The Road Ahead

Investment Thesis

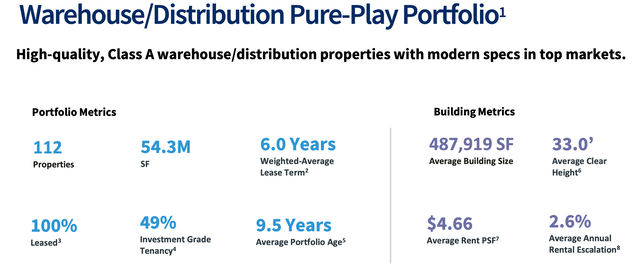

LXP Industrial Trust (NYSE:LXP) is an industrial REIT. Their 112 building, 54 million square foot portfolio of modern single-tenant warehouse and distribution industrial properties is focused in the Sunbelt and Midwest.

Currently trading at 13% above the low and 45% below the high for the last three-year period, with a reasonable 14 P/FFO, and offering a 5.87% dividend yield, LXP might merit investor consideration.

However, LXP has underperformed peer REITs for years, and the market does not appear enthusiastic about performance going forward.

The mix of good assets, reasonable valuation, and underperformance vs. peers, coupled with the consolidation trend in REITs, suggests that LXP may be more valuable as an M&A acquisition for another industrial REIT than as an independent REIT.

We identify three potential buyers and consider the speculative case for M&A.

Evolution from Diversified to Industrial REIT

LXP has not always been an industrial REIT.

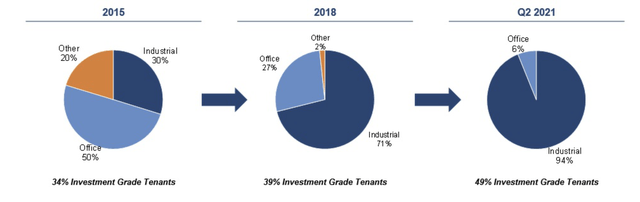

In an October 2021 letter to shareholders LXP discussed its rather lengthy evolution from a diversified net-lease REIT with a heavy focus on office properties to a pure-play industrial REIT focused on single-tenant warehouse and distribution properties. The evolution is summarized below.

LXP Evolution to Industrial (LXP Letter to Shareholders – Oct 2021)

In LXP’s view, they were essentially an industrial REIT by mid 2021, i.e. three years ago. On 15 December 2021, Lexington Realty Trust marked this progress by rebranding as LXP Industrial Trust.

Joint Ventures

As part of this transition, LXP formed two joint ventures “JV,” the Office JV and the Industrial JV.

In September 2018, LXP sold a 21 property, 3.8 million SF suburban office portfolio to a new Office JV, retaining a 20% interest.

On 03 January 2022, LXP “recapitalized a 22-property special purpose industrial portfolio consisting primarily of manufacturing assets” through a sale to a new Industrial JV, with LXP retaining a 20% interest. That partnership agreement is available here.

As an example, the largest property in the Industrial JV is the 994,000 SF occupied by Pratt & Whitney’s North Berwick Aero Systems, producing commercial and military jet engines.

LXP Today

Today LXP characterizes themselves as a “pure-play” warehouse/distribution industrial REIT, owning 112 Class A properties with 54 million SF. In addition there’s a very small Other Property portfolio and the two unconsolidated JVs.

LXP Portfolio Summary (LXP Q4 2023 Presentation )

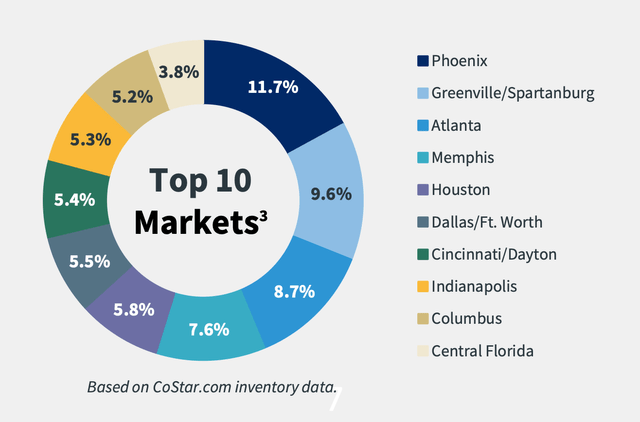

About 70% of ABR comes from LXP’s top 10 markets and demonstrates the Sunbelt and Midwest focus.

