Introduction

In early February 2023, I wrote a bullish article about L.S. Starrett (NYSE:SCX) in which I said that the company was successfully passing on increased costs to customers and the valuation could improve to about 0.8x price to book value over the coming months.

The market capitalization of has soared by just over 60% since then and has surpassed $100 million. In my view, the financial performance of L.S. Starrett over the past few quarters has been decent and its balance sheet is in a better shape compared to a year ago. Yet, the company is starting to look overvalued based on fundamentals and I’m cutting my rating on its stock to neutral. Let’s review.

Overview of the recent developments

If you’re not familiar with the company or my earlier coverage, here’s a short description of the business. L.S. Starrett was established in 1880 and specializes in the manufacturing of precision tools, cutting equipment, and metrology systems products. Its clients include companies in the metalworking, automotive, aviation, marine, and farm industries among others as well as the do-it-yourself (DIY) sector. L.S. Starrett currently has eight production facilities across the USA, Brazil, the UK, and China. Five of those are located in the USA and the country usually accounts for over half of revenues. The company is perhaps best known in the USA for its precision tools, but it also claims to be the largest producer of saw blades in the world. The business is split into three segments – North America Industrial, International Industrial, and Global Test and Measurement. The latter usually has the best margins, with an operating income margin of about 15%.

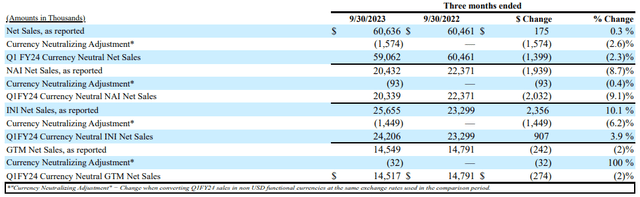

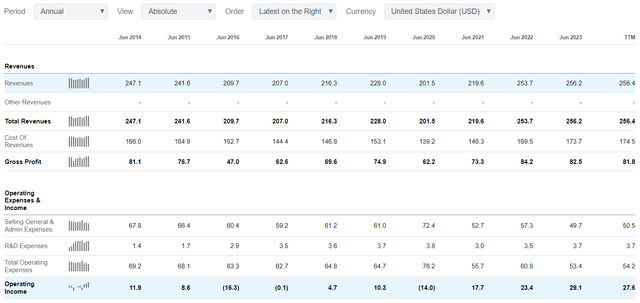

Back in February 2023, I said that L.S. Starrett was implementing price increases to counter pressure from inflation, and that this boosted its operating margins. Looking at the Q1 2024 financial results, there was a positive effect of 2.9% on net sales from pricing actions plus an additional 2.6% improvement thanks to a strong Brazilian real. However, this was offset by volume and mix declines and net sales for the quarter inched down by 0.3% year on year to $60.6 million (page 18 of the Q1 FY24 financial report)

L.S. Starrett

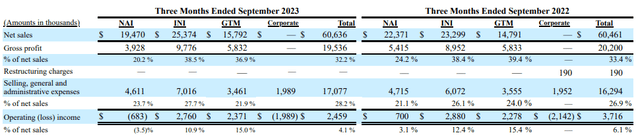

Looking at the breakdown of the financial results by segment, we can see that North America Industrial went into the red and this was attributed to low factory utilization rates as well as measuring tools production due to labor challenges. The net sales of the International Industrial segment rose by 8.9% thanks to improved volumes in Brazil and Europe from new products. The sales of the Global Test and Measurement business, in turn, increased by 6.8% thanks to high demand for precision granite products. However, the operating income margin of L.S. Starrett shrank to 4.05% despite the strong performance of the International Industrial and Global Test and Measurement segments as selling, general and administrative expenses rose by 4.8% to $17.1 million. The increase came from the International Industrial segment and L.S. Starrett said that about half of it came from the translation of foreign currencies into US dollars, mainly due to the strong Brazilian real.

L.S. Starrett

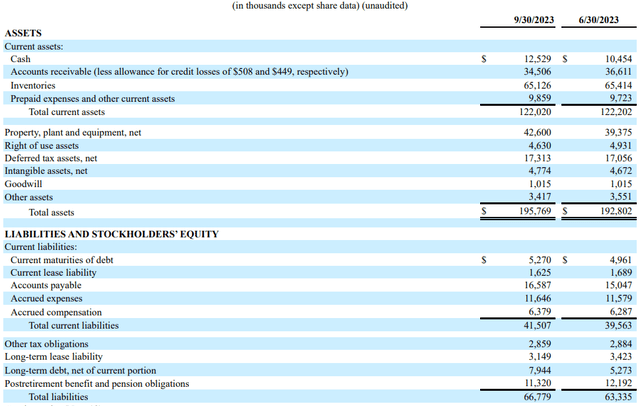

Turning our attention to the balance sheet, the company has embarked on a strategy of limiting working capital growth over the past few quarters with the aim of and improving cash generation and it seems that this is working well. We can see from the table below that net debt was just $12 million as of September 2023 and I’m including postretirement benefit and pension obligations in this amount. For comparison, net debt was $40.9 million a year earlier.

L.S. Starrett

Overall, I think that this was a strong quarter and I find it encouraging how rapidly the net debt is decreasing. L.S. Starrett should release its Q2 FY24 results in early February, and I expect net sales of around $67 million and an operating income of some $6 million. Looking at what to expect for the future, I think that FY24 sales are likely to grow by mid single digit percentage points as L.S. Starrett has implemented a $5 million expansion at its precision granite manufacturing facility in Waite Park which should be completed in the coming months (page 20 of the Q1 FY24 financial report). That being said, I’m concerned about the decrease in the order backlog. While we don’t know the exact numbers as L.S. Starrett only said that it was above $10 million, it seems likely that it’s not improving from the levels of FY22 when it stood at over $14 million. It’s possible that I’m putting too much attention into this metric considering that the company usually carries a relatively small portion of sales in backlog as it generally fills orders from finished goods inventories on hand. Only the Global Test and Measurement segment is characterized by larger projects which leads to conversion to revenues at a slower pace.

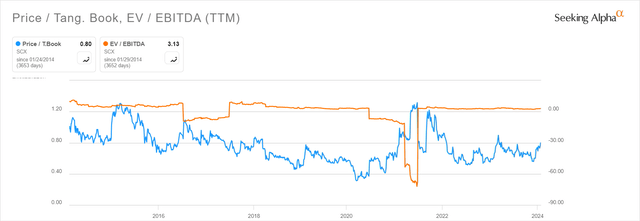

Turning our attention to the valuation, L.S. Starrett is trading at 3.1x EV/EBITDA and 0.8x price to tangible book value as of the time of writing. While these levels might seem low, it’s important to note that this is a cyclical business and annual operating income has dropped into negative territory three times over the past decade.

Seeking Alpha

Looking at historical multiples, the price to tangible book value has rarely surpassed 0.8x over the past 10 years and the EV/EBITDA ratio has seldom been at higher levels. In my view, I think this could be a good time for investors to trim or close their positions.

Seeking Alpha

Investor takeaway

In my view, L.S. Starrett has received a significant boost to its financial results from pent-up demand during the COVID-19 pandemic. The company has strengthened its balance sheet significantly over the past two fiscal years and higher interest rates helped it alleviate its pension plan funding issues. However, the room for further margin improvement seems limited and I’m concerned that it could be in the early stages of becoming a value trap. I expect annual operating income to dip below $20 million over the next few years once again. In my view, it could be best for risk-averse investors to avoid this stock.

Read the full article here