Investment Thesis

Veritone, Inc.’s (NASDAQ:VERI) goal appears to be to leverage AI to help their clients solve complex problems and improve decision-making processes. That’s their narrative. But the underlying facts point to a company that is barely growing on the top line. What’s more, despite their lofty goals, the business is barely profitable.

Meanwhile, its balance sheet is restrictive and doesn’t allow the business much, if any, room to maneuver.

Don’t buy this hyped-up stock.

Rapid Recap

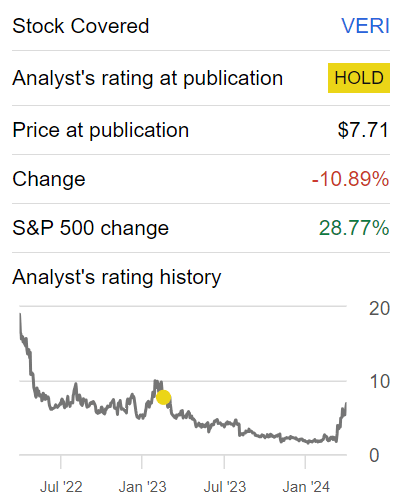

Back in February of last year, I said:

Veritone has dramatically outperformed the S&P500 in the past month, as investors latch onto the AI theme.

However, under the surface, the business’ prospects do not appear to be congruent with investors’ recently found excitement.

At the time, the stock was rallying strongly, but I recommended that investors avoid this name.

Author’s work on VERI

The stock proceeded to sell off subsequently and is down approximately 10% in the past year, while the S&P 500 (SP500) is up more than 28%. I now reiterate my stance. Avoid this hyped stock. Here’s why.

Veritone’s Near-Term Prospects

Veritone specializes in AI technology. They develop services that use AI to analyze data, particularly in areas like talent acquisition, media and entertainment, and the public sector. For example, their AI-powered platform helps companies and organizations process and understand data more efficiently, whether it’s analyzing job postings to find the right candidates, sorting through media content for insights and trends, or assisting government agencies with tasks like analyzing video evidence. They also offer services like advertising and content analytics, helping businesses make better decisions based on AI-driven insights.

Moving on, Veritone faces several near-term challenges as it navigates its path toward profitability. One challenge lies in its dependence on certain key customers, particularly Amazon (AMZN), which represented a substantial portion of its revenue in previous years. Even though the company anticipates reducing Amazon’s contribution to less than 5% of consolidated revenue in 2024.

Another notable challenge for Veritone lies in the company’s exposure to the advertising market. Although the company anticipates improvements starting in Q2 2024.

With this context in mind, let’s now discuss its fundamentals.

Revenue Growth Rates Are Too Volatile

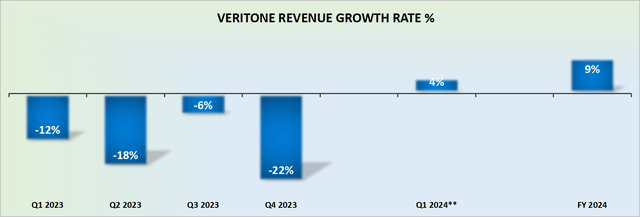

VERI revenue growth rates

Veritone’s revenues imply that there could be as much as 9% y/y revenue growth expected this year (very best-case scenario). That’s terrific, on the surface, at least. But then we contrast this revenue growth to the low comparables with the prior year and a very different sense emerges.

Given the very easy comparables with the prior year, one would have craved at least 30% CAGR for Veritone to be perceived as a company that has suddenly found a way to gain meaningful traction.

What’s more, given how erratic its revenue growth rates are, one should not value this stock as a high-growth business with strong recurring revenues, something that we discuss next.

VERI Stock Valuation – Too Richly Priced For What It Offers

Looking ahead, Veritone’s non-GAAP net margins are expected to close the year at approximately negative 5%. Yes, that’s a tremendous improvement from the negative 29% non-GAAP net margins that it closed 2023 with.

But is this truly enough to make this stock so compelling? I argue that it’s not. For one, despite operating in a highly coveted area of the market, its products are still unprofitable.

And plus, the business still has to embrace the fact that its balance sheet carries approximately $50 million of net debt. Furthermore, Veritone’s term loan carries an interest rate of 8.5% (page 83), a figure that is notably high and reflects creditors’ stance on Veritone’s prospects.

As a reference point, I believe that Veritone’s free cash flow in 2024 will be approximately negative $15 million (in the best case). For this estimate, I took the high-end of Veritone’s non-GAAP net income guidance of negative $10 million, together with its $5 million of capex.

The Bottom Line

In conclusion, after thoroughly analyzing Veritone’s financials and valuation, I firmly believe that investing in this company is not advisable.

Despite its narrative of leveraging AI to solve complex problems, the underlying facts reveal a business struggling to achieve substantial growth and profitability.

While there have been improvements in non-GAAP net margins, they remain negative. Moreover, with a balance sheet burdened by approximately $50 million of net debt and high-interest term loans, Veritone’s financial flexibility is limited.

Considering Veritone, Inc. stock’s valuation, erratic revenue growth rates, and significant financial challenges, I recommend avoiding this stock.

Read the full article here