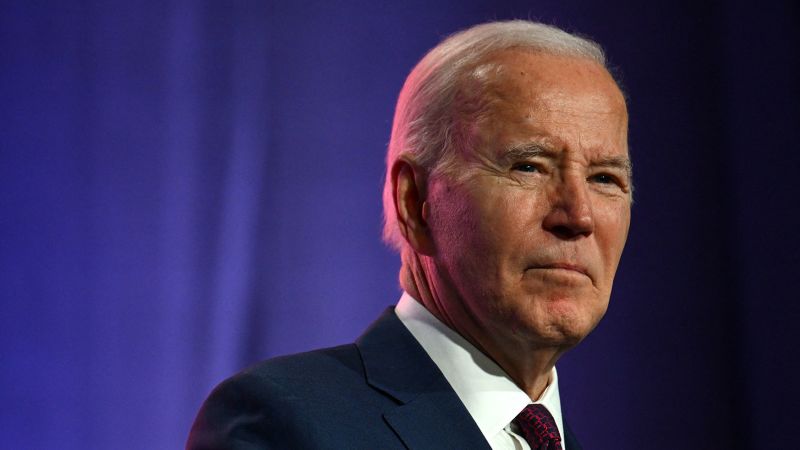

President Joe Biden released his annual budget Monday, laying out policy proposals that he will campaign on as he seeks reelection in November.

Many of the initiatives are longstanding priorities of Biden and congressional Democrats, including raising taxes on big corporations and the wealthy, lowering expenses for working Americans, reducing drug prices and helping families cover the cost of raising children. He previewed many of them in his State of the Union address last week.

The proposals have little chance of making it through the Republican-controlled House but will set up the president to draw contrasts between him and his expected rival, former President Donald Trump, whom Biden argues cares more about rich people and large companies.

The $7.266 trillion budget, which also lays out Biden’s vision to shore up Medicare, would reduce the deficit by $3 trillion over the next decade, as well as pay for new investments, according to a White House fact sheet.

Here’s what’s in Biden’s fiscal year 2025 budget proposal:

Biden is seeking to build on the drug price measures in the Inflation Reduction Act that Democrats passed in 2022. The budget calls for increasing the number of drugs subject to negotiation in Medicare and bringing them into the negotiation process sooner after they launch. It would also extend the $35 monthly cap on out-of-pocket insulin costs to the commercial market, instead of only to Medicare enrollees. Likewise, it would extend beyond Medicare the $2,000 out-of-pocket annual limit on prescription drug costs and the rebates on drugs whose prices rise faster than inflation.

Cut taxes for families and workers

The budget would temporarily restore the expanded child tax credit contained in the 2021 American Rescue Plan Act, which for one year increased the amount of the credit for certain families, enabled low-income families to claim it, provided half of it in monthly installments and cut child poverty nearly in half. The budget provision, which would last through 2025, would lift 3 million children out of poverty and cut taxes by an average of $2,600 for 39 million low- and middle-income families with 66 million children. The budget would also bolster the earned income tax credit for workers without dependent children.

The president’s budget would expand rental assistance for low-income families and provide incentives to address the existing shortage of affordable housing in the US.

The budget calls for a more than $258 billion investment that the administration said would result in the building and renovation of more than 2 million homes.

It also would create two new tax credits. For homeowners, there is a $10,000 tax credit aimed at getting people to put their starter homes on the market. This would be a one-year tax credit to middle-class families who sell a home priced below the area’s median home price to someone who will live in the home.

There’s also a $10,000 refundable credit for middle-class homebuyers – essentially an interest rate buy-down – that would help an estimated more than 3.5 million buyers close a deal on their first home over the next two years.

The budget would also provide $10 billion in for a new First-Generation Down Payment Assistance program to address homeownership and wealth gaps.

Biden announced several of these proposals last week in his State of the Union address.

The budget would provide $90 billion over 10 years to make two years of community college free for eligible students through a federal-state partnership. The president has been calling for free community college since his 2020 campaign, but funding has failed to make it through Congress.

The budget would also expand the Pell grant program, the federal government’s key way to help low-income students pay for college. Currently, the maximum Pell grant is $7,395 and it would increase by $750, according to the Department of Education.

Biden is proposing to eliminate the 1.057% origination fee charged to borrowers on each of their federal student loans.

The president also asks for $12 billion for a new Reducing the Costs of College Fund, aimed at funding strategies to lower college costs for students. More than half of that money would go to states to increase students’ access to career-connected dual enrollment opportunities.

The Biden administration reiterated its $13.6 billion request made in October to address migration at the southern border. Last month, Republicans blocked a major bipartisan border deal and foreign aid package.

Biden’s budget includes funding to hire 1,300 additional Border Patrol agents to secure the border; 1,000 additional Customs and Border Protection officers to stop illicit fentanyl and other contraband from entering the US; an additional 1,600 asylum officers and support staff to facilitate timely immigration dispositions, as well as $849 million for detection technology at ports of entry.

The budget also asks for a $4.7 billion emergency fund that the Department of Homeland Security could access in the event of a migrant surge along the US-Mexico border.

Extend Affordable Care Act subsidies and coverage for children

The budget calls for making permanent the expanded federal premium subsidies for Obamacare policies, which are currently set to expire at the end of 2025. The expansion provides more assistance to a wider range of enrollees and has fueled record sign-ups on the Affordable Care Act exchanges.

One budget proposal would also allow states to keep children continuously eligible in Medicaid or the Children’s Health Insurance Program for 36 months, rather than the current 12 months, and allow states to provide continuous eligibility until children turn 6.

