Introduction

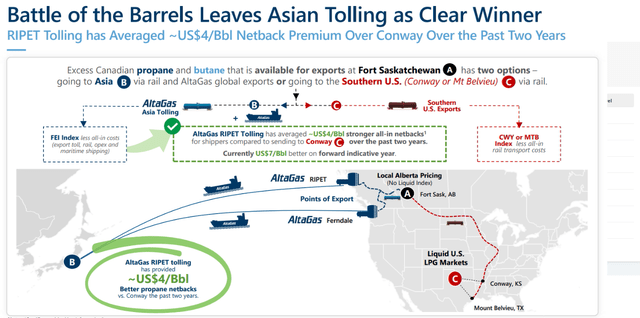

AltaGas (TSX:ALA:CA) (OTCPK:ATGFF) is a Canadian energy infrastructure company focusing on its utilities and midstream divisions. In the midstream division, the company operates two LPG terminals which offer a competitive advantage to serve Asian markets. During the third quarter, AltaGas exported almost 120,000 barrels of LPGs per day to Asia.

AltaGas Investor Relations

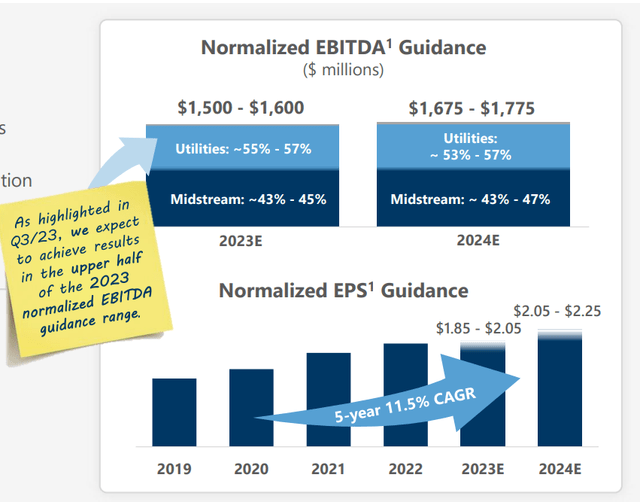

The utilities division includes the rate-regulated natural gas distribution assets in Maryland and parts Michigan, and based on the expectations for 2023 and 2024, the utilities division will account for just over half the EBITDA.

AltaGas Investor Relations

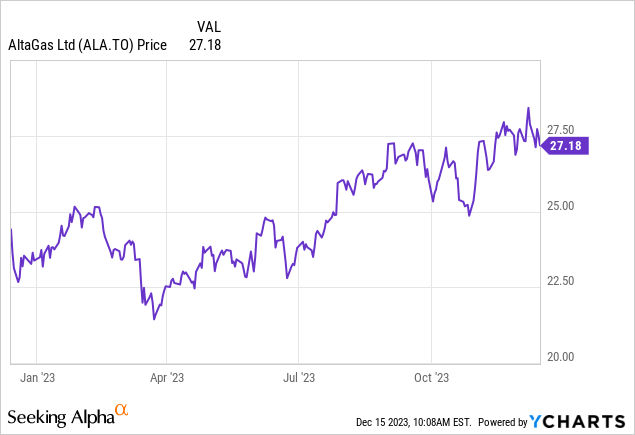

While the company has a somewhat decently liquid listing in the US, the company’s main listing is in Canada where it’s listed with ALA as its ticker symbol. The average daily volume in Canada exceeds 600,000 shares per day so investors with access to the Canadian listing should definitely trade where volumes are the best. As the company reports on its financial results in Canadian Dollar, I will use that currency as base currency throughout this article, unless indicated otherwise.

The recently released guidance for FY 2024 is appealing

The company recently released upbeat guidance for 2024, and I wanted to have a closer look to figure out what this really means for the company and its investment thesis.

The main takeaway is AltaGas’ guidance to report a normalized EPS of C$2.05-2.25 per share, which would be an increase of approximately 10% on a YoY basis using the midpoints of the 2023 and the 2024 guidance. The company also expects to report a normalized EBITDA of C$1.675-1.775B Canadian Dollar which would be an 11% increase on a YoY basis, once again using the midpoints of the respective guidance for both years. AltaGas expects to spend approximately C$1.2B on capital expenditures in 2024 with the majority going toward the utilities division. Hardly a surprise as that division also accounts for the majority of the EBITDA result.

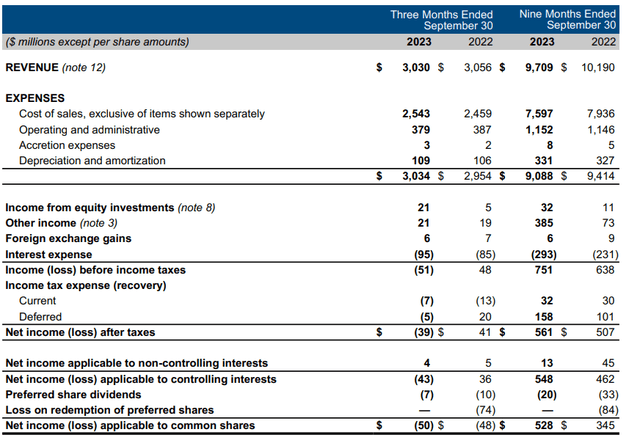

In order to understand the impact of the EBITDA guidance, we should first have a look at how Transalta will perform in 2023, and I thought it makes sense to pull up the Q3 and 9M 2023 results. And while the FFO is an important metric for the company, I’d first like to establish the anticipated sustaining free cash flow.

