based on Visible Alpha’s consensus numbers.

Processed volumes grew by 21% to €243 billion, compared to 1H23’s processed volume growth of 23%.

More importantly, this implies a take rate of 17.0 basis points, an increase of 0.1 basis point from the prior year.

Adyen also further broke down the net revenue growth by Digital, Unified Commerce and Platforms.

The Digital segment volumes grew 21% from the prior year. More importantly, Adyen commented that the underlying growth trends remained stable compared to what the company has seen in the first half of 2023, and this includes its US Digital business. Management also commented that US Digital volumes continued to grow faster than the average in the market, implying continued market share growth and consolidation by Adyen within the U.S. market.

The Unified Commerce segment was up 25% from the prior year and there are clear tailwinds heading into the end of the year as the first Tap to Pay Android transactions went live in August of 2023 and Adyen expects that this solution will soon pilot with major retailers within the Unified Commerce segment in North America.

Last but not least, for the Platform segments, while volumes were up 15% from the prior year, the Platforms segment showed a 120% growth from the prior year when excluding eBay volumes, highlighting continued momentum in the business.

Slowing hiring as planned

One of the big worries in 1H23 was the ability of Adyen to improve its EBITDA margin to its targeted levels. However, Adyen showed that they have the ability to control their investment and expansion while still beating on the top line.

Adyen updated that it added only 175 FTE in 3Q23, compared to the 551 FTE added in 1H23. As a result, Adyen is clearly slowing hiring after a big increase in the number of Sales FTEs from 186 one year ago to 257 today.

Adyen stated that they are now “deliberately and gradually slowing down” their addition of FTEs and in 4Q23, management “anticipates bringing on at maximum 3Q23’s number of FTEs.

In 2024, Adyen mentioned that they are planning to scale back hiring as mentioned earlier as they plan to hire to build their global offices and commercials teams in key markets and tech hubs. Management mentioned that they plan to just add “a couple of hundred” in 2024.

To be clear, the consensus was expecting 600 net adds in 2H23 and 481 net adds in 2024. Thus, Adyen will likely beat expectations for 2H23 as the likely net adds for 2H23 will be 350 at the maximum, and the company likely also beat expectations for the net adds in 2024.

Medium-term plans

Not many management teams can guide for the next three years, but this is what the medium-term guidance is intended to do.

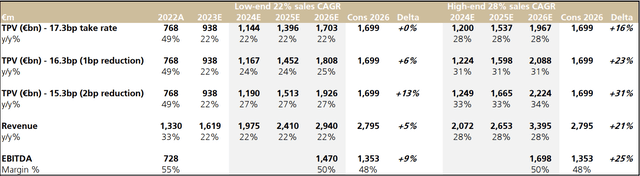

Adyen set a new ambition to grow net revenues between “the low-twenties and high-twenties” through 2026.

Adyen also set the ambition to raise its EBITDA margin to over 50% by then.

Earlier, Adyen set a medium-term ambition for net revenue growth to be “between the mid-twenties and low-thirties” and there was a long-term EBITDA margin target of “above 65%.”

Management reiterated that they continue to see operating leverage beyond 2026.

Adyen implied financials based on targets (Author generated)

As can be seen above, assuming Adyen grows revenue at the low end of 22% CAGR over the next three years and the 50% EBITDA margin is reached, Adyen would generate €2.9 billion in revenue and €1.5 billion in EBITDA by 2026. At the low end, Adyen would have beat consensus expectations for 2026 by 5% on revenue and 9% on EBITDA.

Assuming the high-end of the target is achieved, Adyen would reach €3.4 billion in revenue and €1.7 billion in EBITDA. At the high end, Adyen would have beat consensus expectations for 2026 by 21% on revenue and 25% on EBITDA.

