Written by Ophir Gottlieb

Lede

We reiterate our bullish (but speculative) stance on Jumia but note bankruptcy risk. This is not an investment for everyone.

The CEO, Francis Dufay, has a clear plan, but more importantly, is executing on that plan impeccably well. Our faith in Jumia is a reflection of our faith in Francis based on our several conversations with him.

On January 3rd, Morgan Stanley upgraded Jumia to market perform and raised its price target from $3.00 to $3.60.

We believe this could be the beginning of institutions recognizing the rather radical change in the company’s trajectory.

Preface

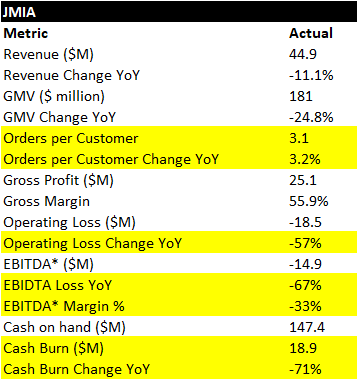

Jumia Technologies (NYSE:JMIA) reported earnings on 11-15-2023 before the market opened and substantial progress was made for the singular goal that we must focus on in the intermediate term: solvency.

While we do some deeper analysis below, these are the crucial takeaways.

Improving Expenses

First, five bullets on improving expenses and losses:

1. Quarterly cash burn dropped 71% year over year (YoY).

2. Liquidity of $147.4 million, leaving the company seven quarters of “survival cash runway.”

3. Net cash used in operations dropped 55% YoY; Adjusted EBITDA loss dropped 67% YoY.

4. Sales and Advertising expenses dropped 74% YoY; Consumer incentives dropped 63% YoY.

5. Fulfillment expense down from 9.6% of revenue to 6.6% of revenue; should be, at least in part, a permanent operational efficiency gain.

Improving Growth

Second, six bullets on growth:

1. Growth strategy working: increase in GMV of physical goods in five countries using the sales approach (JForce) that CEO led in Ivory Coast (for 10 years) before becoming CEO. JForce is immediately accretive to cash flow.

2. Expansion into secondary cities and rural areas is accelerating.

3. Jumia’s new pick-up stations, branded to the firm, now account for 44% of deliveries.

4. Number of orders had dipped due to deliberate decisions to focus on core categories and reduce incentives has now returned to growth with 11% QoQ growth; Q3 usually shows a seasonal drop from Q2.

5. Higher repurchase rates from new customers; increased average physical order value (+5% YoY)

6. Revenue on a constant currency basis rose by 19% YoY.

With little time to show dramatic improvement, Jumia is doing it.

The ultimate must have is cash burn to dip to zero or very close it; and then turn positive.

quarterly results (FactSet)

Update: 11-17-2023

We spoke with the CEO

End Update

At the Top

Last quarter we noted that we had interviewed two experts and shared those conversations with CML Pro members.

Combined with our meeting with new CEO Francis Dufay (a ten-year Jumia veteran), there were many takeaways where all three sources agreed.

From the agreements in those conversations, our own conversations with Nigerian citizens, and hard data from the last seven quarters of financials, it’s now time to pay some attention to Jumia as an ascension story, rather than just a survival story. But this is still a survival story first…

Make no mistake: This is still a survival story first…

The fly in the ointment two quarters ago (Q2 2023) was big: The $38M cash burn in Q2 was larger than the prior quarter but half of it was non-operational – it was currency headwinds.

There’s hardship in covering JMIA: the company has no analysts of record. That means no estimates.

We can’t tell you how the firm did relative to estimates because there are none. But, in this one case, just for the very short-term, it might be better that there are no estimates to compare results to because we can cover survival without needing estimates from analysts of record; we just need a balance sheet and company guidance.

What’s Happening – The Apex of Change

Despite local macro-economic hardships, Jumia’s business is sustaining revenue growth in constant currency (+19%) even as EBITDA loss has dropped by 67%.

The company reported its smallest EBITDA loss in its history in Q2 2023 at $19.3M versus estimates for a loss of $23.9M. This is on the back of two quarters ago (Q1) which at the time was the smallest EBITDA loss in its history.

This quarter progress on cash burn was better as was progress on growth, with an EBITDA loss down to $14.9 million.

