In our last coverage of Ares Commercial Real Estate Corporation (NYSE:ACRE) we gave it a “Sell” rating. What was unusual about our stance is that we did it in the face of a declining stock. Generally, we tend to move our ratings in the opposite direction of the stock price. As good news gets priced in and stocks move higher, we move from “Buy” to “Hold”. Conversely, when stocks tank, we recognize that bad news is possibly getting priced in and move from “Sell” to “Hold”, or even to a “Buy”. When we wrote about ACRE, it had already dropped 25% from recent highs in a short while. Hence, staring with a “Sell” was unusual. Our rationale though was that the book value would get killed in the months ahead, and it also got a scary rating for its dividend safety.

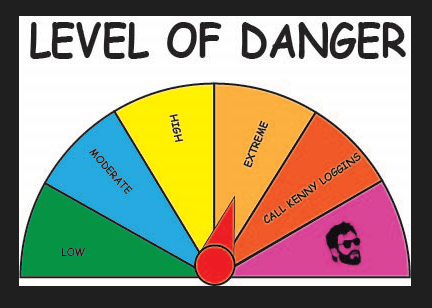

ACRE would get an “Extreme” level of danger of a distribution cut on our proprietary Kenny Loggins Scale.

Author’s Scale

This rating signifies a 50-75% probability of a distribution cut in the next 12 months. We rate this a Sell.

Source: Dividend Cut Highly Probable In 2024

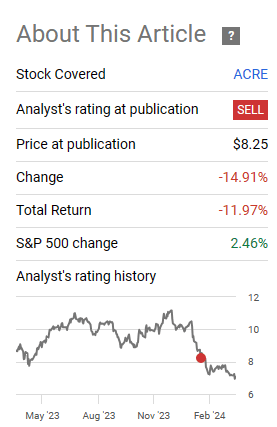

It is rare for calls to work this well, and ACRE cut its distribution less than 12 days after the article. Stock performance has been predictable in light of that with the income investors fleeing.

Seeking Alpha

We don’t think this is done and believe the second round of troubles is around the corner. Let’s go over why.

The Setup

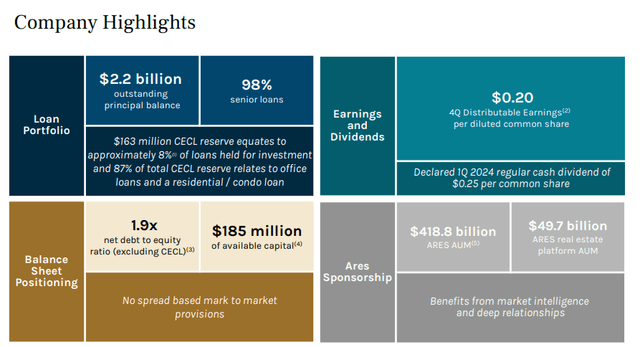

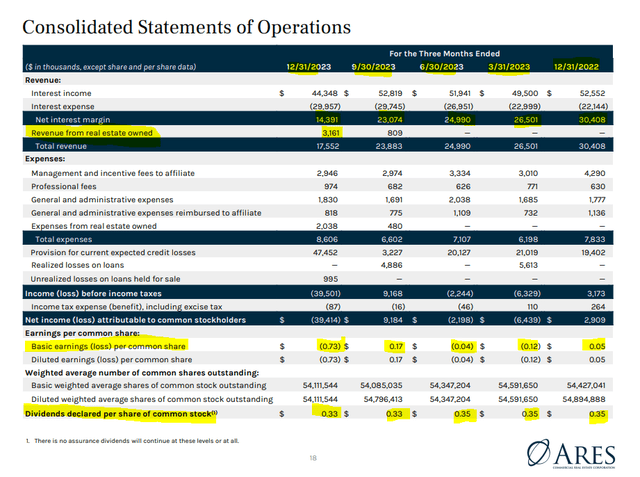

The first slide in the investor deck tells you a lot. The distributable earnings were just 20 cents a share, and the reduced distribution was still 25% higher than that at 25 cents a share.