LXP ABR Distribution by Market (LXP Q4 2023 Presentation)

LXP’s Other Property portfolio held 3 properties on 31 December 2023. Two are office properties in Fort Mill, SC, which are under contract for sale and expected to close in Q2 2024. The third property is a ground lease for land under a parking garage held in a joint venture.

The Office JV held eight properties with 951,000 SF on 31 December 2023, about 25% of the JV’s original size.

The Industrial JV held the original 22 properties on 31 December 2023.

LXP Management

T. Wilson Eglin (age 59), Chairman and CEO, has been associated with LXP or precursor companies since 1993. He has served as CEO since January 2003 and chairman since April 2019.

Per the most recent Proxy Statement (April 2023), Mr. Eglin beneficially owned 2.98 million shares on that date, about 1% of shares outstanding.

LXP 2023 Results and Guidance

LXP reported full-year 2023 results and offered guidance in the Q4 2023 Earning Call and Presentation and 2023 Annual Report, all 15 February 2024.

For full year 2023:

- $340.5 million gross revenue, up 6% from 2022

- $0.70 adjusted FFO/share for 2023, up 4.5% from 2022

- 4.1% full year industrial same-store NOI growth

- 6.8 million square feet leased

- 37% cash based rental increases, excluding fixed renewals

- 3.7% average escalator on leases signed in 2023, excluding fixed renewals

- $122 million spent on development, $53 million remaining to complete current projects

- $36 million G&A, down 5.4% from 2022

- Paid $152 million in dividends to common and preferred shareholders

At the end of year:

- Industrial stabilized portfolio 100% leased

- 98% of industrial portfolio leases had escalators with an average annual rate of 2.6%

- 6x net debt to adjusted EBITDA

- $600 million unsecured revolving credit facility was fully available

- $1.8 billion consolidated debt outstanding

- 3.9% weighted average interest rate

- 5.8 years weighted average term to maturity

- 7% floating rate debt

2024 Guidance

- $0.61-65 FFO/share, down 7.1%-12.9% from 2023; reflecting “revenue loss from our office sales, the timing of development leasing and increased interest expense”

- 3.5%-4.5% same store industrial NOI growth

- 2.9 million square feet of leases expire in 2024

- 20%-30% anticipated cash rental increase for 2024 renewals

- $37-39 million G&A

Longer-Term Expectations

Longer term, the CEO, Will Eglin, pointed to three “building blocks for steady growth”:

- 2.6% average annual fixed rate escalators

- $36 million in initial annual cash rent or $0.12 per share, from leases expiring through 2029 that are 23% below current market

- $20 million of initial annual cash rent or $0.07 per share, from stabilization of the 3.7 million square feet of non-leased development in the pipeline

In addition, LXP expects to shift focus from spec development to build-to-suit.

Brendan Mullinix, the Chief Investment Officer, noted in the Q4 earnings call:

The leasing market for new construction continues to be challenged given the supply of big box product as prospective tenants have more choices, are taking longer to make decisions and are being more cautious in the current macro environment.

We currently believe the build-to-suit market will provide us with the best investment opportunities.

One of the analysts raised the issue of growth.

Recognize you do have a lot of embedded growth within the portfolio to unlock, but that’s sort of limited by how many leases are falling each year. So just how — can you talk to how you’re thinking about how income growth evolves in today’s funding environment?

Brendan Mullinix, the Chief Investment Officer, replied (edited for brevity):

I would point you to the building blocks of growth that Will Eglin outlined in his prepared comments. In addition, in the investment market, we’re currently seeing build-to-suit as potentially being a very interesting line of business for us, which would be – we think in the range of 6.5 to 7 for initial going in yields.

