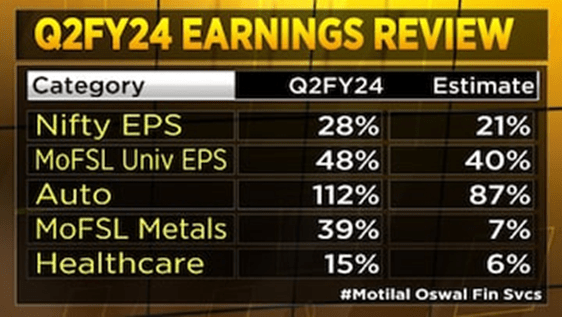

Since I last called for investors to buy the iShares India 50 ETF (NASDAQ:INDY) dip, the fund has surged higher alongside the rest of the broader Indian market. Now that any lingering weather headwinds have cleared, India’s combination of macro and micro fundamentals may be the best in Asia heading into 2024. At the macro level, India’s GDP growth has surged ahead of expectations yet again, led by robust industrial, manufacturing, and construction activity, as well as urban strength more than offsetting any agriculture-led weakness on the rural side. Thus far, economic growth has been translating into solid corporate earnings as well – the flagship Nifty 50 index constituents hit it out of the park in the first half of this fiscal year and look well on track to deliver ~20% earnings growth for the full year.

CNBC

Complementing the fundamental setup is a confluence of technical tailwinds, particularly for large-caps, as foreign investment flows reverse from consecutive months of outflows (note that foreign institutional investor holdings are coming off multi-year lows). Given the move also comes on the heels of sustained downward pressure on US yields following the Fed’s dovish turn, I would favor positioning in large caps, typically the beneficiary of foreign investor flows, over mid and small caps. Valuations are also more palatable for the Nifty 50, with the current forward P/E about in line with historical average levels. Heading into general elections early next year, where opinion polls show an increasing likelihood of a decisive win by the incumbent government, the Nifty 50’s higher mix of macro-linked (recall the Union government’s commitment to a significant capex boost) and politically aligned stocks (e.g., Adani-linked names) makes it an ideal vehicle to capture pre/post-election upside.

iShares India 50 ETF Overview – Play India via a Concentrated 50-Stock Portfolio

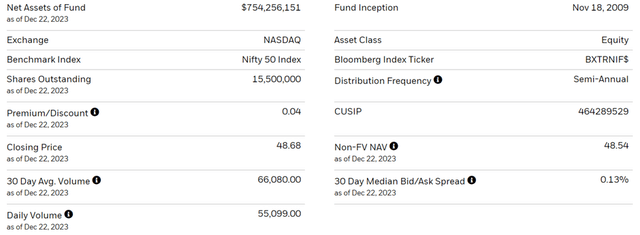

The iShares India 50 ETF tracks (pre-expenses) the performance of India’s fifty largest stocks via the flagship Nifty 50 Index. The ETF comes with a premium 0.9% expense ratio – about ten basis points above its closest comparable, the equal-weighted First Trust India NIFTY 50 Equal Weight ETF (NFTY) (see coverage here), and ~25bps above iShares’ MSCI India tracker (INDA) (see coverage here). While INDY isn’t the cheapest Nifty 50 ETF, it is the largest and most liquid – the fund has further grown its net asset base to $754m over the last quarter (up from ~$667m previously) and maintains a fairly tight 0.13% bid/ask spread. In comparison, the comparable Nifty 50 tracker, NFTY, manages a smaller ~$119m asset base, trades lower volumes, and, by extension, maintains a wider 0.47% bid/ask spread.

iShares

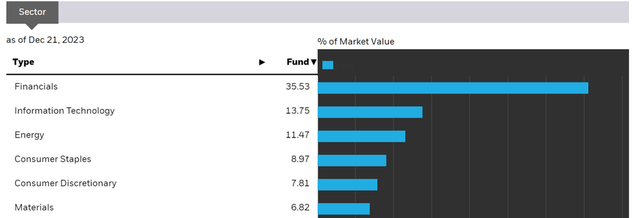

The INDY portfolio is split across a few large sectors. Most notable is its Financial allocation, which remains broadly unchanged at 35.5%, followed by Information Technology (also unchanged at 13.8%). Energy has gained slightly to 11.5%, while the Consumer Staples and Consumer Discretionary allocations are consistent with last quarter at 9.0% and 7.8%, respectively. While iShares’ MSCI India tracker, INDA, doesn’t stray too far from this breakdown, First Trust’s NFTY does – a result of its equal weightings for all fifty constituents. Financials, for instance, while also the largest allocation for NFTY, is a much lower percentage of the portfolio at 19.3%. With INDY’s top five sector contributions also up to ~78% of the total portfolio, investors will want to be mindful of the concentration risks here.

