Sometimes you get opportunities to rectify mistakes. After UiPath Inc. (NYSE:PATH) delivered stunning fourth quarter results highlighted by its first-ever quarter of GAAP profitability, the stock soared in the after-hours session. But in the trading sessions since, the stock has given up those gains – and more. The market’s lack of enthusiasm for the strong results has given investors (including me) an opportunity to return to bullishness, especially as PATH continues to solidify itself as a true beneficiary of generative AI. I am now reducing my required rates of return for the stock on account of the lower implied risk, and am upgrading the stock from hold to buy.

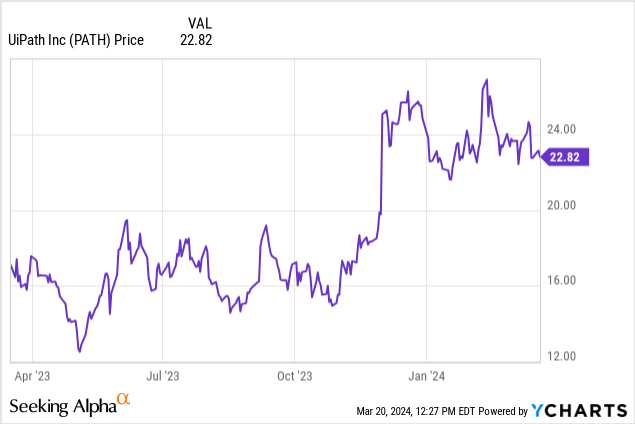

PATH Stock Price

I last covered PATH in December, where I explained why I was downgrading the stock on account of valuation. The stock has since underperformed the broader markets by around 20%.

That kind of underperformance is usually quite significant, though some might overlook it given the high volatility of tech stocks nowadays.

