Introduction

After covering a lot of dividend growth stocks and macroeconomic developments, it’s time to talk about fertilizers.

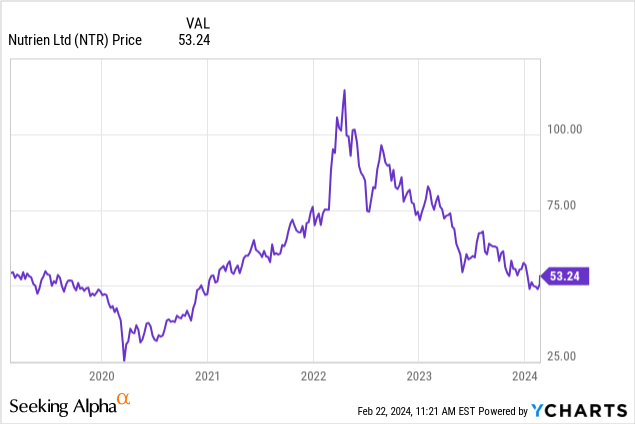

As many of my readers may know, one of the stocks I have covered for many years is Nutrien Ltd. (NYSE:NTR), the world’s largest producer of potash fertilizer.

In 2020, I started to turn bullish on fertilizers, betting on a post-pandemic demand recovery and longer-term inflation tailwinds.

This thesis worked out extremely well as it was supported by an energy crisis, sky-high agriculture commodity prices, and geopolitical issues.

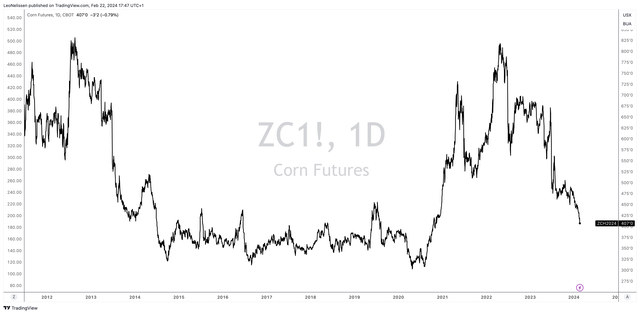

Unfortunately, after peaking in 2022, the stock price of NTR has followed the downtrend in the price of oil, agriculture commodities, and related, ending two years of sky-high gains.

TradingView (CBOT Corn)

My most recent article on NTR was written on Nov. 6, titled Deep Value – Why Nutrien Remains Significantly Undervalued.”

Since then, shares are up 1%, including dividends, lagging the 16% return of the S&P 500 by a huge margin.

While I may have been optimistic a bit too early, the company’s just-released earnings confirm my bullish thesis.

Not only is the company what I would call “dirt cheap,” but it’s also seeing new tailwinds that could unlock a lot of shareholder value.

In this article, we’ll discuss all of this as I explain why the stock remains a Strong Buy.

So, let’s get to it!

Between Headwinds and Tailwinds

As the stock price may suggest, the company is dealing with a number of headwinds right now.

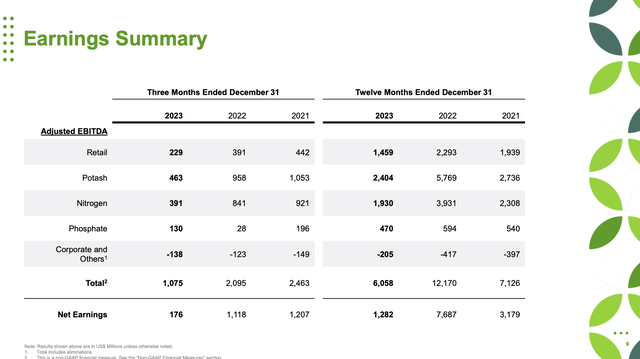

For example, in 2023, the company reported net earnings of $1.3 billion, with diluted net earnings per share of $2.53. Adjusted EBITDA for the year was $6.1 billion, with adjusted net earnings per share of $4.44.

This marked a decrease from the record levels achieved in 2022. Last year, the company generated $7.7 billion in net earnings.

