Investing in Vision: Ocular Therapeutics’ Market Outlook

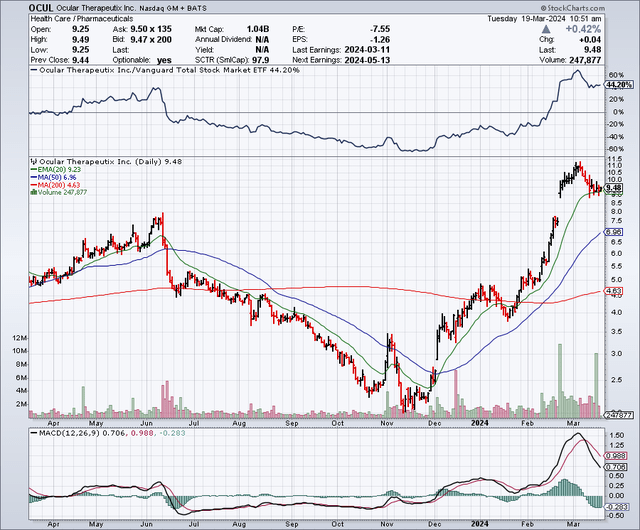

Ocular Therapeutix, Inc. (NASDAQ:OCUL) is catching the eye of many investors these days, with its stock up 184% within the past six months. According to Seeking Alpha’s Quant, Ocular ranks 8th overall and 2nd within its sector. It begs the question: What has changed here?

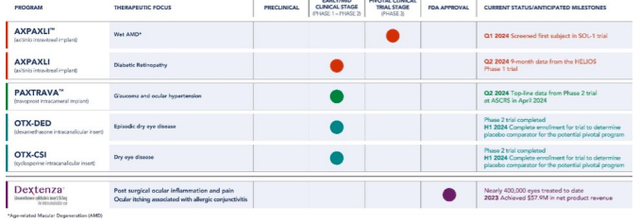

True to its name, Ocular is developing clinical assets for chronic ailments of the eye.

Ocular

There are a number of catalysts expected this year with various assets, so let’s get to it.

For one, Ocular’s Dextenza is an FDA-approved treatment for ocular inflammation and pain following eye surgery. Alongside modest revenue perks ($58.4 million in 2023 revenue; up 13.4 YOY) that are mostly offset by S&M expenses (63% of total revenues), Dextenza serves as a proof-of-concept, as it utilizes Ocular’s “proprietary Elutyx delivery technology” to provide a sustained intracanalicular release of dexamethasone (a common corticosteroid).

The most upfront catalyst will occur in early April s. Ocular’s intravitreal when Ocular anticipates presenting Phase 2 Paxtrava data in patients with open-angle glaucoma [OAG] or ocular hypertension [OHT]. Both conditions are characterized by elevated intraocular pressure [IOP], which can lead to vision loss if left untreated. Paxtrava is described as a “bioresorbable hydrogel implant based on Elutyx.” It aims to deliver travoprost, a prostaglandin that is FDA-approved to lower IOP, over the course of four to six months with a single treatment. This could reduce the burden of daily eye drops. Although Elutyx has proved effective intracanalicular, it’s unknown if the implant will tolerate intracameral injection. That is, if it will stay in the right place. Moreover, it’s unknown how sustained exposure to travoprost will impact outcomes. In the Phase 2 trial, Ocular’s Paxtrava will face off with a topical prostaglandin. Interestingly, prostaglandins have been around for decades. The most popular of these is latanoprost, which is safe, effective, and requires just one dose per day. Even if Ocular proves Paxtrava safe and effective, I don’t see it vying with simple and affordable drugs like latanoprost in first-line treatment. Furthermore, the need for semiannual, invasive injections to insert a new implant may be perceived by many as more burdensome than daily eye drops. Lastly, there are logistical challenges associated with semiannual injections as well, including healthcare provider training and scheduling considerations. So, while Paxtrava will be interesting to watch, I don’t find its market prospects appealing.

Moving on, Ocular anticipates topline data for OTX-DED (dexamethasone intracanalicular insert) in the fourth quarter of this year. OTX-DED targets short-term signs and symptoms of dry eye disease [DED]. This is essentially the same product as Dextenza, but, as the company notes, OTX-DED “has a lower dose and smaller insert size.” Ocular is also developing OTX-CSI (cyclosporine intracanalicular insert) for chronic treatment of DED, which is a considerably larger market than short-term DED. Again, Ocular is using a well-established drug but changing the delivery method to provide differentiation (e.g., less frequent dosing). The company reported (page 19) Phase 2 data for OTX-DED in December 2021.