Building blocks for net revenue growth

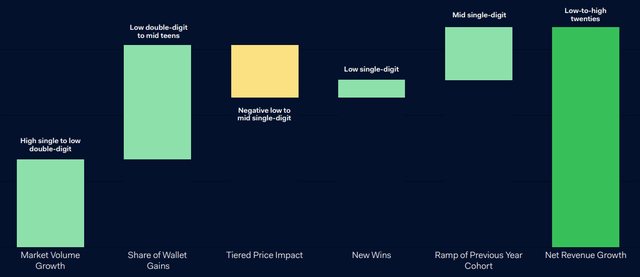

Adyen did well on the investor day by showing transparency about not just what they expect net revenue growth to be in the medium term, but also how it plans to achieve it, as can be seen below.

Building blocks for growth (Adyen Investor Day)

Firstly, market volume growth will contribute high single to low double-digit growth for Adyen as its markets continue to grow itself.

Secondly, the share of wallet gains of existing customers is expected to bring low double-digit to mid-teens growth in the medium term, as it has done so in the past.

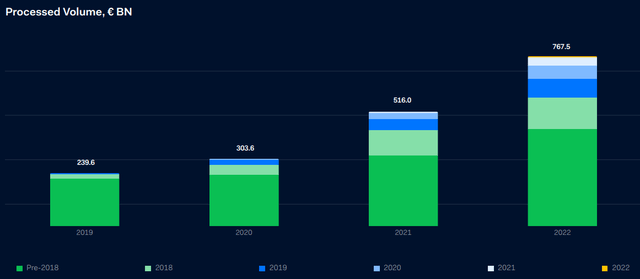

Another chart that Adyen provided that I think provides more transparency is this one about the processed volume of existing customers based on the cohort year. Clearly, the volumes take time to ramp and scale up, with the customers that have been with Adyen longer bringing a larger portion of growth to the company in terms of processed volume.

This share of wallet gains has been a consistent growth driver for Adyen and I expect this to continue in the future.

Adyen’s process volumes based on existing customer base cohorts (Adyen Investor Day)

Thirdly, for existing customers, Adyen provides them with tiered pricing which reduces the per transaction fees as a customer expands and grows with Adyen, which leads to a negative low to mid single digits.

Lastly, there are new wins and ramp of previous year cohorts, which makes up low single-digit and mid single-digit net revenue growth respectively. New wins bring the lowest revenue growth but it is important because it is about landing and expanding them to maximize revenue potential.

Adyen also provided more transparency into this trend about the first and second year cohorts, and as can be seen for 2022, the new sales made up a small percentage of net revenue growth for the year, and just one year later, they contributed much more to net revenue growth.

This also highlights that as Adyen hires new sales staff, the effects of these new hires will likely lag and appear about one year later.

New sales impact by year (Adyen investor day)

Valuation

Unsurprisingly, given the conservatism I have embedded into the financial forecasts for Adyen, the earlier financial forecasts are actually in line with the medium-term plans for the company, with revenue CAGR at 24% and 2028 EBITDA of more than 50%.

As such, I continue to reiterate my 1-year price target of $13.17.

There may be room for upside if these medium-term targets that the management set prove to be conservative.

Conclusion

Adyen has grown nicely to become one of the largest positions in the portfolio today after we took a contrarian position in the company after its surprise negative earnings in 1H23 when the market thought that all was lost for the company.

However, as I have highlighted above, Adyen continues to see that it has strong competitive advantages, it continues to invest and innovate to ensure it stays ahead of the competition, and it does so thinking about operating and running the business for the long term.

In addition, after the 1H23 results, I mentioned that the investor day will likely be a catalyst for the company because of not just increased transparency, but also the willingness to report 3Q23 results as well.

With the medium-term targets and ambitions, I think that has helped assure the market that Adyen remains confident in continuing to grow at a strong rate and doing so profitability.

The bridge to achieving the medium-term net revenue target also shows where the drivers of this growth come from and further quantifies how the team can achieve this.

All in all, the investor day and business update was highly effective in bringing Adyen’s share price and sentiment from one that was highly depressed to a more normalized level today.

I continue to see Adyen as one of the highest conviction ideas in the portfolio as I see it as a high-quality company to own given the quality of the management team, the quality of the platform, and the opportunity set it has.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here