To tell the truth is very difficult, and young people are rarely capable of it.”― Leo Tolstoy.

Today, we put Artivion, Inc. (AORT) in the spotlight for the first time today. The company was previously known as CryoLife but changed its name in January 2022. The stock has had a bit of a roller coaster ride over the past year, but is still up some 90% over the past 12 months. The company recently affirmed its full-year outlook and named a new CFO. Will the good times continue in 2024 for AORT shareholders? An analysis follows below.

Seeking Alpha

Company Overview:

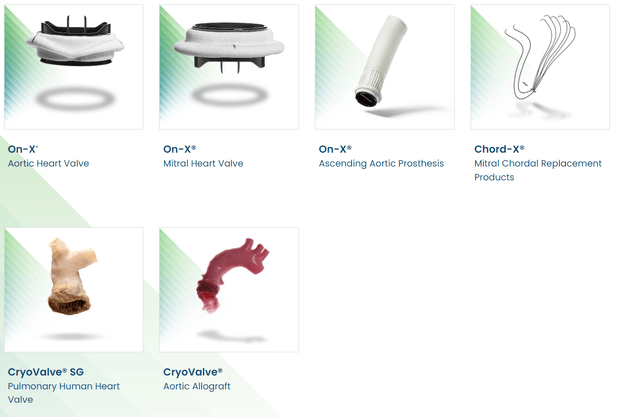

The company manufactures and distributes medical devices and implantable human tissues. Artivion has many products on the market including BioGlue, a polymer that consists of bovine blood protein and an agent for cross-linking proteins for cardiac, vascular, neurologic, and pulmonary procedures. The company is seeing its fastest revenue growth from its aortic stent grafts. The stock currently trades at around $19.00 a share and sports an approximate market capitalization of $740 million.

Company Website

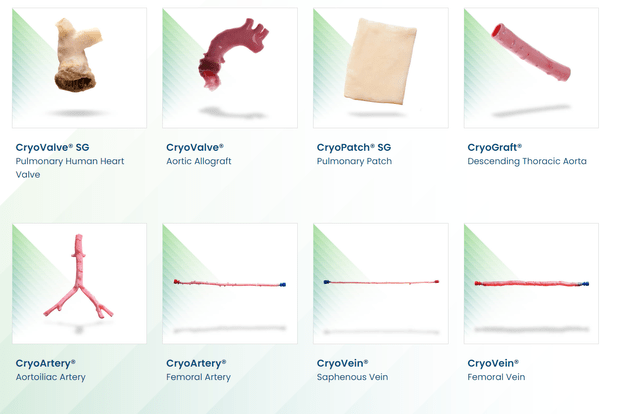

Artivion’s work is focused on the aorta and offers a variety of aortic valve replacement solutions. Artivion also provides numerous cryopreserved allografts.

Company Website

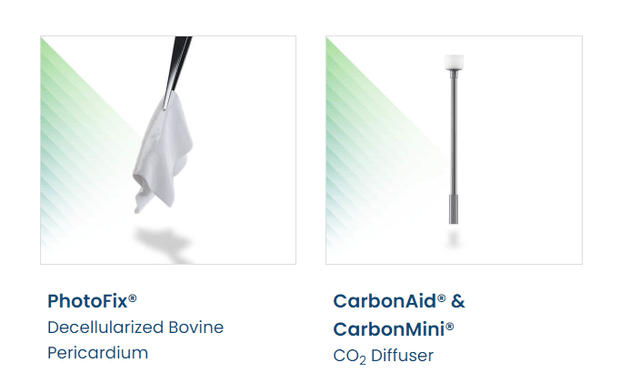

In addition, it provides surgical sealants (e.g., BioGlue) and cardiac and vascular ancillary solutions.

