We previously covered Roblox Corporation (NYSE:RBLX) in January 2023, discussing why it remained a speculative stock, with the management’s focus on delivering high growth implying its inability to generate positive net income profitability.

Despite the gaining traction and the injection of optimism from the management, we maintained our stance that the stock remained overvalued and was likely to be overvalued moving forward, resulting in our reiterated Hold rating.

In this article, we shall discuss why RBLX is still not a Buy, despite the double beat FQ4’23 earnings call, promising FY2024 guidance, and projected top-line growth at +20% through 2027.

Much of our bearish sentiments are attributed to the management’s over reliance on stock-based compensation and share dilution, with the accelerated erosion in shareholder equity well negating its high growth potential.

The RBLX Investment Thesis Remains Highly Speculative

For now, RBLX has reported a double beat FQ4’23 earnings call, with revenues of $749.9M (+5.1% QoQ/ +29.5% YoY), bookings of $1.12B (+34.9% QoQ/ +25.8% YoY), and GAAP EPS of -$0.52 (-13.3% QoQ/ -6.2% YoY), with FY2023 numbers of $2.79B (+26.8% YoY), $3.52B (+21.3% YoY), and -$1.86 (-20% YoY), respectively.

The top-line tailwinds are mostly attributed to the excellent growth in its Average Daily Active Users [DAU] to 71.5M (+1.3M QoQ/ +15.5M YoY/ +52.4M from FQ4’19 levels) and Average bookings per DAU to $15.75 (+31.6% QoQ/ +3% YoY/ +27.3% from FQ4’19 levels) by the latest quarter.

RBLX has also reported a successful aging up of its target demographics, with 41.4M of its DAU (+1.4M QoQ/ +9M YoY/ +33.7M from FQ4’19 levels) aged-13-and-over, comprising 57.9% of its overall user base (+1 points QoQ/ +2.8 YoY/ +17.6 from FQ4’19 levels).

Most importantly, readers must note that those aged-13-and-over have recorded increased engagement at 9.37B hours on the platform (-0.12B hours QoQ/ +2.05B YoY/ +7.85B from FQ4’19 levels), implying its ability to better monetize existing users while growing its target audience.

With growing overall hours engaged at 15.5B (-0.5B QoQ/ +2.7B YoY/ +11.8B from FQ4’19), it is unsurprising that RBLX has reported growing deferred revenue of $3.77B (+24.4% YoY) to be recognized over the next 28 months.

Thanks to the robust US labor market, the UCAN region continues to be the company’s top-line driver at $480M (+4.8% QoQ/ +27.1%) as well, comprising 64% of its FQ4’23 revenues (-0.3 points QoQ/ -1.1 YoY), well negating the inflationary pressures and elevated interest rate headwinds.

With the $1B debt only maturing by 2030, it appears that we may see RBLX’s cash on balance sheet continually grow from FQ4’23 levels of $2.19B (+1.8% QoQ/ -26.2% YoY/ +525.7% from FY2019 levels of $358.54M).

Much of the balance sheet tailwinds are attributed to the company’s improving Free Cash Flow generation of $78.11M (+31.2% QoQ/ +305.6% YoY).

This is on top of the management’s excellent use of cash at a time of elevated interest rate environment, with $116.92M in annualized interest income (+11.6% QoQ/ +151.3% YoY) by the latest quarter.

With a normalized economy likely to occur only by Q4’26, we may see RBLX’s liquidity remaining robust, supporting its growing operations without a need to rely on more debt and capital raises.

Unfortunately, here is where the good news end.

For now, RBLX has been reporting elevated Stock-Based Compensations of $867.97M (+47.2% YoY/ +4922.2% from FY2019 levels of $17.63M) in FY2023.

This consequently results in the sustained shareholder dilution to 626.82M (+7.47M QoQ/ +24.96M YoY/ +463.77M from FY2019 levels of 163.05M). The same has been observed in the declining Book Value Per Share of $0.12 (-40% QoQ/ -76.4% YoY/ -88% compared to FY2021 levels of $1.00) by the latest quarter.

As a result, while the management has guided impressive annual top-line growth at +20% through 2027, it appears that shareholder equity may be diluted at the same pace, if not faster.