LXP Debt – OK For Now

Fitch affirmed LXP’s rating as BBB and stable on 15 March 2024.

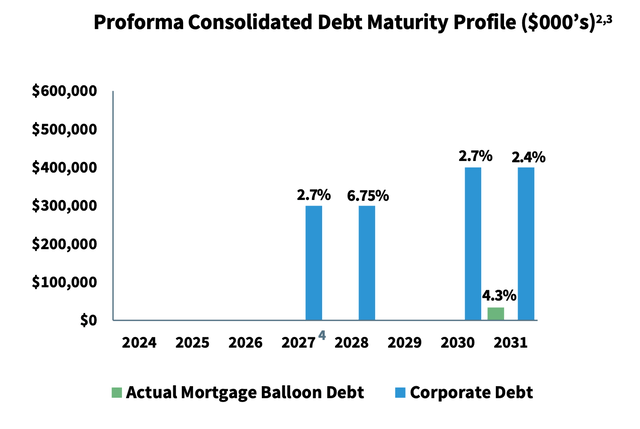

In 2023, LXP extended the maturity of their $300 million term loan from 2025 to 2027 and raised $300 million at 6.75% in a bond offering due November 2028 (to be used in part to pay off all the June 2024 debt), leaving their expected pro forma debt going forward as shown below. The 2027 debt adjusts to SOFR + 100 bps rate February 2025.

LXP Proforma Debt (Q4 2023 Earning Presentation )

From the Q4 earnings call:

With the expected payoff of the 2024 notes, we’ll have no debt maturing until 2027 and a proforma weighted average interest rate of 3.8% and a weighted average term of 6.5 years. Approximately 7.2% of our debt is currently floating, which is expected to increase to 27% at the beginning of 2025.

They have about two years before refunding begins to become a significant issue, although the 2027 debt converts to floating at SOFR + 100 bp in January 2025.

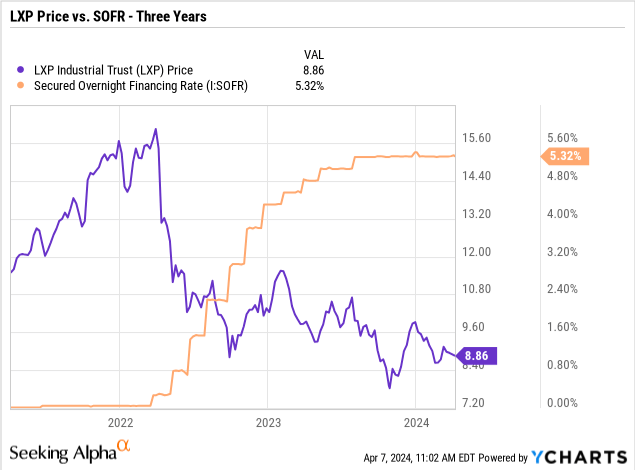

There certainly appears to be an inverse correlation between their stock price and the Secured Overnight Financing Rate, the reference interest rate for their floating rate debt.

One might also note that the 6.5%-7% initial yields they currently see for build-to-suit investments doesn’t leave much margin over their recent 6.75% debt issue.

Depending on one’s view of “higher for longer,” the potential refunding impact going forward could be significant.

LXP paid $46 million in interest in 2023. Back of the envelope, if the $1.4 billion in corporate debt above was refunded at 300 basis points higher than the 2023 rates, it would roughly double 2023 interest costs, costing ~ $0.15 per share.

LXP Dividend

LXP pays a common share dividend of $0.13 per quarter, yielding ~ 5.87% at the current price. The projected dividend / FFO payout ratio for 2024 is a relatively secure 83%, but leaves limited room for material growth. The dividend was increased by 4% for Q4 2023.