Company Website

Third Quarter Results:

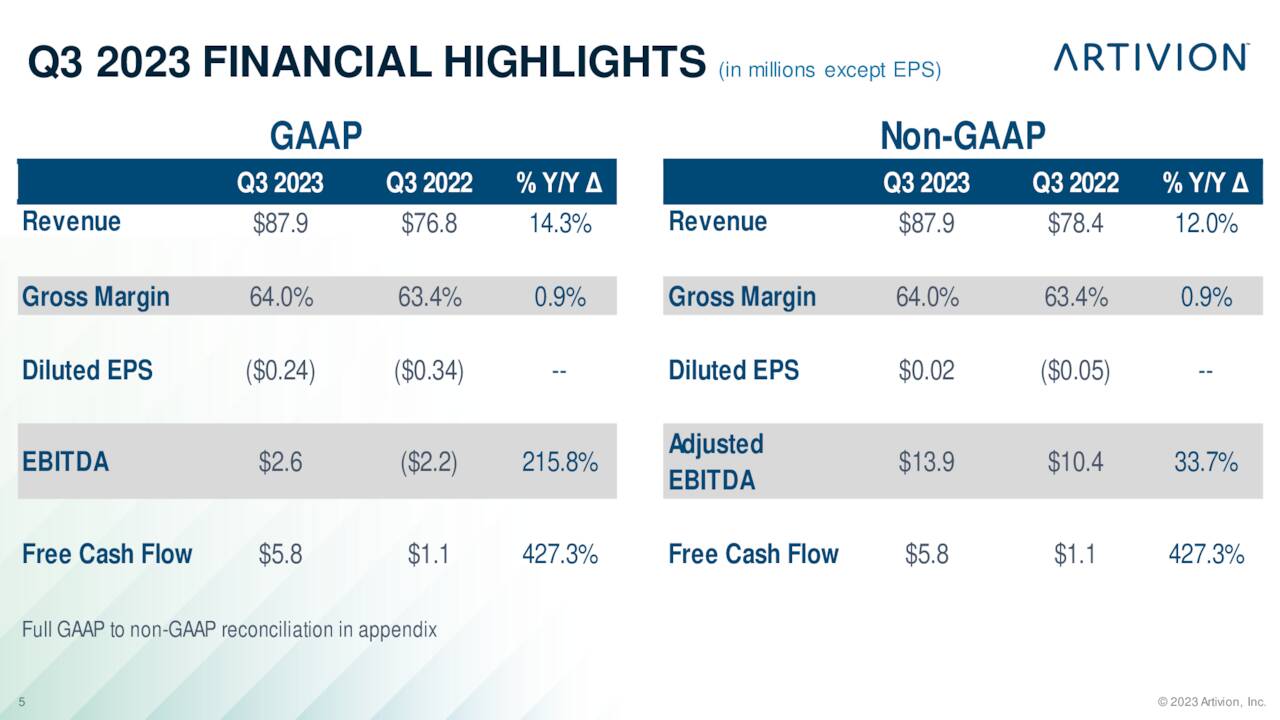

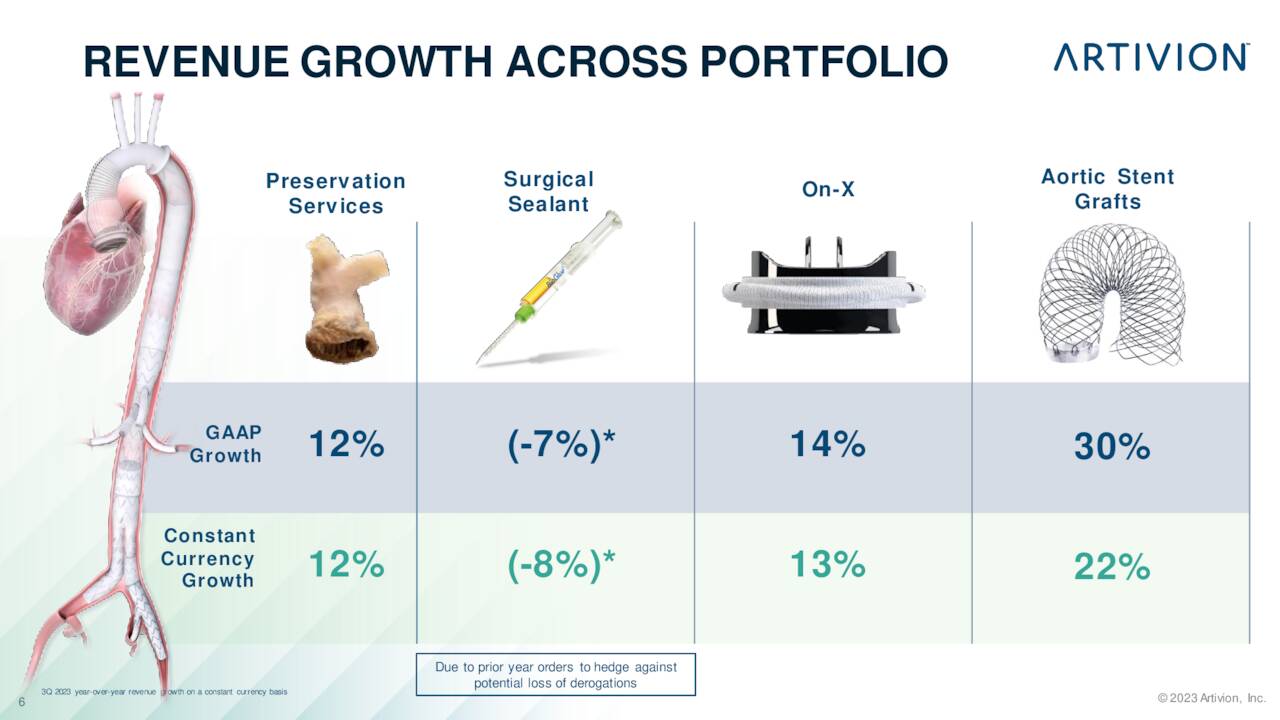

The company posted mixed Q3 results on November 2nd. Artivion delivered a non-GAAP profit of two cents a share, a penny below the consensus. On a GAAP basis, the company lost 24 cents a share. However, revenues rose more than 14% on a year-over-year basis to $87.9 million, some $3 million above expectations.

November Company Presentation

