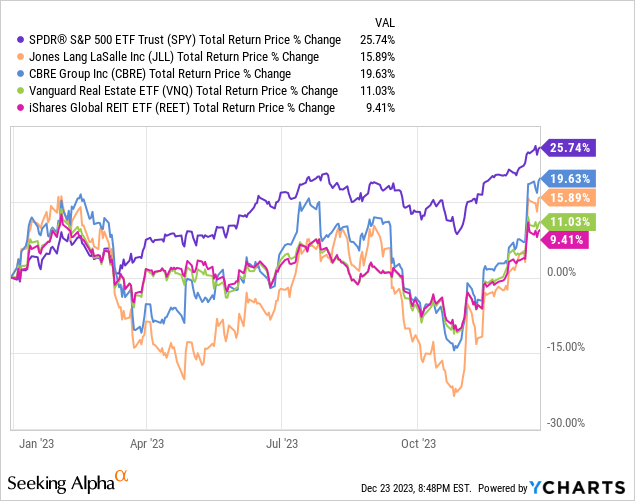

The fact that real estate services companies Jones Lang LaSalle (NYSE:JLL) and CBRE Group (CBRE) came close to matching the S&P 500 index (SPY) performance this year, despite the massive headwinds in the industry, shows the power of having a robust business model and a low starting valuation.

We believe this is quite an accomplishment, considering the major boost the S&P 500 index got from the “Magnificent Seven”. Both companies have outperformed the popular Vanguard Real Estate ETF (VNQ) and the iShares Global REIT ETF (REET) this year.

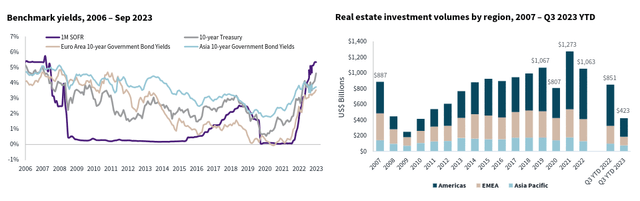

We have been arguing for some time that these companies were cheap, in particular JLL. At the same time we were acknowledging the headwinds in the industry. Still, considering that there was no economic recession in the US this year, things got a lot worse than we expected. Interest rates had not been this high in decades, and real estate investment volumes plummeted across regions. This naturally had a massive negative impact on its transactional businesses that offer brokerage and leasing services. Fortunately, its business segments focused on outsourcing services served as a counter-weight, delivering positive revenue growth in the most recent quarter.

JLL Investor Presentation

Company Overview

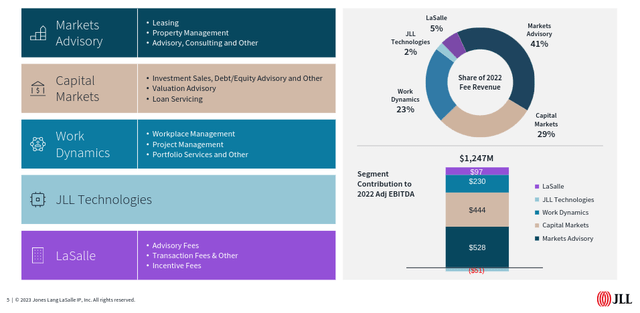

As a reminder, JLL serves global clients through five business segments. These include “Markets Advisory” which offers leasing services, property management, and other consulting and advisory services. The “Capital Markets” segment offers investment sales, valuation advisory, and loan services. The “Work Dynamics” segment offers several types of outsourcing services, including project and workplace management and portfolio services. This segment has proved to be quite resilient during this downturn. JLL Technologies is basically the venture capital segment of the company, and LaSalle is an operationally independent subsidiary of JLL that buys, builds, occupies, and invests across various types of real estate.

JLL Investor Presentation

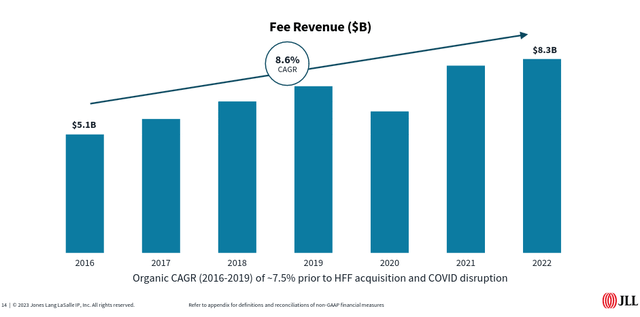

Growth

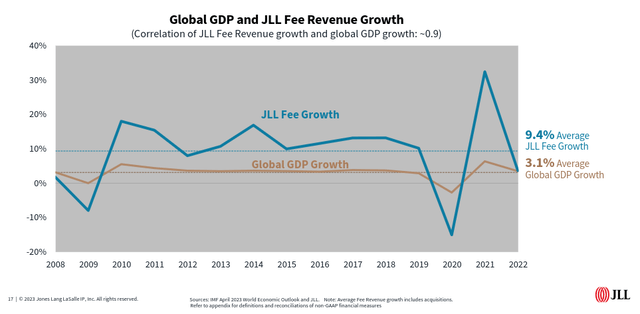

While revenue growth has been negative recently due to market conditions, the company has historically delivered very decent organic revenue growth. In particular, its most attractive revenue type is fee revenue, and the company has delivered high single-digit fee revenue growth in recent years. Thanks to some margin expansion, adjusted EBITDA growth has reached low double-digit numbers.