LXP Valuation

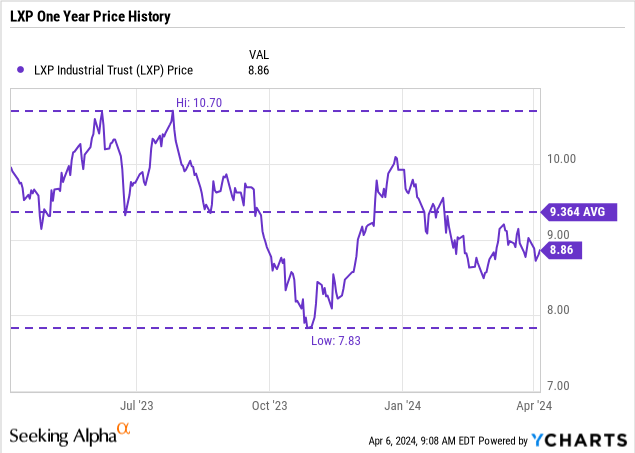

The market’s assessment over the last year has ranged between ~ $8-11. Wall Street (average of six analysts) suggests that’s not going to change dramatically, with a $9.90 price target (and a $7.00 to $11.50 range), about 10% above the current price.

Seeking Alpha reports that LXP’s relative valuation with other industry REITs, e.g. Prologis, Inc. (PLD), First Industrial Realty Trust, Inc. (NYSE:FR), and STAG Industrial, Inc. (NYSE:STAG) appears reasonable to inexpensive.

EV/EBTIDA for LXP is 17.8, STAG is 18.3, FR is 22.0, and PLD is 25.4. In terms of forward P/FFO, LXP is 14.2, STAG is 15.8, FR is 19.7, and PLD is 22.7.

All in all, this suggests that a fair value for LXP is in the $10-$11 range, with a maximum value of perhaps $13-$14.

Considering LXP as a Candidate for M&A

We should be clear that there is, as far as I know, no current public discussion or comment by LXP or any potential buyer of M&A activity involving LXP. But it’s interesting to speculate on the potential.

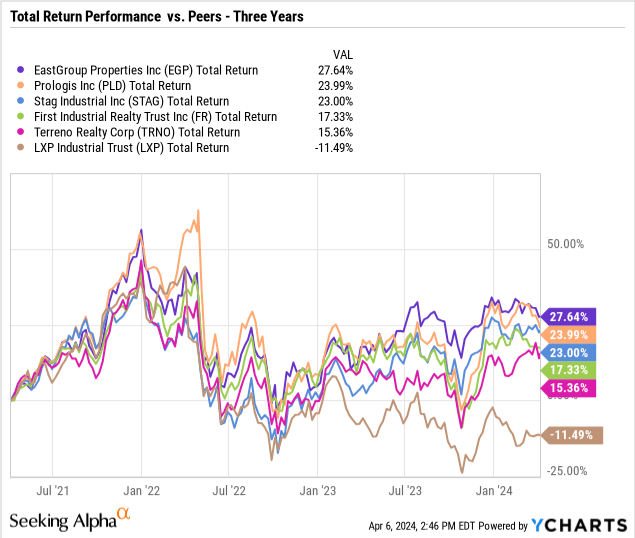

I view the potential here to have three parts: Good assets, a reasonable current valuation of the stock (both discussed above), and history of underperformance vs. peers. The underperformance suggests there may be an opportunity for improvement.

LXP Has Underperformed vs. Peers

LXP has underperformed industrial REIT peers on a total return basis over one, three and five years – the results for three years are shown in the chart below. Note that their conversion to industrial was essentially completed by mid 2021.

Recall that the above results don’t consider inflation, which over that three-year period was about 18%, per the CPI calculator.