This is attributed to RBLX’s underwhelming FY2024 profit margin guidance of 13.4% (+1.1 points YoY) at the midpoint, with the management also expecting “to continue to incur net losses in the foreseeable future.”

Much of the headwinds are attributed to the expectations that its “operating expenses will continue to increase, as we intend to continue to make investments to grow our business, including an expected increase in infrastructure, stock-based compensation expenses, and acquisitions,” with an “accumulated deficit of $3.6B” as of December 2023.

With RBLX still in a high growth stage, interested investors must also temper their intermediate term expectations, with GAAP profitability likely to occur only in the far future.

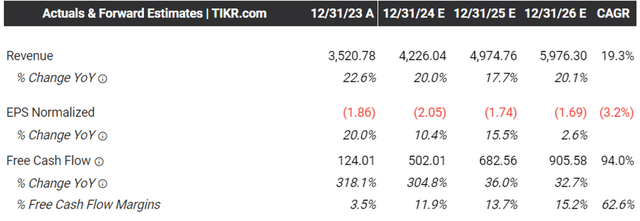

The Consensus Forward Estimates

Tikr Terminal

In addition, readers must also note that RBLX is not expected to be GAAP profitable any time soon, based on the management’s FY2024 revenue guidance of $3.35B (+20% YoY), booking of $4.21B (+19.6% YoY), and consolidated net losses of -$1.38B at the midpoint (-20% YoY).

These numbers imply that while the company may continue to report high top-line growth, losses may also deepen accordingly, sustaining its FY2024 net losses margin at approximately -41.1% (inline YoY), with the consensus estimates reflecting a similar unprofitable trend over the next few years.

So, Is RBLX Stock A Buy, Sell, or Hold?

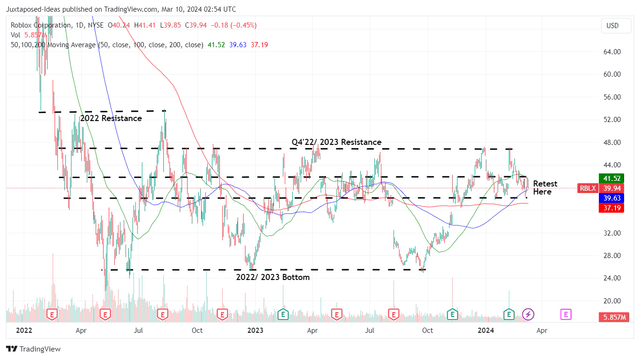

RBLX 2Y Stock Price

Trading View

For now, RBLX has lost much of its recent gains, while appearing to return to its previous trading range of below $42s, as observed since early 2022.

However, while the company may continue to generate positive Free Cash Flow, investors looking to add must also temper their intermediate term expectations, with the stock more likely to be a trade candidate instead of a growth candidate.

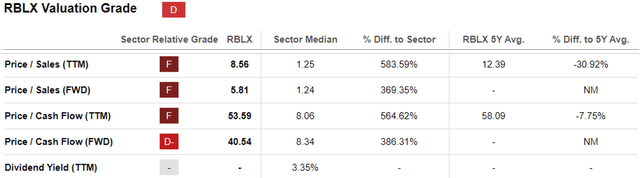

RBLX Valuations

Seeking Alpha

Most importantly, with inflated stock valuations at FWD Price/ Sales of 5.81x and FWD Price/ Cash Flow of 40.54x, compared to the sector median of 1.24x and 8.34x, it is apparent that RBLX is still very expensive here, offering interested investors with a minimal margin of safety.

While there has been promising developments in the real-time AI chat translation, avatar creation for social interaction, and advertising/ shopping related sales, readers must note that these are still early days, with RBLX only reporting increased brand engagement without any material sales contribution.

If anything, the management has highlighted that the advertising segment has yet to go to market as of FQ4’23, with sales recognition only expected over the next few quarters.

Given the early developments, we believe that it may be more prudent to observe RBLX’s execution for a little longer before being overly exuberant about its prospects.

As a result, we prefer to prudently maintain our Hold rating here.

Read the full article here