Sale growth was led by aortic stents during the quarter.

November Company Presentation

And growth was solid across all regions.

November Company Presentation

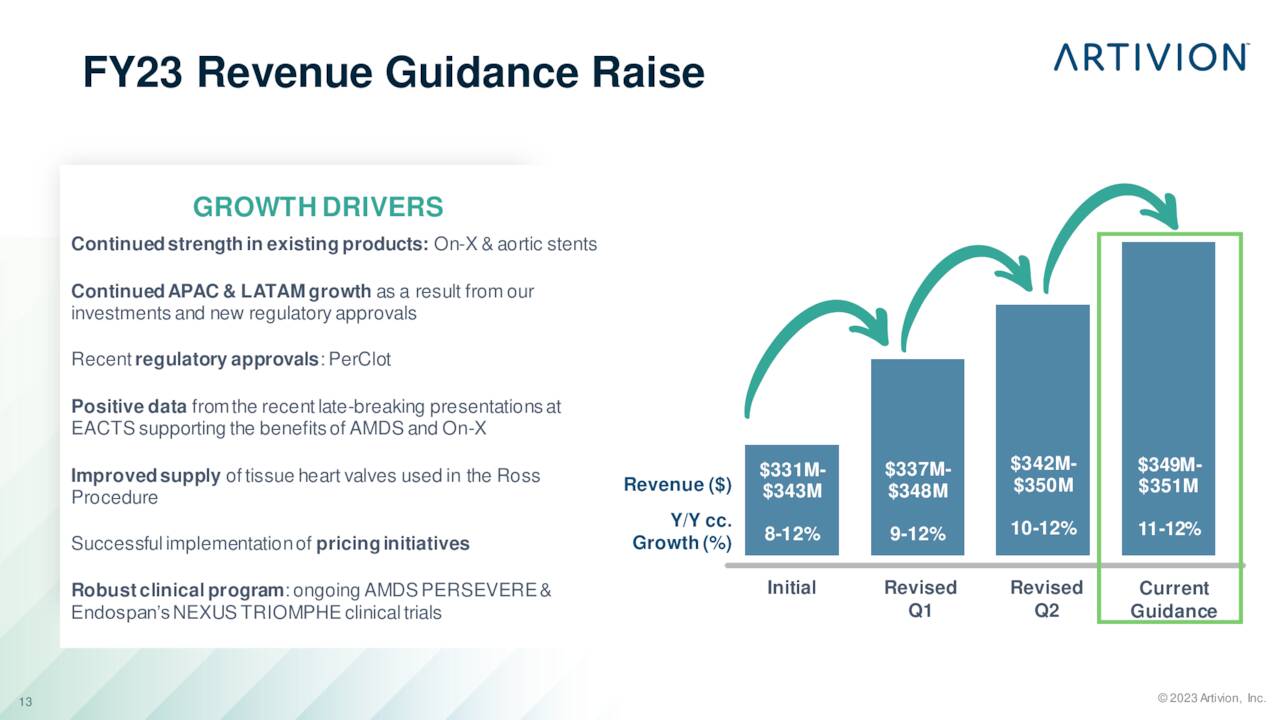

The company does not clearly break down revenues by product line or region, which keeps this analysis from being more granular. Management bumped up its FY2023 sales guidance to between $349 million to $351 million from a range of $342 million to $350 million previously.

