Fashion is a fast-changing business, but Industria de Diseño Textil, S.A. (OTCPK:IDEXY) or ‘Inditex’ has seen its unique blend of speed and quality weather the cycles exceptionally well. If anything, the moat may actually be wider today, as Inditex continues to lead on inventory management, helped by an integrated supply chain and more recently, tech enhancements to product tracking. The relatively low capital intensity of its model also helps, and the net result is that Inditex uses capital very efficiently, as reflected in its best-in-class returns on capital. So even with the company pulling back on store growth over the last year, it more than makes up for this with its cash generation and long-term capital return potential.

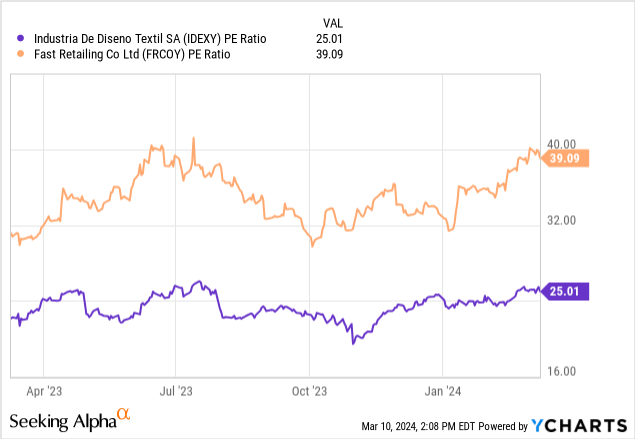

Momentum is also on the side of Inditex heading into this week’s quarterly update, with sales growth already accelerating in early Q4. Assuming pricing remains intact, margins should also hold up well, as should free cash generation. All signs, therefore, point to a growing net cash pile and a potential shareholder return catalyst (higher dividends or buybacks) sooner rather than later. Catalyst or no catalyst, though, Inditex is not that pricey at ~20x ex-cash P/E, given global comparables like Fast Retailing Co., Ltd. (OTCPK:FRCOY) (see coverage here) trades at a far wider premium, and likely still have room to grow into its multiple. In line with my last coverage of the stock (see here) and its strong Seeking Alpha quant rating, I remain quite upbeat.

Q3 Trading Update Offers Positive Forward-Looking Insight

As strongly as Inditex’s stock price has rallied in recent months, its earnings growth has more than matched the move. Recall from the company’s last trading update that year-to-date sales growth was running well above peers at +15% YoY in constant currency terms. While down from the high teens YoY pace in H1, implied Q3 growth of over 11% YoY remains very positive, as does the broad-based strength across all geographies and concepts.

Inditex

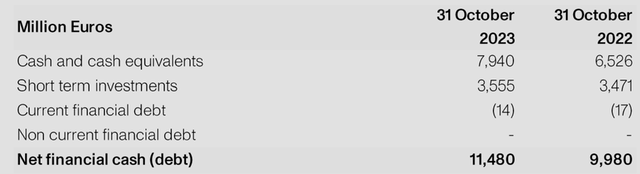

Margins are also notably higher at both the gross and operating levels, with much of the operating leverage coming from expenses growing well below reported sales. Finally, the fact that these P&L gains have translated into cash is a testament to the earnings quality here, with a net cash position of EUR11.5bn in Q3, representing a ~EUR1bn swing vs. the prior EUR10.5bn balance.

Perhaps the biggest positive from Q3, though, was that Q4-to-date trading is off to a very strong start. Per management, sales growth in the first six weeks has accelerated to +14% (constant currency terms) – almost two percentage points above the Q3 run rate. In addition, the company is now on track for a higher full-year gross margin of +75bps, more than offsetting any currency-related headwinds. Given Inditex remains comparatively well insulated from external supply chain impacts at a time when Red Sea disruptions are hitting its peers hard (note that it relies on air freight, rather than sea, for ex-Europe transport), I wouldn’t rule out more upside surprises in the quarters to come.

Store Growth Slows; Productivity Improvement is the New Driver

Inditex isn’t growing its store base any longer. In fact, the store footprint has shrunk quite materially over the last year. Some of this is down to Russian sanctions, but for the most part, it reflects management’s prudent decision to optimize its store portfolio over growing at all costs.