ACRE Q4-2023 Presentation

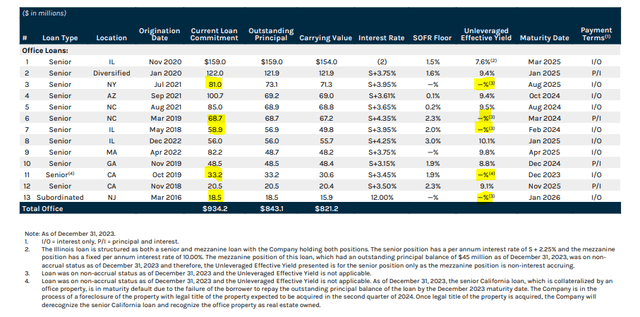

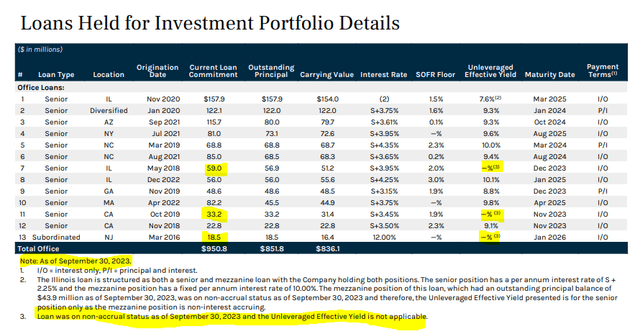

The $163 million CECL reserve sounds impressive until you reach the fact that it is just 8% of loans. 4 loans went into non-accrual status in the quarter. At first glance you might think that these 4 loans were all for the office sector. After all, you can find 5 loans on non-accrual status here.

ACRE Q4-2023 Presentation

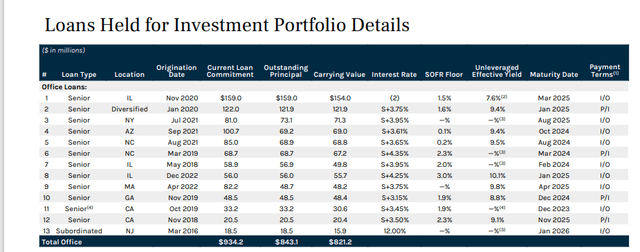

But that is not the case. Out of the 5 loans above, 3 were already in non-accrual status on September 30, 2023.

ACRE Q3-2023 Presentation

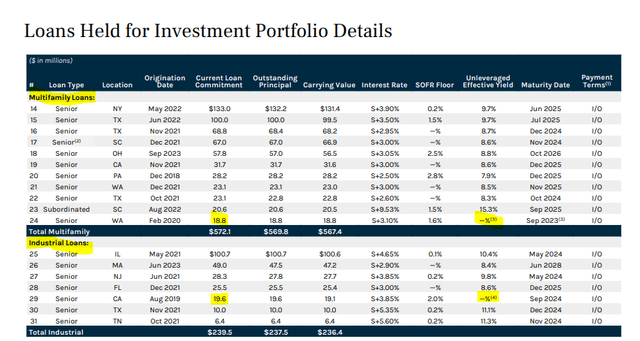

So we had two office loans and one loan each from Multifamily and Industrial segments go into non-accrual this quarter.

ACRE Q4-2023 Presentation

Our bigger point is that there is a lot more room for things to go bad in the office sector. Don’t assume the worst is priced in. 5 out of the 13 loans are on non-accrual status. That itself should show you the combination of market stress and underwriting standards.

ACRE Q4-2023 Presentation

The 4 largest loans here, which are paying as per the agreement, all mature in the next 12 months. We think the best case would be one default here and the worst case would be all 4 defaulting. These numbers may sound extreme but we are just using the current market state and not even assuming the deterioration continues. Recent work shows about 44% of office loans will likely default and based on ACRE’s performance to date, we think they will do worse.