LXP Has a History of M&A Interest

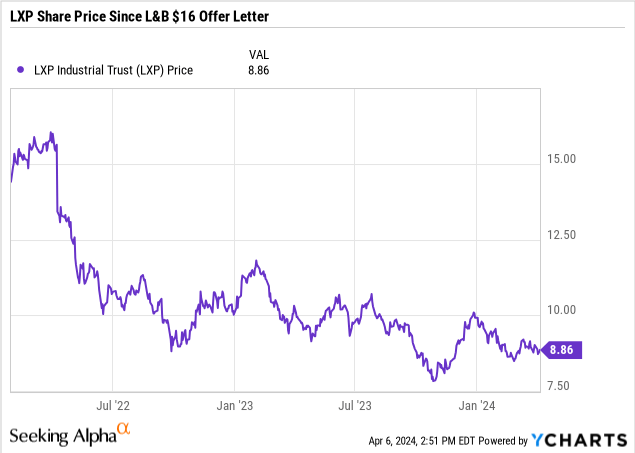

LXP attracted M&A attention in 2022.

On 28 January 2022, Land & Buildings Investment Management (“L&B”) sent a letter to LXP stating they would be interested in acquiring LXP at $16 per share in cash, with LXP then trading at $14.41.

LXP began a strategic review process in February 2022, “including a sale or merger of the Company.” They suspended the process in April 2022, citing “significant changes to macroeconomic, geopolitical and financing conditions.”

Richard S. Frary, Lead Independent Trustee of the Board, commented:

Following a thorough evaluation of alternatives the LXP Board determined that, the continued execution of LXP’s strategy remains the best path to enhance shareholder value at this time. As we continue to execute our disciplined growth strategy to build on our strong momentum, we will remain open to all alternatives to maximize shareholder value.

The share price has declined 40% since the L&B offer letter.

Well, that’s water under the bridge. Let’s take a look at the environment today.

M&A – Potential Buyers for LXP Today

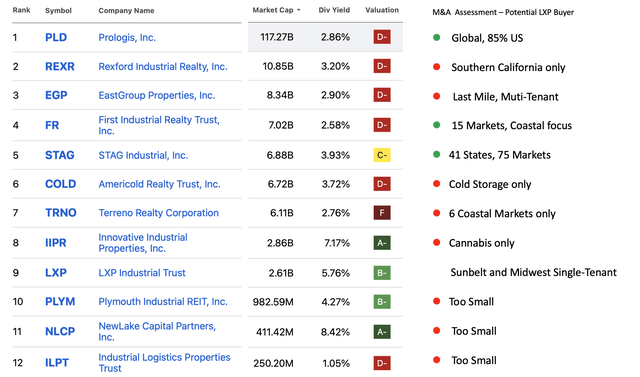

Seeking Alpha identifies 12 industrial REITs. The table below lists them by Market Cap, with Dividend Yield and Valuation. I added the M&A Assessment column to the right, with the red and green stoplights denoting my assessment of potential buyers.

LXP Potential M&A Summary (Seeking Alpha data, author analysis and table)

LXP ranks No. 9 by market cap. Three materially smaller REITs are unlikely to have the capability to acquire LXP and will not be considered further.

Based on my review of the strategic fit for LXP assets, I eliminated five of these as potential buyers:

- Rexford Industrial Realty, Inc. (NYSE:REXR); Southern California only

- EastGroup Properties, Inc. (NYSE:EGP); Multi-Tenant Last Mile Distribution

- Americold Realty Trust, Inc. (NYSE:COLD); cold storage only

- Terreno Realty Corporation (NYSE:TRNO); 6 coastal markets only, infill

- Innovative Industrial Properties, Inc. (NYSE:IIPR); cannabis cultivation

That leaves only three industrial REITs as realistic candidates, to acquire LXP:

- Prologis, Inc. (NYSE:PLD)

- First Industrial Realty Trust, Inc. (FR)

- STAG Industrial, Inc. (STAG)

Note again this is speculative. We will look at these in a little more detail in the next section.

Other Possibilities

There are at least two other possible buyers for LXP that come to mind.

First, Realty Income (NYSE:O) is a $45 billion market cap triple-net REIT with 12.7% of $4.0 billion 2023 ABR (i.e. ~ $500 million) from industrial properties. LXP’s $340 in revenue would bring the industrial fraction up to ~ 19%.

