Editor’s note: Seeking Alpha is proud to welcome Jerad W Starr as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

After thoroughly reviewing the past 10 years of financial statements for Ecolab (NYSE:ECL), and most importantly, the Q3 earnings call in Oct 2023, I think there is certainly plenty to discuss about the company. I’ll briefly list some highlights: Ecolab carries a powerful, century-old brand name, which has made it the global leader in water, hygiene, and infection prevention. They are extremely diversified, and ECL is showing signs of aggressive expansion in sales, margins, and EPS.

But there’s a catch. Much of the company’s recent success has already been priced in. The company’s P/E ratio of 44.6 is substantially higher than its historical average, and I believe there’s very little room to grow from today’s price of $195.75. Based on my intrinsic calculations, the stock’s history, and factoring in fundamental improvements, I do not see signs of near-term stock appreciation.

My recommendation for Ecolab is HOLD.

Company: Profile

I should mention that I recently moved to Saint Paul, MN, and just down the road is Ecolab’s World Headquarters. After speaking with the retired President of Global Institutions, Mr. M. Hickey, I decided to investigate the company.

Almost anyone who’s used a public restroom is familiar with Ecolab’s ubiquitous soap dispensers. But I was wrong to assume that the company only sold bathroom supplies-very wrong. Ecolab is a diversified fortress spanning multiple sectors across 172 countries. There’s no company quite like them. Beginning as a seller of dishwasher dispensers, the company is now a basic materials conglomerate that manufactures various derivatives of chemicals.

Products range from insecticides, water treatment, manufacturing compounds, commercial cleaners, healthcare products, and of course cleaning agents.

Humble Beginnings (Ecolab )

Furthermore, ECL’s moat is wide, and it adds greater depth with high switching costs. About 80% of Ecolab’s revenues come from existing customers within a business model that’s commonly referred to as “Razor-and-Blade.” As the model suggests, ECL sells equipment to its installed customer base (the razor) and then sells proprietary chemical agents (the blade) to be dispensed with said equipment. This provides re-occurring revenue.

Today, the company carries a market cap of $55.95 billion. It faced some significant challenges throughout Covid and under recent inflation, but that has not affected the company’s long-term prospects.

Recent Developments: Dividends

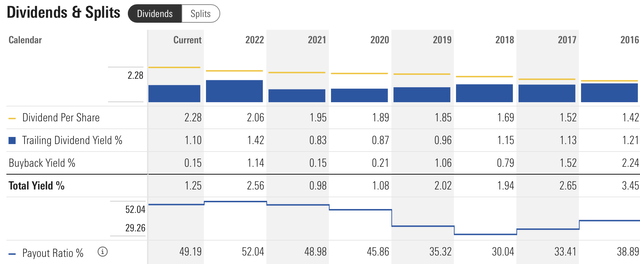

Two weeks ago, Ecolab announced its 32nd consecutive annual dividend increase of 8%, which equates to $2.28 per share in 2024 and is certainly a significant milestone. It’s to be paid January 16, 2024, to shareholders of record, at the close of business on December 19, 2023. It’s a reassuring milestone as it marks ECL’s 87th year of dividends to its common stock shareholders. Comments from CEO, Christophe Beck, are below:

The robust growth in Ecolab’s cash dividend reflects our strong business momentum heading into 2024, excellent cash flow, and our commitment to returning to historical dividend payout ratio levels. We remain committed to enhancing total shareholder returns through strong growth in our business and attractive cash dividends.”

This is comforting news, no doubt. But in light of the current share prices, I don’t believe this dividend raise comes without some constructive criticism.

It comes down to the share price. First, Ecolab’s dividend yield is substantially lower than its peers. With a 4yr. avg. yield of 1.07%, ECL’s payout is less than half (-51%) the yield of its sector Median of 2.17%. This implies that while the raise is significant, shares are trading at such a premium that it doesn’t translate into serious profits for shareholders. ECL’s dividend yield grade scores a “D-” on Seeking Alpha because you could get 2.5x the yield by buying a competitor like Int’l Flavors & Fragrant (IFF) with a dividend yield of 2.84%.

The second issue is the payout ratio %.

Morningstar

The payout ratio is quite high, at least compared to what it used to be. This suggests ECL’s fundamentals are still catching up, but they’re almost out of the woods. I discuss this more below.

