Arm Holdings plc (NASDAQ:ARM) recently IPOed at around $50. After an initial pop, ARM shares declined below their $50 price tag. Then, the year-end rally pushed shares higher to nearly $80. Now, we’re seeing the decline. So, where does Arm stock go from here?

While Arm is a leading chip designer, its valuation is rich, even by the frothy artificial intelligence (“AI”) industry standards. Arm has a $77 billion valuation and trades at a nose-bleeding high 25 times this year’s sales estimates. Also, at 16%, the short interest is very high. Arm is an excellent company with significant growth and profitability potential. However, the stock has a high probability of heading lower before it makes a sustainable move up. If you need to own this stock, please wait for the lock-up period to end. The stock may be at a post-IPO bottom by then, presenting a solid long-term buying opportunity in several months.

Technically – ARM Likely To Remain Volatile

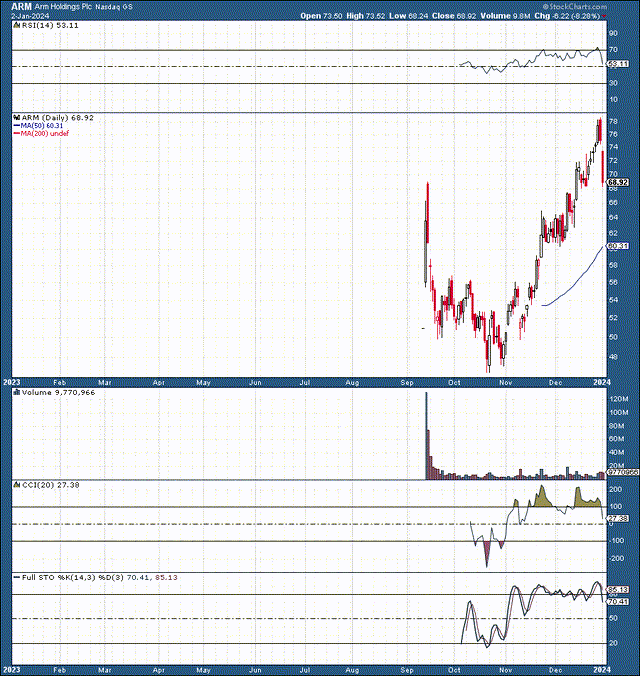

ARM (StockCharts.com )

Arm has had a volatile ride since its debut in September. The stock recently became highly overbought, as the post-IPO and year-end mania combined with the AI hype pushed Arm’s stock to nearly $80 a share. Now that reality is setting back in, we will probably see its share price deflate in the first quarter. Again, a solid time to revisit Arm may be around the end of the lock-up period, which should arrive toward the end of the first quarter.

Arm – Recognizing The Benefits

Arm is an influential chip design firm with excellent intellectual property. It’s estimated that Arm’s designs are used in 99% of smartphones globally. Moreover, it’s not just smartphones. Arm’s tips are everywhere, with over 270 billion chips in everything from sensors to smartphones to servers. Arm is the leading technology provider of processor IP, offering the broadest range of processors to address every device’s performance, power, and cost requirements.

Arm demonstrates substantial AI potential. Arm’s highly versatile and scalable AI-optimized platform architecture leverages CPUs, GPUs, and NPUs to run machine learning workloads with high performance and efficiency across all devices. Moreover, Arm AI is a versatile and scalable environment for AI development, combining IP, tools, software, and support.

Serious Headwinds Exist

Despite the substantial potential, serious headwinds exist for Arm. The number one concern is Arm’s growth/valuation dynamic. Due to the popularity in the chip industry, AI potential, and other prospects, Arm’s valuation is sky-high now. Consensus estimates are for about $1.05 in EPS and roughly $3B in revenues for 2024. This dynamic illustrates a very high 65 forward P/E ratio and 25 times forward P/S multiple.

The Valuation is Ludicrous

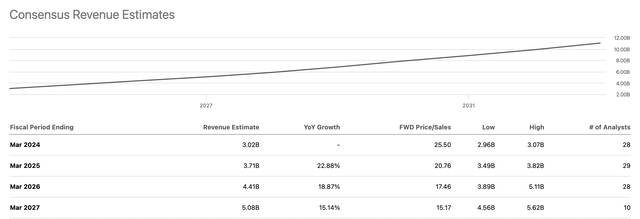

Revenue growth (SeekingAlpha.com)

Despite medium growth prospects, Arm’s valuation is exceptionally high. Next year, Arm could provide revenues of around $3.7B and $4.4B in 2026. This dynamic illustrates a sales growth rate of about 20%. Also, sales growth will likely decline to about 15% in 2027 and could continue dropping in the future. Therefore, Arm’s valuation of 20 times next year’s sales estimates is remarkably high and leaves no room for error from here.

Additionally, what if Arm misses sales estimates? What if Arm’s growth is lower than expected in the coming years? The stock will likely get bludgeoned, as this company, with roughly $3B in annual sales, sports a market cap of around $77B here. I’d be more comfortable buying shares at ten times sales or lower. This dynamic would enable much more upside potential and limit the downside in case something doesn’t go Arm’s way.

Looking at other high-profile chip stocks, Nvidia (NVDA) trades at about 13 times forward sales estimates. Advanced Micro Devices (AMD) trades below eight times 2025’s estimated sales. Many other high-quality chip stocks are even cheaper. So, why should we pay such a massive premium to own Arm’s shares? Once the lock-up period ends, many insiders may unload their shares around the elevated valuation, enabling the stock to drop considerably, potentially leading to a compelling buying opportunity in the coming months.

The Bottom Line

Despite its significant growth and profitability potential, there are concerns regarding Arm’s valuation and near-term stock performance potential. With a $77 billion market cap and 25 times this year’s sales estimates, Arm is priced beyond perfection. Moreover, there are the post-IPO variables to consider. Arm’s stock got a lift as the year-end rally and the AI hype converged, propelling Arm’s stock into the stratosphere. However, with some optimism coming out of the market now, Arm’s stock could deflate further, especially as the lock-up period ends this quarter.

Investors and insiders who’ve had their shares locked up during the post-IPO phase will likely sell around the end of the quarter, leading to a transitory drop in Arm’s stock. This dynamic should create a buying opportunity and enable Arm’s valuation to contract to a much more attractive ten times sales or lower. Therefore, despite the prospects, Arm Holdings plc stock is a hold here, but it becomes a buy at lower levels with a market cap around the $30-50B range. This phenomenon suggests Arm’s stock could get cut in half during the first quarter, becoming a solid buy in the $30-40 range.

Read the full article here