Gold prices continue to surge. The spot price of the precious metal touched $2,400 per ounce on Friday, April 12, a new record. It comes after a years-long consolidation that frustrated many investors seeking diversification and safety from geopolitical risks and ballooning US federal debt. With a decisive breakout above $2100 per ounce earlier this year, it appears to be clear skies ahead. What has made the latest thrust higher all the more impressive is that it has come amid rising real interest rates and a firming dollar – both are thought to be headwinds for gold. Of course, rising geopolitical risks in the Middle East is a bullish factor.

Bespoke notes that gold has risen for the eighth time in the past ten days, currently trading 20% above its 200-day moving average (97th percentile) and 12% above its 50-day moving average (99th percentile) as of Friday, April 12.

I have a buy rating on Agnico Eagle Mines Limited (NYSE:AEM). I see the stock as having strong upside momentum, though its valuation is not a screaming buy. But with higher gold prices, the firm should be able to deliver healthy earnings.

Gold Prices Touch $2,400 Per Ounce for the First Time

Seeking Alpha

For background, AEM is a gold mining company engaged in the exploration, development, and production of precious metals. It explores primarily for gold. The company’s mines are in Canada, Australia, Finland, and Mexico, with exploration and development activities in Canada, Australia, Europe, Latin America, and the United States.

Back in February, AEM reported a strong set of Q4 results. The firm boasted record quarterly gold production, helping to drive non-GAAP EPS of $0.57 and revenue that rose 28% from year-ago levels. Shares traded higher by 2.5% after the February report, and there has been a slew of EPS upgrades in the last two months.

Ahead of its Q1 report, the options market has priced in a significant 5.1% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the reporting date, according to data from Option Research & Technology Services (ORATS). $0.58 of operating EPS would be unchanged from per-share earnings in Q1 last year.

In the Q4 report, the management team offered guidance that was in line with expectations, with gold production forecast in the 3.35 million to 3.55 million ounces range. With decreasing net debt and new reserves in the East Goldie zone, there are financial and operational tailwinds.

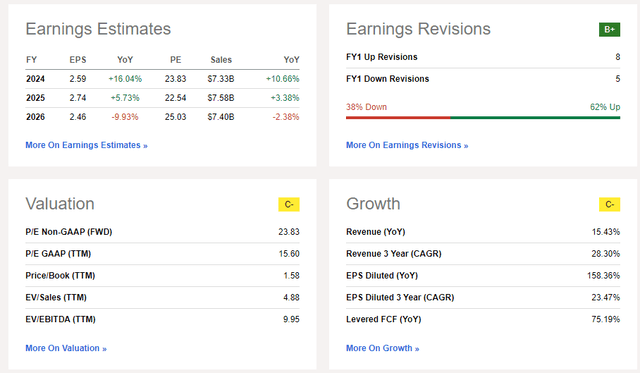

On valuation, analysts expect $2.59 of non-GAAP EPS in 2024 with rising profits in the out year. Revenue is seen increasing by 10% this year, but then holding steady around $7.5 billion annually. With the very recent run-up in gold, I would expect further upward earnings revisions from the sell-side community. Moreover, with solid free cash flow in the past 12 months and healthy margins, AEM appears well-positioned to capitalize on gold’s breakout.

AEM: Earnings, Valuation Forecasts

Seeking Alpha

AEM trades under its 5-year historical forward non-GAAP price-to-earnings ratio. If we assume $3 of normalized EPS considering that gold is now into the mid-$2000s per ounce and apply a 25 multiple, below its long-term average, then shares should trade near $75, making the stock undervalued today.