PATH Stock Key Metrics

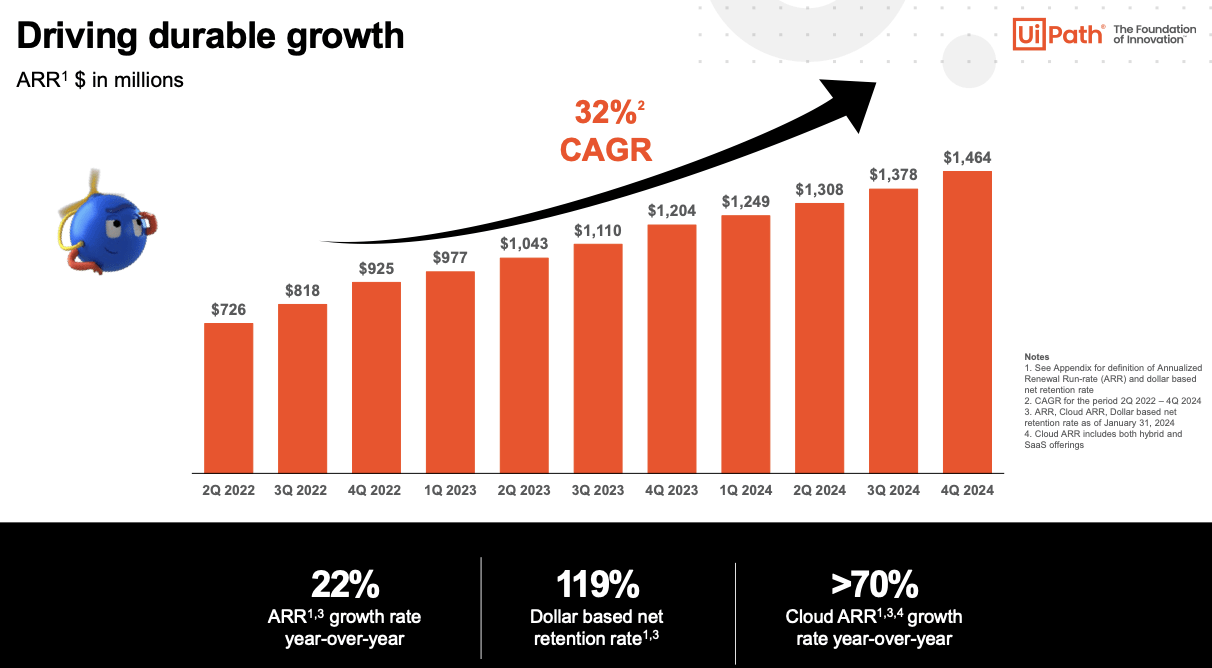

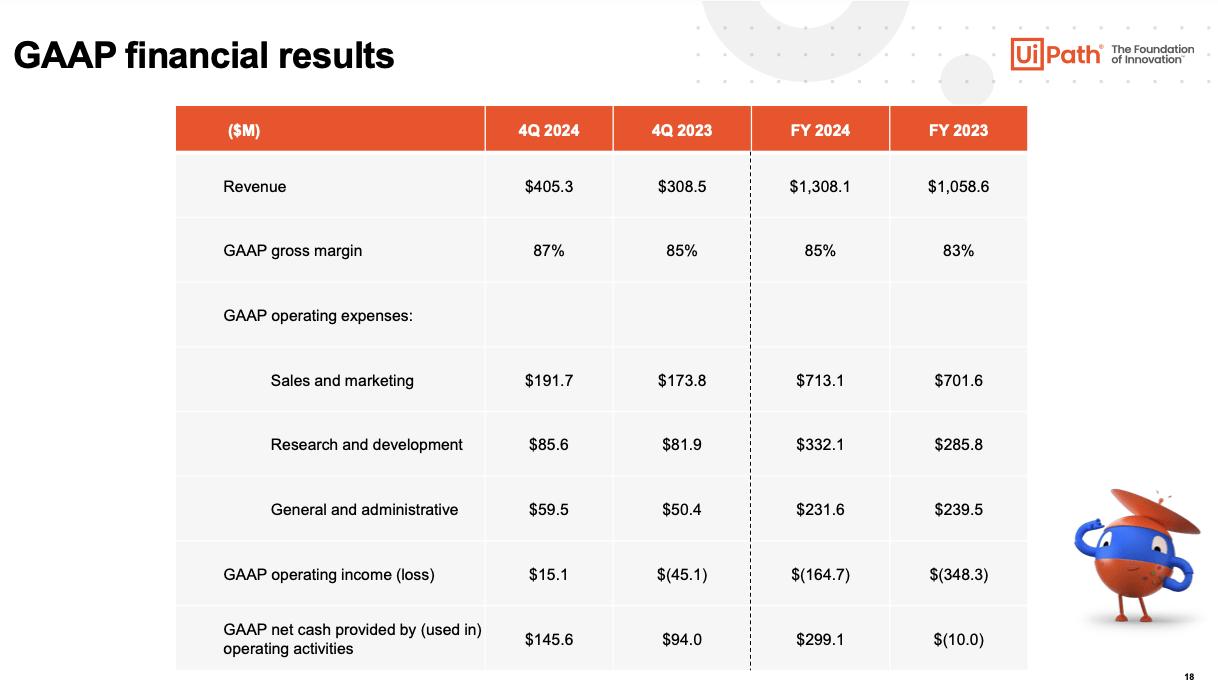

In its most recent quarter, PATH delivered 22% YoY growth in ARR to $1.464 billion, surpassing guidance for $1.455 billion.

FY24 Q4 Presentation

The company generated a 119% dollar-based net retention rate, representing some sequential deceleration from the 121% rate posted in the third quarter but still pacing the industry.