This level of growth has been possible as a result of market share gains, growth in the demand for outsourcing services, and general growth in the real estate sector.

JLL Investor Presentation

JLL’s growth is highly correlated to GDP growth, although the correlation is not perfect, as we have seen in the last few quarters where the economy has posted strong growth while the real estate sector has continued declining.

In any case, over the long-term the track record of growing roughly 3x faster than global GDP is good. Right now the combination real estate is facing too many headwinds, from high interest rates to work-from-home, so it is likely to take some time to stabilize and start growing at a healthy rate again.

JLL Investor Presentation

Financials

Fortunately JLL has a very strong business model that has allowed the company to remain profitable despite the headwinds in its industry. It has some very resilient revenue streams, and a variable cost structure, that protect profitability from a decline in business. The company has also been historically very proactive taking actions on fixed costs when it starts seeing signs of a slowdown. As a result, the company usually experiences very quick recovery from economic downturns.

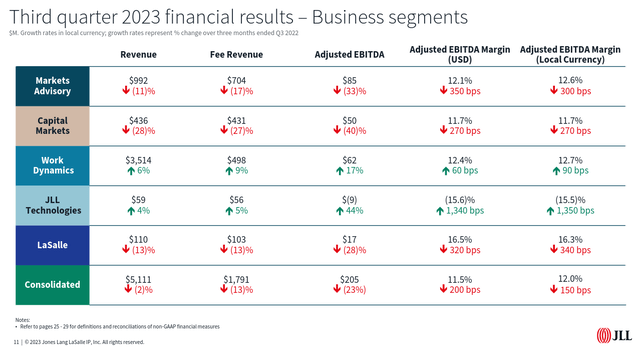

Looking at the financial results of the third quarter, it is clear most businesses were impacted. The bright star was the “Work Dynamics” segment, which continues to benefit from companies continuing to outsource certain functions. In any case, what we find reassuring, is that despite industry conditions being incredibly unfavorable for the company, it still managed to deliver more than $200 million in consolidated adjusted EBITDA. This allows the company to wait for a recovery without having to issue dilutive equity or sell parts of the business.

JLL Investor Presentation

Work Dynamics

The one bright spot in recent quarters has been the “Work Dynamics” segment, which has served to counter the decline in the rest of the business. It has a strong competitive moat, largely derived from high customer switching costs. It is very disruptive for its customers to change providers, and it has some scale and network effect advantages as it is able to use lessons learned working with one customer on another customer’s project.

It offers a wide range of services to manage workplaces and projects for its customers. The company has shared that the average client relationship is six years or more, and is diversified with more than 500 total clients. In the most recent quarter it saw project management fee revenue growth of 8%, and portfolio services fee revenue growth of 21%, both in local currency. This strong growth led to adjusted EBITDA margin expansion for the segment. During the Q&A session of the most recent earnings call, CEO Christian Ulbrich even mentioned that they might see double-digit growth in some future quarters.

Listen, we have been pretty consistent that we are very pleased with the long-term outlook for our Work Dynamics business. Indeed the win rate in the first half of this year was unusually high and we are starting to mobilize those contracts. The mobilization phase has just about started and it will continue in the fourth quarter and move into the first quarter of next year. So, the outlook for that business for next year is equally positive and so we expect it to see that topline growth as we have stated before, and the high end of single-digit maybe even moving into low-double digit in some quarters.

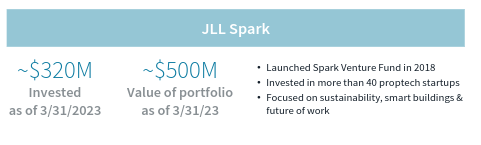

JLL Spark

Another great business JLL has is Spark, even if quite small, it has delivered excellent results. The company launched the Spark Venture Fund in 2018, and so far results look good. It has been investing in startups focused on sustainability, smart buildings, and the future of work. Earlier this year the company disclosed that the ~$320 million it has invested is now valued at ~$500 million.

JLL Investor Presentation

Financial Targets

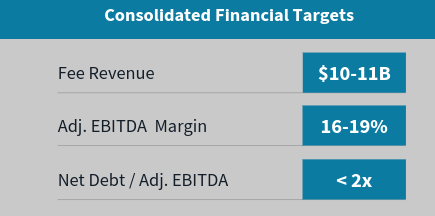

During their 2022 investor day, which we covered in this article, the company discussed their 2025 financial targets. In the most recent earnings call the company admitted they will be hard to reach given conditions in the real estate industry, so it is pushing them further into the future. JLL also reminded investors that it is favoring margins over top-line growth.