Anyways, ECL’s fundamentals are recovering to where they used to be in 2016-19 prior to Covid-19’s horror show. It’s true that dividends have increased, but the company needs time for earnings to grow into current valuations. The historic avg. payout ratio equaled ~33.92% of earnings. In recent years, it’s closer to 50.08%. In other words, the dividend is growing, but the earnings required to pay them have increased 47%. I don’t believe this will be a problem as ECL is accelerating in revenue, margins, and earnings, like no other, but this takes time… With margin expansion, top-line growth, and returning cashflow, I expect ECL will strengthen its fundamentals further, however, I would not get side-tracked by this perennial dividend announcement. It’s reassuring that dividends will continue to grow, but a bigger issue is the stock price, which I believe overshadows this issue.

Q3 Synopsis: Margins

Earnings were quite positive in Q3… but there was something far more important for the valuation of the company. It’s something that they’ve been grappling with for years and few have talked about. This problem has corroded their earnings since Covid-19 and has distorted their valuation. The problem was the gross margin, and gross margin expansion is what mattered this quarter.

The Q3 conference call had many highlights: every segment (except paper) grew, EPS hit 1.41, (+17% yoy) which is superb, and pest control and institutional sales were highlighted, but all this, especially the earnings, can be attributed to improved COGS.

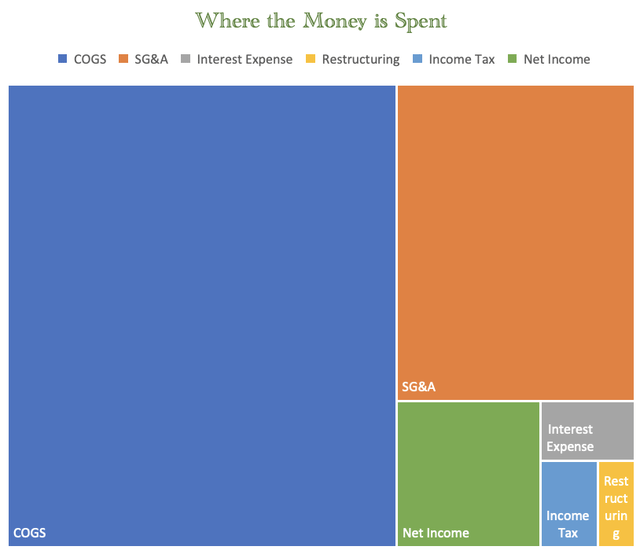

It’s a matter of magnitude. The cost of goods sold represents the most dollars that flow through the company. And by improving 160bps, with room to expand further, its impact reverberated throughout the entire P&L statement.

Revenues by Expense (Author’s Work)

In the above chart, TTM COGS represent 62.5% of total sales revenue. This expense has risen over 380 bps since 2018-19 where COGS only comprised 58.7%. This increase in costs makes quite an impact-especially on EBITDA. By analyzing the SEC portal’s 10Ks, we see that last year’s EBITDA was 200 bps less than 2018’s and subsequent years. This difference may seem small, but in large conglomerates, a single basis point translates into millions of dollars.

But that’s being addressed. Like a cruise ship that’s a couple of degrees off course, the company has begun steering itself in the optimal direction. The past six months have proven that ECL can thwart inflationary costs with their aggressive pricing and improved digital efficiency. After CEO Christophe Beck emphasized “gross margin expansion” as the root catalyst this quarter, I did some investigating.

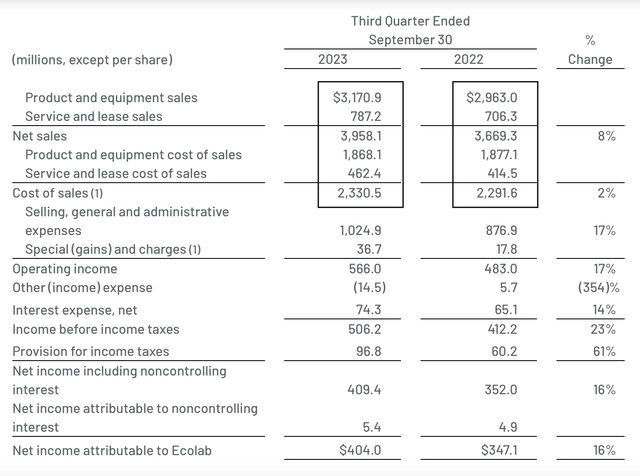

Earnings Release Pg. 16 (2023 Q3 Earnings Release)

We can see that product and equipment costs were the catalyst this quarter. While the company grew sales by almost $300 million in Q3 or 8%, its expenses actually shrank. This translated into a 16% growth in profits, which is anticipated to expand further. Better yet, margin expansion is anticipated to continue. The company’s established target is to achieve 20% operating income within the foreseeable future. That’s 2.2% greater than Q3 and a target I believe is realistic.

