DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Zzzzz … Wait, WHAT?

As everyone knows, (1) the current rally in US equities is just a fakeout until the Great Depression 2.0 hits us all due to a Credit Event or something else that Few realize is about to happen, and also (2) Salesforce (NYSE:CRM) is a now-rather-dull grandpa tech kind of stock that more and more resembles its alma mater Oracle (ORCL). It’s even a Dow constituent. What more kind of snoozefest could you want?

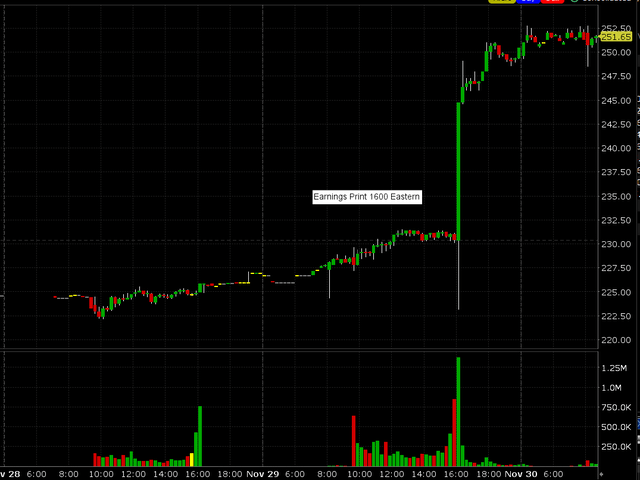

Well, Salesforce stock apparently didn’t get the memo. The company printed perfectly acceptable but utterly unexceptional numbers yesterday after the close, whereupon the stock promptly jumped around 10% in post-market trading. It remains around this level as we approach the open today.

Let’s take a look at those numbers.

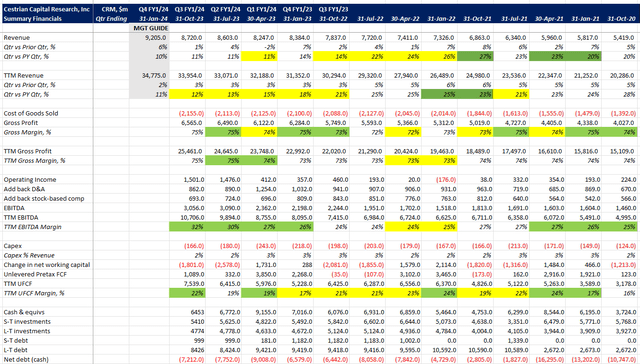

CRM Fundamentals I (Company SEC filings, YCharts.com, Cestrian Analysis)

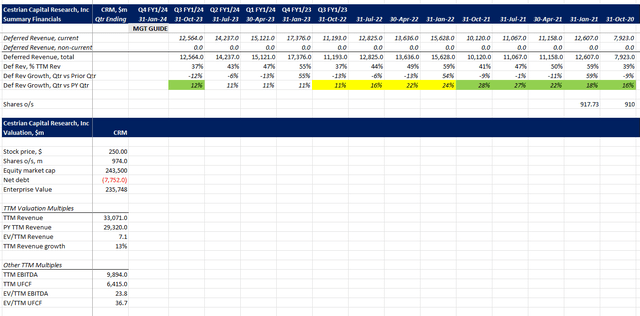

CRM Fundamentals II And Valuation Multiples (Company SEC Filings, YCharts.com, Cestrian Analysis)

So, let’s step through the numbers.

- Revenue growth held steady at +11% in the quarter and +12% on a TTM basis. The company is guiding to a slight deceleration next quarter – we assume that the next quarter comes in at +11% growth once more.

- Gross margins held at 75% on a TTM basis.

- EBITDA margins moved up a couple points, to +32% on a TTM basis. And cash flow followed suit, with unlevered pretax free cash flow margins moving up to +22% on a TTM basis.

- Deferred revenue growth ticked up a point to +12%. (If you’re unfamiliar, deferred revenue = invoices sent to and accepted by customers for service that has yet to be delivered ergo cannot yet be recognized as revenue. Deferred revenue growth vs. prior year is a useful but not by any means perfect or linear forward indicator of future recognized revenue growth.)

- $7.2bn in net cash on the balance sheet, less than it has been recently, more than it was a while ago. Plenty enough to keep the bailiff away.

This is all good obviously. Go-to-work-work-hard-get-paid-come-home type good. Not, break-open-the-good-bubbly-Carol-I-hit-the-ball-out-the-park-with-the-bonus-and-the-corner-office type good.

Despite which, the stock did this:

CRM Stock Chart I (Interactive Brokers)

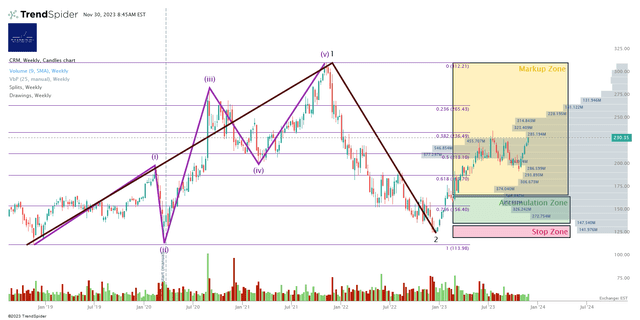

And if we were to zoom out, we think that means the stock might do this:

CRM Stock Chart II (TrendSpider, Cestrian Analysis)

What that chart above says to us is that if CRM stock can stay above $250/share then it has much lower levels of unsold inventory above it at higher prices. $250 is the top of the last truly high volume node in that gray vol x price set of bars on the right hand side. If the market gives CRM a tailwind, there isn’t much supply of stock to be sold by unhappy longtime bagholders up between $250-$320. And if (big if) the market holds, we believe that CRM, like XLK before it, can make new all-time highs.

Back to that market-fakeout-we’re-all-going-to-be-poor-in-’24 thing. We don’t agree. Indeed, this is our house view on the market. Which until the facts change, we’re sticking to. And in that kind of market environment (clue: green), we believe CRM can indeed reach new highs. And the earnings reaction – again, +10% on so-what earnings – tells us that this present bull wants to keep running yet.

We rate CRM at Hold (we had it at Accumulate rating earlier this year between $137-165), and own long positions in the name in staff personal accounts.

Cestrian Capital Research, Inc – 30 November 2023.

Read the full article here