In this article we are going to zoom in on the valuation of T-Mobile US (NASDAQ:TMUS). As we see in the below table T-Mobile is far higher valued than its peers, Verizon (VZ) and AT&T (T).

|

Price/ earnings |

Enterprise value/EBITDA |

EV/EBIT |

|

|

T-Mobile US |

21 |

10.6 |

19.5 |

|

Verizon |

8.6 |

7.3 |

11.5 |

|

AT&T |

7.0 |

6.8 |

12.4 |

Why would you pay 50% or more for T-Mobile? One dollar invested in its peers would generate a direct return that is 50% higher or more. Which indirect return makes T-Mobile attractive? That is the question we try to answer in this article.

The best answer to the question is relative growth (remember: value=cashflow/(r-g)). It is expected that T-Mobile will continue to grow its income far faster than its competitors. We are going to look at the likelihood of that to occur. If that likelihood is low, it may be time to sell.

The current wireless market

The US mobile phone market is divided among three participants T-Mobile, Verizon, and AT&T. There are also two very fast-growing new players, Comcast (CMCSA) and Charter (CHTR), or “cable”, that rent mobile lines on a wholesale basis from Verizon. They sell these lines in combination with a cable internet subscription. A relatively insignificant fifth player is DISH (DISH), which is currently building out a 5G network. Since Dish is not very busy with winning market share we can ignore them, for now.

T-Mobile’s future growth rate

T-Mobile is the fastest-growing of the three carriers and a likely explanation for that is its current advantage in 5G. For investors, it is important to know how long the company will keep that advantage. The longer it can sustain relatively high growth rates, the more valuable the company.

To find out how long that advantage will last we are going to look into various indicators that tell us whether that higher growth rate will persist. First, we are looking at the investment levels of the three companies. Bigger investments by its peers may be a sign that they are catching up. Next, we look at the expected growth path of T-Mobile’s fixed-wireless offering. T-Mobile has already indicated that there is too little capacity to continue growing at the current rate. A third explanation is that T-Mobile is ‘buying market share’ by offering the highest subsidies on new phones. We are going to compare equipment sales subsidies. Last topic will be the growing competition from cable companies.

T-Mobile’s 5G advantage

T-Mobile was the first of the three to be able to roll out a fast 5G network as it had earlier access to the required spectrum. Sprint had obtained that spectrum already years ago while Verizon and AT&T just recently obtained access. That advantage is currently paying off and T-Mobile is clearly the company with the most customer phone additions:

Phone net additions, prepaid and postpaid, in thousands.*

T-Mobile: first table p40. Verizon: p30. AT&T: p35 (postpaid: 1,218m 9 months + 526 Q4 + prepaid 263 9 months – 132 Q4)

As we see, T-Mobile is the clear leader with 2.4 and 3.4 million added phone lines in the last two years, AT&T is in the middle and Verizon is the laggard. Verizon however gains many millions of subscribers annually via the cable companies.

The same is true for the number of fixed-wireless (FWA) broadband customers. By the end of 2023, T-Mobile had already 4.8 million FWA customers, Verizon was far behind with 3 million and AT&T had only 93 thousand. Virtually all of these 4.8 million customers were added in the last three years with 2.1 new customers in 2023 alone.

As we now have established that T-Mobile currently is the fastest growing carrier, we try to answer the question of whether this growth path will continue.

*Based on year-end totals of prepaid and postpaid. Numbers do not adjust for 3G switch-offs.

Phone subscriber growth

The US telecom market is a regulated market. One of the prime goals of that regulation is to achieve about equal competition between the players. Regulation therefore almost predicts that T-Mobile’s advantage will not last forever. If that had been the case, the regulator would have stepped in and allocated some spectrum away from T-Mobile towards the other players.

You can therefore expect that it is just a matter of time until Verizon and AT&T are in an about equal position as T-Mobile. If we look at the capital investment numbers of the three companies that is exactly what we see happening:

|

Capital expenditures ($bn) |

2023 |

2024 |

|

T-Mobile US |

9.8 |

9.0 |

|

Verizon |

18.8 |

17.2 |

|

AT&T |

23.6 |

21.5 |

The table shows that T-Mobile is investing each year about half the amount of the other players. The difference is eight to twelve billion dollars per annum. This clearly suggests that Verizon and AT&T are lagging behind and are currently catching up.