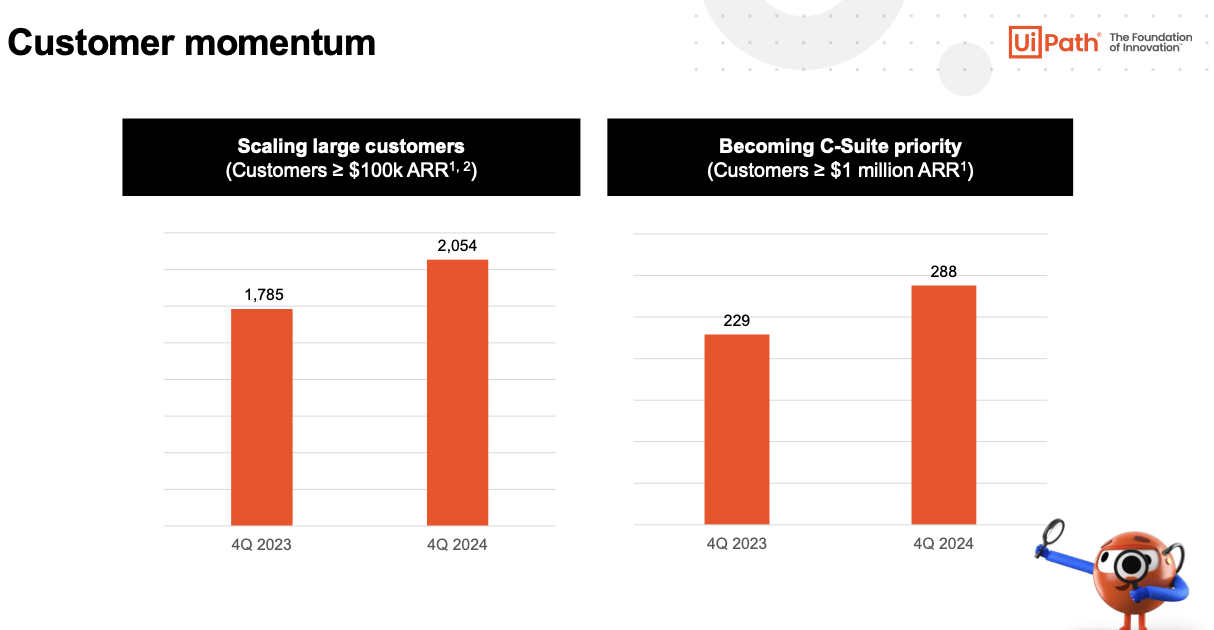

PATH continues to show solid growth among its largest customers.