JLL Investor Presentation

CEO Christian Ulbrich ended his prepared remarks with the following explanation on why the targets are being pushed further into the future. Management did not share a new target date, but did sound optimistic about reaching the profit margin target before it does the fee revenue target.

As a result of the industry-wide softness in transaction activity, we are extendingthe timeline to achieve all of our mid-term targets beyond 2025. We have built aresilient platform and expect to reach our mid-term Adjusted EBITDA margintarget of 16-19% before we achieve the Fee Revenue target of $10-$11 billion.

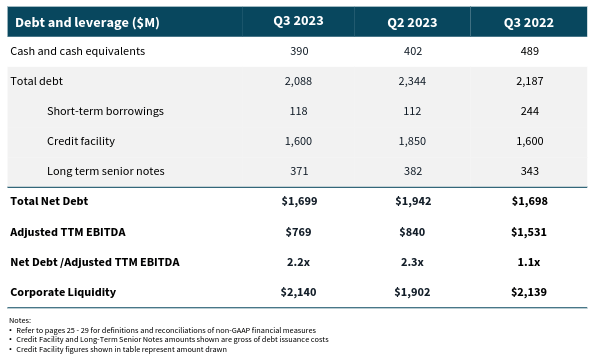

Balance Sheet

The company continues to have a solid balance sheet and investment-grade credit ratings, but as profitability has declined, leverage has increased. JLL has a ‘Baa1’ credit rating from Moody’s (MCO) and ‘BBB+’ from S&P (SPGI). Most of the debt comes from its credit facility, with most of the rest in long-term bonds with low fixed interest rates that mature in 2027 and 2029.

JLL Investor Presentation

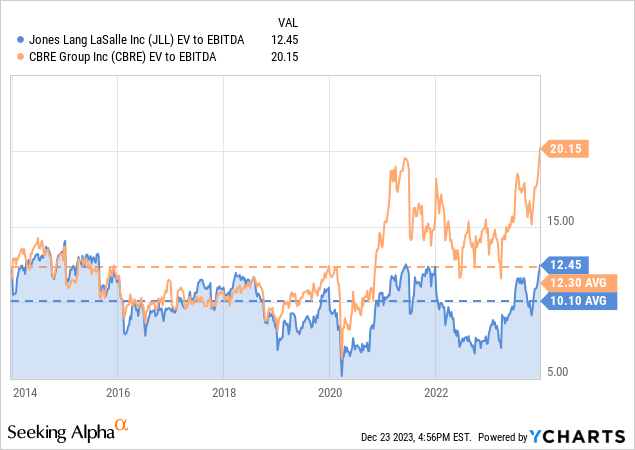

Valuation

Shares look more expensive than they really are, given that the company’s earnings are being significantly affected by the massive weakness in the global real estate industry. Despite this, the EV/EBITDA multiple is only a couple of turns above its ten-year average, and significantly below that of its competitor CBRE.

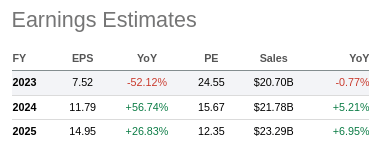

Based on average analyst estimates as compiled by SeekingAlpha, earnings are expected to see a significant improvement in FY24, and additional growth in FY25. The forward FY25 price/earnings ratio is only ~12x.

SeekingAlpha

We estimate the net present value of its future earnings stream to be approximately $288. With shares trading at roughly $184, we believe they continue to be significantly undervalued. We are maintaining our ‘Strong Buy’ rating, despite persistent headwinds in the global real estate industry.

| EPS | Discounted @ 10% | |

| FY 24E | 11.79 | 10.72 |

| FY 25E | 14.95 | 12.36 |

| FY 26E | 19.95 | 14.99 |

| FY 27E | 23.26 | 15.89 |

| FY 28E | 24.42 | 15.16 |

| FY 29E | 25.64 | 14.48 |

| FY 30E | 26.93 | 13.82 |

| FY 31E | 28.27 | 13.19 |

| FY 32E | 29.69 | 12.59 |

| FY 33E | 31.17 | 12.02 |

| FY 34E | 32.73 | 11.47 |

| Terminal Value @ 3% terminal growth | 445.29 | 141.88 |

| NPV | $288.56 |

Risks

With the global real estate industry already facing massive headwinds, things could certainly get more complicated for the company should the US enter a recession. So far JLL has been able to maintain profitability, but the decline in earnings has seen the company’s leverage increase. If this continues, the company could face more difficult accessing credit at attractive terms.

Conclusion

Shares of JLL have delivered a solid performance in 2023, despite the global real estate industry continuing to face massive headwinds. We believe this is the result of a very low starting valuation, and a resilient business model. Shares continue to look undervalued, but it remains unclear when its industry will start to recover. Despite uncertainty as to when headwinds will start to dissipate, we are maintaining a ‘Strong Buy’ rating given that we consider shares to be meaningfully undervalued.

Read the full article here