Savaria Corporation (OTCPK:SISXF), is a relatively unknown company in the fast growing, if not sexy, business of mobility solutions for the physically challenged. Their product mix includes both in home and vehicular mobility aids. With an aging and increasingly obese population, demand for these products is growing.

The business has grown rapidly, increasing revenues and EBITDA by close to 300% in the last five years. Net income, however, has not kept pace, dropping from 6.2% of revenue to 4.5% over the period. Cost of debt is the culprit here. The interest expense increased by 1.7% of revenues, bringing the margin down commensurately.

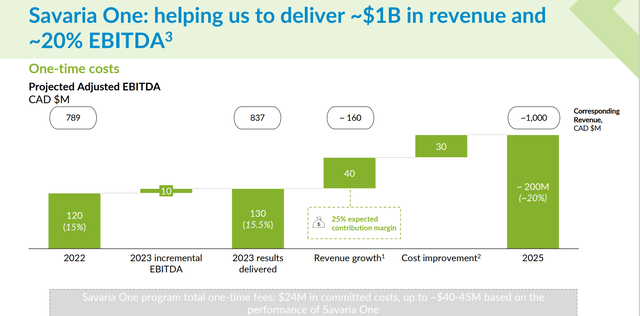

Management has now undertaken a significant investment in transforming the business performance, with an expensive consultancy engagement, plus key hires of a new CTO and CFO. With recent earnings, they released 2025 targets, which include significant margin improvement with continued revenue growth. Meeting these targets (or even close) implies significant upside for the stock. Insiders have backed this with recent stock purchases.

Company overview

Savaria Corporation provides accessibility solutions for the elderly and physically challenged people in Canada, the United States, Europe, and internationally. The company operates in two segments, Accessibility and Patient Care. The Accessibility segment designs, manufactures, distributes, and installs a portfolio of accessibility products, including commercial and home elevators, stairlifts, platform lifts, and wheelchair lowered-floor accessible conversions for selected brands of minivans, personal, residential, or commercial applications. The Patient Care segment designs, manufactures, distributes, and installs ceiling lifts, patient transfer slings and accessories, floor lifts, standing aids, bathing equipment, medical beds, therapeutic support surfaces, and pressure management products used in healthcare facilities and home care settings. It sells its products through dealers or direct stores to end-user customers. The company was founded in 1979 and is headquartered in Quebec, Canada.

The company is listed on the TSX, and as such, the figures presented are all in CAD.

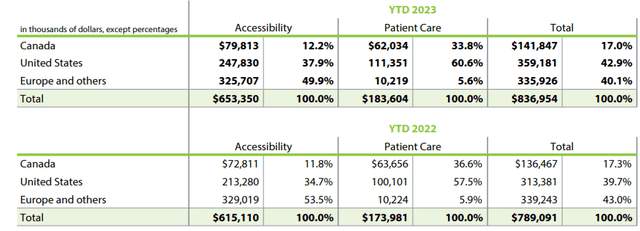

As the chart below from the 2023 annual report shows, the company has grown from its Canadian roots into a globally diversified business, with under 20% of revenues emanating from its home market, the balance split evenly between the US and Europe et al.

Of the two businesses, the Accessibility business has grown to account for nearly 80% of the revenues, with a much larger European footprint than the Patient Care division, which is centered in North America.

Savaria

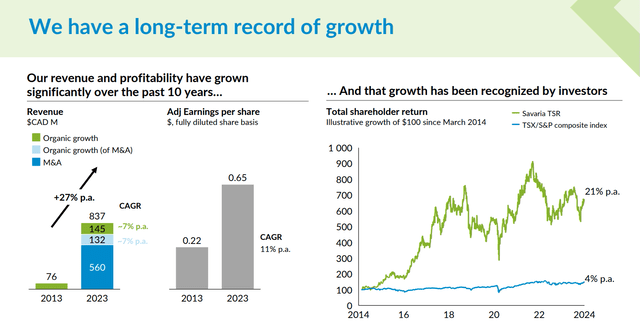

Over the last decade, the revenues have grown ten-fold from a modest $83m in 2014, a CAGR of 26% over the period.

