As the world watched the dramatic ouster and 11th-hour reinstatement of OpenAI CEO Sam Altman, a question formed in many people’s minds: who exactly was in charge at the world’s most famous AI company?

Generative AI companies like OpenAI and Anthropic promised to reinvent every area of human endeavor, it seems they started with the field of corporate governance. In theory these supra-corporate structures are meant to place guardrails on management, to make sure they don’t unleash Skynet on an unsuspecting planet.

But does an unprecedented technology really require an unprecedented corporate charter? For AI rival Cohere, which is in the midst of raising its latest funding round, the answer is no.

“Trying to reinvent the wheel in terms of governance is a very risky proposition,” Cohere’s co-founder and CEO Aidan Gomez told Business Insider, “as you start to get into these more complex arrangements there can be strange properties, you can have hocking events.”

Corporate structures and messy entanglements

Microsoft, which has committed up to $10 billion in cash and Azure cloud credits to OpenAI and played a crucial role in engineering Altman’s return, claims it doesn’t actually own any of the company.

Microsoft, which had no seat on OpenAI’s board at the time, reportedly found out about Altman’s firing just minutes before the rest of the world.

Though it is entitled to some undisclosed share of profits from OpenAI Global LLC a “capped-profit entity” which is controlled by Open AI GP LLC, a shell company which is owned by OpenAI Inc, a public charity tasked with protecting the world from super intelligence.

Anthropic’s corporate structure, only slightly less arcane, allows investors to elect a single seat to the board of a public benefit corporation, a board which will eventually be controlled by a “long term benefit trust” which is tasked with, you guessed it, protecting the world from super intelligence.

Cohere is taking an approach to fundraising that venture-backed startups have used for half a century. In June, Cohere raised $270 million at a $2.2 billion valuation, according to TechCrunch.

Investors in that round included Oracle, Nvidia, and Salesforce Ventures.

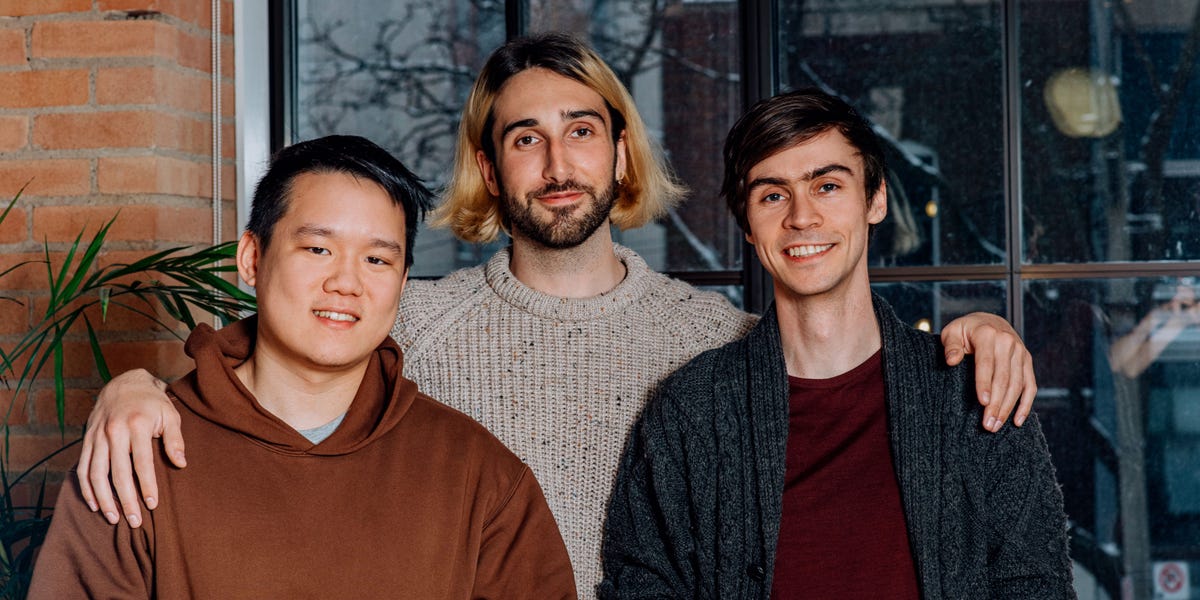

These investors pay Cohere in cash, not cloud credits, and receive equity, not “profit participation units” or PPUs. The company’s founders, including Gomez, control a majority of the company’s board with three seats going to VCs who backed the AI company. It’s a standard-issue, founder-controlled, Silicon Valley board.

For Gomez, it was crucial to avoid messy entanglements with tech giants like Microsoft, Amazon, and Google.

“No one is writing a massive outsized check,” Gomez said, “it gives the company more leverage to say no.”

OpenAI’s deal with Microsoft for instance involves an exclusivity agreement for some of OpenAI’s technology and locks the company into using Azure as its cloud provider. Anthropic has announced similar “strategic collaborations” with Amazon and Google, which constrain the company when it comes to choosing infrastructure providers.

“If you look at OpenAI, basically they’re beholden to the cloud vendors like Microsoft,” said Ashish Kakran, a principal at Thomvest and an investor in Cohere. To him, not having a large corporate patron is a feature not a bug.

‘Cloud-agnostic’

Part of Cohere’s pitch to enterprise customers is that its technology is “cloud-agnostic”, unfettered by any complex corporate partnerships, able to move nimbly from Azure to AWS.

Gomez does admit that rejecting alliances with big cloud providers has made fundraising more difficult. “But I think it’s worth it,” he said, “it makes sense for us to keep our independence. We don’t want to just cede value to the incumbents.”

Some might say this structure incentivizes Gomez to consider his fiduciary duty to shareholders over his duty to humanity. Some might also say that for all its complexity, when push came to shove, OpenAI’ corporate structure did the same thing.

“The money is always going to win out,” said Jordan Jacobs, managing partner of Radical Ventures and a board member at Cohere. Jacobs says he sees a “fracture” at the heart of OpenAI’s corporate structure and that he wasn’t surprised at all when the company underwent a messy power struggle.

“How do you reconcile building AGI for the good of the world with building products that make a lot of money for one company? The two things, as much as you want to try to align them, are not aligned,” he said.

He says he likes that investors and employees at Cohere are given equity in the company rather than just profit participation, arguing that it aligns everyone’s incentives and makes clear the goals of the institution. He also trusts the management team to make responsible decisions around AI safety.

While the board members may be more involved than at many other large companies (Jacobs says they have an active group chat where they exchange messages almost every day), the final say ultimately rests with Gomez and his co-founders, who control a majority of the board seats.

As for the whole Skynet contingency? Gomez says some combination of market forces and government regulation will address that.

“If these models weren’t safe to use and we couldn’t provide assurances around that, no one would adopt, we wouldn’t be able to sell,” Gomez said, arguing that enterprise customers are too risk averse to buy an unsafe AI product.

What happens if the financial incentives and moral incentives don’t line up as Gomez hopes? That’s still an open question, but at least at Cohere there’s no confusion about who’s responsible to answer it.

Read the full article here