Introduction

As I recently initiated a long position in certain issues of preferred shares of Wells Fargo (NYSE:WFC), I now need to keep track of the banking giant’s financial results to make sure the preferred dividends are safe. As all preferred shares that have been issued are non-cumulative in nature (which means the bank can in theory skip a preferred dividend and doesn’t have to make up for it), I need to watch these preferred shares more closely than others. Although all banks continued to make their preferred dividend payments even during the COVID pandemic, I want to keep close tabs to ensure I can immediately act if problems would arise.

A look at the Q4 results from the perspective of a preferred shareholder

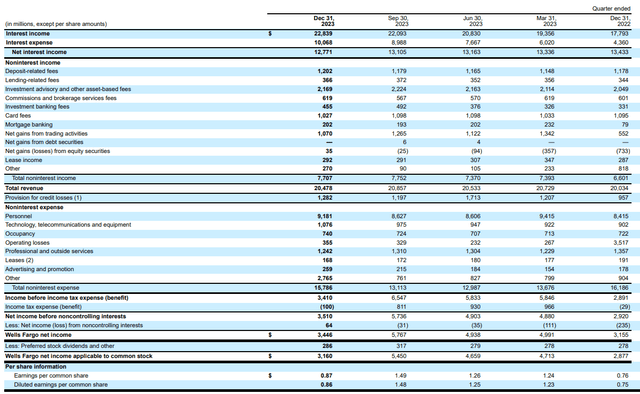

The headline result of the fourth quarter, as posted by the bank, was quite disappointing. Wells Fargo announced an EPS of $0.86 during the fourth quarter, while the full-year net income was $4.83 per share. The culprit were some non-recurring items as a special assessment by the FDIC resulted in a $1.9B charge (representing an impact of $0.40 per share) while the bank also allocated $969M for future severance packages. On the other hand, there also was a non-recurring tax benefit to the tune of $621M, which means the net impact of the non-recurring items was approximately $2.25B or $0.43/share. Excluding those Q4 elements, the adjusted EPS during Q4 would have been $1.29 per share and the FY 2023 EPS would have exceeded $5.25 per share.

The bank reported a total net interest income of $12.8B which is slightly lower than the Q3 net interest income as the interest expenses increased by in excess of 10% while the interest income increased by just under $750M.

Wells Fargo Investor Relations

The bank also reported a stable non-interest income at $7.7B, while the total amount of non-interest expenses increased to almost $16B (but this obviously includes the non-recurring items I discussed above). Wells Fargo also recorded about $1.28B in loan loss provisions and this resulted in a pre-tax income of $3.4B and a net profit of $3.5B thanks to the tax benefit discussed earlier in this article. After deducting the $64M in net income attributable to non-controlling interests and the $286M in preferred dividend payments, the net profit attributable to the common shareholders was $3.16B for a diluted EPS of $0.86 and a reported EPS of $0.87.

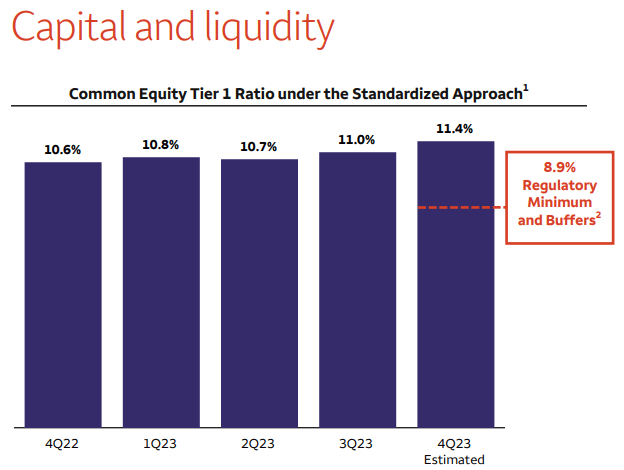

The Q4 results immediately confirm that despite the non-recurring items, the preferred dividend is still very well covered. Although the payout ratio increased to 8.3% in Q4 compared to 5.5% and 5.6% in Q3 and Q2 2023 respectively, there’s very little doubt the bank can continue to pay the non-cumulative preferred dividends, even if/when it gets plagued by quarterly multi-billion dollar losses. And despite the negative impact of the non-recurring items in the fourth quarter of 2023, the capital ratios remain strong with an anticipated CET1 ratio of 11.4% as of the end of last year.

Wells Fargo Investor Relations

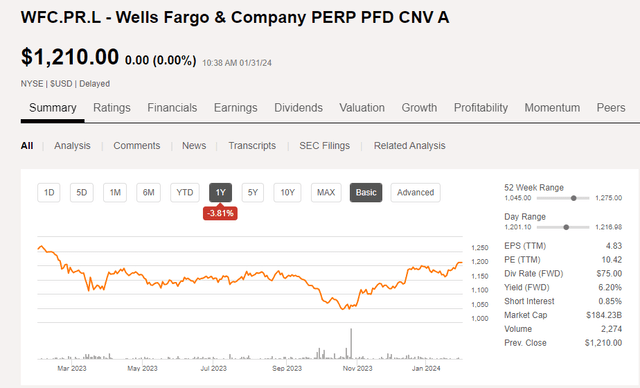

As I disclosed in a previous article, I started to accumulate a position in the preferred shares series L, trading with (WFC.PR.L) as their ticker symbol. That series of preferred stock was initially issued by Wachovia and cannot be called by Wells Fargo. There is a conversion feature with a conversion price of $156.7, but this only comes into play when Wells’ common shares are trading well north of $200, as per the terms of the preferred shares.

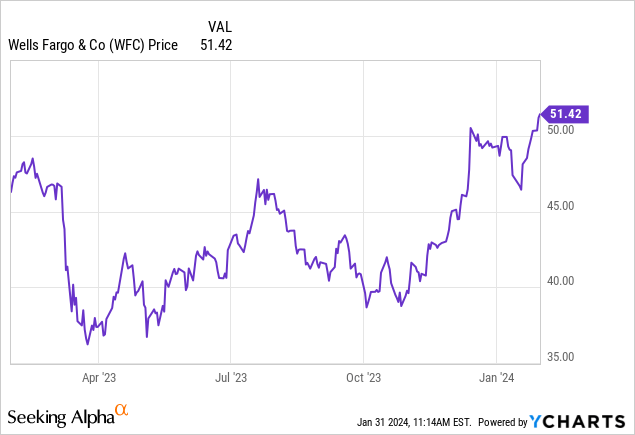

Seeking Alpha

I consider it to be quite unlikely that will happen anytime soon as it implies the share price would have to quadruple from the current levels, so for all intents and purposes we should consider this series of preferred equity to be a ‘busted’ preferred share and its share price will fluctuate based on the market interest rates and the risk premium the market attaches to an investment in Wells Fargo.

Investment thesis

At the current share price of $1210, this series of preferred shares is offering a yield of approximately 6.2%. As market interest rates are expected to continue to decrease, investors could consider this series of preferred equity to be an interesting tool to speculate on said decreases. If the financial markets would be fine with a 5.5% yield on Wells Fargo’s preferred equity, the share price will increase to approximately $1360 and that would be a level I’d consider selling my position at. Meanwhile, I wouldn’t mind to continue to add to this series of preferred shares on weakness.

Read the full article here