Savaria

This has been achieved via a long string of acquisitions under the leadership of CEO Marcel Bourassa, who acquired the company in 1989, and listed it in 2002.

Savaria

During 2023, he handed over the leadership of the company to Sebastien Bourassa as CEO and President, taking up the position of Executive Chairman. A business school graduate, the new CEO has been involved in the business for many years, having set up their China manufacturing center back in 2007.

The new leadership team now includes a new CFO, and for the first time, a Chief Transformation officer (CTO).

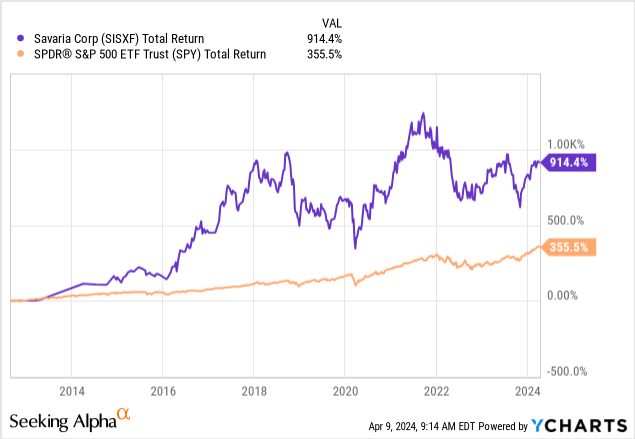

Stock performance

The market certainly rewarded the strong growth track record, with a total return 2.5 times that achieved by the S&P 500 over the decade.

However, over the last five years, the outperformance has reversed, as Savaria, while still showing a decent return, has lagged SPY, which has provided double the total return over the more recent period.

I attribute this to an erosion of profitability of the underlying business, which seems to have been unable to capitalise on the synergies available between the business units, or exercise discipline in pursuing a strategic focus while managing underperforming assets.

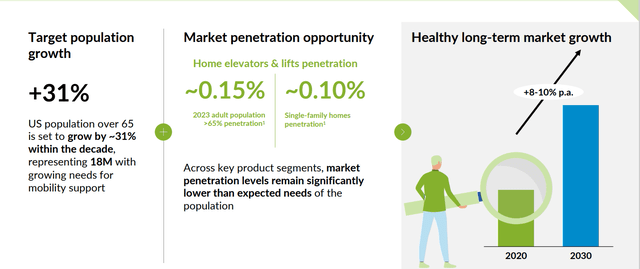

The segment outlook is strong

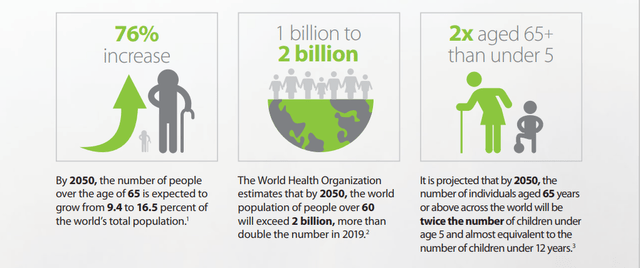

With the focus on mobility solutions, and a global footprint, Savaria is well positioned for the huge increase in demand for its products from an aging population. The company highlights estimates from the World Health Organization that by 2050, the global seniors population will increase by 76%.

Savaria

A further demographic trend likely to boost demand is the increasing tendency for obesity in the US and globally. According to this study by the new England Journal of Medicine, half the population of the US is expected to be medically obese by 2030, with 25% chronically obese. The latter category is a huge market for home mobility aids.

While the market itself is growing, market penetration is also low, which Savaria translates to an 8-10% sustainable market growth across its segments.