This revenue growth (on constant currency) comes even as the firm dropped unprofitable business lines and intentionally reduced certain revenue streams that have proven to be cash flow negative. The intentionally dropped businesses accounted for 45% of the decline in total orders in Q2 2023.

(We note that expenses are far less impacted by currency headwinds since revenue and expense are mostly transacted in the same currency.)

But that is not the story; far from it. Operating cash flow burn, year over year, dropped by 75% in Q1 2023, two-quarters into the new CEO’s leadership.

Last quarter the operating loss reduction was 64%.

This quarter saw a 57% drop in operating loss.

The company could be less than twelve-months away from breakeven with its $147 million USD on the balance sheet (as of Sep 30, 2023), and it better be.

We believe that if the firm can provide guidance of operating cash flow breakeven within a few quarters, the solvency risk will be off the table and that leaves an enterprise to be valued on its business, not its bankruptcy risk and that enterprise is worth far more than pennies on the dollar.

That leaves an enterprise priced at less than 2x cash on hand, growing revenue at 19% (constant currency), operating cash flow loss down 55%, an immovable logistics and brand moat in ten African economies, where even UPS has submitted to its strength, and a profitable growth trajectory that could last more than a decade.

Of course, the alternative is a company that is defunct in a matter of less than two years. In other words, this breakeven is not a nice to have – it’s a must have.

We start with agreements from the conversations and then to the financials, which have been radically improved in just three quarters.

The four fundamental agreements from the conversations we noted above were the following:

Four fundamental Agreements from Expert Checks

1. The Jumia brand is stronger than even that of Amazon, with comparisons to Google and Facebook as a global brand. The commentary to this manner has been ubiquitous and unanimous.

In fact, the Jumia brand appeal is so strong that the firm is able and continues to hire more talent at a lower cost simply for the benefit of the imprimatur of the employer.

2. Logistics outside of major cities in the African countries that Jumia serves is unlike anything in Western countries.

There are no addresses, no road signs, and even, in some places, no roads at all, with limited Internet.

Without Jumia, that portion of the world, hundreds of millions of people, is cut off from the West and from supply beyond what their local markets carry.

Evidence of the moat Jumia holds within its logistics business was exposed in April of 2022, when UPS announced a partnership with Jumia to expand its logistics services in Africa.

But contrary to popular Western based analysis, the local markets that serve these vast populations are not a barrier to entry for alternatives, but rather a conduit to those alternatives, and this point is crucially important and vastly misunderstood as is the populace at large.

The Jumia logistics arm and JForce are crown jewels of the business as Jumia employs locals in dozens of non-urban geographies to hand deliver the Internet to people’s doorsteps (JForce), and then hand deliver the packages, facilitating commerce at a scale that is virtually impossible for another firm to achieve.

Using Jumia Pay, no cash is exchanged and payment on delivery reduces much of the friction of a (rightfully) hesitant customer cohort. This sales motion (JForce) has been successfully completed and proved out in various countries, most notably in parts of the Ivory Coast, where the current CEO formerly ran business operations.

The business, per our internal conversations with former Jumia senior managers, is nearly immediately accretive to cash flow.

3. The total addressable market as measured by demand for goods combined with the ability of customers to pay for those goods are both underappreciated by the outside world.

Locals spend money for goods weekly; they are simply limited to those products that are within walking distance. This phenomenon exists throughout the nine countries that Jumia serves and total to billions of unaddressed demand.

With its logistic arm and JForce, Jumia has found and continues to find high demand and a willingness to spend as various populaces once extraordinarily limited to local supply choices are now exposed to variety from anything that Jumia / China / The Internet can deliver.

When addressing this particular phenomenon, the CEO noted that he “deeply believes” that current markets are constrained by supply, not demand, and that accessing the vast pool of Chinese suppliers is a “huge advantage” where Jumia will capture a “sizeable take rate.”

The margins are high in this business, profitable nearly immediately, and has been proven out in several locations already, and the demand, per our expert calls, is recurring and quite substantial.

4. Jumia is and has intentionally moved away from unprofitable categories. It has suspended first party grocery offering in most countries and “significantly reduced” promotional intensity behind a number of non-profitable services. This will appear as a lower user base in the near-term, but it is due to intentional moves that will be accretive to long-term sustainable profitability while focusing on growth in profitable enterprises (like local selling through JForce).