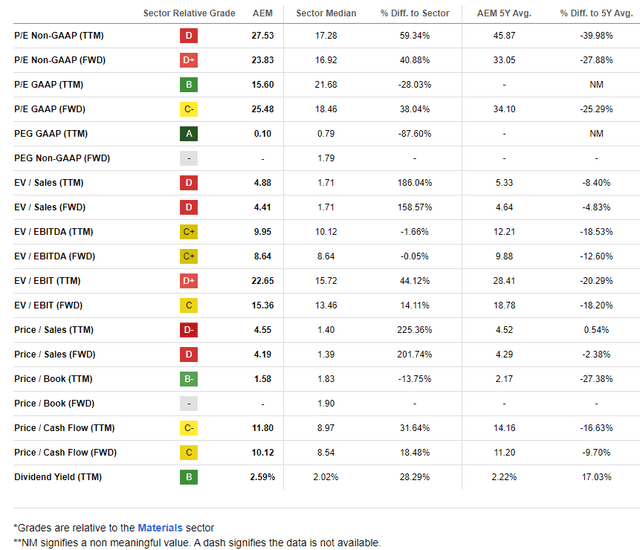

AEM: Shares Historically Cheap, But Not an Absolute Value, Positive FCF

Seeking Alpha

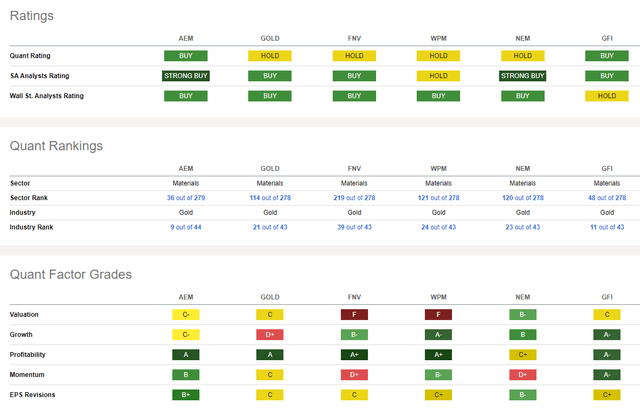

Compared to its peers, AEM features a mixed valuation grade, while its growth trajectory is likewise muted. But with solid earnings growth in 2024 and the prospect of strong commodity prices helping profitability trends, the fundamentals look more sanguine today compared to just six months ago. Share-price momentum trends are solid, while EPS revisions have been on the good side in the last 90 days.

Competitor Analysis

Seeking Alpha

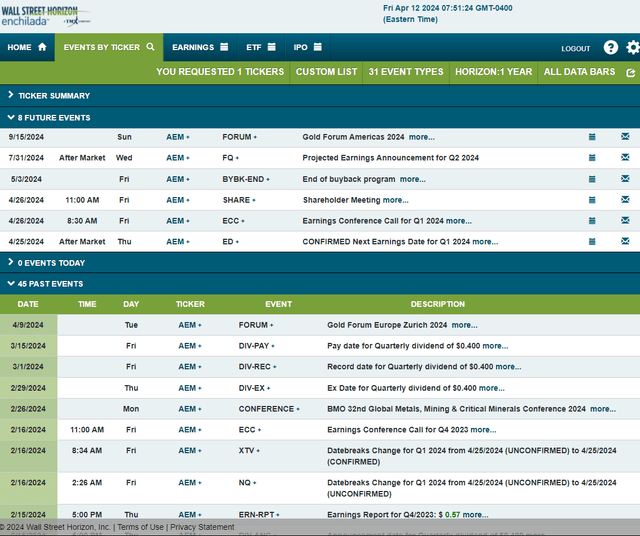

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q1 2024 earnings date of Thursday, April 25 after the close, with a conference call the following morning. You can listen live here. The firm then hosts its annual shareholders’ meeting on the same day.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

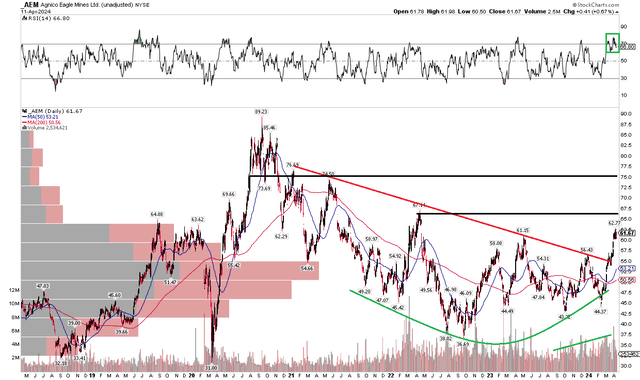

A clear beneficiary of higher gold prices, AEM’s technical chart appears much healthier compared to the consolidation that was seen in 2022 and 2023. Notice in the graph below that AEM has undergone a bearish to bullish reversal pattern. The stock also broke out above a downtrend resistance line of the early 2021 peak, down to the $55 level earlier this year.

Also, take a look at the volume profile at the bottom of the graph – there have been increasing shares traded as AEM has ascended, and that is generally considered a bullish signature. Moreover, the RSI momentum indicator at the top of the chart confirms the upside price move. I would like to see the long-term 200-day moving average inflect higher, though. In terms of upside targets, the $67 early 2022 high is in play, with the mid-$70s offering a longer-term target.

Overall, AEM’s momentum is strong, and the stock appears to have broken out from a long-term downtrend.

AEM: Bearish to Bullish Reversal, Rising Volume & Strong RSI

StockCharts.com

The Bottom Line

I have a buy rating on AEM. I see shares undervalued today with upside momentum from the material increase in gold prices. With earnings growth ahead this year and an improved chart, shares of this gold miner look strong for the balance of 2024.

Read the full article here