The budget includes a 25% minimum tax on all the income of the wealthiest .01% of Americans, including their appreciated assets, which are not currently taxed. The measure would hit those with a net worth of more than $100 million. Prior efforts to add this type of tax were not successful.

The budget also proposes taxing capital gains at the same rate as wage income for those earning more than $1 million.

Biden wants to increase the corporate tax rate to 28%, up from the 21% rate set by the GOP tax cut package in 2017.

The budget would also raise the corporate minimum tax rate on billion-dollar corporations to 21%, from 15%.

Like last year’s budget, this year’s proposal would reduce incentives for multinational businesses to book profits in low-tax jurisdictions and raise the tax rate on their foreign earnings to 21% from 10.5%.

Biden proposes a new tax policy that would prevent C corporations from taking deductions for compensation over $1 million paid to any employee. The measure is aimed at discouraging companies from giving their executives massive pay packages.

Biden’s budget would restore the full $80 billion investment initially provided by the Inflation Reduction Act to help modernize the IRS and ramp up enforcement efforts on the wealthy. In a deal to address the debt ceiling and avoid a US default last June, Democrats agreed to allow for $20 billion of the Inflation Reduction Act funds to be rescinded.

In this year’s budget, the president reissued his plan to strengthen Medicare’s hospital insurance trust fund. The plan, first proposed in last year’s budget, would increase the net investment income tax rate on earned and unearned income above $400,000 to 5%, up from 3.8%. Also, it would be levied on the owners of certain pass-through firms who include business income on their personal tax returns and aren’t currently subject to the tax. In addition, it would dedicate the revenue from the tax, which was created by the Affordable Care Act, to Medicare’s hospital insurance trust fund. And it would funnel some savings from the proposed Medicare drug reforms into the trust fund.

This year, the administration said the proposal would shore up the hospital insurance trust fund indefinitely – rather than last year’s projection of 25 years or more – because it is looking over a longer time frame and anticipating slightly better economic assumptions, Shalanda Young , director of the Office of Management and Budget, said in a call with reporters.

Medicare’s hospital insurance trust fund, known as Medicare Part A, will only be able to pay scheduled benefits in full until 2031, according to the latest Medicare trustees’ annual report. At that time, Medicare, which covers nearly 67 million senior citizens and people with disabilities, will only be able to cover 89% of total scheduled benefits.

The president did not offer a detailed proposal to address the looming shortfall in Social Security’s trust fund. The budget reiterated his principles of not cutting benefits, asking higher-income Americans to pay more in taxes and improving benefits for lower-income seniors and people with disabilities. Social Security’s combined trust funds are set to run dry in 2034, at which time the program’s continuing income from taxes will only be able to cover 80% of benefits owed, according to the most recent Social Security trustees report.

Also, Biden’s budget calls for a funding increase of $1.3 billion, or 9%, from the enacted fiscal 2023 budget, to improve customer service at field offices and process disability claims more quickly.

Provide paid family and medical leave

Biden’s budget would establish a national paid family and medical leave program. It would provide 12 weeks of leave for eligible employees to take time off to care for and bond with a new child, care for a seriously ill loved one, heal from their own serious illness, address circumstances arising from a loved one’s military deployment or find safety from domestic violence, sexual assault or stalking, according to the administration.

Biden also wants to require employers to provide seven job-protected paid sick days each year to all workers.

Congress provided for some paid sick leave during the Covid-19 pandemic, but lawmakers let the benefit expire in 2021.

The president is proposing a new program to guarantee affordable child care for families with incomes up to $200,000 a year, saving the average family $600 per month, per child. Under the effort, which would cost about $400 billion over a decade, most parents would pay no more than $10 a day, and the lowest income families would pay nothing. It also provides $8.5 billion for the Child Care and Development Block Grant, which provides child care subsidies for low-income working families. And it would expand a tax credit to encourage businesses to provide child care benefits to their workers.

Invest in clean energy jobs and infrastructure

The budget calls for $1.6 billion, a 29% increase compared to 2023, to support clean energy infrastructure projects and jobs across the nation. This includes money to weatherize homes of low-income families as well as funds to help state and local governments build secure, reliable electric grids.

The budget also would provide long-term funding for the American Climate Corps, an initiative that launched last year to provide job training and service opportunities on a wide range of projects that tackle climate change.

The budget would provide an increase of $2 billion for cancer research at the National Cancer Institute and other agencies as part of the Biden Cancer Moonshot initiative.

Provide assistance with home heating and cooling costs

The budget provides $4.1 billion for the Low Income Home Energy Assistance Program, known as LIHEAP. That’s $111 million more than the fiscal year 2023 budget.

The number of people behind on their utility bills and the amount of money they owe are at record highs, according to the National Energy Assistance Directors Association, which began tracking these figures when arrearages exploded at the start of the Covid-19 pandemic in 2020.

The president would provide $8.5 billion for nutrition programs, including $7.7 billion dollars in the Special Supplemental Nutrition Program for Women, Infants and Children, known as WIC, which has seen a surge in enrollment lately.

Fund universal Pre-K and Head Start

The budget would create a voluntary, universal free preschool for the nation’s 4 million 4-year-olds and charts a path to expand preschool for 3-year-olds. Expanding preschool is one of Biden’s longstanding priorities. The president is also calling for beefing up funding for Head Start by $544 million to increase pay parity between the program’s staffers and public elementary school teachers with similar qualifications.

Read the full article here