Ecolab’s net operating profits of 1.98B have finally returned to where they were prior to the pandemic i.e. $2.0 billion – $2.2 billion from 2018 to 2019.

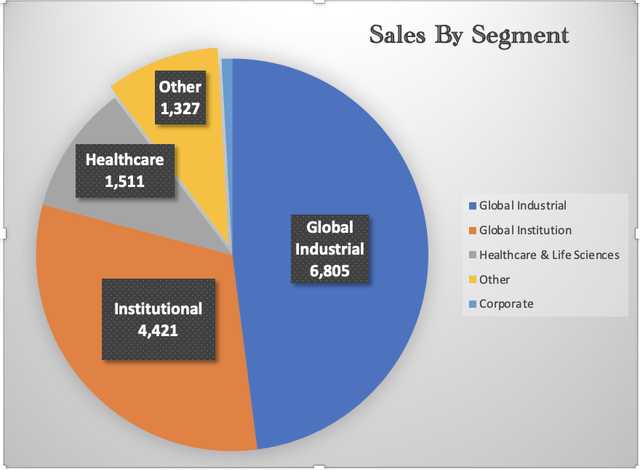

Sales Growth: Segments

I believe in the Pareto effect when it comes to investing. A lot of numbers get thrown around on quarterly reports and attention should be primarily focused on the handful that make the greatest difference. We’ve already touched on margins, so institutional and industrial sales should follow next.

Segments (Author’s Work)

Earlier this year in Q2’s Q&A, the CEO emphasized that resources are invested only where they make the greatest impact. This includes a couple of segments (institutions & industrials) and a handful of countries: the U.S., China, and Western Europe. Thus, special attention should be given to understanding these key markets. This year, institutions have been the highest-performing segment. This segment includes restaurants, hotels, businesses, and the hospitality industry in general. Q3 gained 11% organically yoy with 70% of sales originating in the United States. Income grew disproportionately at 28% and 260 bps higher than last year.

Institutions were particularly hard-hit during the shutdowns and have since become ECL’s fastest-growing segment according to the 3Q Supplemental. Ecolab’s selling point is cost reduction. By purchasing their products, businesses use fewer resources like water and electricity, but the greatest selling point is cutting labor costs. It takes fewer people and less time when using ECL’s chemical formulas. This is especially the case when using ECL’s automated products because devices can use extra-powerful chemicals and heat that would otherwise be too dangerous to operate by hand.

Industrial income increased 8% in Q3 with a further margin expansion of 60 bps. Furthermore, management provided guidance that industrials may return to double-digit growth in the fourth quarter. Industrials are far more diverse in global sales than institutions and are facing lower volume due to softening global demand.

Healthcare and Life Sciences experienced a surge in margins growing 38% yoy. And lastly, Ecolab gained market share over competitors in pest control, which collects the greatest marginal return of all 5 segments.

To wrap up Q3, it was very successful in shoring weaknesses and capitalizing on strengths. I expect ECL will accomplish Q4’s outlook with adjusted EPS of $1.48-$1.58. I also have faith that margins will continue to expand 250 bps yoy with growing volume and more favorable pricing.

All this is good news, however, we’re still a long way away from actualizing these results in the form of substantial EPS. The company needs time to grow into its current valuation, which I believe is substantially inflated.

