Investment Thesis

I last covered Snap-on (NYSE:SNA) in October last year. While the company was doing alright for some time, the stock has given up most of its gains after its recent earnings release. Snap-on Incorporated faced challenges related to customer demand changes, especially in its Tools business last quarter. However, I believe we are near the bottom and the company’s revenues should see a recovery moving ahead with the help of easing Y/Y comparison, and strategic adjustments in the Tools segment, like adopting a smaller ticket marketing approach and launching innovative, quicker payback products to respond to changing customer needs. In the long run, favorable demand trends in the automotive repair market, such as increasing vehicle complexity and electrification, should support the company’s sales growth.

On the margin front, the company should benefit from a slightly more favorable mix as it launches more quicker payback items that carry good margins, operating leverage from sales recovery, and benefits from its RCI initiatives. The stock is trading at a discount compared to its historical averages. This, coupled with improving growth prospects, makes SNA’s stock a good buy.

SNA Revenue Analysis and Outlook

Snap-on has seen good growth over the last couple of years, helped by strong end-market demand. However, in the first quarter of 2024, the company’s sales were negatively impacted due to lower demand from vehicle service and repair technicians for the company’s tools and equipment.

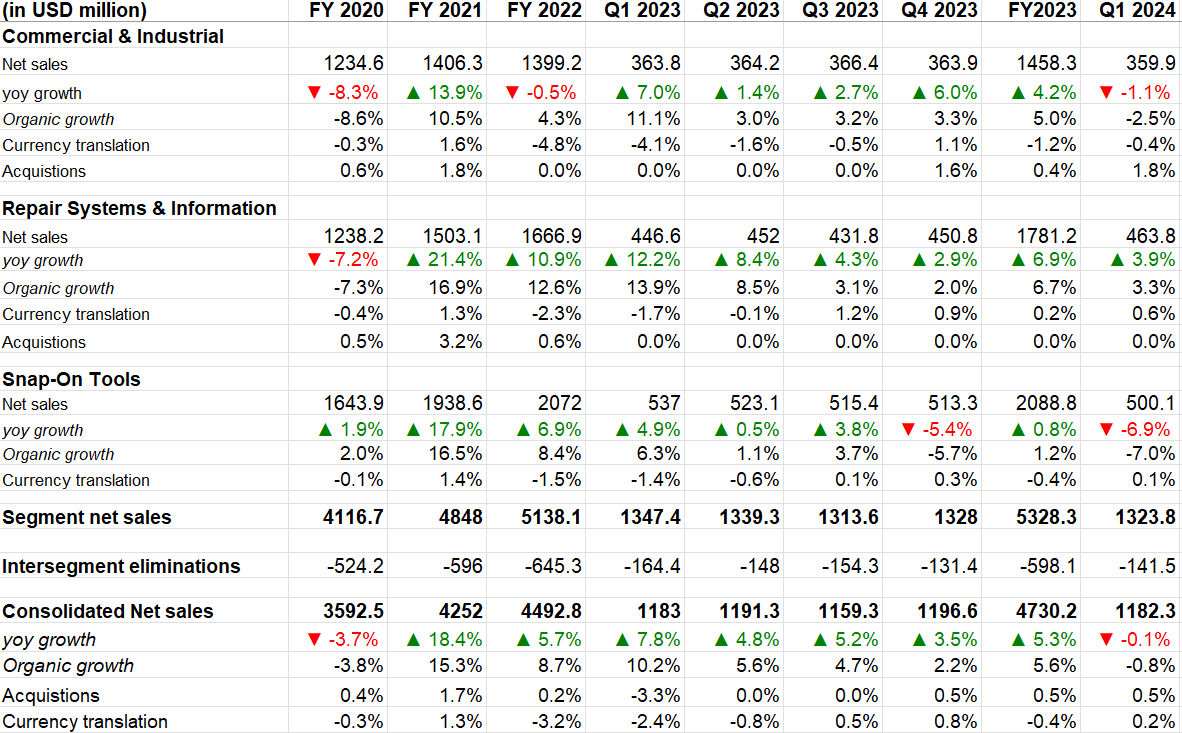

As a result, the company posted a 0.1% Y/Y decline in net sales to $1.1823 billion in the first quarter. Excluding a 0.5% benefit from acquisitions and a 0.2% favorable impact from FX translation, sales declined 0.8% Y/Y organically.

Segment-wise, Snap-on Tools Group’s sales declined 6.9% Y/Y due to a 7% Y/Y decline in organic sales, partially offset by a 0.1% favorable impact of FX translation. The decline in organic sales was caused by lower activity in the U.S. operations, which more than offset the higher sales in the segment’s international operations.

In the Commercial & Industrial (C&I) Group, sales declined 1.1% Y/Y driven by a 2.5% organic decline and a 0.4% unfavorable impact of FX translation, partially offset by a 1.8% contribution from the Mountz acquisition. The organic sales decline was due to weakness in the power tools business and Asia Pacific operations, partly offset by higher customer activity customers in critical industries.

