2023 was an excellent year for stocks and a welcomed change after the 2022 disaster. The end of the brutal 2022 tech lead bear market gave way to significant gains for many high-quality tech stocks in 2023. Also, it wasn’t just tech stocks, as many companies saw their shares rise considerably last year. Easing inflation, a resilient economy, the Fed’s pivot, emerging new industries like AI, and other constructive elements contributed to the favorable backdrop for equities, leading to significant gains in 2023.

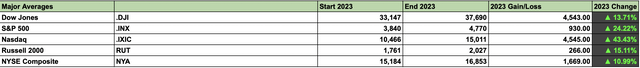

Major Average Performance 2023

Major averages 2023 (The AWP)

The S&P 500/SPX (SP500) appreciated by 24% last year, and the Nasdaq gained about 43%. The R2K came alive in the fourth quarter, gaining 15% for the year. The DJIA gained about 14%, and the NYSE composite increased by about 11% in 2023. My diversified All-Weather Portfolio (“AWP”) returned 15% in the fourth quarter, appreciating by 47% in 2023.

I put out a quarterly review at the end of each quarter. So, let’s look at the AWP’s Q4 holdings, results, what could have performed better, and what to expect in 2024.

The Tech Plus Segment – 16.5% Gain in Q4

The tech segment had an excellent showing last quarter, with the overall segment appreciating by 16.5%. The tech segment is the AWP’s most significant sector, maintaining about a 50% weight in Q4. Last quarter’s best performer was Block (SQ), which was up by about 75% in Q4. AMD (AMD) was the second best-performing stock holding, up by 44% in the quarter. Other top performers included ARK ETFs, Amazon (AMZN), Twilio (TWLO), and Nvidia (NVDA).

Moving Forward – I’ve reduced the tech segment slightly. Yet, the sector’s weight remains significant at about 46%. Substantial holdings and core positions remain as in the previous quarter. Some of the segment’s top holdings include Palantir (PLTR), AMD, Nvidia, Amazon, Alphabet (GOOG), and Match Group (MTCH).

Tech should remain a solid theme for the new year. AI, augmented/virtual reality, and other developing segments should enable growth to flourish, allowing top-quality stocks to increase throughout the new year.

The China Segment – The Worst Performer

Q4 was tough for China, as the AWP’s China segment lost about 6%. The underperformance was due to an 11% drop in Baidu (BIDU) shares in the quarter. Also, part of my (PDD) position got exercised at a lower price due to a covered call play from Q3. The remaining PDD position was one of the best performers last quarter, appreciating by about 50%. Also, I exited Alibaba (BABA) and XPeng (XPEV) at a loss.

Moving Forward – I’ve reduced the China segment to just three holdings. The top and most significant position remains Baidu. Baidu remains extremely undervalued and has substantial AI and other robust growth potential ahead. PDD is a growth monster, posting remarkable results three quarters in a row now. Continued outperformance from PDD in 2024 should lead to a higher stock price for the e-commerce giant. I’ve also reentered NIO Inc. (NIO). NIO may be the most speculative stock in the AWP. While it is an elevated-risk investment, the reward potential is high if NIO becomes more profitable throughout the new year.

Oil & Energy – A Flat Quarter

The oil and energy segment was flat for the quarter. While the alternative energy portion performed well, it was weighed down by the traditional oil and gas names. Enphase (ENPH) was the best-performing stock, and the worst performer was APA Corp. (APA).

Moving Forward – Enphase remains my most significant energy holding. Also, I continue to have some diversified exposure via two solar/alternative energy ETFs. In addition, we have several solid oil/oil services names in the AWP. An improving global economy, more accessible monetary standards, and increased demand should enable energy prices to drift higher in the new year.

Materials/Industrials/Defense (“MID”)

The MID segment accounted for about 10% of portfolio holdings at the end of 2023. Significant holdings in this segment included lithium mining companies Albemarle (ALB) and Livent (LTHM). I made adds at opportune times last quarter, resulting in a 28% gain in a partial Livent position and about a 20% gain in a partial Albemarle position.