Building on the work of Jiang et al. (2023) we develop a framework to analyze the effects of credit risk on the solvency of U.S. banks in the rising interest rate environment. We focus on commercial real estate (CRE) loans that account for about quarter of assets for an average bank and about $2.7 trillion of bank assets in the aggregate. Using loan-level data we find that after recent declines in property values following higher interest rates and adoption of hybrid working patterns about 14% of all loans and 44% of office loans appear to be in a “negative equity” where their current property values are less than the outstanding loan balances. Additionally, around one-third of all loans and the majority of office loans may encounter substantial cash flow problems and refinancing challenges.

Source: SSRN

What Is Distributable Earnings?

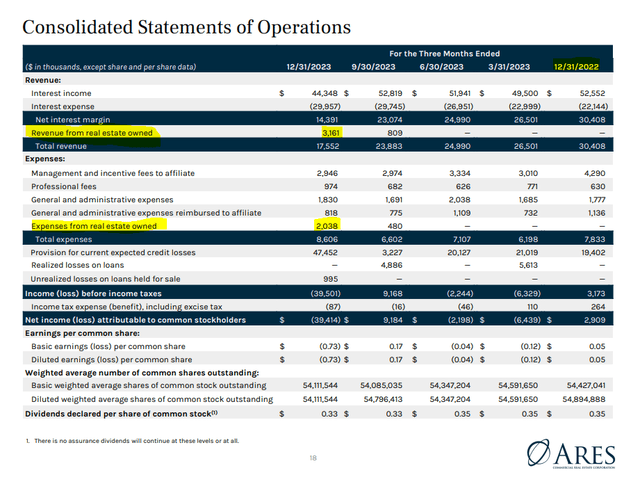

We doubt this would have the same ringtone popularity as the Haddaway song, but the “Baby don’t hurt me” part will be identical. ACRE’s investors are suffering simply as they have focused on distributable earnings and ignored the GAAP picture. Yes, GAAP can be misleading, but the ability to distinguish when it is telling the truth and when it is lying is what makes a successful investor. Here, GAAP was showing you quarter after quarter of poor earnings, and you ignored it. Net interest margin, which is extremely relevant whether or not you like GAAP, is also down 50% over 12 months.

ACRE Q4-2023 Presentation

This is where bulls will step in with smoke and mirrors. The positive spin? ACRE now owns real estate and is getting revenue from that. We have highlighted that portion above as well. So the first bull selling point when ACRE was $14 was that it is great that it does not own real estate. But now at half the price, it is great that it does. Ok.

That ownership revenue is not that great either, by the way. It comes with a lot of expenses.

ACRE Q4-2023 Presentation

How This Shakes Out

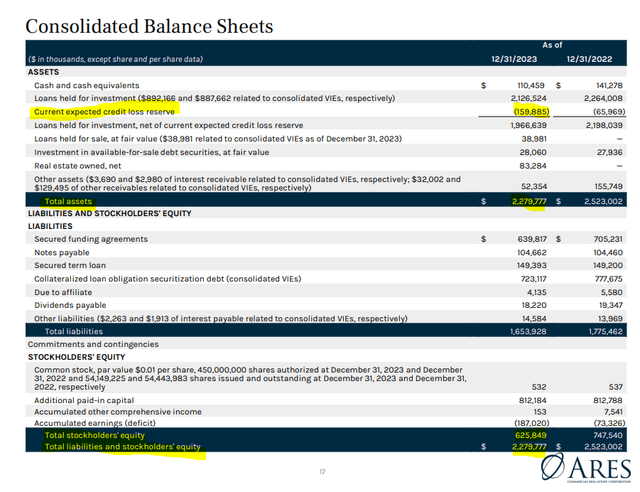

The current balance sheet is still way too leveraged for the stress in the office sector. This includes the adjustment for the CECL reserves. $625 million of equity is buffering $2.27 billion of assets.

