Despite the turbulent environment in tech, early stage founders’ optimism about their ability to raise capital is at a 5 year high. Could this optimism at the early stage be a leading indicator that the tech ecosystem is recovering?

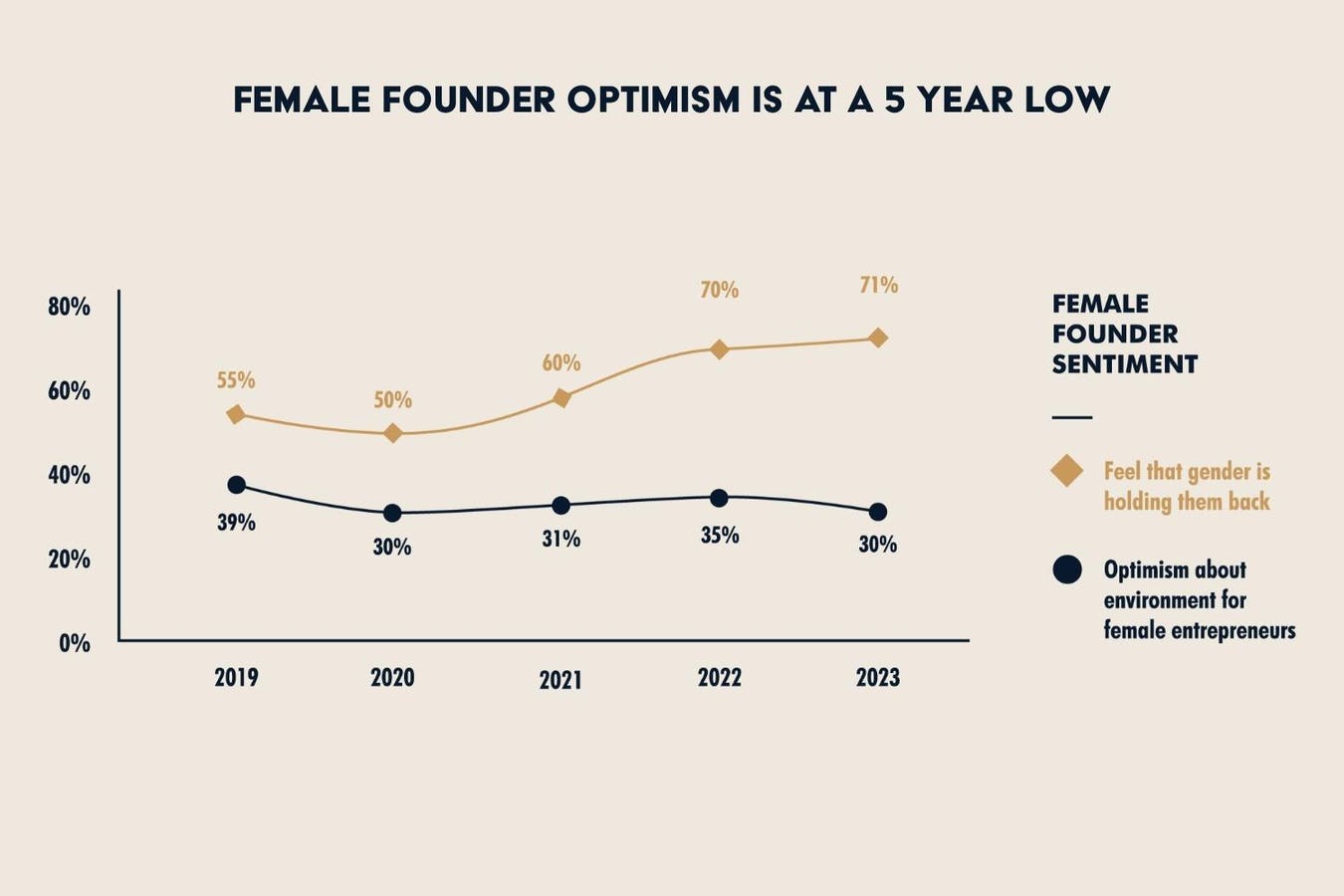

In the 5th Annual January Ventures Founder Sentiment Report, which surveyed 437 pre-seed and seed-stage founders from June through September 2023, 57% say they’re more optimistic than they were nine months ago, and that percentage is higher than it was in 2022 (43%) and 2021 (54%).When you break it down a little further, however — by gender — an uncomfortable disparity emerges. Only 30% of female entrepreneurs feel optimistic about the fundraising environment. In fact, 50% more men than women are optimistic about raising capital and female founder optimism is at a five-year low. 71% of female founders say their gender is holding them back.

There has been a lot of talk over the past few years about creating change in the tech ecosystem for women and people of color, but unfortunately progress has stalled. Still only 2% of venture funding goes to all female teams, and that number has not wavered for a decade, despite the #MeToo movement and all the attention on the gender gap.

Even more alarming, venture funding to Black founders actually dropped by 45% last year. In the January Venture survey 49% of Black and Latinx founders say that are pausing fundraising efforts or facing issues raising capital. Only 19% of female founders of color were optimistic about the fundraising environment for founders of color.

The sample set from this particular survey is unique, in that half the respondents were women and people of color. When this pool of early stage startup founders was asked about topics including company building, raising capital, challenges and overall sentiment, a stark picture emerged.

Personal networks are an enormous driver for founders seeking funding

Although the data is disheartening, unearthing the mechanisms behind the numbers is important for creating change. One of the biggest themes that emerged was: being well-connected matters.

Networks have been part of early stage tech and venture from the beginning, and they have the power to accelerate access for some groups of founders and hold others back. Most pre-seed funding comes from personal capital (76%), friends and family (50%) and angels (46%). Only 13% of pre-seed companies raise capital from an institutional VC firm.

In addition, the founders surveyed reported that other founders are the most important source of intros for fundraising. There is a common adage that the best intro to a VC comes from a successful founder who has made that VC a lot of money. Currently, most successful founders are white, male and come from a narrow set of networks; there is a vicious cycle at play of this group continuing to open doors for more of the same.

There are talented, ambitious founders who don’t have the same access to early funding sources and connections. While 57% of white males raise funds via friends and family, only 46% of BIPOC founders say the same.

Another important factor to note: fundraising takes up significant time for most founders (73%). This data also shows that investors are retreating to their networks during this downturn. More than half (54%) of founders felt that investors are backing people they already know and/or focusing more on their existing portfolio.

And after fundraising, female founders continue to face a disparity in how helpful their networks are when it comes to sales and hiring. 36% and 37% of male founders found their networks very helpful for sales and hiring efforts, respectively, while only 25% and 29% of female founders felt the same.

Where to go from here

This data should serve less as an alarm and more as a call to action. To better support female, BIPOC and other underrepresented founder groups, there are some critical next steps.

- Fully capitalize diverse founders from the earliest stages so they can reach venture-scale metrics.

- Offer transparency and education about what VCs are looking for, as well as access (not just reliance on warm intros).

- Plug founders into networks that can introduce them to investors and customers.

- Continue educating the VC ecosystem about the bias and pattern matching that can penalize diverse founders.

- Recruit more female and diverse check writers in VC.

- Highlight successful women and people of color as role models.

Seeing is believing, so the more attention we draw to successful examples of underrepresented founders achieving funding and business success, the quicker we can collectively institute change. Ideally, next year’s survey surfaces different data.

Read the full article here