Savaria

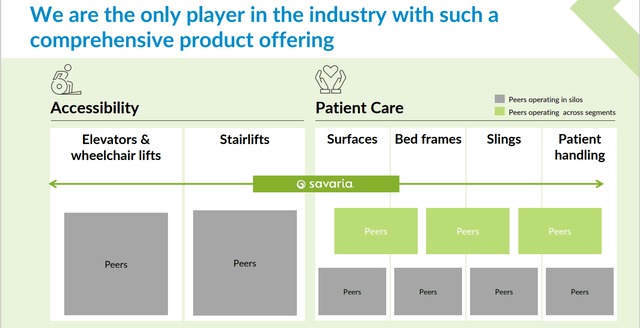

Savaria recognizes a strategic advantage over its competitors, in that it is a unique play across the complementary products in its two focus areas.

Savaria

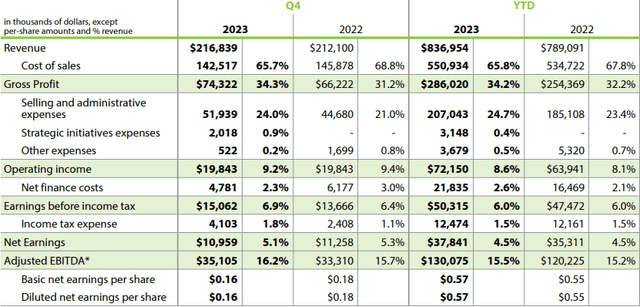

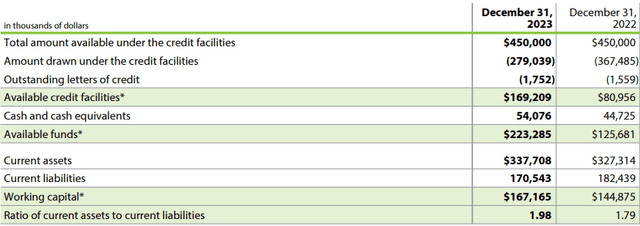

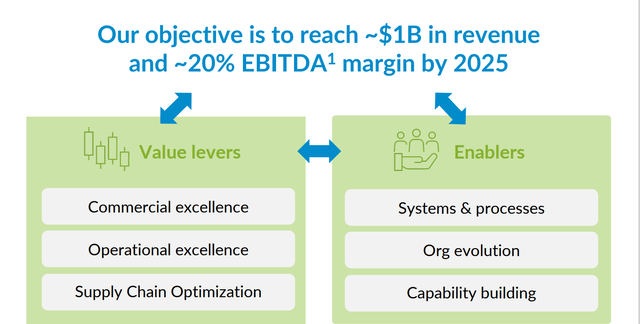

Savaria has released ambitious targets for the coming two years, projecting $1bn in revenues by the end of 2025, a more modest CAGR of around 10%, but importantly, an increase in adjusted EBITDA margins from the currently realised 15.5% to 20% via a huge increase in productivity. This implies an increase in EBITDA from $130m in 2023 to $2bn by 2025, a 24% CAGR.

While adjusted EBITDA is a non GAAP item, the GAAP EBITDA was not too far behind, at $120m. Adjustments for one offs include strategic initiatives (more on this below) and stock-based compensation.

2023 Results

The 2023 results were solid, but not spectacular:

- Revenue was $837.0M, compared to $789.1M in 2022, an increase of 6.1%

- The accessibility segment 7.8% on a consolidated basis – with North America growing by 13.6%, reflecting a static Europe top line.

- The patient care segment grew by a more stable 3.0%.

- Adjusted EBITDA was $130.1M, up by 8.2% YOY

- Net earnings were $37.8M vs. $35.3M, an increase of 7% YOY.