ACRE Q4-2023 Presentation

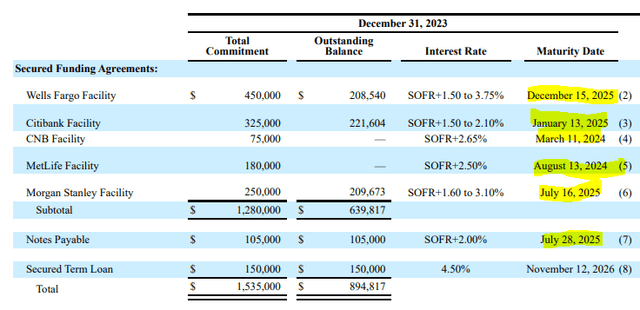

The next 18 months will be when the troubles will be full catalyzed. That’s 18 months, not 18 weeks, 18 days or 18 minutes after this article is published. So keep time horizons in mind. At the same time, a lot of ACRE’s debt comes due.

10-K

These all were loaned at far happier times and come renewal, we would expect a very different pound of flesh to be extracted.

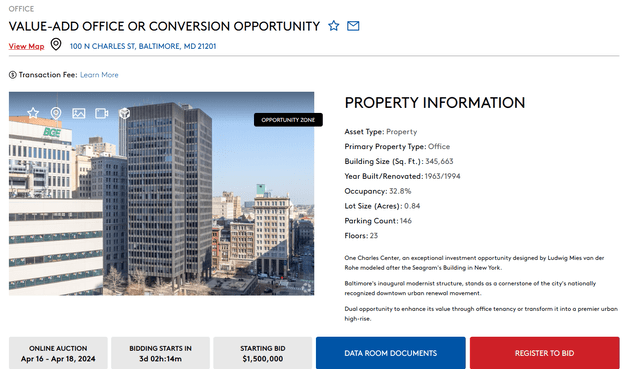

For the intrepid bulls, if you think office assets are cheap and you would like to bid, here is one for you.

Ten-X

Starting bid is $4 per square foot. That is 99% off the replacement cost.

The average construction cost for commercial office buildings varies depending on the size and number of floors. The average cost is $313 per square foot for a single-story office building, $562 for a mid-rise and $660 for a high-rise in the U.S. Multiple factors cause the price to increase for multi-story offices, including more expensive building materials, stricter building codes and higher labor costs.

Source: Big Rentz

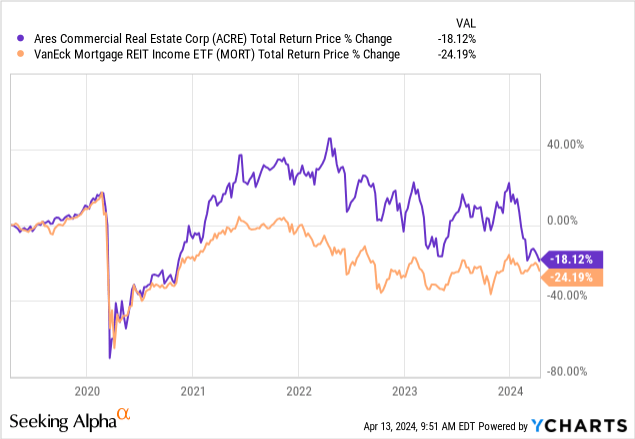

So there are some genuine problems in this sector, and anyone holding on to the pre-2020 model likely will struggle. Sure, some REITs will make it and some of the top buildings will lose less value than others. We won’t all go to WFH model. But there is a reason that ACRE’s total return including distributions is negative 18% over the last 5 years.

Well, two reasons actually. The first is that it is a mortgage REIT and those tend to be the worst performers over longer time frames. We threw in VanEck Mortgage REIT Income ETF (MORT) for comparison to prove our point.

The second is, of course, that we believe ACRE is still too exposed to office and that will impact things down the line. ACRE would still get an “Extreme” level of danger (50%-75%) of another distribution cut on our proprietary Kenny Loggins Scale.

Author’s Scale

We continue to rate this a Sell.

Read the full article here