In this 2023 year-end sector review, part 2, we look at what kind of year it was for healthcare, industrial, technology, materials, REITs, and utility sectors. How is 2024 shaping up for them?

Missed part 1 of our 2023 year-end sector review? No worries, read it here.

Healthcare

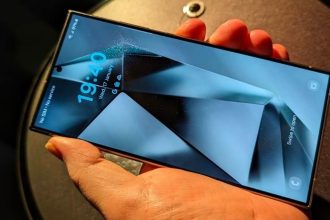

If you invested in healthcare in 2023, chances are you didn’t have a good year. The ETF benchmark shows a total return of -1.72% as of December 6th, but there are many major losers.

The graph shows some companies had it hard (Baxter (BAX) -28%, and Pfizer (PFE) -39%) while most just didn’t do much (between -7% to +5%). Special mention to Cardinal Health (CAH) at +42%. Pharmaceutical wholesalers operate in a razor-thin margin environment with large volumes and heavy regulation, that can change at any time. We feel the weight of debt and the hangover from the COVID hype, especially for Pfizer.

Industrials

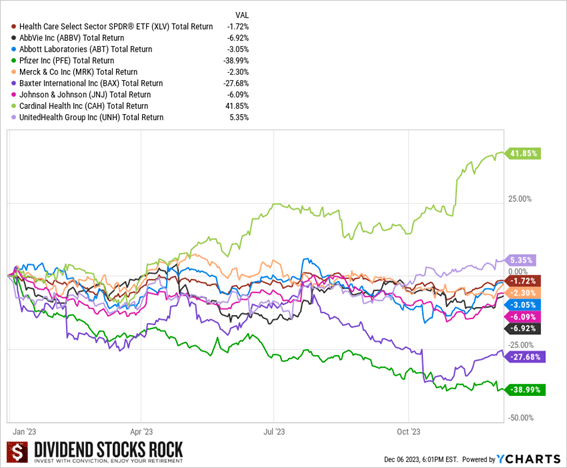

Industrial companies are highly cyclical and usually follow the economy. Many old industrials are a “GDP+” type of business, i.e., they generate a bit more than the economic growth of their market, be it a single country or the whole world for the bigger guys. For example, the transportation industry’s volume (railroads, trucking, parcel delivery) depends on how much people consume. Not many resources or goods to transport if nobody’s buying.

After a difficult year in 2022, many industrial stocks came back strongly. Defense stocks continue to get a lot of love as the war between Russia and Ukraine keeps raging, and now, another conflict erupted between Israel and Palestine. In transportation, we saw railroads and trucking signalling the economic slowdown with lower volumes. Industrial parts manufacturers also saw revenue slowing down as most companies tried to keep lean inventory. Such slowdowns should continue in 2024. However, if we hear talk about interest rate cuts in the new year, you can bet industrials will rise faster than their backlogs!

Information Technology

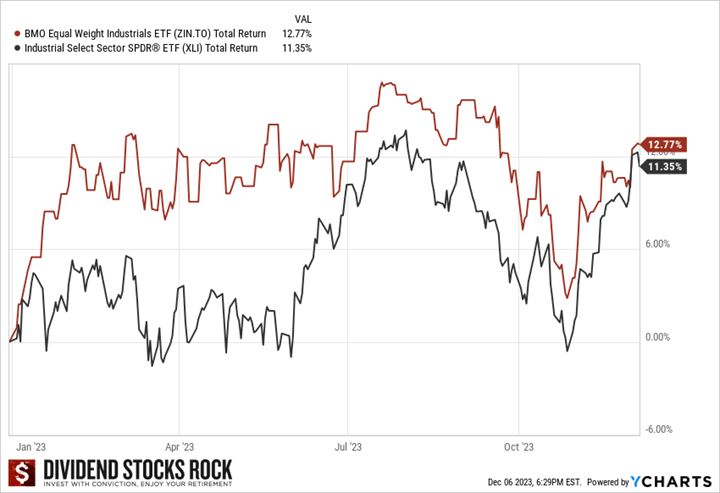

After the bear market of 2022 for the tech world – Technology Sector ETF XLK was down 24% and Nasdaq -29% – 2023 was quite the comeback! The XLK ETF is now +50% and Nasdaq is +38%. Over two years, XLK’s total return is +7.65% while the Nasdaq trails at -7.39%. The bull ride of 2021 was exceptional… and exaggerated!

The theme in 2023 was the rise of artificial intelligence. While most semiconductor makers are still in a down investment cycle, those making chips to power AI got all the love in the world. Nvidia (NVDA) stock price more than tripled in 2023; you might want to revisit your exposure to this one.

A warning about chasing trends, though. AI will help many industries to save on costs and improve productivity across the board. There will be winners and losers. Most trends push all stocks in an industry way too high. Remember cannabis stocks in 2018, gold mining stocks in 2020, and crypto companies in 2021? While you want to participate in the trend, you don’t want to be overexposed. Good diversification with exposure to the tech sector will do the job more safely than going all in.