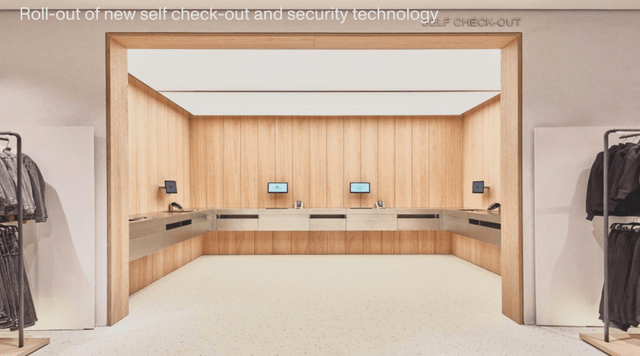

Efforts have mostly been focused on increasing square footage in key markets – the recent Zara store opening in Rotterdam (the largest to date), spanning 9k square meters over five floors, is a case in point. The logic is that a bigger store enhances both the customer experience and Inditex’s ability to integrate adjacencies like houseware retailing (‘Zara Home’) and cosmetics, among others. From here, larger format stores are due for rollout elsewhere in its key markets; if successful, expect the transition from small to large stores to roll through the base (guidance is currently for an incremental low-single-digit yearly space growth contribution), boosting sales productivity and by extension, operating margins over time.

Inditex

Beyond the square footage angle, Inditex also has more efficiency to unlock from inventory management. Recall that the company has successfully pushed for RFID (Radio Frequency Identification) and SINT (its integrated stock management system) in recent years, allowing for better inventory tracking and, by extension, order fulfillment. In effect, the company is only getting better at matching inventory to demand, allowing for structurally better efficiency and pricing relative to its peers. All of this should translate into best-in-class returns on capital and continued P&L outperformance for some time to come.

Inditex

Growing Net Cash Balance Paves the Way for More Dividends

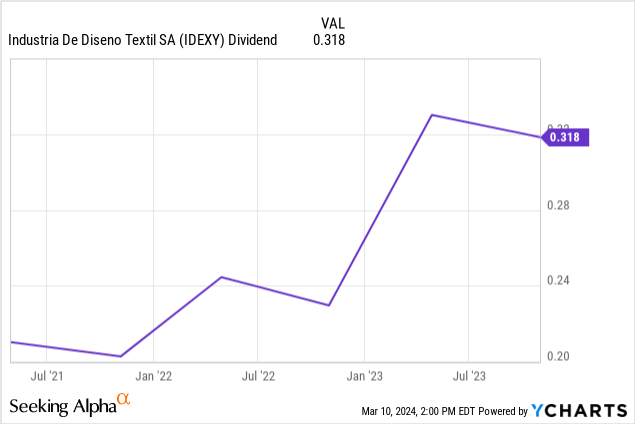

An underestimated aspect of the Inditex story is its very solid ~3% dividend yield. As the recurring portion equates to a rather undemanding 60% payout ratio on earnings, there’s room to raise this. Alternatively, management could keep some flexibility by paying out the rest of its earnings via a special dividend (note that last year’s total payout was almost 90%).

Either way, there’s plenty of cash generation and not enough reinvestment opportunities – even after accounting for the recently increased capex program. Coupled with the business’s ability to sustain a negative working capital position, Inditex’s EUR11.5bn (and growing) net cash position is here to stay; this bodes well for the dividend.

Inditex

Thus, heading into Q4/full-year results, there’s a good chance we see a significant step-up in the dividend – both in dollar terms and as a percentage of earnings. A wider dividend yield gap relative to global fashion and consumer peers could well re-rate the stock, particularly as we enter a period of declining interest rates.

Fast Fashion Compounder with a Possible Near-Term Catalyst

Inditex’s winning formula remains intact and so should its cash generation. The store expansion runway might well be narrower than before, but there’s still ample room for long-term earnings upside as the company optimizes store-level economics. The setup for this week’s quarterly update also looks good in light of the last trading update and updates to the shareholder return plan will be worth keeping an eye on. Yes, the stock isn’t optically cheap at the current ~20x cash adjusted earnings multiple (~25x trailing) but quality rarely is. Relative to both Inditex’s compounding potential and its higher-priced peers, I feel quite comfortable underwriting a position here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here