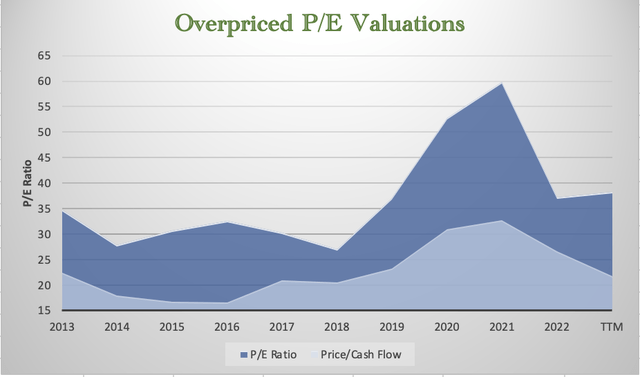

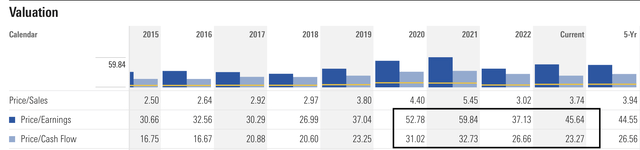

P/E & Cash Flow Ratios

Now that gross margin is expanding-and is projected to grow even further- investors can expect better EPS and new valuations. But what’s the appropriate P/E and Price/Cashflow ratio? In Ecolab’s case, it’s not an easy question. Multiples expanded after a robust fiscal 2019. Their P/E ratio in particular appreciated greatly getting as high as 60x earnings by 2021. Today it trades at 45x earnings, which is lower than before, but still much higher than what it has traded historically.

Will this continue? Because if it doesn’t, ECL is quite overpriced.

Table 1 (Morningstar) Table 2 (Morningstar)

Although ECL is in line with its 5-year P/E average (see Table 2), I believe this fact is misleading. What’s key to understanding is that these high valuations came as a result of poor bottom-line performance during the years of Covid, which skewed the company’s historical averages.

Table 3 (Morningstar)

Table 3 provides extra information because it highlights the Pandemic from late 2019 to 2022. What amazes me is that shares of Ecolab actually grew throughout this period. That’s not what I would have expected, given that until this quarter, the company has been on the mend from plunging sales, discontinued operations, stunted earnings, and macroeconomic headwinds. Perhaps, it’s because the company is, after all, an infection prevention conglomerate. Despite a collapse in fundamentals, shares grew to over $225. The stock, essentially, corrected until 2022. This ever is helps explain why valuation metrics grew so wildly.

But I do not think a ratio of 45x earnings is an accurate or safe way to value the company. Instead, I believe the company should be valued near its historic P/E average of 31.5x earnings plus a premium for its moat and proven investor demand. Thus, a ratio of ~35x earnings I believe is fair, which is 22% less than today.

While the company has recovered its top-line, margins, and cashflows, I believe Q3 results are priced in. I see little chance of shares rising significantly higher from current levels, which is beyond analyst predictions anyway. By almost every metric, the company today is overvalued; it scores an “F” for book value, an “F” for PEG ratio, and a “D-” for both cashflow and earnings ratios on this platform. Ecolab gets a valuation grade of “F” on Seeking Alpha, and I agree entirely.

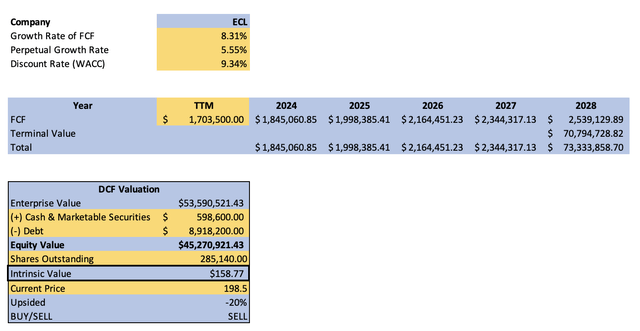

Ecolab – Valuation

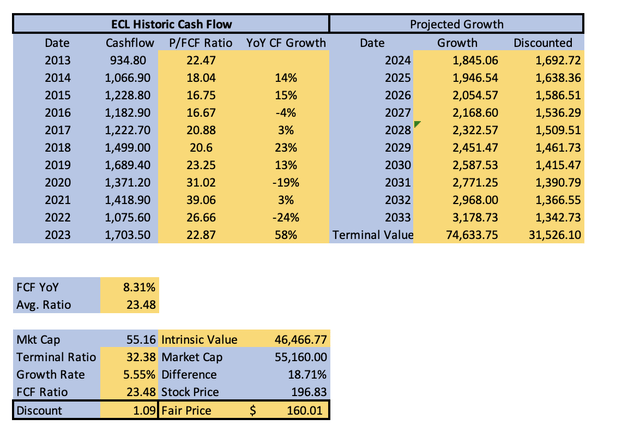

I was very thorough analyzing Ecolab’s cashflow statements. Because the company underwent multiple expansion in 2019, I used a capital asset pricing model and reviewed Morningstar, Seeking Alpha, Yahoo Finance, and the last ten years of annual reports to assess projections. Based on the information from the 10Ks, I was conservative with ECL’s cashflow growth. Yahoo Finance estimates a 5yr. growth rate of 14.64%. However, based on my personal research, I believe this figure is a bit inflated. Ecolab has grown its cashflow, on average 8.31% for the last ten years. It’s true that cashflows surged 50% in 2023, but this is in large part due to fundamentals recovering from several years of loss during Covid.