The decline in adjusted EBITDA from $12.2 billion in 2022 was primarily attributed to lower net realized selling prices across all segments and lower earnings from the Retail segment.

Nutrien Ltd.

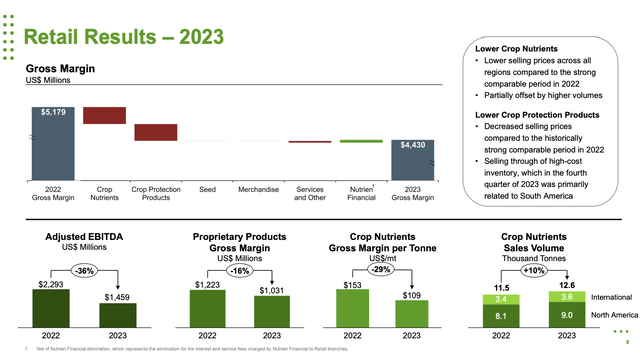

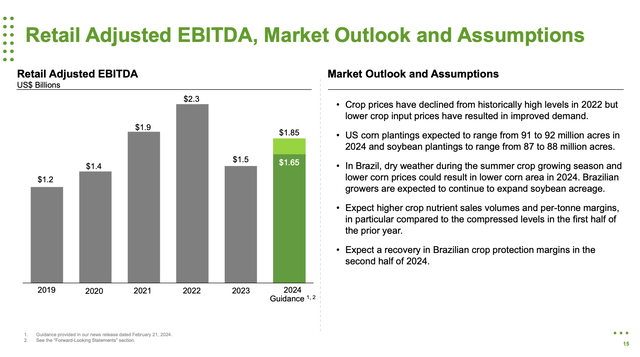

To be precise, the Retail segment’s adjusted EBITDA for 2023 was $1.5 billion, a decrease primarily due to lower gross margins for both crop nutrients and crop protection products.

Despite this, crop nutrient sales volumes increased as growers returned to more normalized application rates to replenish nutrients in the soil.

Nutrien Ltd.

The company also focused on growing proprietary nutritional and biostimulant sales and margins through differentiated product offerings and expanded manufacturing capacity.

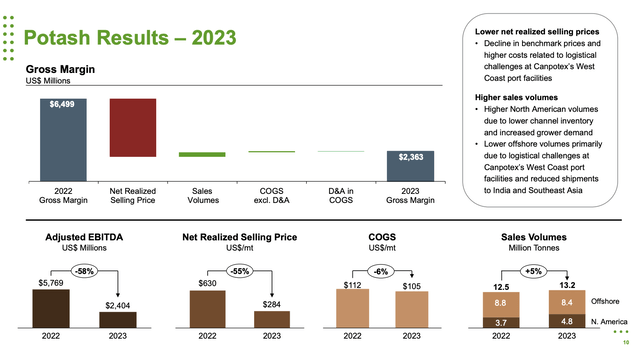

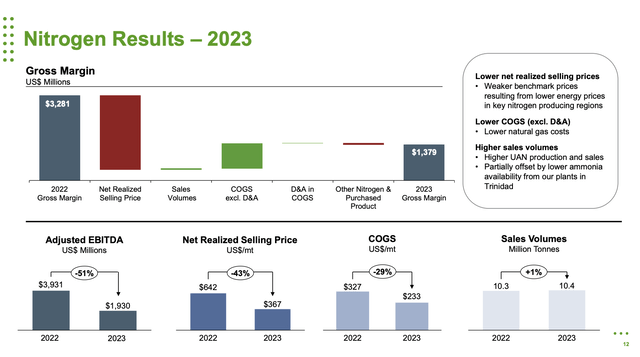

In the Potash segment, full-year 2023 adjusted EBITDA declined to $2.4 billion due to lower net realized selling prices, although record fourth quarter potash sales volumes were achieved.

Nutrien Ltd.

The Nitrogen segment saw a decrease in full-year 2023 adjusted EBITDA to $1.9 billion, attributed to lower net realized selling prices for major nitrogen products.

Nutrien Ltd.

In other words, I can summarize 2023 in one sentence: Prices normalized while volumes started to improve.