After the second quarter report and our expert channel checks, we felt that everything we had heard about Jumia from our other research is true: dominant brand recognition.

We have an expert now, more senior than the one prior, that laid out the incredible issues with making a business work in the Sub-Saharan African countries; just wild obstacles from no addresses, to thuggery, theft, political corruption, and even the difficulty of maintaining the quality of the paper money held in wallets since banking isn’t that common.

The opportunity is huge but the risks are well discussed here. Jumia is quite risky – very risky even – just know that.

The question is how soon profitability can be achieved, in particular with respect to the cash on hand.

Two quarters ago, as in Q1 2023, Operating loss was surprisingly low.

Loss from operations was just under $31 million, while Wall Street estimates were at a $44 million loss.

That is a substantial turnaround from the $66.4 million loss in the same quarter a year ago.

In constant currency, JMIA revenue grew 24%.

The core business grew and expenses dropped.

A few catch-all charts updated for the quarter just reported do the story’s introduction justice.

While a DCF model could extrapolate various outcomes of value for the firm, the equity market has made the computation easier:

If the enterprise can sustain as a going concern, then the equity value would be worth substantially more than simply cash on hand.

So, the focus for Jumia is, while easy to lose the forest for the trees, survival.

If the firm can reach cash flow breakeven, shorts will have a problem.

If the firm cannot reach cash flow breakeven, the equity may be worth $0.

While the data all go in the right direction for losses, they have to fall further, and have to fall faster.

With a $19M cash burn in Q3 and $147M in cash on hand, that reads as a company with seven quarters of cash left (up from four quarters in Q2 2023).

Certainly that cash burn is declining substantially, but truth is truth: numbers are numbers. Jumia needs to slow its losses by another 75% rather quickly.

Earnings Quick Takeaways

At the present time, JMIA is trading at about a $130 million enterprise value (EV); that’s market cap – cash.

Further, we have no analyst estimates to compare results to; there are no analysts.

If JMIA is actually a going concern in three-years, in should be worth more than $130 million, and analyst estimates won’t matter to hit that low bar (survival).

Our prior dossiers on Jumia were always quite long – including a reiteration of its history.

Last quarter we finally reached the point where we could (and will) simply review the quarter reported, and direct all interested investors to our prior dossiers on JMIA for the rather long and involved history.

Risk

There are many, many risks for Jumia but the single most important is the first bullet point:

• Will Jumia exist in a two-years, or will it go bankrupt?

• Even if the idea is right, Africa is like no other place in the world in many ways.

• This logistics network is brilliant, but it’s not easy and we really don’t know what happens if it has to scale up.

• Can Jumia handle $500 million in sales? $1 billion? $10 billion?

These are reasonable questions, and we have no obvious answer.

• Will Jumia do the hard part and build out a digital Africa only to see a massive American or (more likely) Chinese firm take that market once it’s made and crush the Jumia business?

After all, China is essentially in “colonization” mode over Africa as it builds out its infrastructure (water, electricity, roads) with a likely boomerang quid pro quo – “we built it, we own it.”

What does Jumia do in that regard? What does Africa do?

• Where are the large investors? Why hasn’t a well-respected firm like Abdiel, Dragoneer, Whale Rock, Tiger… anyone invested even $100 million to take a 5% stake in the company? Are we the fools at the poker table?

• Is the platform strategy working or is this all due to aggressive advertising spend and will drop off after advertising dies down.

• The company will likely raise capital again if it continues to spend to grow.

• There are many more risks for Jumia but most of those fall under the purview of “normal technology company risks” so we will just leave the last bit as a catch-all.

Conclusion

We reiterate our bullish (but speculative) stance on Jumia but note bankruptcy risk.

The CEO, Francis Dufay, has a clear plan, but more importantly, is executing on that plan impeccably well. Our faith in Jumia is a reflection of our faith in Francis.

The author is long Jumia (JMIA) at the time of this writing.

Please read the legal disclaimers below and as always, remember, CML Pro does not make recommendations or solicitations for the sale or purchase of any security ever. We are not licensed to do so, and wouldn’t do it even if we were. We share research and provide you the power to be knowledgeable to make your own decisions.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

Read the full article here