Second, private equity might be interested. Blackstone (NYSE:BX) for example raised $30 billion in 2023 for real estate investments.

The Impact of Acquiring LXP’s Assets

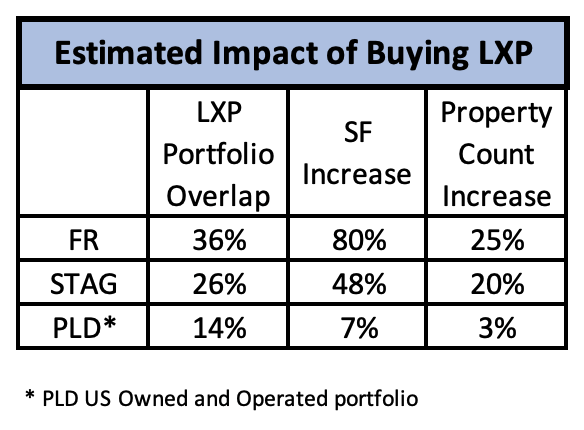

We will next try to make an assessment of how acquiring LXP’s assets might impact on PLD, FR, and STAG. The table below summarizes three indicators – how well the assets match (overlap), and the relative size of the addition in SF and property count.

Impact of Buying LXP (Data from company Annual Reports, table by author)

The (admittedly rough) portfolio overlap estimate presented in the table require some explanation.

The estimate is based on an analysis of the geographic data presented in the four annual reports, which in terms of Top N Markets. We calculate the fraction of LXP’s Top 10 Markets that overlap with PLD’s Top 13 markets, and FR’s and STAG’s Top 15 markets. We use SF for PLD, all others use ABR.

These overlap estimate should be a lower bound but give a fair sense of how well the companies strategies – as reflected by their most important markets – match.

These top markets account for less than 100% of each total portfolio – 69% for LXP, 74% for PLD, 95% for FR, and 49% for STAG. (For PLD we use the US Owned and Managed portfolio). This means that FR has the most concentrated portfolio, followed by LXP, then PLD, with STAG by far the most distributed.

For example, Houston (which is the only market that is a top market for all four), constitutes 5.8% for LXP, 5.2% for PLD, 4.1% for FR, and 2.6% for STAG. We assume that adding LXP’s Houston market assets to PLD, FR, or STAG would support their existing strategy and be valuable.

By contrast, Memphis is 7.6% of LXP’s Top 10, but Memphis is not in the top markets for PLD, FR, and STAG, so those assets may be less attractive.

As an example of a better fit, using this same analysis technique, 79% of FR’s Top 15 (which is 95% of their total portfolio) overlap PLD’s Top 13 markets. It’s a great fit.

Motivation for M&A

I would like to make three comments on the possible motivations for both buyer and seller to consider M&A.

1. The Value of Scale and Concentration

For all the potential buyers, the motivation is to increase corporate scale (efficiency) and market concentration (efficiency and pricing power). I discussed this at some length in the context of medical office building REITs here. These advantages of scale and market concentration drive consolidation.

In a March 2024 interview at Nareit’s REITwise, Robin Panovka, a partner at Wachtell, Lipton, Rosen &Katz, predicted three major themes for REIT M&A in 2024: Continued consolidation driven by the advantages of scale, an increase in stock-for-stock deals, and a resurgence of private equity involvement.

PLD, FR, and LXP have all intentionally concentrated their portfolios in a limited number of markets. (REXR and TRNO are even more concentrated.) STAG has a different strategy and is markedly more dispersed.

Both PLD and Realty Income explicitly highlight that they’re leveraging their scale to drive growth. PLD notes that even though they have grown in recent years, they have decreased the number of markets where they operate.

Smaller industrial REITs like LXP may likely find it difficult to compete.

2. Elevated Expenses a Significant Drag on Shareholder Returns

G&A provides an explicit metric to show the cost challenges faced by a smaller REIT.