On the other hand, sales in the Repair Systems & Information (RS&I) Group increased by 3.9% Y/Y and 3.3% Y/Y organically attributed to increased activity with OEM dealerships and increased sales of under-car equipment.

SNA’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, the company’s near-term outlook is mixed, but I believe we are close to the bottom. The company’s Tools business (Snap-on Tools), which is the largest segment by revenue, is a major point of focus among investors. This segment saw a ~7% Y/Y organic revenue decline last quarter, which worried investors and resulted in a sharp sell-off post-earnings. An interesting dynamic is playing in the segment. While the average age of vehicles on the road continues to increase, it is not translating into an increase in demand for Snap-on Tools. Snap-on Tools mainly focuses on DIFM (Do-it-for-me) clients (technicians/mechanics) and due to rising inflation, there has been a shift from DIFM to DIY demand. Even DIFM clients (technicians/mechanics) are now focusing on quicker payback items rather than big-ticket/long-term investments.

The long-term demand drivers for DIFM business remain in place, given the increasing vehicle complexity and electrification. However, the inflationary headwinds have caused a temporary speed bump. The company is controlling what it can control and has recently started focusing on launching and marketing new product lines with lower payback periods to address current customer preferences. This effort to redirect the Tools group focus to quick payback items should help sales recovery in the coming quarters.

Another factor that can help Snap-on Tools’ organic sales recovery in the coming quarters is easing comparisons. In Q1 2023, Snap-on Tools’ organic growth was 6.3% Y/Y which slowed to 1.1% Y/Y in Q2 2023. So, we have significantly easier comparisons ahead in the Snap-on Tools segment.

The company’s C&I segment is also seeing similar dynamics, with tough comparisons in the power tools business. Compared to 11.1% Y/Y organic growth in Q1 2023, the company’s sales growth was only 3% Y/Y in Q2 2023. So, we have much easier comparisons moving ahead.

The company also launched new products like PH3045B Air Hammer which hurdles the hammer 3500 times a minute and a new 18-volt nibbler designed for collision repair and metal fabrication, which are getting good responses from customers and should help sales moving forward.

Finally, the company’s Repair Systems and Information segment is seeing good growth with expanded reach in OEM programs as well as increased demand from dealerships and independent garages as they upgrade their offering to suit new vehicle platforms that are coming. I expect this strength to continue in the near to medium term.

In a nutshell, while the company’s growth was impacted due to some near-term headwinds, especially in the Tools business, I believe we are near the bottom and long-term fundamental drivers like increasing complexity of vehicles and electrification can help drive good sales growth for the company in the coming years.

Snap-on Margin Analysis and Outlook

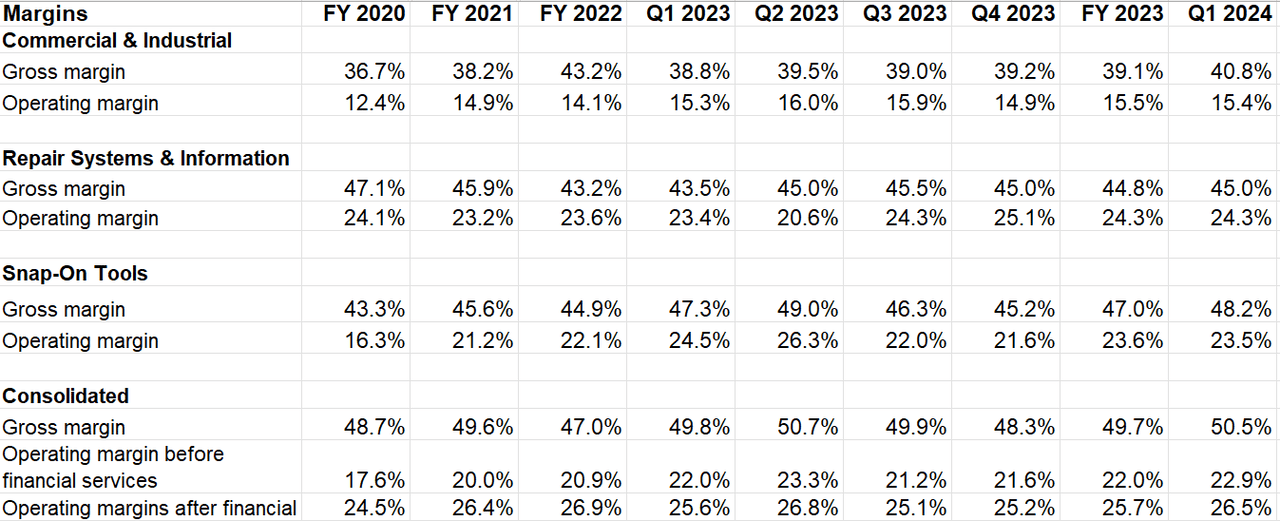

In Q1 2024, the company’s gross margin benefited from lower material and other costs, and savings from the Rapid Continuous Improvement (“RCI”) initiatives resulting in a 70 bps Y/Y gross margin improvement to 50.5%.