iShares

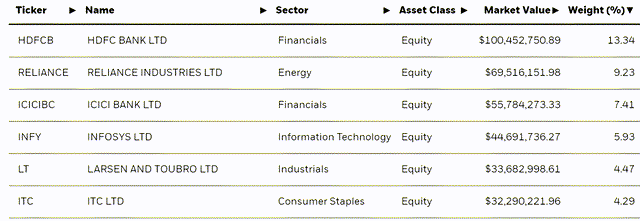

The largest INDY single-stock holdings are the usual suspects – leading Indian banks, HDFC Bank (HDB) and ICICI Bank (IBN), feature prominently at 13.3% and 9.2%, respectively. Conglomerate Reliance Industries Limited (OTC:RLNIY) and tech services company Infosys (INFY) are the two other major holdings INDY shares with other Indian large-cap ETFs, although the key difference is the higher percentage contributions – a result of INDY’s narrower portfolio size. The five largest holdings currently contribute ~41% of the overall portfolio, so this is a far more top-heavy fund than comparable Indian large-cap ETFs.

iShares

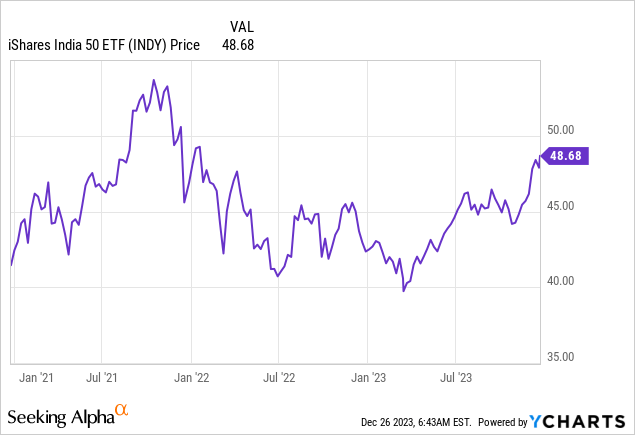

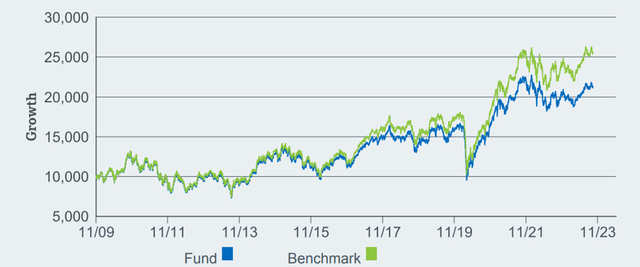

INDY Performance – Surging Higher after Q3 Malaise

INDY has been on a run this year, and while monsoon-related concerns paused the rally somewhat, the fund’s Q4 surge has driven its YTD return to +15.2% in NAV terms. While the fund slightly trails its equal-weight equivalent, NFTY, which has delivered +16.0% this year, its uncapped approach has still outpaced peers over longer timelines (ten-year annualized return at +8.9% (vs. +7.2% for NFTY). Also worth noting is the tracking error here – while wide on an absolute basis, INDY boasts a far narrower delta vs. key peer NFTY (after fees).

iShares

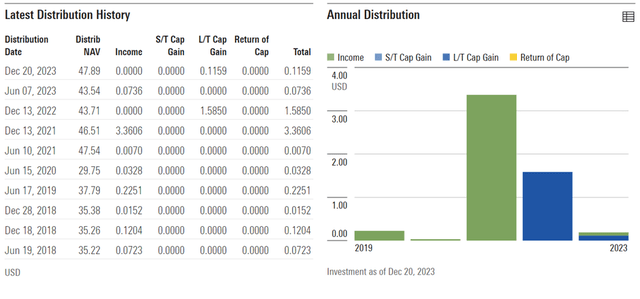

From an income standpoint, INDY’s H2 distribution of $0.12/share offers little appeal. While last year’s yield was boosted by the realization of capital gains, this year has seen no such benefit, resulting in an unimpressive 30-day ~0.3% yield (~0.2% on a trailing twelve-month basis). NFTY offers a comparatively higher distribution, though at <1%, income investors won’t be too impressed here either. At the end of the day, Indian Nifty 50 trackers are still very much growth-oriented and, thus, much better suited for investors who prioritize high returns on capital (vs high returns of capital).

Morningstar

No Stopping India’s Nifty 50 Stocks into 2024

Data out of India has remained impressively strong through a rather challenging year for the US/EU and China economies. Looking forward to 2024 and beyond, India continues to offer one of the best combinations of macro and company-level tailwinds in Asia, which should translate into more upside ahead. Incremental flows from foreign investors present an added technical tailwind, particularly for the higher-quality Nifty 50 large caps, many of which have lagged the small/mid-caps this year. 2024 will also see India go through a general election, typically bullish for stocks, and more so in the likely scenario that we see more policy continuity.

The catch is the headline valuation multiple – relative to trailing and one-year forward earnings, Nifty 50 trackers like INDY do come at a premium price relative to other emerging Asian ETFs. Balanced with the higher structural earnings growth and return on equity profiles, on the other hand, it’s hard to argue against the Nifty 50 stocks deserving their multiple. Net-net, I continue to like INDY heading into election season.

Bloomberg

Read the full article here