Essentially, higher volumes were not enough to offset pricing weakness for two reasons:

- Like most basic material industries, revenues are mainly driven by pricing.

- 2022 was such a strong year that there was no way NTR (or any of its peers) could have beaten it – or come even remotely close.

The Outlook Is Good News For Shareholders

During the fourth quarter of 2023, the company recognized a $76 million non-cash impairment in its Nitrogen segment related to its Trinidad property, plant, and equipment.

This impairment was due to a new natural gas contract and the resulting outlook for higher expected natural gas costs.

Despite this, and in light of pricing headwinds, the company maintained a commitment to returning value to shareholders, having returned $2.1 billion to shareholders in 2023 through dividends and share repurchases.

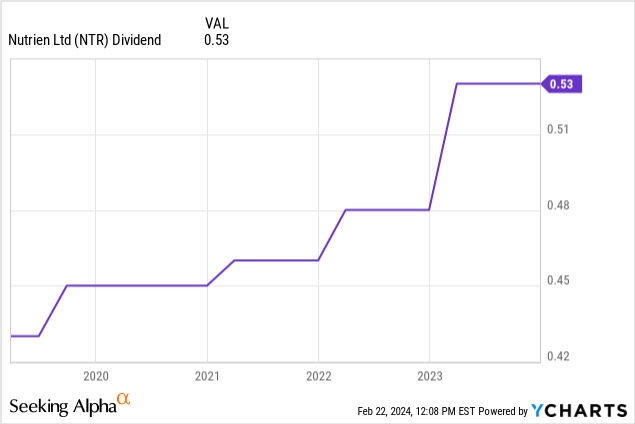

More recently, the board of directors approved an increase in the quarterly dividend to $0.54 per share, which translates to a 1.9% hike. This hike is NOT reflected in the chart below.

NTR shares currently yield 4.0%.

While the 2% dividend hike may be a bit underwhelming, it perfectly displays the company’s improving confidence in its future.

Looking ahead to 2024, the company anticipates higher fertilizer sales volumes and retail earnings, supported by increased crop input market stability and demand.

Nutrien Ltd.

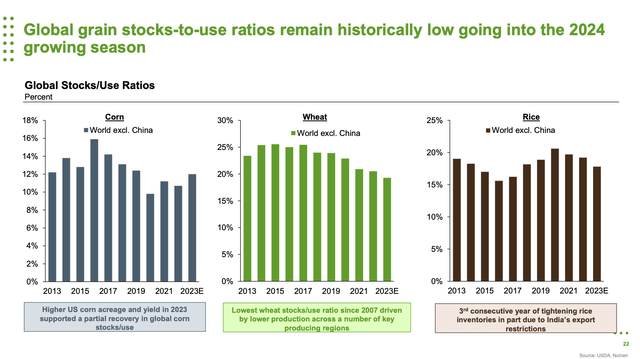

Moreover, global grain stocks-to-use ratios remain historically low, with weather and geopolitical issues expected to continue impacting grain and oilseed production, exports, and inventory levels.

This is very bullish for agriculture crop prices, grower margins, fertilizer demand, and overall pricing. It’s also why I remain a long-term bull, buying equipment producers like Deere & Company (DE) for my dividend (growth) portfolio.

Nutrien Ltd.

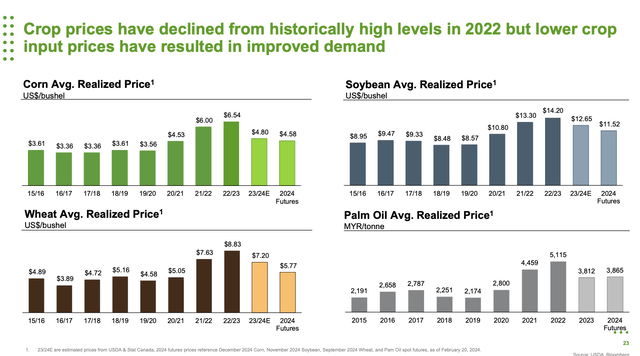

Despite declining crop prices from historically high levels in 2022, improved demand was observed, particularly supported by the strong North American fall application season in 2023.