The operating margin before financial services increased by 90 bps Y/Y to 22.9% and the consolidated operating margin expanded by 90 bps Y/Y to 26.5%. This was attributed to a 20 bps Y/Y decline in operating expenses as a percentage of net sales, primarily because of a benefit of $11.3 million for payments received related to a legal matter.

Segment-wise, the operating margin of the C&I and RS&I segments improved by 10 bps Y/Y and 90 bps Y/Y, respectively. However, the Snap-on Tools segment’s operating margin decreased by 100 bps Y/Y driven by lower sales volumes.

SNA’s Segment-Wise Margin Growth (Company Data, GS Analytics Research)

One interesting thing that happened last quarter was that the company was able to improve its gross and operating margins despite lower sales. Since the product mix in the quarter shifted towards lower payback period products, it indicates that these products have attractive margin profiles. As Snap-on launches more of these products in the coming quarter, it may be slightly positive for the company’s mix. In addition, we are likely near the bottom in terms of sales and as sales recover in the coming quarters, the company can see benefits from operating leverage. Further, the company continues to focus on Rapid Continuous Improvement (‘RCI’) initiatives, where it applies a structured set of tools and processes to eliminate waste and improve operations and this continuous improvement philosophy should help margin improvement in the long run.

SNA Valuation and Conclusion

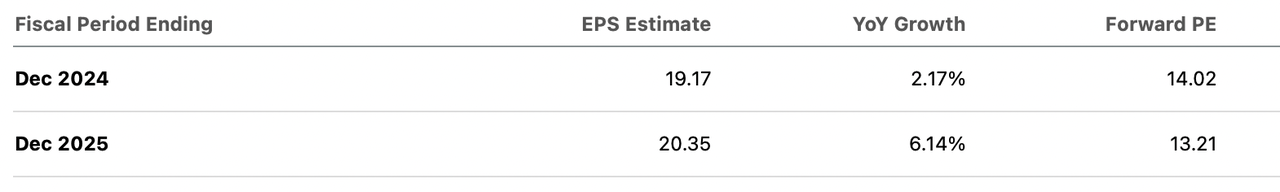

SNA is currently trading at ~14.02x FY24 consensus EPS estimate of $19.17 and ~13.21x FY25 consensus EPS estimate of $20.35 which is lower than its 5-year average forward P/E of 14.55x.

SNA Consensus estimates and P/E (Seeking Alpha)

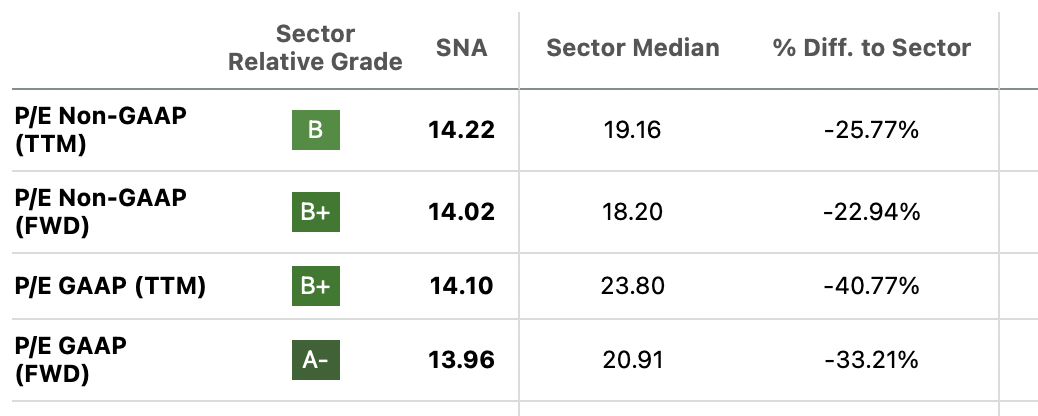

The company’s valuation also compares favorably versus the sector median and the stock offers an attractive 2.77% dividend yield..

SNA Valuation versus Sector Median (Seeking Alpha)

While the company faces near-term headwinds, particularly in its Tools business, I believe we are near the bottom and the company sales should see a recovery with the help of easing comps in the Snap-on Tools and C&I segments and strategic adjustments in the Tools segment, including launching innovative, quicker payback products. The long-term fundamentals remain solid for the company, with favorable trends in the automotive repair market, such as the increasing complexity of vehicles and electrification. The margins should also see gains from a slightly more favorable mix as the company launches quicker payback items, which carry good margins, operating leverage as sales recovers, and benefits from RCI initiatives. The company’s valuation also looks cheap compared to its 5-year historical averages. Hence, I have a buy rating on the SNA’s stock.

Risks

- If the inflation remains high and the trend from DIFM to DIY continues in the near term, the P/E multiple may remain depressed.

- The company’s C&I business has substantial international exposure and any incremental weakness in Europe and China may impact the business.

Read the full article here