As the income statement below shows, the company reported approximately C$109M in depreciation and amortization expenses in the third quarter while its interest expenses came in at C$95M.

AltaGas Investor Relations

That’s important to know as this allows us to apply these numbers to the anticipated full-year EBITDA to determine the tax basis and the total tax bill. We know the company aims for C$1.73B EBITDA (that’s the midpoint of the FY 2024 guidance) and we know the annualized depreciation and amortization charges will be around C$450M. This results in a C$1.28B EBIT, and after deducting approximately C$400M in interest expenses, the pre-tax income will be approximately C$880M while the net income should be around C$660M after applying an average tax rate of 25%.

From C$660M net income, we should still deduct the anticipated C$25M in preferred dividend payments. That’s lower than what AltaGas will be paying in 2023 (and the total amount of preferred dividends could even drop to C$20M but I prefer to err on the side of being cautious here) as the company recently called C$200M worth of preferred shares.

This means there will be about C$635M in net profit which, divided over the current share count of 282M shares, the bottom line result will show an EPS of approximately C$2.25. That’s in line with the normalized EPS guidance, so the math checks out.

Now we should translate this into a free cash flow result. We know the net operating cash flow should be approximately C$1.08B. While this won’t be sufficient to cover the total anticipated capex bill of C$1.2B, it is important to understand the company plans to invest in additional growth in 2024.

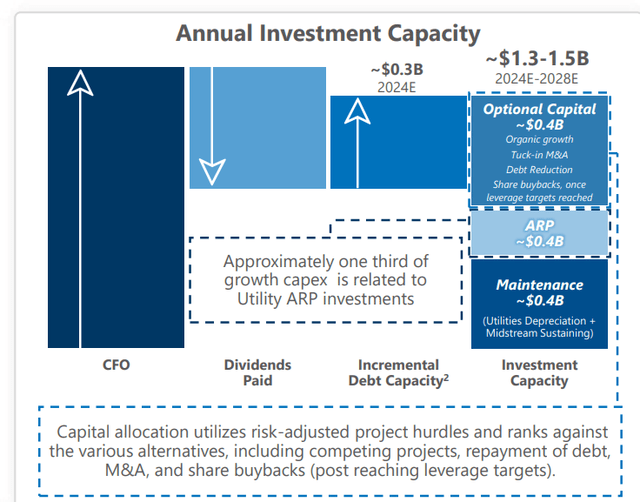

AltaGas Investor Relations

As the image above shows, the maintenance capex is just C$0.4B while the Accelerated pipeline Replacement Program will cost an additional C$0.4B per year. You could argue the ARP investments shouldn’t be considered as a sustaining capex but those pipelines would have to be replaced over time anyway, but indeed not at the current pace. If you would include the ARP investments in the free cash flow calculation, you’d end up at a free cash flow result of C$280M. if you would exclude them, the underlying free cash flow result would be C$680M or C$2.40 per share. I think the most fair interpretation would be to include a portion of the ARP in the sustaining capex in which case the sustaining free cash flow would come at a level pretty close to the adjusted EPS.

The company promises additional dividend growth

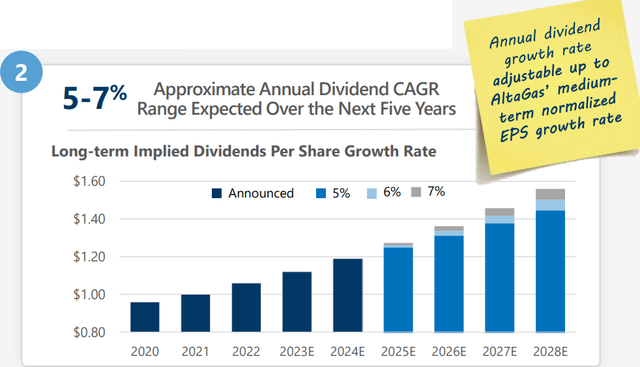

After increasing the projected dividend by 6% to C$1.19 per share for 2024, AltaGas expects to be in a position to continue to increase its dividends in the foreseeable future. The official guidance calls for an annual dividend CAGR of 5%-7% over the next five years. And AltaGas is transparent enough to actually provide a visualization of the anticipated dividend growth trajectory.

AltaGas Investor Relations

At a 5% CAGR, the dividend on the common shares would increase to C$1.45 per share by FY 2028. At a 7% CAGR, this would jump to C$1.56 per share. And of course the payout ratio of 50%-60% of the adjusted EPS remains unchanged.

Investment thesis

Trading at approximately 13 times the mid-point of the anticipated earnings for 2024, AltaGas isn’t cheap. That being said, I’m initiating a small long position as I like the company’s competitive position to ship NGL products to Asia. The recently-announced acquisition of additional infrastructure assets will likely prove to be a good move while I like the company’s prudent capital allocation plans. While 2024 will be a capex-heavy year, the underlying operating and financial performance should stay strong.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here