Here at the Lab, we have missed our coverage of Assicurazioni Generali S.p.A. (OTCPK: ARZGF). Following our last update (August 2023), the company’s stock price is up by almost 25% (Fig 1). In the meantime, Generali released a 2024 Investor Update and the Fiscal Year 2023 results.

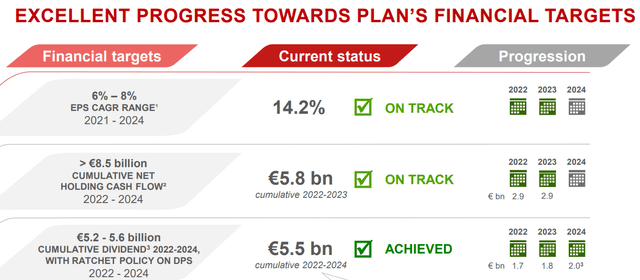

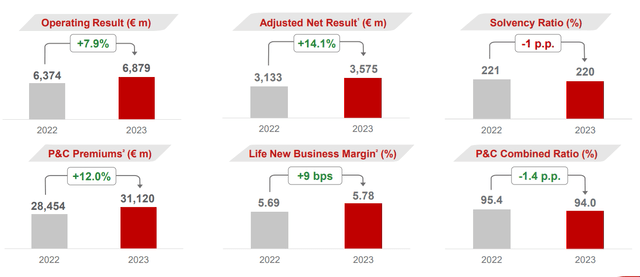

For our new readers, Generali is an Italian-based company engaged in insurance and financial activities. The integrated insurance player operates globally through three segments: Life, P&C, and Holding business (such as its banking division). Our buy rating was backed by 1) Generali’s stand-out results (Fig 2), 2) a compelling strategic plan with solid execution (Lifetime Partner 24: Driving Growth), 3) M&A optionality, and 4) Generali Bank’s robust performance.

Mare Ev. Lab past analysis

Fig 1

Generali Track Record

Source: Generali Fiscal Year 2023 results presentation – Fig 2

Why are we still positive?

- In our last assessment, we reported that Generali has €200 million available liquidity for bolt-on M&A and €300 million excess capital from Liberty Seguros. If these resources were not used for inorganic growth, we anticipate a 2024 potential buyback. This is precisely what is happening. Generali communicated a €500 million stock repurchase plan. It still needs to be approved by the board; therefore, it will likely support the company’s stock price during the remaining part of the year;

- Following Conning and Liberty Seguros’ acquisition, we believe there is further inorganic growth to grab. Generali has been among the most active insurance companies. In recent years, the company invested €7 billion, and among these, Liberty Seguros, which was a €2.3 billion deal, was the most significant company cash-out in the last ten years. According to Bloomberg, the insurance group is looking for a potential acquisition target in the €10 billion market cap area. In this case, we believe it would only consider amicable deals to merge operations (without using cash). Here at the Lab, we have good coverage of the EU second-tier insurer players. That said, we do not speculate on potential M&A, but there is an M&A premium to consider. Looking ahead, we now believe in higher synergies from the Liberty transaction, estimated in a recurring savings of €50 million (year one – 2024) to €90 million (year five – 2028);

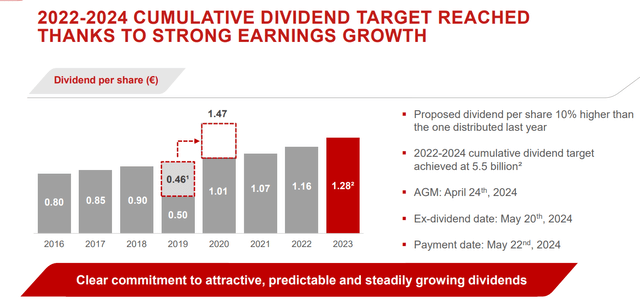

- In our supportive equity story, we forecasted a DPS of €1.26 in 2024. Following the solid 2023 results, the company proposed a DPS of €1.28 (Fig 3). Generali’s dividend is also higher than Wall Street’s estimations, which, on average, expected a coupon of €1.25 per share. The CEO has repeatedly reiterated its commitment to reward shareholders at €5.5 billion from 2022 to 2024. In our new estimates, we now forecast a 2025 DPS of €1.37. In addition, we are expecting a new industrial plan at the beginning of 2025 that might provide a positive catalyst for Generali stock price development. Finally, consensus has been trending positively for the company. On average, looking at July 2023, analysts increased Generali EPS by 12%;

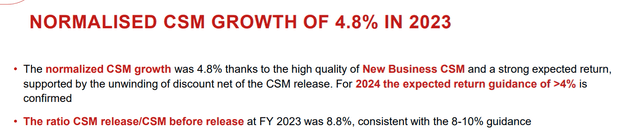

- Despite the solid results, the CEO changed the company’s organization by simplifying double carryovers. There is now direct reporting to the CEO in the Datch and International areas. In addition, Generali is now being given credit for its combined ratio. Looking at 2024 numbers, Wall Street’s average combined ratio is 95.7% and is still lower than the company’s objective for 2025. In our estimates, we anticipate a combined ratio of 95.5%. However, to support the Generali equity story, as already evident in 2023, the company has Contractual Service Margin release potential (Fig 4) and might further improve its non-life performance with higher cash conversion. Operationally and considering last year’s bolt-on acquisitions, Generali will likely reach a net income of at least €3.8 billion in 2024. For this reason, our 2024 EPS is estimated at €2.52.

Generali DPS evolution

Fig 3

Generali CSM upside

Fig 4

Generali Combined Ratio and Solvency Ratio

Fig 5

Valuation

In 2023, Generali recorded an operating result of €6.9 billion, achieving a positive performance from all segments. The company achieved a record net income of €3.57 billion with a +14.1% output compared to last year. Despite challenging macro conditions, the company remained well above the capital regulatory requirements and achieved a Solvency Ratio of 220% (Fig 5). This was mainly supported by its capital generation. The Generali plan aims to increase the company’s EPS between 6% and 8% in the period 2021-2024. Despite the solid track record and EPS upgrade from consensus, the company remains at a sizeable discount to its closest EU peers. Allianz, AXA, and Zurich Insurance trade at a P/E of 12x, 10.6x, and 14x, respectively. Without even considering our updated number, Generali P/E trades at 9.5x on a trailing basis. In 2023, Generali recorded an EPS of €2.32. As reported above, we project an earning per share estimate of €2.52 in 2024. Continuing to value Generali with a target P/E 10x and a 20% unjustified discount versus peers, we arrive at a valuation of €25.2 per share (from €21). The Italian integrated insurer also has a safe balance sheet aligned with peers;

- Allianz Solvency II capitalization ratio was at 206%;

- Zurich Solvency II ratio arrived at 233%;

- AXA’s Solvency ratio reached 227%.

Risks

Our target price includes downside risks such as regulatory changes, higher default risk, movements in exchange rates, and a volatile market in equities and fixed income. The company is also exposed to accounting changes and disruptive M&A. Operationally, the non-life division is exposed to natural catastrophe risks.

Conclusion

Our team believes this valuation discount is excessively wide compared to peers. This discrepancy is also emphasized by Generali’s balance sheet de-risking and its continuous improvement in operational performance. The company has been delivering on its promises, increasing dividends (above internal estimates), and announcing a buyback. With a valuation gap versus its peers, our buy rating is then confirmed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here