Improvements from baseline were noted in the VAS dry eye symptoms for both OTX-DED 0.2 mg and OTXDED 0.3 mg groups, but there was little separation between OTX-DED and the vehicle hydrogel insert.

Ocular attributes the “little separation” to placebo performance and has since initiated a “small trial to develop an appropriate placebo comparator” for their DED programs. This small trial is the data they plan to report later this year.

The first-line treatment of DED involves artificial tears and environmental changes. Beyond that, there are a number of safe, affordable, effective, convenient, and well-tolerated topical treatments for DED (e.g., cyclosporine and lifitegrast). So, again, even in the event Ocular proves successful here in the clinic, I don’t think this will easily translate to the market.

Finally, Ocular is enrolling wet AMD patients in one of two pivotal Phase 3 trials to evaluate Axpaxli. This is their lead program and probably the most interesting prospect. Axpaxli is an intravitreal implant that delivers axitinib, a TKI approved for kidney cancer. Tyrosine kinase inhibitors (TKIs), which are popular choices in cancer treatment, have been tested in wet AMD before. The rationale for using TKIs for wet AMD centers around their ability to inhibit vascular endothelial growth factor (VEGF), which is known to play a significant role in the development of the disorder. However, past attempts have been unsuccessful due to systemic side effects. Ocular’s intravitreal implant should theoretically limit the risk of systemic side effects. Last June, Ocular presented (pages 13 & 14) 12-month data from a Phase 1 clinical trial.

The results showed subjects treated with a single AXPAXLI implant continued to demonstrate sustained BCVA (mean change from baseline of -1.0 letters) and CSFT (mean change from baseline of +20.2 μm) in the AXPAXLI arm at 12 months, which was comparable with the aflibercept arm (mean change from BCVA baseline of +2.0 letters; mean change from CSFT baseline of -2.2 μm). Sixty percent of AXPAXLI subjects were rescue-free up to Month 12.

The data for Axpaxli notably dropped off from what they presented after ten months (CSFT was -1.3 μm from baseline) and this is consistent with the implant lasting only 8-9 months (per the company). The goal here is, again, to reduce the treatment burden, as first-line treatment (VEGF inhibitors like Eylea) requires multiple injections per year and is associated with adverse effects.

However, as Ocular notes (page 29), there are several competitors for each of their products. Axpaxli, for example, faces competition from other sustained-release TKIs, some of which also utilize bioerodible devices. Moreover, companies like Adverum Biotechnologies, Inc. (ADVM) and REGENXBIO Inc. (RGNX) are developing one-and-done gene therapies for wet AMD.

Financial Health

Turning to the balance sheet, as of December 31, Ocular reported $195 million in cash and cash equivalents. Their current ratio, after dividing their current assets by their current liabilities, is 6.8. This signals that the company is easily able to cover its liabilities over the next twelve months.

For the year, net cash used in operating activities totaled $70 million. This suggests a monthly cash burn of nearly $5.8 million. Their cash runway, based on historical figures, can be estimated to last another 33 months.

However, Ocular raised an additional $325 million after securing a private placement of its shares in February. This significantly extends their cash runway.

Based on the information above, the odds of Ocular requiring additional capital within the next year seem low.

Market Sentiment

According to Seeking Alpha, after outperforming the broader market (SP500) 90% to 31% over the past year, Ocular’s market capitalization is $1.4 billion.

StockCharts.com

Short interest is 3.69% of the float, which is modest for a biotechnology stock. Ocular has seen robust institutional activity as of late, with new positions totaling ~30 million shares compared to just 2.4 million shares sold out. Deer Track Capital is a new name and a top holder. Others include biotechnology-focused funds like Citadel Advisors and Opaleye Management. Insider activity has been positive, too. Nearly 4 million shares have been bought, versus just 89,484 sold over the past year.

Based on the data, Ocular’s market sentiment can be qualified as “robust.”

My Analysis and Recommendation

Ocular is a good example of how fast the market sentiment can change in biotechnology. There haven’t been many updates since December, yet shares have rallied massively on relatively heavy volume. I do find their prospects for wet AMD particularly interesting and worthy of speculation. TKIs probably have a future role in wet AMD and Ocular’s data, so far, appears superior over its competitors (based on the data I’ve seen). However, Ocular faces considerable existing and potential competition, even within their sustain-release TKI niche. Moreover, the clinical development pathway has been a slow process thus far. Ocular remains a few years away from marketization for “big money” indications like wet AMD and glaucoma.

I think the stock’s rally has fully priced in Ocular’s prospects at the moment, so this is a Hold and buy on dips for me. Despite having an approved drug, Ocular is very much still a speculative investment, so investors are encouraged to diversify their portfolios to mitigate idiosyncratic risks (e.g., clinical trial failure, dilution, competition, etc.).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here