Materials

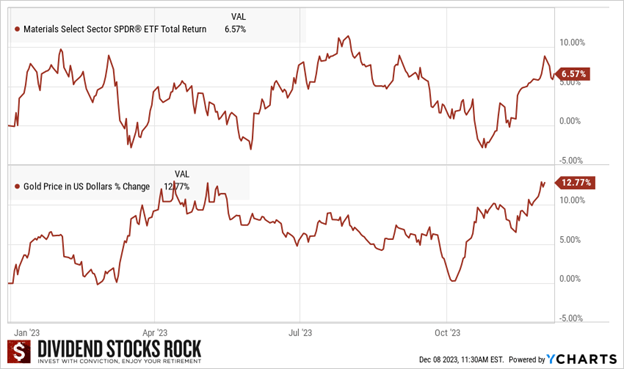

Historically, most commodities are volatile, but effective to fight inflation. Surprisingly, most commodities didn’t keep up with inflation over the past 3 years.

“Gold is back” in 2023 with a push toward 13% gain in value and now trades above $2,000, pretty close to its all-time high of 2020. Gold experts predicted gold price to reach $3,000 before Christmas… of 2020. Careful with expert predictions.

Demand surged for many commodities in 2021. Then, it cooled off rapidly in 2022, which continued in 2023. The 2021 rush for materials brought many companies to historic highs last year. Unlike the energy sector, the commodity price party crashed rapidly. Demand for lumber, iron, paint, etc., weakened and many investors sobered up. There isn’t much a company can do when its selling price declines rapidly. It was a modest year for basic materials, with many burdened with higher-than-expected inventory.

You know the drill with materials: buy market leaders when the commodity price is depreciated, and cash your profit when you can. I’m not a big fan of this strategy because you have to “guess right” when you buy and also when you sell. My warning about chasing the AI trend also applies to battery makers and lithium.

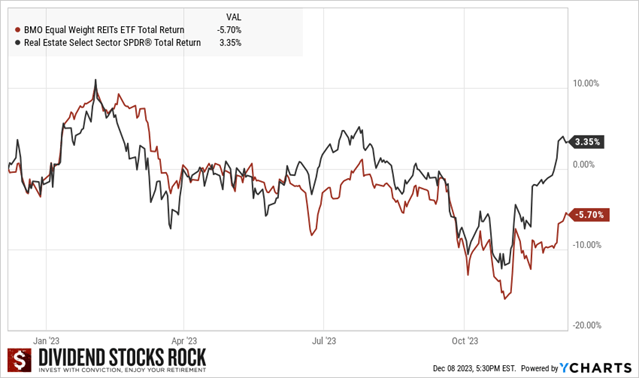

Real Estate

Another sector that suffered in 2022 and that didn’t do much in 2023. REITs are slightly positive in the U.S., but they continue to drag their feet in Canada.

The obvious narrative is that interest rates will affect REITs’ funds from operations going forward. Since REITs use lots of leverage, debt payments will become a larger burden, forcing some REITs to slow down their distribution growth, to forget about increasing their payouts, or to slash their juicy dividends.

Since REITs diversify their debt maturity over many years, they might not feel the impact on their quarterly earnings just yet. But rest assured, the storm is coming. It’s just that real estate usually lags, but the market is proactive with its valuation.

REITs are also suffering due to income-seeking investor dropping their investments in equities to go back to their beloved bonds and GICs. We might see them come back sooner than expected if rates go the other way in 2024.

Another question mark surrounds real estate sub-sectors still affected by the pandemic. Office REITs may see their occupation rates go down as businesses revise their office space needs. Healthcare REITs are stuck with a dual problem: lower occupation rates and higher expenses to ensure senior security. This trend will continue to affect REITs in 2024.

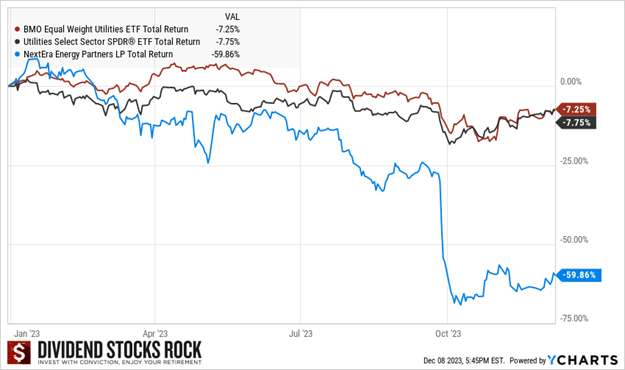

Utilities

Algonquin (AQN) dropped a bomb on the market with a bad quarter in November 2022, signalling the worst for 2023, which happened faster than expected. It cut its dividend in January, weeks before announcing its quarterly results. The rest of the year is history; utilities suffered from higher interest rates and lack of love as income-seeking investors left the boat to disembark on Bonds & GICs island. In fairness, when 10-year government bonds offer over 4.5%, income-seeking investors would be fools to go for stocks paying the same yield.

With higher interest charges hurting their balance sheet and cash flow, it’s clear that all utilities will suffer for a while.

Renewables

Renewable energy utilities also had a really bad year, which NextEra Partners (NEP) didn’t help. The graph shows NEP sinking like a stone after it announced a reduction of its distribution per unit growth. The financing burden caught up with NEP; it has debt it had planned to pay off in part by issuing more shares; with a dwindling share price, they’ll have to resort to using costly debt for near-term financing.

While most renewables face a challenging environment, not all renewable energy utilities are such precarious positions, as explained in What’s Happening with Renewables? Different companies with different business models have different debt structures. When a NEP-like situation happens, the market puts all renewable companies in the same basket, and solid companies are also punished, unfairly. Renewable energy is here to stay. Investors simply have to do their homework to choose companies with strong financial metrics and be patient.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here