November Company Presentation

Analyst Commentary & Balance Sheet:

Four analyst firms including Stifel Nicolaus and Needham have reissued Buy ratings on the stock since third-quarter earnings came across the wires. Price targets proffered range from $22 to $28 a share.

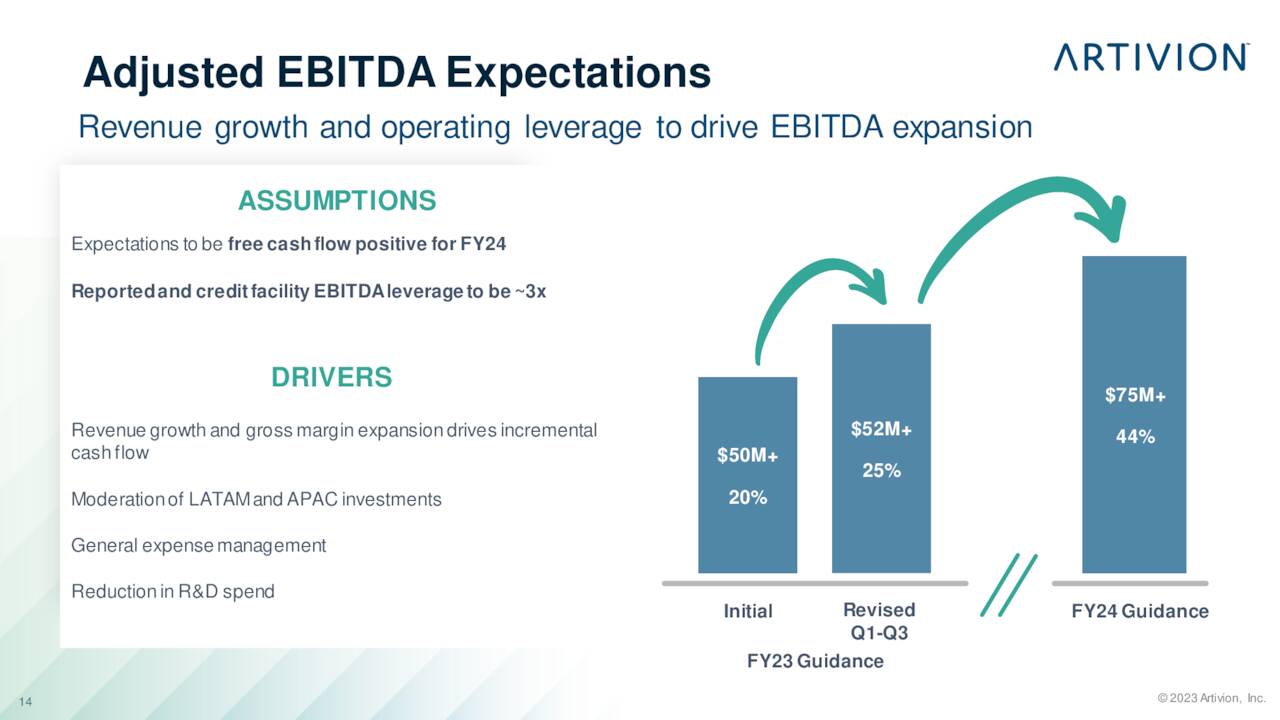

Approximately eight percent of the outstanding float is currently held short. Several insiders sold nearly $2 million worth of shares collectively in February, but that has been the only notable insider activity in the equity so far in 2023. According to Artivion’s third quarter 10-Q, the company ended the quarter with just less than $55 million of cash and marketable securities on its balance sheet after posting a GAAP net loss of $9.8 million for Q3. The company listed long-term debt of just over $310 million as of the end of the third quarter. It also has $30 million available on an unused credit facility. Artivion did produce a free cash flow of $5.8 million in the quarter. Management also has guided the company’s plans to be free cash flow positive for FY2024.