FY24 Q4 Presentation

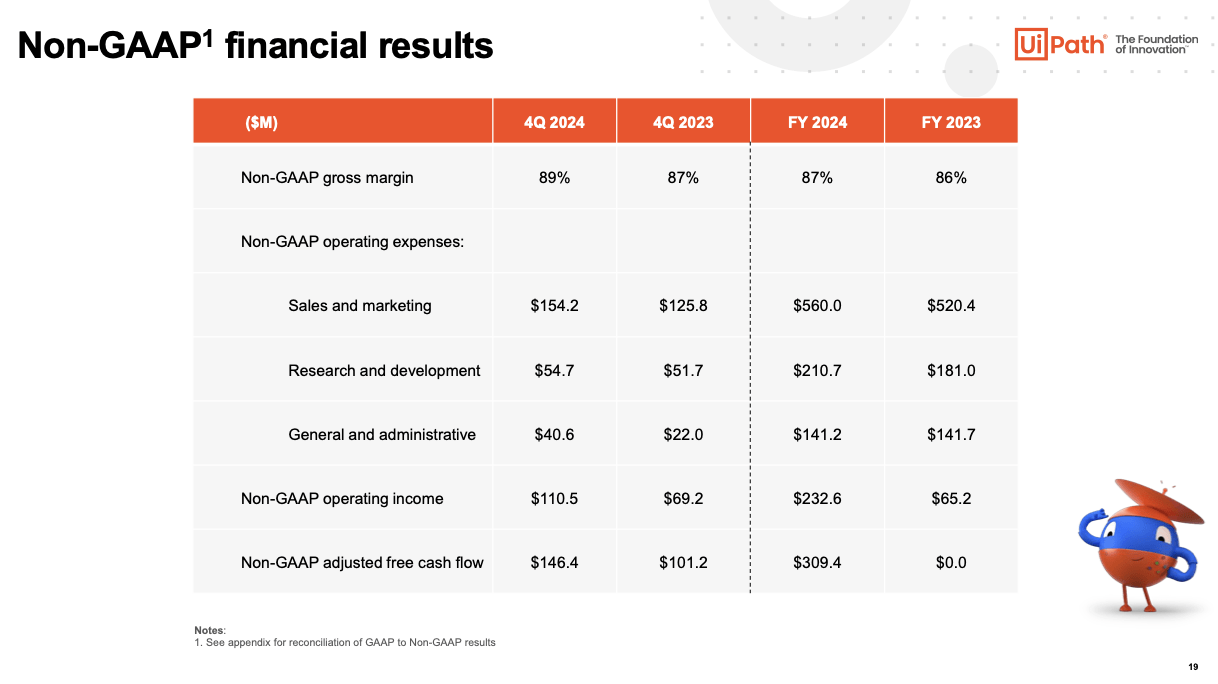

On the profitability front, PATH crushed non-GAAP operating guidance of $78 million as it ended up generating $110.5 million.

FY24 Q4 Presentation

The company actually ended up delivering positive GAAP operating income which in conjunction with the net interest income led to $33.9 million in GAAP net income.

FY24 Q4 Presentation

PATH ended the quarter with $1.9 billion of net cash, representing a bulletproof balance sheet.

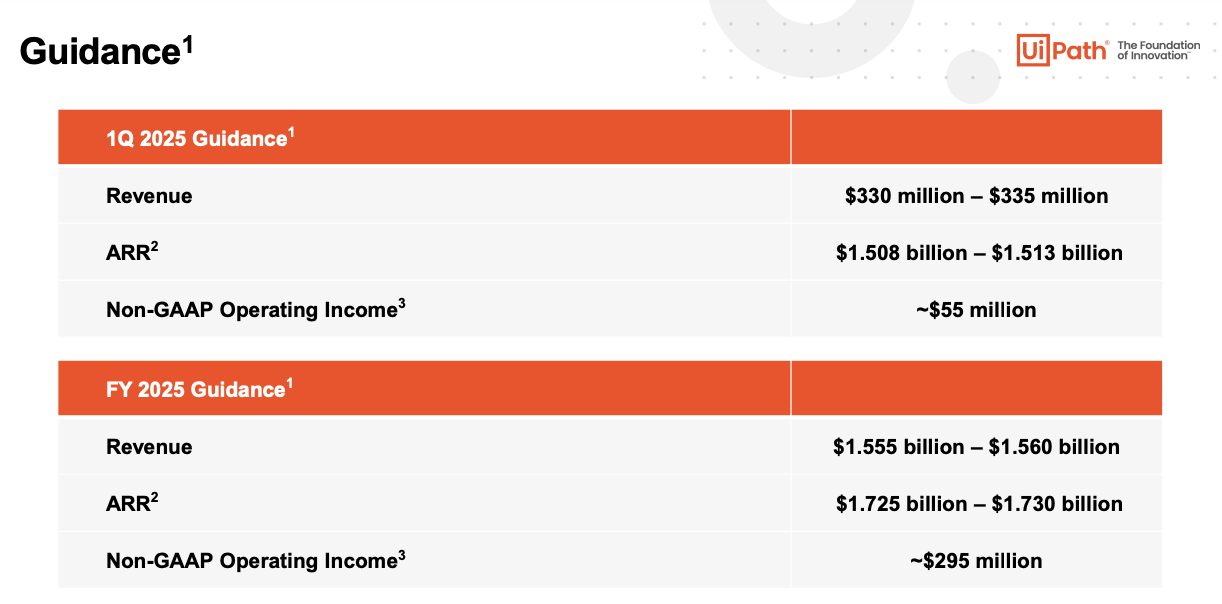

Looking ahead, management has guided for the first quarter to see up to $1.513 billion in ARR, representing 21% YoY growth and for the full-year to see up to $1.73 billion in ARR, representing 18.2% YoY growth. Non-GAAP operating income is expected to rise 26%.

FY24 Q4 Presentation

Management assumes $675 million in first half revenues, implying stronger second half growth, which is typical of the company’s historic seasonality.