Meanwhile, projections for U.S. corn and soybean plantings in 2024 indicate stability, while factors such as dry weather in Brazil and the El Niño weather pattern could influence crop production in various regions.

Nutrien Ltd.

This also is what I get from insiders and railroad companies that observe strong demand.

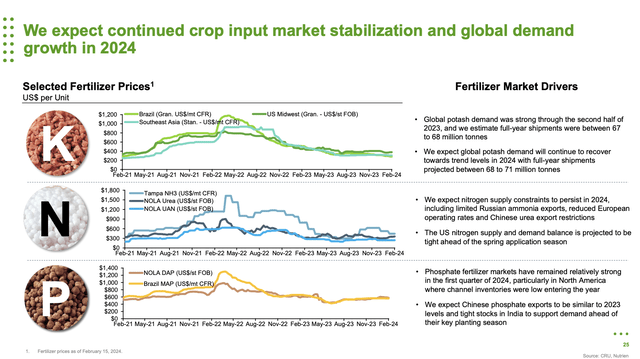

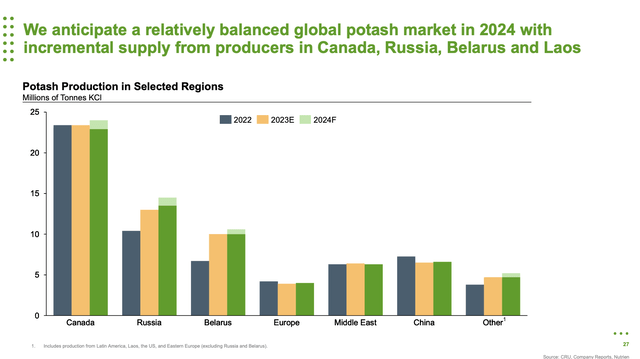

With that in mind, global potash demand remained strong through the second half of 2023, with full-year shipments estimated between 67 to 68 million tonnes.

Nutrien Ltd.

The increase was supported by strong consumption and increased imports in key markets such as North America, China, and Brazil.

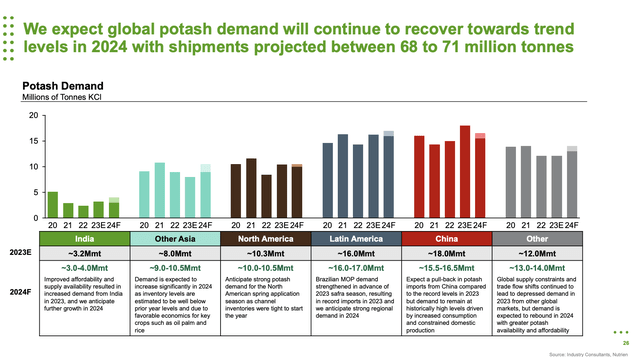

Looking ahead to 2024, the company expects global potash demand to continue recovering towards trend levels, with full-year shipments projected between 68 to 71 million tonnes.

Nutrien Ltd.

Strong potash demand is anticipated ahead of the North American spring application season, with significant increases expected in Southeast Asia.

Nitrogen supply constraints are projected to persist in 2024, with factors such as limited Russian ammonia exports and reduced European operating rates influencing the market dynamics.

Nutrien Ltd.

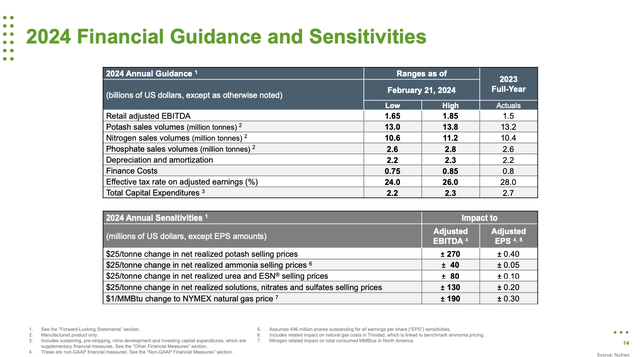

In light of these developments, the company revised its guidance for 2024 to provide forward-looking estimates on metrics less impacted by fertilizer commodity prices.

