Quick Overview

Today’s research note covers Jefferies Financial (NYSE:JEF).

This article will make use of our Investing Flow below, which is based on waterfall methodology from the world of project management.

Today’s article aims to answer questions like: why consider this specific stock and sector? What are the risks and benefits we can plan for? Whether the current share price and valuation make sense, what metrics matter to this specific sector, and what could be a long-term exit strategy for this stock?

The answers to these questions, holistically, should lead to a decision of whether we buy, sell, or hold this stock today.

Investing Flow (Albert Anthony & Co.)

Initiating: Why this Stock & Sector?

To initiate today’s analysis, we wanted to first answer the question of why this specific stock and what about this sector caught our interest.

We picked Jefferies Financial for our watch list this week as it is in business since 1962, trades on the NYSE, a major US exchange, and is a major firm in the investment banking, advisory, and asset management space.

One notable growth item to mention is that in its December press release, the firm announced they are establishing full-service investment banking and capital markets capabilities in Canada.

It is also worth mentioning this firm has a robust wealth management shop too, with an array of financial and estate planning solutions.

As for the financials sector, we know from key market data that this sector has seen nearly +30% growth in 3 years, but also more recently has seen bullishness, particularly after the Fed’s December meeting.

Jefferies – Sector Data (Seeking Alpha)

This scenario may present a sector that is currently overpriced or overvalued, which we hope to uncover today with this stock specifically, as it could also be an opportunity to catch the sector tailwind which could continue plowing further ahead this year.

Planning: What are Risks & Benefits?

Next, we need to plan for the risk and potential benefits of investing in Jefferies Financial.

First, we should address macro risks. Because a major business of this firm is investment banking, we want to look at the trends in mergers and acquisitions (M&A activity) for 2024, since that is a major business of investment banks.

A study this week by Morgan Stanley, for example, stated that “mergers and acquisitions are due for a comeback in 2024 after a slowdown in 2023.”

The study went on to cite multiple factors that will contribute to this:

The S&P 500 Index ended the year near record highs not seen since January 2022, corporate balance sheets are strong, financing markets are improving and CEO confidence, which is closely correlated with M&A activity, is climbing.

Another macro risk is the interest rate environment, and it being elevated can be a double-edged sword for this sector. For example, although we see from the income statement that Jefferies’ interest income has climbed since November 2022, so has interest expense, which puts a squeeze on net interest margins. With the Fed expected to most likely keep rates where they are after the March meeting, according to the latest predictors on CME FedWatch, this could mean the high rate environment lasting longer.

On a micro level, both the firm’s revenue and earnings declined on a YoY basis, with FY2023 being called a “trough” year by executive comments.

They also had impacts in 2023 from the divestiture of their interests in Vitesse Energy (VTS) and their merchant banking portfolio being wound down.

Though the company did not provide forward guidance, here are some items that could provide upside to the firm in 2024, according to the Q4 comments:

lower-risk Investment Banking revenue driving our growth, a diversified sales, trading and research platform serving our clients and the foundation of a strong alternative asset management business.

We believe that this firm is deserving of a modestly positive but cautious outlook, due to ongoing net interest margins being squeezed while non-interest business segments like fee-based ones should benefit from the expected boost in M&A this year.

Executing: Is the Price & Valuation Justified?

Now that we have planned for risk and reward, we analyze the current share price and valuation next.

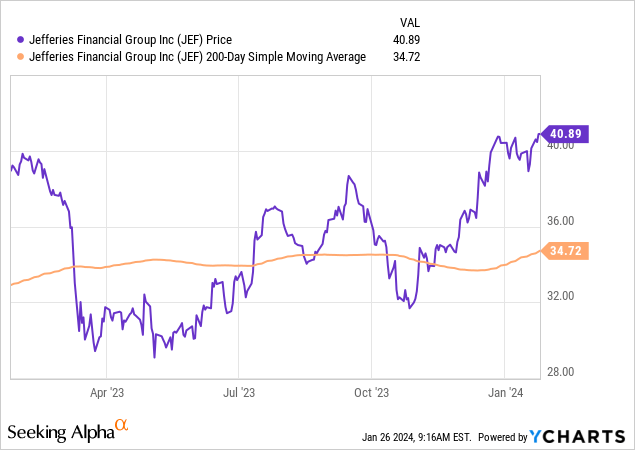

Here is the chart we pulled showing the most recent share price vs the 200-day SMA, a long-term price trend indicator we like to use to smooth out volatility:

Reflective of the bullishness we spoke about in financials stocks lately, we see that this stock too has climbed well above its autumn lows, and at $40.89 is now nearly +18% vs its 200-day SMA.