On the conference call, management noted that remaining performance obligations grew 30% YoY to $1.16 billion and cRPOs grew 26% YoY to $707 million. I continue to expect the strong RPO growth to lead to an acceleration in revenue and ARR growth at some point.

Management also noted that the company repurchased 2.6 million shares at an average price of $19.21 in the quarter, as well as an additional 938,000 shares at an average price of $23.46 through March 12th. Given the company’s GAAP profitability and net cash balance sheet, I have no issues with continued execution of the share repurchase program.

An analyst asked management if they intend to sustain GAAP profitability moving forward. While management declined to provide explicit guidance confirming as such, they did state that they are looking at both cash and equity expenses “as equal components of capital now,” and that they may “update more information at the appropriate times in terms of long-term margins.” My guess is that the company can generate positive GAAP net income in several quarters this year, before aiming for sustainable GAAP profitability in the next fiscal year, if not earlier.

Is PATH Stock A Buy, Sell, Or Hold?

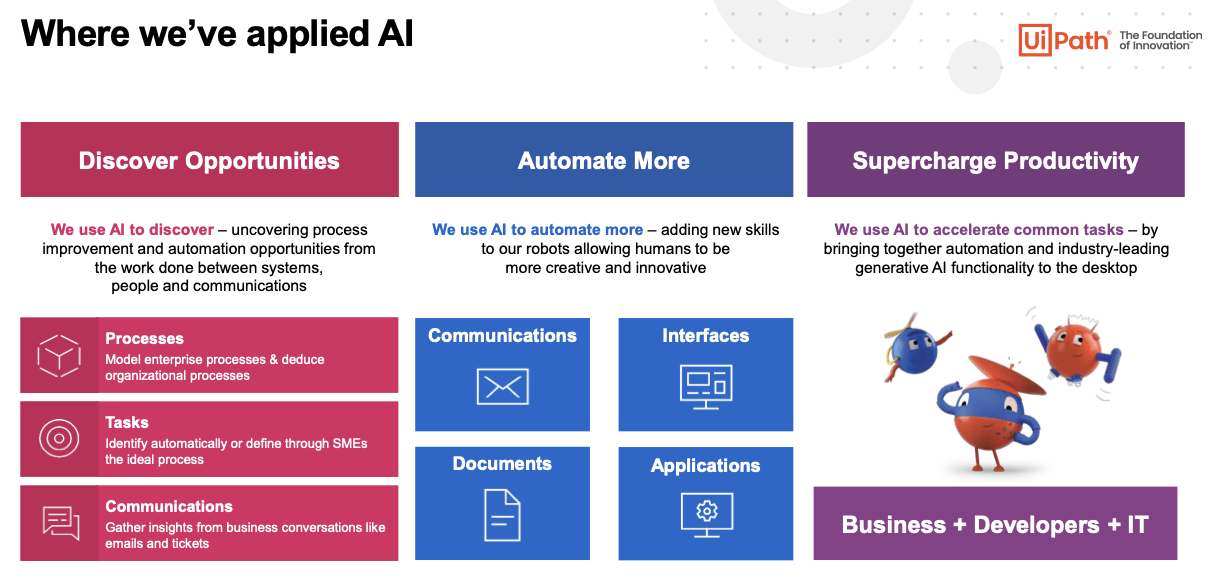

PATH is an enterprise tech company enabling digital automation. That has made it a natural beneficiary of generative AI.