From these numbers, we cannot figure out precisely when the two competitors will have come by. But given the very large size of the investments at AT&T and Verizon, it would surprise me if that takes longer than four years. That implies that T-Mobile will have only a limited period to monetize its competitive advantage.

Fixed Wireless growth

The period of outsized growth is even shorter when we look at fixed-wireless. According to T-Mobile itself, it expects to run into capacity constraints already next year. The company currently has 4.8 million subscribers and the total capacity, it says, is 8 to 9 million. At last year’s growth rate, 2.1 million, that implies that T-Mobile has a maximum of only two years of growth ahead.

T-Mobile may increase capacity but I wouldn’t hold my breath. When asked, T-Mobile is always very vague about fixed wireless capacity increases (Mike Sievert, CEO, Q4 ’23 earnings call):

We haven’t drawn any new conclusions versus what we previously told you about possible models. Beyond this initial capital-light model that we have for high-speed Internet. As you know, our forecast all along has said that the model takes us to 7 million to 8 million subscribers. We’re well on our way.

We’ll monitor that as we get closer. And we got a lot of time left. So stay tuned if we’re able to provide you with an update on that in the future, but no update today.

Note that Sievert says if, not when, a big difference. If indeed it were very lucrative to increase capacity, why hasn’t the company already started building that capacity? T-Mobile is already capacity constraint in some places. The company already scaled down its ambition from about 500 thousand new customers per quarter last year to 400 thousand in 2024, as CFO Osvaldik indicated in the latest conference call. Why wasn’t the ambition 600 thousand?

On the other hand, given that T-Mobile will soon reach its maximum addressable market, it is in the position to start raising prices. It is no coincidence that T-Mobile raised prices for the first time last year. And, given the nature of subscription-based economics, we can expect many more price rises in the future.

Phone subsidies

A quick way to grow in the telecom business is to subsidize phones as a form of customer acquisition. The three mobile phone companies spend a lot of money on financing phones for their customers. These phones are paid for by the mobile phone company and paid back over the life of the subscription. It turns out all three phone companies report heavy losses:

|

Company |

Equipment sales 2023 |

Cost of equipment 2023 |

Loss over 2023 |

Loss over 2022 |

|

T-Mobile |

14.1 |

18.5 |

-4.4 |

-4.4 |

|

AT&T |

15.8* |

15.9* |

-0.1* |

-1.1 |

|

Verizon |

20.6 |

21.8 |

-1.2 |

-2.0 |

Equipment sales revenue and costs, in billion dollars

*first nine months

We see that the telecom companies subsidize phone purchases at a massive scale*. T-Mobile was the most aggressive in subsidizing these purchases. It costed the company 4.4 billion dollars in 2023 alone, over three billion more than the loss at Verizon. It appears that AT&T hardly lost money on equipment sales**.

To get a better feel of what is going on, let’s relate these losses to gross customer additions. You would expect that losses on equipment sales are a function of gross postpaid customer additions.

|

Net adds in million* |

Churn rate per month |

Gross adds (million) ** |

Cost per gross add |

|

|

T-Mobile |

3.082 |

0,87% |

10.9 |

$405 |

|

AT&T |

1.744 |

0,81% |

8.6 |

***$70 |

|

Verizon |

-0.132 |

0,83% |

9.1 |

$131 |

Retail postpaid equipment losses per gross add, 2023

*This table only represents postpaid retail (phone) net adds, excluding prepaid and business.

**Calculated based on a customer base of resp. 74.5, 70, and 93 million customers at T-Mobile, AT&T, and Verizon.

*** The annual number is not yet available. Based on 9m 2023 losses plus q4 2022 losses, of resp. $100 million and $500 million, in total $600 million for 2023

From the above table, we learn that T-Mobile spends on average $405 per gross customer addition, over three times the amount at Verizon. It is remarkable how disciplined AT&T appears to be. I remember a couple of years ago it was just AT&T that was most aggressive in subsidizing handsets. Maybe they have learnt a lesson?***

A reasonable question that comes up is whether T-Mobile is just purchasing market share by heavily subsidizing equipment. What happens if T-Mobile stops subsidizing at this gigantic scale?

Just to give you the order of magnitude, if each phone costs one thousand dollars then the company purchased 18.5 million phones for its clients of which it gave 4.4 million away for free. In that light, its 3.4 million subscription growth over 2023 doesn’t look so great.