We can see from valuation metrics that the trailing price-to-earnings ratio (P/E) had been as high as 37x earnings, while the sector was just around 11x earnings. On a forward basis, though, it came down to 11.8x earnings, closer in line with the sector.

This forward P/E is justifiable because the consensus on forward earnings in 2024 has increased, and the Q4 results resulted in an earnings beat, so both are calling for earnings growth expected ahead.

As for the other valuation we track, the price-to-book value (P/B), on both a trailing and forward basis, is in the range of 0.85x-0.89x book value, lower than the sector range of 1.11x-1.18x book value.

Although equity (book value) on the balance sheet has declined on a YoY basis, in the quarter ending November the firm still has a sizeable $9.7B in equity. We believe the market is anticipating growth in equity in 2024 driven by increased earnings, so we think this forward price multiple of less than 1x book value is justified.

Another positive benefit of this stock is the nearly 3% dividend yield it offers right now, but also 10 years of proven dividend growth.

Monitor & Control: What Metrics Matter to this Sector?

In this phase, if we were to invest in this equity, we care about monitoring and controlling key metrics relevant to this industry.

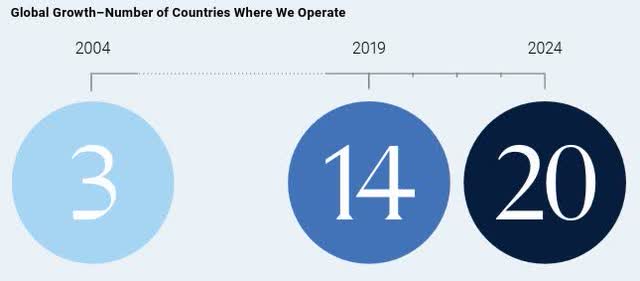

In this case, one of them would be growth and market penetration globally, because we believe its competitors are doing so too. Jefferies in their January letter to shareholders highlighted the growth of new countries they have entered going into 2024:

Jefferies – Global Growth (Company Letter)

Another item we are monitoring actively is this firm’s market position in relation to competitors. Here is what their shareholder letter said about their strong equities position in the capital markets segment:

Jefferies is now among a select few leaders in global Equities and continues to gain market share across all regions in 2023.

However, in comparing forward revenue growth estimates within the investment banking and brokerage subsector of financials, we can see that peers like Nomura Holdings (NMR), Interactive Brokers (IBKR), and Raymond James Financial (RJF) are in a much better position when it comes to forward revenue growth estimates.

For example, expected forward revenue growth at Nomura is a sizeable +57% while at Jefferies it is just 5%:

Investment Banking – Fwd Revenue Growth (Seeking Alpha)

So, this data makes us add some caution to our outlook on this stock, if we are picking among peers in the same subsector.

Closing: When do I Exit This Investment?

Now that we have planned for potential risk and benefit, thought about what price to execute at, and considered metrics that matter to an investor in this specific sector, we need a portfolio strategy but also an exit strategy with which to exit this position if needed.

Based on the evidence holistically, we are inclined to agree with today’s consensus from SA analysts, which calls for a hold rather than a buy or sell. Our strategy in this case, assuming we bought shares at an earlier price, perhaps at the autumn low, would be to hold on to collect the $0.30/share quarterly dividend income.

In addition, if we did buy at the October low, we are already seeing a significant unrealized capital gain as well, so need to add more shares to our position.

Considering the annual dividend grew 166% in 5 years, if we assume this growth rate to continue, in 5 more years we are projecting an annual dividend of around $4/share. On a 100 share position, that would be $400/year in dividend income for our portfolio.

Actual dividend growth to continue would be more likely if earnings improve significantly in 2024, and from estimates we already talked about earlier, it seems like it should take a positive course this year.

Though it is not a Morgan Stanley (MS) or Goldman Sachs (GS), and therefore not considered a global systemically important bank, which certainly can add weight to our consideration in this sector, it is currently trading near $40 and is a long-established firm in the investment banking space, so we feel it is a reasonably-valued opportunity to hold on to and the exposure it gives us in the investment-banking subsector, assuming we had been trading this stock.

As for an exit, we think perhaps 5 years from now – if the price appreciates significantly (20 to 40%) – it could present an exit opportunity to then redeploy into some of the systemically-critical banks, otherwise it would be an equity we hold long term for reliable dividends, perhaps in a portfolio of 30+ years.

Should it get acquired by a peer in that time, at a significant price premium over the current $40/share, that would also be a win for our portfolio – and our hold rating on Jefferies Financial from last September has been reaffirmed.

Read the full article here