FY24 Q4 Presentation

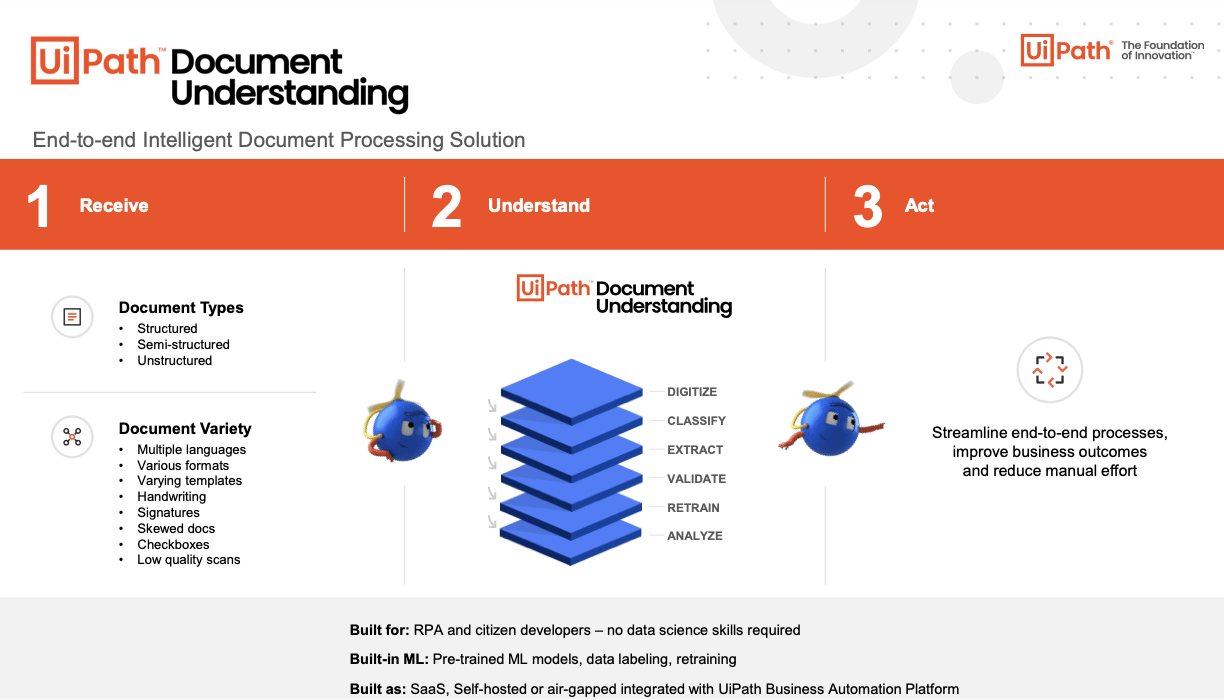

PATH has integrated generative AI into its product suite, including an end-to-end document processing solution.

FY24 Q4 Presentation

During a period in which tech stocks with vague association with generative AI have seemingly all soared to incredible valuations, it is interesting to see PATH stock trading at “just” 8.4x this year’s sales. Consensus estimates are not expecting any acceleration in top line growth.

Seeking Alpha

In my view, consensus earnings estimates look too conservative given that they are not incorporating much operating leverage at all.

Seeking Alpha

I previously thought that PATH was not trading at compelling value when the stock was 10% higher. A 10% drop since my last report has improved the margin of safety slightly, but not that much. Instead, my improving view of the stock comes from the company’s positive GAAP net income generation in this past quarter, as that helps to reduce the risk profile and therefore the required hurdle rate. I can now see PATH sustaining its 8.4x sales multiple, and even trade up to as high as 10x sales. I expect the company to generate 30% net margins over the long term, which would place those multiples at around 28x to 33x long term earnings power. That valuation looks justified when compared against the 15% to 20% top-line growth rate as well as the net cash balance sheet.

What are the key risks? I should note that while I have not factored in accelerating top line growth in my valuation model, it is possible that growth rates decelerate even faster than consensus estimates. RPO growth is typically an indicator of future top line growth, but that has not proven to be the case for PATH for many quarters now. While PATH appears to be a likely beneficiary of generative AI, it is still too early to conclude as such, as generative AI’s true long-term impact is arguably still largely unknown. Some of my increased bullishness is due to the rising valuations in the tech sector – I would likely need to lower my fair value ranges if the tech sector overall retreats.

I am upgrading UiPath Inc. stock from hold to buy due to the sudden push to GAAP profitability, as the current valuation appears attractive relative to the improving risk profile.

Read the full article here