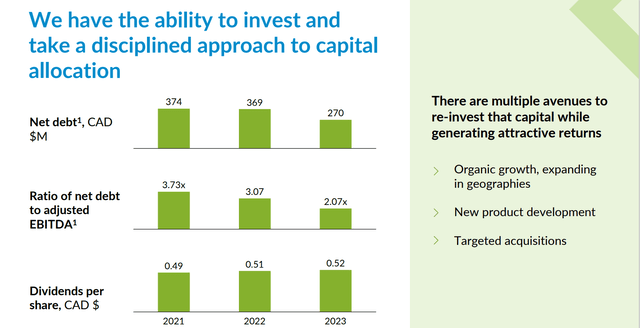

- Some good progress was made on balance sheet deleveraging, with the net debt to EBITDA ratio down from 3x at year end 2022 to 2x.

- After December 31, 2023, Savaria finalised the transaction to sell the Van-Action and Freedom Motors divisions. During 2023, the Norwegian operations were sold. These businesses combined accounted for $50m of revenue.

Balance Sheet

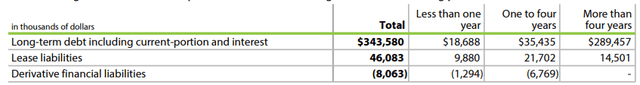

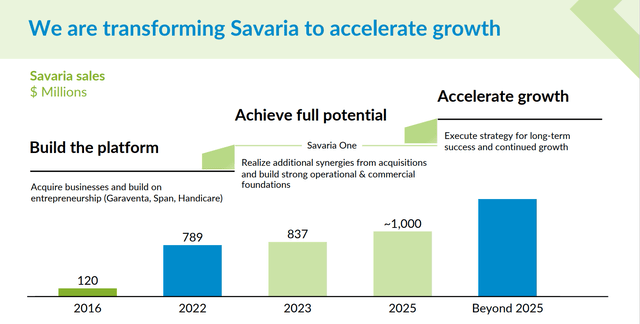

As mentioned above, one of the main headwinds to margins for Savaria has been the cost of debt. The company has managed to deleverage in 2023, reducing the net debt to EBITDA (adj) from 3.7x to 2x over the last five years.

Savaria

While this is good news, the absolute cost of debt still remains high.

In the annual filing, the following is explained/shown, detailing that net finance costs increased from $16.5m to $21.8m, a 32% absolute increase.

The notes explain that this is due to higher interest on long term debt of $7.2m, offset partly by an unrealised foreign currency gain of $1.8m.

Savaria

The upcoming debt maturity schedule is of decent duration, with only 15% of long term debt maturing within the coming four years.

Savaria

Overall, the company seems to be in decent overall health, with a year-on-year improvement in available funds from $125m to $223m, and close to 2x assets to liabilities. The increase in funding costs looks like a one-off, and projected growth should continue to bring down the expense to net income ratio.

Savaria

‘Savaria One’

Key to the outlook and the realisation of the ambitious revenue and margin targets is a strategic initiative titled Savaria One. This is a major exercise being undertaken with the support of a management consultant. Clearly this is a major investment for the business which seems dead set on engineering a radical uplift in operating performance.

Savaria

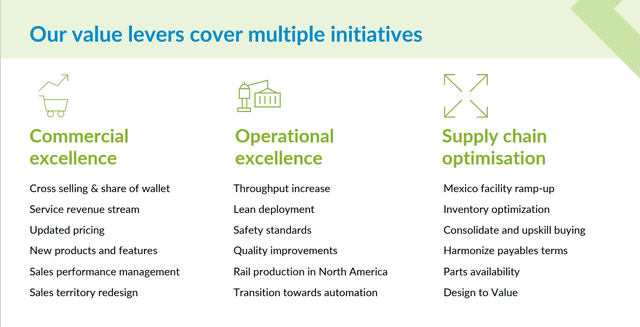

The goal is to conduct an end to end operational review of the business with a focus on achieving operational synergies, and improvements in procurement and productivity.

Savaria

The programme seems to be far reaching and well integrated, covering sales, operations, and procurement.

Savaria

The revenue and margin targets for 2025 are derived from the work done to date on Savaria One.

Savaria

The earnings call transcript includes some interesting insights.