November Company Presentation

Verdict:

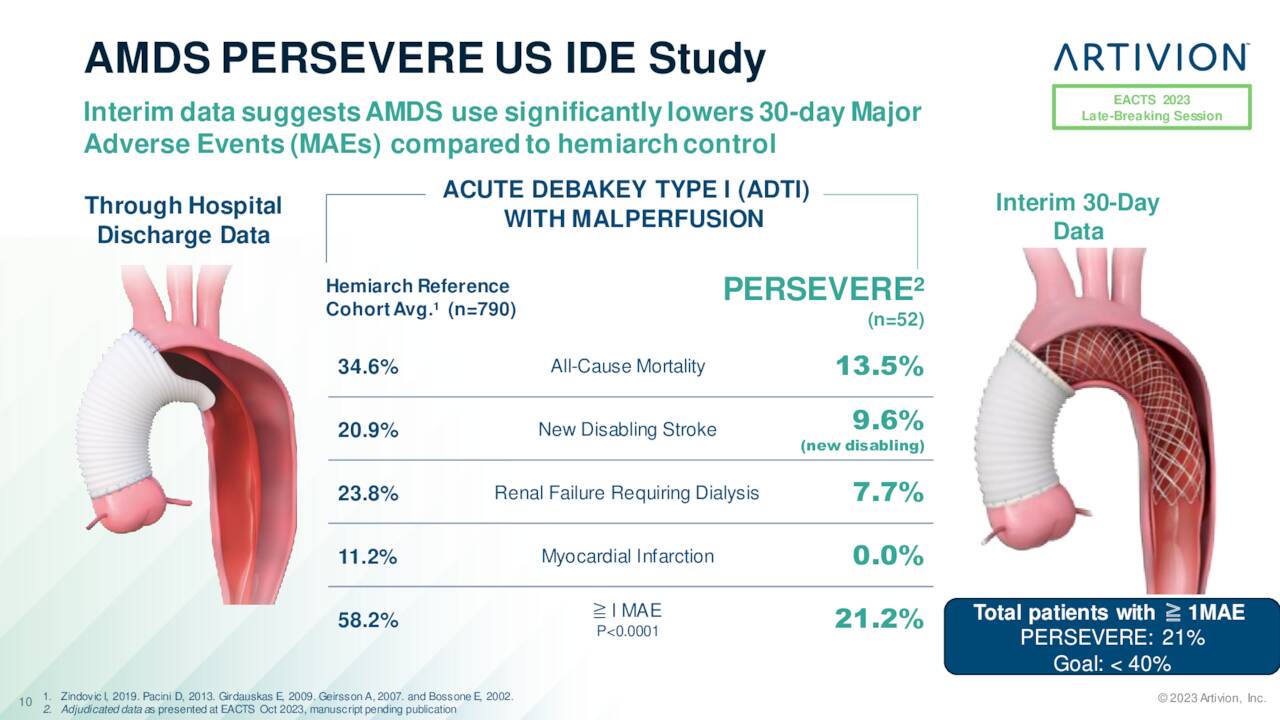

The company posted a loss of 48 cents a share in FY2022 on just less than $314 million in sales. The current analyst firm consensus sees losses widening in FY2023 to 76 cents a share even as sales rise to nearly $350 million. They do project a near breakeven status for Artivion in FY2024 on sales growth of 10%. Of note, the company has several ongoing studies that could expand its potential market for some key products starting in 2025. Management also met with some 25 cardiologists and determined the new GLP-1 drugs like Ozempic should have no impact on its business.

November Company Presentation

The analyst community is higher on Artivion’s prospects than I am at the moment. This is especially true after the stock has risen nearly 50% from its October 26th lows. The company is projected to come close or get to break even in FY2024, and if trends hold, be profitable in FY2025. On a price-to-sales basis, Artivion, Inc. stock trades at 2.1 times this fiscal year’s sales. This is not outlandish by any stretch. However, given sales growth and the company’s debt load, neither is it compelling after the equity’s big recent rise. Therefore, I am passing on any investment recommendation around AORT at this time.

There are a dozen views about everything until you know the answer. Then there’s never more than one.”― C.S. Lewis.

Read the full article here