Over the last three years, LXP G&A has been running at about 11% of revenue. For 2023, G&A ran 10.9% for LXP, 6.7% for STAG, and 6.2% for FR. If LXP G&A was at FR’s rate, it would add about $0.05 a share to NOI.

3. PLD Has Demonstrated Successful Growth Through M&A

PLD has a long history of successful growth, in large part through a series of major acquisitions of industrial REITs:

- 1998 Meridian Industrial Trust $1.5 billion

- 2004 Keystone Industrial Trust $1.5 billion

- 2011 AMB

- 2015 KTR Capital Partners

- 2018 DCT Industrial Trust. $8.5 billion

- 2020 Industrial Properties Trust $4 billion

- 2020 Liberty Property Trust $13 billion

- 2022 Duke Realty $23 billion

As a shareholder at the time in PLD, AMB, Liberty Property, and Duke Realty, I have directly seen the benefits to both the buyer and seller of this strategy.

Assessment of the Candidates

We can sum up our speculative exercise – each of the three candidates should have the capability to acquire LXP. I would expect an all stock transaction in each case. PLD may have an advantage in that regard as their stock appears most richly valued.

All three have quite similar total returns over the last three years and should be attractive to LXP shareholders.

LXP assets appear to be the best strategic fit to for FR, with a 36% Top Market match. The acquisition would be a very significant growth step for FR, boosting SF by 80%. One drawback is that FR is now heavily focused on 15 markets, and this would change that focus.

LXP assets appears to be the weakest strategic fit for PLD, with only a 14% Top Market match. PLD has a long track record of large M&A activity. LXP would be a bite sized acquisition for PLD.

As the largest publicly-traded industrial REIT in the world, PLD offers exceptional management, the lowest G&A burden (about 50% of peer REITs), very low debt funding cost, and an solid track record of performance.

For STAG, LXP’s assets are a reasonable 26% Top Market match. STAG appears to have been quite opportunistic in growing their portfolio, and with a markedly less concentrated footprint (569 buildings in 41 states) might actually welcome a limited Top Market match. On the other hand, an M&A transaction of the size is outside of STAG’s normally very granular acquisition strategy.

In summary, I would say that while FR may be the best fit, PLD has perhaps the most to offer current LXP stockholders. As a current LXP stockholder, I would find a reasonable offer from any of the three potential candidates worth serious consideration.

Risks to Investment Thesis

1. LXP management may be entirely uninterested. They have rejected this path before. Per Seeking Alpha data, LXP has notably higher insider ownership at 2.5% than its potential buyers; FR has 0.42%, STAG 0.18%, PLD 0.16%.

2. LXP management may opt for a “not yet” strategy, hoping for a better deal later, perhaps particularly anticipating lower interest rates. And the CEO gets another year older every year. M&A action in that case might be deferred for a year or three.

3. The potential acquirers may decide there are better options elsewhere and never make an offer. For example, I would not be surprised to see PLD offer to acquire FR, which is both larger and appears to be a better geographic fit than LXP.

4. In the absence of a buyout, LXP investors may face continued underperformance.

Investor Takeaway

The attraction of LXP today is that it’s a reasonably priced option in a sector that appears generally fully or perhaps even richly valued.

However, LXP has a long history of disappointing performance. To paraphrase Alice in Wonderland, it seems to always be “jam tomorrow, but never jam today.”

Given the trend toward consolidation, a hypothetical acquisition of LXP could provide an attractive M&A growth opportunity for a larger REIT, and an attractive path forward for LXP owners.

Investors interested in an industrial REIT value play, with a relatively generous 5.9% dividend, and a potential M&A exit, may find LXP an option worth considering. I would rate it a Hold at the current price, and a Buy below $8.

Personally, I own a full position in LXP, acquired in several tranches between February 2018 and January 2020, with an average cost of $9.44 and a yield on cost of 5.5%. Considering the performance of the industrial REIT sector in recent years, it’s been a disappointment, but I would consider adding at $7.50. Perhaps there will be jam one day.

Read the full article here