For this reason, I used an 8.31% growth rate of future cashflows with a more aggressive terminal growth rate of 5.55%. This calculation was drawn in lieu of Morningstar’s research on ECL’s accelerating future prospects in water treatment and pest control + its core business units. And finally, I calculated a discount ratio of 9.34% after calculating the cost of debt and the current cost of equity.

Author’s Calculation

It’s worth noting that due to fluctuating Price/Cashflow ratios from Covid, I calculated intrinsic value a second time with some adjustments. By using a terminal value of projected cashflows and multiplying it by the ten-year average Price/Cashflow ratio of 23.48 I arrived at a second estimate <1% the difference from my initial calculation. See the table below.

Author’s Calculation

Thus, I find Ecolab to be roughly 19% overpriced from its fair value, with a Fair Value estimate price of $160.00. This coincides very closely with a hypothetical P/E ratio of 36.5, which I believe is appropriate based on historic ratios plus a premium based on a wide moat and investors’ demand for ownership of the company.

Rock-solid Management

Leadership is arguably the most qualitative asset a company has. I’m impressed with what I have seen with management and their success in executing their objectives. I particularly like that they are clear, simple, non-reactionary, and they play to win. Since spring, management has rallied 1,100 sales associates to go on the offensive and the strategy has worked all year. Organic sales are up consistently 7% on average since they began. And this is directly attributed to the sales team’s tenacity in expanding ECL’s footprint.

CEO Beck says his approach is “old school” and that sales are driven by knocking on doors and doubling down on what is working. Simplicity first, not convoluted strategies. I find this attitude to be remarkably rare these days as most companies facing similar challenges would be on their heels. Above all else, this strategy is working. I am confident that Ecolab will achieve its guidance projections from management.

Diversifying with Competitors

If one were to own Ecolab, I believe it may be beneficial to also hold one or several competitors. Because Ecolab is heavily engaged in various industries from water treatment, infection prevention, industrials, pest-control etc. there isn’t one company that competes squarely with ECL. Instead, ECL’s segments compete with an array of other specialty chemical giants from across the globe. This includes: Sika AG (OTCPK:SXYAY), The Sherwin-Williams Comp. (SHW), PPG Industries (PPG), Givaudan SA (OTCPK:GVDBF), and DuPont de Nemours (DD) to list a few.