On the defense side, L3Harris (LHX), RTX Corp (RTX), and the defense ETF (ITA) increased by about 15-18% since establishing positions last quarter. Combined, the MID space returned 7% in Q4.

Moving Forward – Lithium stocks got hammered last year. We saw a robust comeback in the second half of the fourth quarter, and there should be more upside in the new year. Increased demand for EVs, a more accessible monetary regime, improved supply/demand dynamic, and other factors should enable lithium prices to climb in 2024. Conflicts in Ukraine, Israel, and other hot spots and a general move toward more global defense spending should allow high-quality defense contractors to increase revenues and profits in 2024.

Financial Segment – Nothing Exciting

The AWP’s financial exposure was limited in the AWP in recent quarters. I sold part of my PayPal (PYPL) position after about an 8% gain in the quarter. I entered the bond ETF (TLT) around the lows, and the return was about 16% at the end of the quarter. The financial segment return was about 5% last quarter.

Moving Forward – I have about a 2% PayPal allocation and a 1.7% allocation in the bond ETF TLT. TLT should continue appreciating as long-term rates continue moderating throughout the year. PayPal remains very cheap and likely has more upside ahead. However, I will likely keep the financial segment of the AWP minimal as lower rates aren’t favorable for bank profits.

The Healthcare Basket – A New Addition

I introduced the healthcare segment late in Q4 as part of the year-end rebalancing and diversification effort. The healthcare basket returned about 2.5% in Q4.

Moving Forward – Pfizer (PFE) got crushed in 2023 and likely has considerable upside from the $27 buy-in point. Other healthcare/biotech stocks were also depressed throughout last year and could have a big year in 2024. We should also see a significant earnings recovery, helping push prices higher as we advance.

Gold/Silver/Miners (“GSMs”) – Hot, Hot, Hot

The GSM segment performed very well last quarter. With an 18% return, GSMs outperformed the tech segment. The top-performing stock in the GSM segment, Kinross Gold (KGC), increased by about 33% last quarter. I trimmed the position slightly after around a 36% gain in Q4. Other top performers include Barrick (GOLD) and Agnico Eagle Mines (AEM).

Moving Forward – With a 17% allocation, GSMs remain a significant portion of the AWP in the new year. A more accessible monetary policy should enable gold and silver prices to rise in 2024. Moreover, gold has underperformed over the last decade, and we could have a solid and sustainable long-term breakout above $2K.

The Cryptocurrency Basket – Top Performer

With about a 31% gain, the digital assets segment was the best-performing segment of the AWP in Q4. Bitcoin was the best-performing coin, appreciating by nearly 60% in the quarter. Ethereum increased by about 37%, and other coins in the segment also provided solid returns.

Moving Forward – The digital assets segment accounts for about 5% of the AWP’s holdings. Bitcoin and digital assets are in a relatively new bull market and likely have considerable upside in 2024. A more accessible monetary environment, increased risk appetite, improved fundamentals, increased institutional demand, and other constructive elements should help drive prices higher in 2024.

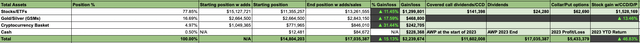

The AWP – 2023 Return 47%

2023 returns (The AWP)

The AWP returned 47% in 2023, achieving my target return rate of 40-50% for the year. The non-GSM stock and ETF segment provided an 11.5% return in the fourth quarter. The return was expanded to 13.5% once covered call dividends (“CCDs”) were factored in. The GSM sector delivered an 18% return last quarter, and the digital assets segment returned roughly 31%.

A more accessible monetary environment, solid growth opportunities, and other constructive fundamental factors should enable high-quality stocks and other key assets to increase in 2024, allowing the AWP to have another strong year. My initial target return for 2024 is 30%, and my 2024 year-end SPX target remains 5,250.

Read the full article here