- Retail adjusted EBITDA guidance is $1.65 to $1.85 billion, assuming increased gross margins in all major product lines compared to 2023. This would be up from $1.5 billion in 2023.

- Potash sales volume guidance is 13.0 to 13.8 million tonnes, with increased first-quarter sales volumes expected in North America.

- Nitrogen sales volume guidance is 10.6 to 11.2 million tonnes, assuming higher operating rates at U.S. and Trinidad plants compared to 2023.

- Phosphate sales volume guidance is 2.6 to 2.8 million tonnes, with improved operating rates expected compared to the prior year.

Nutrien Ltd.

This also bodes well for its valuation.

Valuation

I don’t really like to use words like “dirt cheap,” as it isn’t professional.

However, when dealing with NTR, I believe this term can be applied.

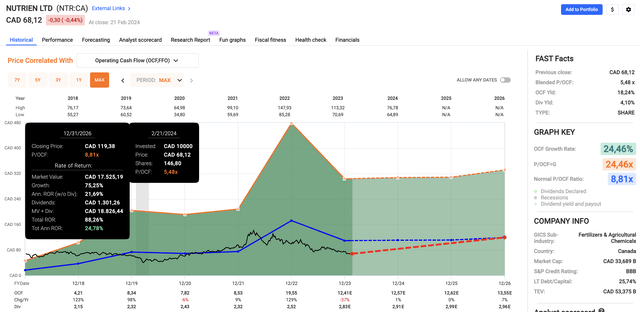

Using the data in the chart below:

- NTR had a normalized P/OCF (operating cash flow) ratio of 8.8x, going back to the merger between PotashCorp and Agrium in 2018.

- Currently, the stock trades at a blended P/OCF ratio of 5.5x.

- Analysts expect the company to grow its OCF by 1% in 2024, potentially followed by 0% growth in 2025 and 7% growth in 2026. This conservative outlook still implies a fair price target of $119 in Toronto. That’s 60% above its current price. Please note that the chart below does not include the company’s 6% post-earnings stock price surge.

FAST Graphs

I believe the stock has more room to run than that, especially if energy prices continue to climb, paving a favorable foundation for higher agriculture prices.

As a result, I added a few more shares to my NTR position.

However, please note that NTR is a holding of my trading account, not my dividend growth portfolio. NTR is very volatile and may not be right for you, regardless of how bullish I am.

Takeaway

While Nutrien faced some challenges in 2023, including pricing headwinds and a decline in earnings compared to the previous year, there are promising signs for the future.

Despite the setback, the company remains committed to delivering value to shareholders, as evidenced by its increased dividend and share repurchase programs.

Looking ahead to 2024, there are positive indicators for fertilizer demand and pricing, supported by various factors, including global grain stocks, weather patterns, and geopolitical issues.

With strong potash demand anticipated and revised guidance indicating improved metrics, Nutrien appears well-positioned for growth.

Considering the stock’s attractive valuation and potential for further upside, I’ve increased my position in NTR.

Pros and Cons

Pros:

- Strong Demand: With global potash demand expected to continue recovering and promising projections for fertilizer sales volumes, NTR stands to benefit from increased demand in the agriculture sector.

- Value Potential: Despite recent challenges, NTR’s current valuation suggests significant upside potential.

- Dividend Growth: NTR’s commitment to returning value to shareholders through dividend hikes and share repurchases reflects confidence in its future earnings and cash flow generation.

- Long-Term Bullish Outlook: Factors such as low global grain stocks, weather patterns, and geopolitical issues indicate favorable conditions for agriculture prices, which could further boost NTR’s profitability.

Cons:

- Earnings Volatility: NTR’s earnings can be volatile, as seen in the decline in adjusted EBITDA and net earnings in 2023 compared to the previous year, highlighting the inherent risks in the industry.

- Market Sensitivity: The stock price of NTR is closely tied to factors such as energy prices, agriculture commodity prices, and geopolitical tensions, which can lead to fluctuations and impact short-term performance.

Read the full article here