- A clear acknowledgment that with the rapid acquisitions, the business has not been working efficiently.

- The programme is at its core and an investment, not a cost cutting exercise, and employees are deeply engaged.

- The cost of the programme is expected to be $5m per quarter in 2024, and a further $4m in 2025.

- Costs in 2023 already incurred of $3.1m

- Future costs are heavily dependent on the results of the initiative – fees are success based.

- Management is very confident on realising the targets.

All in all, I see in Savaria One the fingerprints of the new CEO and next generation management. My take is that this is a long overdue overhaul of the business, driving efficiency and producing a solid platform for sustainable growth in the decade to come.

Furthermore, Savaria has had a poor level of transparency for investors, who have relied upon statutory filings, and earnings calls for company information.

The company just rectified this with its first ever Investor Day on April 9, in which it outlined its strategy, explained its targets, and provided good color on the business transformation project. All supported by a detailed slide deck. Several of the slides above are drawn from this deck.

Valuation

So, is Savaria a good deal at current prices?

Given how niche the business is, it is quite hard to find appropriate competitors to compare its valuation. Most of the accessibility peers remain private companies, while patient care competitors are integrated into much larger healthcare brands.

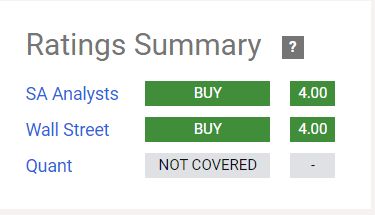

Both SA and Wall Street analysts rate the company a buy, however it is not well covered. Of the six Wall St analysts covering the stock, the FV estimate is $21, with a range between $18.72 and $23. The last Morningstar report I could find had a fair value of $18.72 – vs a current price of $16.65.

So low end 11% discount to FV, median 26% discount to FV.

(all data from Interactive Brokers)

It’s too small for SA’s Quant ratings.

Seeking Alpha

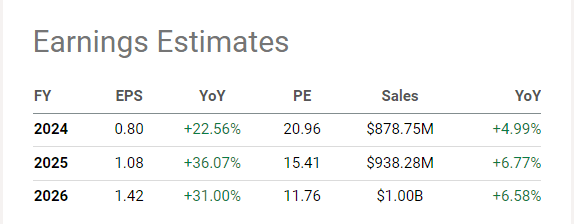

On an absolute basis, the valuation looks relatively high for a manufacturing company, with a forward P/E of 21, and a price to book of over 2x.

Seeking Alpha

However, the forward earnings estimates show a major uplift in earnings per share over the coming two-year period, and if Savaria One is effective in providing a platform for growth, this should be sustainable into the future.

It should be noted that the forward estimates have a year lag on those of Savaria’s own management, which is confident in predicting $1bn in sales and a 20% EBITDA margin by 2025.

Seeking Alpha

I conducted my own DCF calculation, using a 12.5% discount rate and assuming 6% annualised revenue growth short term, with a terminal rate of 3%. This indicates a FV of $21, or a 26% upside to the current price. This price equates to the median of the analysts figures. A more aggressive 8% growth assumption, which is in line with management’s low end market expectation results in a 35% upside. This equates to the ‘high’ end of analysts’ ratings.

In my mind, even the high end discounts some of the margin improvements, and the soft impact of a more shareholder friendly company. As such, I find myself on the high side of the analysts, with a price target of $23.

Risks

Key risks to the thesis include:

- Failure of the Savaria One project

- Credit risk and interest rate risk

- Competition risk and pricing

- Currency risk due to globally diversified footprint

- Economic risk

- Acquisition integration risk

All in all – I find these risks to be generally acceptable.

Conclusion

- Savaria has been a fast growing business for the last 20 years.

- Demographic tailwinds provide a huge market opportunity.

- New management is in place, and undertaking a massive business transformation.

- The opportunity for efficiencies and operational excellence to improve margins is real.

- I rate Savaria as a Buy, and will initiate a position accordingly.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here