* Although the companies may amortize revenues and costs over the life of each purchase, I expect the overall picture remains the same. We can ignore the cost of 5G routers as these are reported under property, plant, and equipment.

** Which I can hardly believe, please let me know where I go wrong.

***Unfortunately equipment revenues and costs were in the past not disclosed by AT&T.

Cable competition

Comcast and Charter are relatively new providers of wireless access. These companies are typically offering very fast and, per gigabyte, cheap data access over fixed lines. As we are now using more and more data over our telephones, cable companies have become a natural party to deliver that data, via Wi-Fi. Cable itself provides your data access as long as you are in reach of one of their Wi-Fi radios, outside that reach Verizon provides the connection.

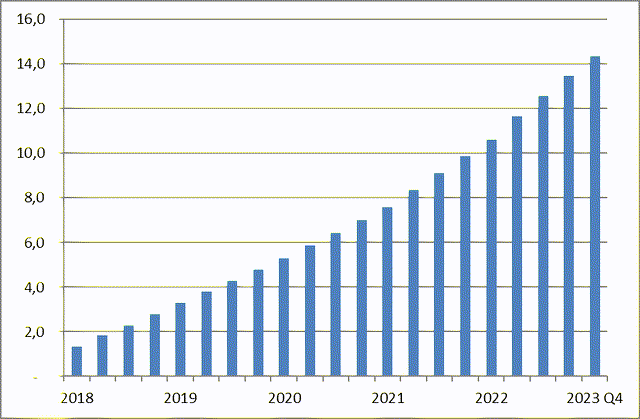

Total number of wireless lines at Comcast and Charter, in million (author’s)

As the chart shows, Comcast and Charter are growing rapidly in the wireless space. Growth even accelerated in Q4,2022, with the introduction of ‘buy one, get one free’ by Charter. We can expect a further acceleration this year as Comcast is going to copy Charter’s success:

Mike Cavanagh (CEO Comcast, UBS conference, December 4, 2023)

… let’s test and see what works, we’ll be in and out of the market with some offers. But then, buy one, get one is also out and that’s starting to be something that you’ll see across the footprint and start to kind of build momentum hopefully as we get into the new year.

… Charter, obviously, is doing the same there. … we always get the benefit of watching what a player like Charter does

In another public appearance, Comcast basically said that it wanted to see the stickiness of Charter’s ‘buy one line, get one free’ offer before it would copy that strategy. We now know from Charter’s recent earnings call that that marketing strategy was a success, i.e., few disconnections.

That is bad news for the wireless carriers, as we can now expect cable’s wireless growth to further accelerate to 4-5 million lines per annum. That implies that cable will capture a large part of the market growth in the coming years.

As a side note, it is interesting to ask how long cable will keep growing. Initially, I put the number at until 25-30 million lines are reached, when I expect growth to drop below 15% of the lines outstanding. At that rate the extra income from raising prices outweighs the incremental value of higher growth, I guessed. But since lowering churn among internet customers is an explicit secondary goal of the cable companies, I expect them to favor growth over higher prices even longer. Cable may be saturated only after growth drops below 10%. That implies cable may continue growing at the current pace until it reaches 35-40 million lines, or six-seven years from now.

Conclusion

There is nothing magic, disruptive, or un-carrier about T-Mobile. If indeed T-Mobile is so much more advanced than Verizon and AT&T, why is it losing over four billion dollars per annum on equipment sales? That is four million of one thousand dollar phones each year.

T-Mobile had a nice run as it was the first in the US to roll out a 5G network. It still has a few good years to go before its competition catches up. But a few years of higher growth rates do not warrant a 50% or 100% higher valuation, depending on the metric you choose.

The US wireless market is very competitive. The new cable players compete aggressively on price and we can expect that to continue for many years in the future.

It seems T-Mobile is overvalued. One of the reasons may be that the company distorts supply and demand by repurchasing at a massive scale its own stock. T-Mobile intends to repurchase 60 billion of its own stock while half of the shares remain in the hands of Deutsche Telekom.

Warren Buffett is always very critical towards companies that repurchase their own stock. In his opinion, they all too often pay too much. I disagree with him as there is an easy way out for investors: just join the company’s stock repurchases and sell your proportional share. In this way, you never get hurt.

Read the full article here