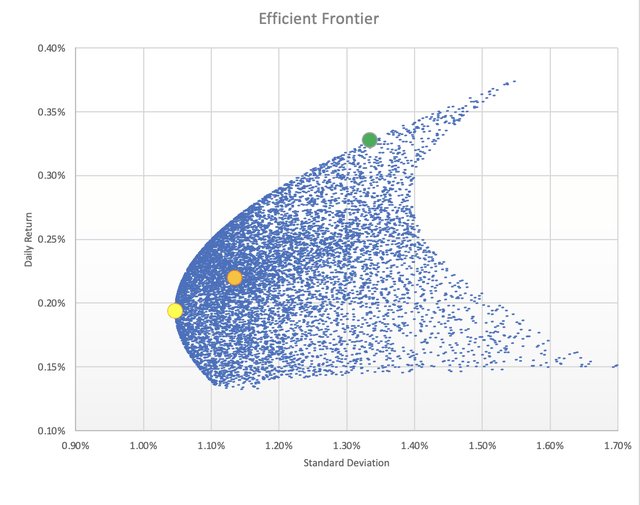

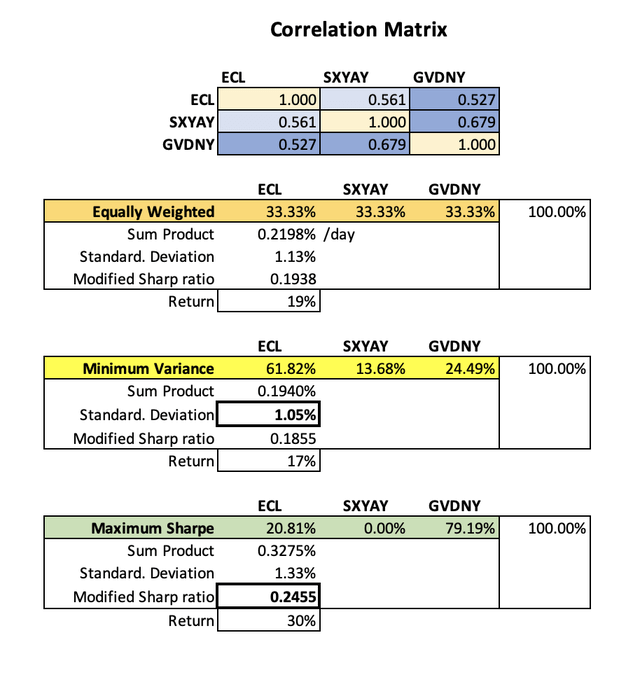

I spent a lot of time and consideration reviewing these companies. For this, I used the renowned Efficient Frontier model. The efficient frontier is a set of optimal portfolios that provide the highest return for the lowest level of risk. There are many benefits to this… For one, it shows how owning several competitors may be beneficial instead of putting all your investable income into one single company. It also is a great tool to compare performance and volatility.

After many calculations, I constructed a portfolio of Ecolab, Sika and Givaudan. Running 10,000 simulations of their recent quarterly performance, I calculated the optimal portfolio (mathematically speaking), in addition to how they’ve performed respectively to one another.

Author’s Calculation

The above graphic illustrates 10,000 separate portfolios and 3 have been highlighted. The yellow dot represents the portfolio with the lowest volatility; the orange dot shows an evenly split 33% ownership of each, and the green dot demonstrates the highest Sharpe ratio. To put it simply, any scatter point that falls below the arched line is considered inefficient. The higher any given point falls on the y-axis suggests greater returns, and the further it moves to the left suggests lower risk. The optimal portfolio i.e. the green dot, is a balance between the highest return at the lowest risk. See the table below.

Author’s Calculation

As we can see from the data, the two strongest performers have been Givaudan followed by Ecolab. Where GVDNY contributes the greatest net return, Ecolab lowers volatility substantially. Owning a combination of the two provides the greatest returns and lowest standard deviation e.g. a 30% return over the last quarter. Further, ECL is only ~50% correlated with GVDNY suggesting the two make a strong pairing while avoiding unwanted volatility and lockstep price movements. If you’re interested in ECL I suggest taking a look at GVDNY as well.

Downside Risk

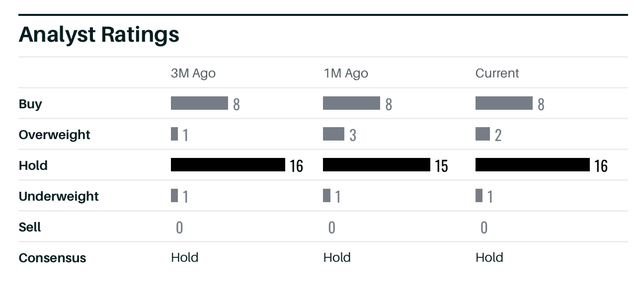

As I stated in the intro, I believe with the recent 18% uptick there’s little room to grow further with plenty of room to retreat. Even if the stock climbs to 2021 levels, and I don’t see any near-term catalyst capable of accomplishing that, the company would be vastly overvalued.

Barrons

Of course, I could be wrong. The stock certainly has been valued higher in the past and it’s past its Wall Street price target of $195 yet distant from its historic highs over $225. Investors could miss out on returns if they sell. CEO Christophe Beck said in the Q3 presentation “Our fundamentals have never been better.”

To be exact, Wall Street analysts have an average target price of $195.50 with the highest estimates at $215.00. With Q3 being a great success it’s not unlikely that its target price could be raised soon. But if that’s the case, I don’t believe it’s warranted. Now that the company has reached its consensus target, I believe betting on continued appreciation to be more akin to gambling.

Conclusion

Warren Buffett once said that he likes to read a company’s annual report without looking at its price. Only after the company checks out on paper does he then look at what it trades for. After reading TEN annual reports I think ECL has recovered from its broken fundamentals during Covid, but proceeding to look at its price, I would conclude it’s far too expensive. A P/E of 45 simply commands too much risk, especially when considering the ratio was 30% smaller with near identical sales, and operating margins five years ago.

The stock has appreciated 18% since the earnings call and this trend may continue, but as a fundamental investor, I am uninterested in paying $195 for the chance that an overvalued company will continue to appreciate. HOLD.

Read the full article here